DEC 15, 2023

Bitcoin Regains Momentum After Early Dip, Fed Projects 3 Rate Cuts in 2024, Dow Hits All-Time Highs, and New Accounting Rules Could Facilitate More Corporate Ownership of Bitcoin and Crypto

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we highlight !

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -4.30% | $41,995 |

$41,995

-4.30%

| |

Ether

ETH | -4.81% | $2,241 |

$2,241

-4.81%

| |

GeoJam

JAM | +67.20% | $0.00184 |

$0.00184

+67.20%

| |

Injective

INJ | +66.90% | $32.86 |

$32.86

+66.90%

| |

Immutable X

IMX | +43.60% | $2.284 |

$2.284

+43.60%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, December 15, 2023, at 1:30pm ET. . All prices in USD.

Takeaways

- Bitcoin starts the week with a dip but recovers after FOMC meeting: Following eight successive weeks of gains, bitcoin (BTC) faced a volatile start to this week. Opening the week around $43.8k, the price suddenly dropped as low as ~$40.3k as a cascade of over $300 million in liquidations drove the market lower. The Fed’s decision to hold rates steady and its foreshadowing of three rate cuts in 2024 helped buoy BTC on Wednesday, with prices consolidating around the $43k level.

- Bitcoin ETF issuers continue to meet with SEC to discuss fund structures: Bitcoin ETF issuers continued to hold meetings with the SEC this week as we near the possible approval of the first US-based spot bitcoin ETFs in early January. Despite several issuers, including Blackrock, proposing the use of an “in-kind” model, it is looking more likely that the initial approvals will be for a “cash creation and redemption” model.

- Dow hits all-time highs as US equities get a boost from Fed and inflation data: Stocks and bonds rallied following the FOMC meeting on Wednesday, as the Federal Reserve held rates steady and signaled several interest rate cuts next year. The Dow reached its highest ever recorded level on Wednesday, closing above 37,000 for the first time. The S&P 500 also saw its price jump, reaching its highest level since January 2022. Inflation data earlier in the week had helped push prices higher in the build up to the Fed meeting.

- New accounting rules allow for fair value reporting of crypto holdings: The Financial Accounting Standards Board (FASB) announced a new set of rules that will require companies to account for crypto at fair value, with the rules set to be effective from December 2024. As part of the rules, companies will report the value of crypto they hold on their balance sheets at market prices, rather than only being able to report gains when assets are sold, which is the current practice.

- Altcoins have a strong week as IMX surges 40%: A number of altcoins have seen outsized gains this week as confidence grows across the crypto markets. For example, Immutable X (IMX) posted a 40% gain after a positive 2024 prediction from VanEck.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Bitcoin Has Volatile Start to Week, With Rebound After Fed Holds Rates Steady

Following eight successive weeks of gains, faced a volatile start to this week. Opening the week around $43.8k, the price suddenly dropped as markets opened in Asia, with falling as low as ~$40.3k as drove the market lower. The price quickly snapped back to $42k before entering a steady decline throughout Monday morning as investors took some profits off the table from the prolonged BTC rally we have seen over the past two months.

The conclusion of the final federal open market committee (FOMC) meeting of the year helped buoy on Wednesday, alongside other risk assets, with the leading crypto consolidating around the $43k level. The Federal Reserve and projected multiple rate cuts in 2024.

Aspiring Bitcoin ETF Issuers Discuss In-Kind vs. Cash Creation Models With SEC

with the Securities and Exchange Commission (SEC) this week as we near the possible approval of the first spot bitcoin ETFs in early January. Despite several issuers, including Blackrock, , it is looking more likely that the initial approvals will be for a “cash creation and redemption” model.

Senior ETF analyst for Bloomberg Eric Balchumas : “pretty big clue that SEC is dug in on only letting cash create ETFs out in the first run (which is what we hearing back channel as well),” in reaction to the updated S-1 from Invesco that stated they are committing to cash redemption initially. The market is now waiting on an update from Blackrock to see if they can persuade the SEC to allow an “in-kind” model.

Dow Break All-Time High as US Equities Rise

Stocks and bonds rallied following the FOMC meeting on Wednesday, as the Federal Reserve held rates steady and next year. The Dow Jones Industrial Average and reached its , closing above 37,000 for the first time. also saw its price jump, adding ~1.37% and reaching its highest level since January 2022.

While the Fed in the 5.25%-5.50% range, as was widely expected, three three interest rate cuts in 2024 were forecast. The announcement added one more projected rate cut than what was indicated in September, sending a wave of optimism through the market. The Fed acknowledged that and to 2.4% (2.6% previously).

Inflation data earlier in the week helped push prices higher in the build up to the FOMC meeting, with the Producer Price Index (PPI) , while Tuesday's Consumer Price Index (CPI) . The bond market reacted to the news positively too, with the dropping below 4% for the first time since August.

Corporations Can Report Crypto at Fair Value Under New Accounting Rules

On Wednesday, The Financial Accounting Standards Board (FASB) announced that will require companies to account for crypto at fair value, with the rules set to be effective from December 2024.

, companies will report the value of crypto they hold on their balance sheets at market prices. The existing practice is to book an impairment charge on their books if the price of an asset moved below its purchase price, even if the tokens were not sold. Corporations are also unable to record any benefit if the value of crypto holdings increased, unless those assets were sold.

The new guidelines, which allow firms to report unrealised gains on their books without having to sell crypto, could lead to more businesses adding BTC or other crypto assets to their balance sheets as they can now hold for the long term and report any increase in value on their books.

