AUG 08, 2024

Bitcoin Rallies Back Toward $60K Despite Soft Economic Data and Continued Recession Fears

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about Solana.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -5.38% | $59,394.55 |

$59,394.55

-5.38%

| |

Ether

ETH | -16.5% | $2,579.22 |

$2,579.22

-16.5%

| |

SKALE

SKL | -26.4% | $.0344 |

$.0344

-26.4%

| |

Maker

MKR | -25.6% | $1,979.53 |

$1,979.53

-25.6%

| |

Lido DAO Token

LDO | -20.1% | $1.147 |

$1.147

-20.1%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, August 8, 2024, at 2:57 pm ET. . All prices in USD.

Takeaways

- Bitcoin's value dropped below $50,000 early this week, marking its lowest point since mid-February: But prices quickly bounced back, briefly pushing near $60,000 on Thursday, as major indices regained their footing despite fears of a US recession.

- Amid global market turbulence, US spot Bitcoin ETFs saw $168.4 million in net outflows on Monday: Grayscale’s GBTC led the withdrawals, while macroeconomic issues and crypto-specific factors intensified the market selloff.

- Crypto coalition asks for clarity on digital assets: A group of more than 50 crypto asset firms, dubbed The Crypto Market Integrity Coalition, wrote a letter to President Joe Biden and Vice President Kamala Harris asking the White House for more regulatory clarity around digital assets.

- New Ethereum wallet addresses have fallen to their lowest level this year amid the launch of spot ether ETFs: Solana, however, saw an uptick in new addresses due to its growing DEX ecosystem and interest in memecoins.

- Ripple is advancing its stablecoin strategy with the upcoming launch of Ripple USD (RLUSD): Set to debut on XRP Ledger and Ethereum, RLUSD will reportedly help advance the company’s focus on cross-border transaction innovation.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Bitcoin Drops Below the $50,000, then Pushes Back to $60,000 Amid Economic and Geopolitical Concerns

The cryptocurrency's downturn is attributed to increasing geopolitical tensions in the Middle East and growing concerns about the global economy, both of which have shaken investor confidence.

Gemini data indicates that bitcoin hit a low of $49,540 before rebounding some 8% over the past 24 hours. Meanwhile, ether fell to almost $2,000 early this week, its weakest point since early January, before pushing back to nearly $2,600 as of Thursday.

The start of the week was not positive for global markets. Japan's Nikkei 225 Index tumbled by 12.4%, the Stoxx Europe 600 Index decreased by 2.8%, and S&P 500 micro futures lost 2.9%. The NASDAQ also tumbled by almost 2.5%. This panic selling reflects investor anxieties about potential economic instability and geopolitical unrest.

Spot Bitcoin ETFs Experience $168M Outflows Amidst Market Volatility

Grayscale’s GBTC led the pack with $69.12 million in daily net outflows, according to data from SoSoValue. This was followed by Ark Invest and 21Shares’ ARKB, which saw $69 million in outflows, and Fidelity’s Bitcoin fund, which reported $58 million in net outflows. Despite these significant outflows, Grayscale’s latest Bitcoin trust, which launched last week, recorded net inflows of $21.81 million.

Since January, 12 spot bitcoin ETFs have collectively amassed a net inflow of $17.34 billion. Monday's trading volume in these ETFs surged to $5.24 billion, marking the highest trading value since March 25. This uptick coincided with widespread market turmoil, triggered by macroeconomic factors such as escalating tensions in the Middle East and weaker-than-expected US economic data.

The Crypto Market Integrity Coalition Asks White House to Rule on Crypto

“The lack of regulatory clarity in the US has harmed domestic innovation and left consumers exposed to bad actors,” the letter said. “Many of the losses of the last few years could have been avoided with basic consumer protections.”

The latest push from the crypto industry to cement ties with the current administration comes after the US House in May passed FIT 21, which offered a comprehensive regulatory framework for digital assets. The Biden administration did not sign the Republican-led bill but said they would work with Congress on the framework.

Since supplanting Biden as the Democratic nominee, Harris’s team has reached out to the crypto industry. But Harris has yet to publicly state how her administration will approach or regulate the crypto ecosystem.

SEC Accuses Coinbase of "Overreaching" in Legal Battle Over Gensler Emails

In court documents filed on Monday, the SEC argued that Coinbase's demand for additional documents and evidence is not proportionate to the requirements of the case.

The regulator stated that it has already provided more than 240,000 relevant documents to Coinbase but claims that the exchange has not clarified why it requires more.

The SEC also argued that it would likely claim privilege over many of these documents, which would necessitate a manual logging process which the body stated would be highly time consuming. Coinbase, on the other hand, argues that the SEC is overstepping its regulatory authority and has failed to offer clear guidance on what constitutes a security. The company believes that accessing the SEC's documents would highlight this lack of clarity in the agency’s regulatory stance.

New Ethereum Wallets Hit Annual Low Post-ETF Launch

[The creation of new Ethereum wallet addresses has reached its lowest point this year, just weeks after the recent launch of spot ETH ETFs on the US stock market. The seven-day moving average of new Ethereum wallets has dipped to levels not seen since December 2023.

In addition to the decline in new wallet addresses, the Ethereum network is experiencing a drop in both active addresses and transaction numbers, reaching nearly six-month lows. This decrease in network activity suggests that some investors may be opting to gain exposure to ether through the newly launched ETFs.

