JUN 13, 2024

Bitcoin Price Drops to $66K Despite Soft Inflation Report, Trump Pledges Support for Mining

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we look at how investors can gain exposure to crypto in their retirement accounts.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -5.94% | $66,872.74 |

$66,872.74

-5.94%

| |

Ether

ETH | -9.48% | $3,467.05 |

$3,467.05

-9.48%

| |

Terra

LUNA | -47.4% | $0.00003 |

$0.00003

-47.4%

| |

Gala

GALA | -24.6% | $0.03446 |

$0.03446

-24.6%

| |

Curve

CRV | -21.4% | $0.2916 |

$0.2916

-21.4

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, June 13, 2024, at 2:30 pm ET. . All prices in USD.

Takeaways

- The US CPI remained flat in May, beating forecasts and lifting by nearly 4% on Wednesday: But bitcoin prices quickly retreated on Thursday as traders grappled with the possibility of just one rate cut by the Federal Reserve by the end of the year.

- Trump voices support for Bitcoin mining at Mar-a-Lago: President Biden’s campaign also consulted the crypto industry on his digital asset policy.

- Gensler confirms spot ether ETFs are coming soon: In a Senate Banking hearing on Thursday, SEC chairman Gary Gensler said he expects spot ether ETFs will begin trading this summer.

- GameStop's stock drops 12%, impacting related meme tokens: The dip comes after recent highs and announcements of new share sales and declining quarterly sales.

- HSBC Bank's China branch begins offering e-CNY services to corporate clients: It’s the first foreign bank to support the digital yuan to facilitate transactions and asset management.

- The ZKsync Association will airdrop 3.675 billion ZK tokens next week: Early users and contributors will receive the distributions, with claims available until January 2025.

Bitcoin Rallies on Soft Inflation Data after CPI Remains Flat in May

CPI rose by 3.3% year-over-year, slightly below the anticipated 3.4% and April’s figure.

Core CPI, which excludes volatile food and energy prices, increased by 0.2% in May, better than the forecasted 0.3% rise and down from April's 0.3% bump.

Bitcoin reacted positively to the softer inflation data on Wednesday, climbing nearly 4% to $69,400.

Earlier this year, traders anticipated five or six 25 basis point cuts in 2024 by the end of December, but expectations have since dwindled to one cut in 2024, with the first cut projected for September. In the run up to the CPI announcement, investors reportedly withdrew some $200 million out of spot BTC ETFs.

Trump Supports Bitcoin Mining, Biden Reaches Out to Crypto Industry

Trump has recently adopted a pro-crypto stance for the upcoming November election. He told a gathering of Bitcoin miners that he would take a more positive stance towards the space at the White House, highlighting the role mining companies could play in stabilizing the energy grid.

The meeting included representatives from Nasdaq-listed Bitcoin mining firms CleanSpark Inc. and Riot Platforms. Key crypto industry leaders have recently backed Trump, evidenced by a recent $12 million fundraising event in Silicon Valley hosted by David Sacks and Chamath Palihapitiya. Last month, the former president also announced that he would accept political donations in cryptocurrency.

However, Trump isn’t the only candidate taking steps to woo the crypto space. President Joe Biden’s re-election campaign is reaching out to the crypto industry for advice on digital asset policies, signaling a shift from the administration’s previous stance. It’s clear both candidates believe the issue is important for votes ahead of November's election.

Gensler Confirms Spot ETH ETFs Will Arrive This Summer

In a Senate Banking Committee hearing to set the 2025 budget for the Securities and Exchange Commission and Commodity Futures Trading Commission, SEC chairman Gary Gensler said that the long-awaited ether ETFs will arrive sometime this summer.

The SEC already approved 19b-4 forms for eight spot ether ETFs in late May, but the ETFs also need S-1 approvals to begin trading on US exchanges. And it was unclear when those forms would be approved.

The news comes after spot bitcoin ETFs launched in the US in January, paving the way for billions in inflows. Spot ether ETFs will closely track the price of ether, allowing investors to get price exposure to the cryptocurrency without opening a digital wallet and buying it directly.

GameStop Stock and Meme Tokens Decline Amid Share Sale Announcement

The recent downturn seems to have also affected several meme tokens that typically follow GME’s price movements. GME ended Monday at $24.89, a steep 62% fall from its two-year high of $61, whcich it reached last Thursday.

GME, a Solana-based meme token which parodies the company, also saw a sharp decline of 25%, reversing a substantial 200% rally from the previous week. Similarly, related tokens such as Roaring Kitty (KITTY) and various cat-themed tokens saw average losses of at least 10%, while the likes of DOGE, SHIB, and FLOKI, also pared gains from the last week with declines ranging from 4% to 10%.

The volatility was in part driven by Keith Gill, known for his alias TheRoaringKitty, who revealed a $580 million position in GME equity and options last week, temporarily boosting the stock's price. However, the gains didn’t last long after the company announced plans to sell up to 75 million shares, following a previous sale of 45 million shares for $933M just days earlier. In Q1, Gamestop sales dropped 29% YoY to $882 million, a decrease from $1.24 billion during the same period last year.

HSBC China Launches e-CNY Services for Corporate Clients

This development allows HSBC's corporate customers to link their bank accounts with digital yuan accounts for asset management. The e-CNY, also known as the digital yuan, is a central bank digital currency (CBDC) issued by the People’s Bank of China, intended to complement the physical yuan in circulation.

In a recent statement, HSBC China announced it has facilitated an educational group to receive payments in e-CNY for its branches in Shanghai, Beijing, Guangzhou, Jiaxing, and Suzhou. The digital yuan initiative, launched by China’s central bank in late 2019, has expanded to numerous regions and includes payments to state employees in certain cities.