Altcoins Rally, With IMX Up +50% Following VanEck Prediction

A number of altcoins have seen outsized gains this week as confidence grows across the crypto markets. Last week, VanEck released a blog of its . Among them was that blockchain gaming could see a surge next year and will finally demonstrate its long awaited potential. As part of this, they named “IMX is most likely to become a top 25 coin by market cap with the release of Illuvium, Guild of Guardians and other high-budget games in 2024”. This may have contributed to a rally in , which has posted a 50% gain since the release of the blog.

-From the Gemini Trading Desk

data as of 5:10pm ET on December 14, 2023.

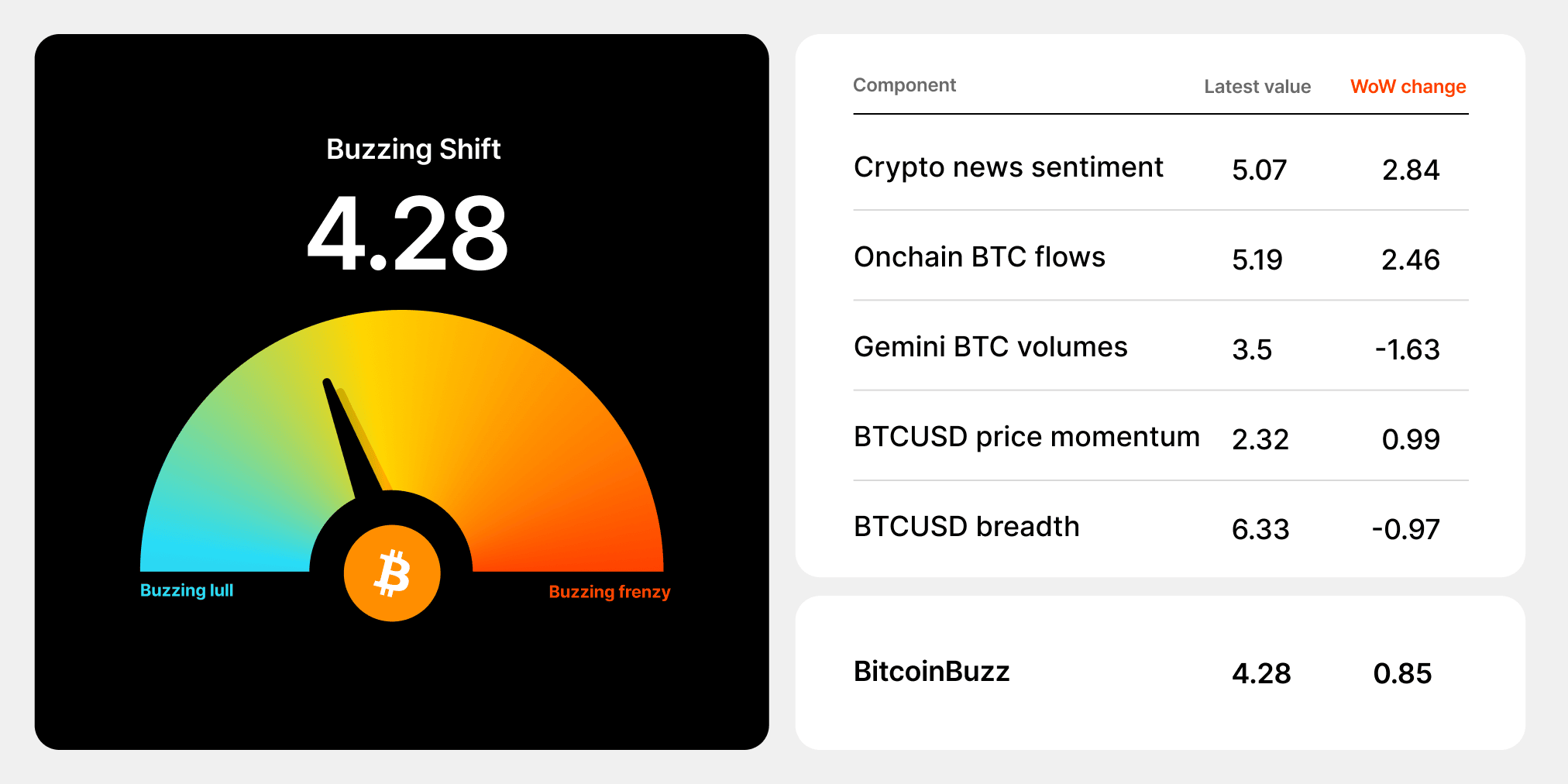

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

This week we unveiled our where we highlight five emerging trends that make us particularly optimistic about the future of crypto: 1) the potential approval of a spot bitcoin ETF in the US and 2) the Bitcoin halving, which can both have huge implications on crypto market dynamics, 3) the powerful intersection of AI and blockchain, 4) the importance of improved security adaptations for Web3, and 5) regulatory clarity in jurisdictions around the world, that can bring renewed confidence and user growth.

We invite you to read through our 2024 Crypto Trend Report series:

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

NIFTY GATEWAY STUDIO

JAN 23, 2026

Announcing Nifty Gateway’s Closure

WEEKLY MARKET UPDATE

JAN 22, 2026

Bitcoin Pulls Back, Strategy Buys $2.13B BTC, and NYSE Announces Plan To Launch Tokenized Stocks

COMPANY

JAN 16, 2026