Contrasting with Ethereum's downturn, Solana has experienced an increase in new addresses. This growth is in part driven by the expansion of Solana's decentralized exchange ecosystem and the ongoing interest in memecoins, which some have argued is the main cause for its growing user base.]()

Ripple Doubles Down on Stablecoins

It marked a significant milestone in Ripple's broader vision to enhance cross-border transactions and remittances.

While an exact launch date has not been announced, Ripple President Monica Long has indicated a 2024 launch timeframe, and the creation of a dedicated website could suggest that the company is in the final stages of development.

As RLUSD prepares to enter the competitive stablecoin market, it will face significant competition from established players. However, Ripple's focus on regulatory compliance could help position the stablecoin as a strong contender in a market which values stability and security. As it stands, the market cap of the stablecoin space is around $172 billion.

-The Gemini Team

data as of 4:40 pm ET on August 8, 2024.

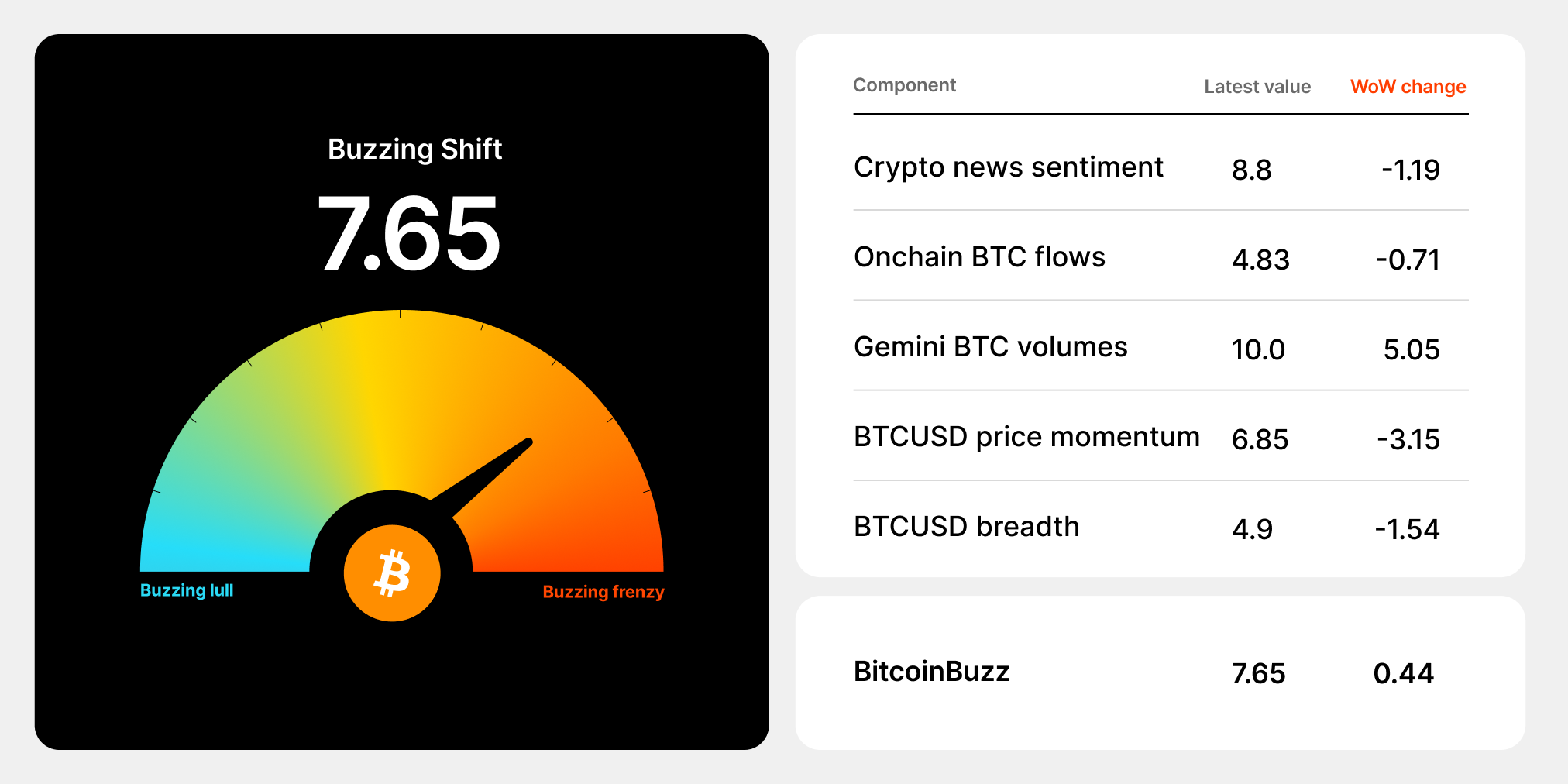

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

Solana (SOL): Scaling Crypto to the Masses

Solana (SOL) was created in 2017 with the goal of scaling censorship resistance to support an order of magnitude increase in transaction throughput, at a much lower cost compared to other blockchains like Bitcoin or Ethereum. Designed as a decentralized protocol, Solana incorporates an innovative Proof-of-History (PoH) timing mechanism that is implemented prior to, and facilitates, its Proof-of-Stake (PoS) protocol structure. The result is an ultrafast blockchain capable of processing more than 50,000 transactions per second, with the ability to scale as usage of the protocol grows without relying on Layer-2 systems or sharding.

Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

MAR 06, 2026

Sui Is Now Available On Gemini

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026