Hong Kong introduced personal e-CNY wallets for cross-border payments, just one of the steps taken in efforts to increase digital yuan usage among its residents.

ZKsync to Airdrop 3.675 Billion ZK Tokens to Early Adopters

, representing 17.5% of the total ZK token supply of 21 billion. This one-time airdrop allows users to claim their tokens from next week until January 3, 2025, while contributors can start claiming on June 24.

Additionally, 49.1% of the total supply will be distributed through ecosystem initiatives, with 17.2% allocated to investors and 16.1% to the Matter Labs team. The airdrop will reach 695,232 wallets, chosen based on a snapshot of activity on ZKsync Era and ZKsync Lite taken on March 24, 2024, at 0:00 UTC, the one-year anniversary of the ZKsync Era mainnet launch.

The 17.5% ZK airdrop is divided into two categories: 89% for users who transacted and met an activity threshold, and 11% for contributors, including developers, researchers, and community members who supported the ZKsync ecosystem through various efforts.

-Team Gemini

data as of 2:30 pm ET on June 13, 2024.

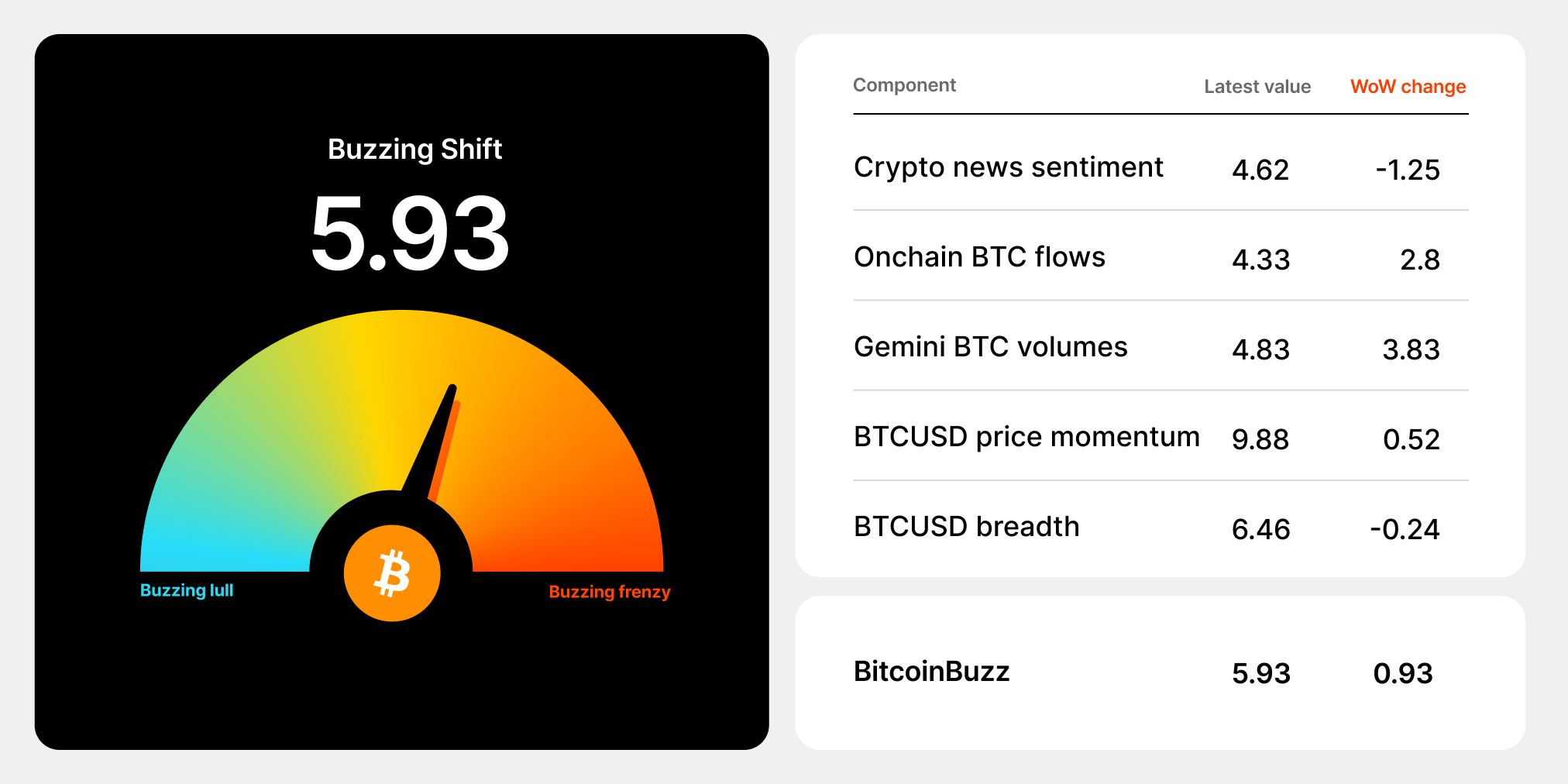

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

Crypto and Retirement Accounts: 401ks and IRAs

In the United States, some of the most common vehicles for saving for retirement are a 401(k) and an IRA. As blockchain technology becomes more mainstream worldwide, an increasing number of investors looking to save for retirement are also considering crypto investment options. A growing number of financial technology (FinTech) companies and legacy financial institutions are now offering crypto-based 401(k) or IRA products.

What are some of the most popular methods for investing in a crypto retirement plan?

Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

JAN 22, 2026

Bitcoin Pulls Back, Strategy Buys $2.13B BTC, and NYSE Announces Plan To Launch Tokenized Stocks

COMPANY

JAN 16, 2026

Five Crypto Market Predictions for 2026

WEEKLY MARKET UPDATE

JAN 15, 2026