JAN 26, 2024

Bitcoin Hovers Above $40k, Ether’s Rally Against Bitcoin Stalls as SEC Delays Spot ETF Decisions, Altcoins Largely Flat After Dip, and Stock Market Continues to Hit New Highs Following Strong GDP Growth

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we introduce the concept of double spending and how blockchain solves this problem.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +3.42% | $41,887 |

$41,887

+3.42%

| |

Ether

ETH | -6.56% | $2,276 |

$2,276

-6.56%

| |

API3

API3 | +37.70% | $2.122 |

$2.122

+37.70%

| |

Chiliz

CHZ | +31.70% | $0.1143 |

$0.1143

+31.70%

| |

0x

ZRX | +19.70% | $0.369 |

$0.369

+19.70%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, January 26, 2024, at 11:50am ET. . All prices in USD.

Takeaways

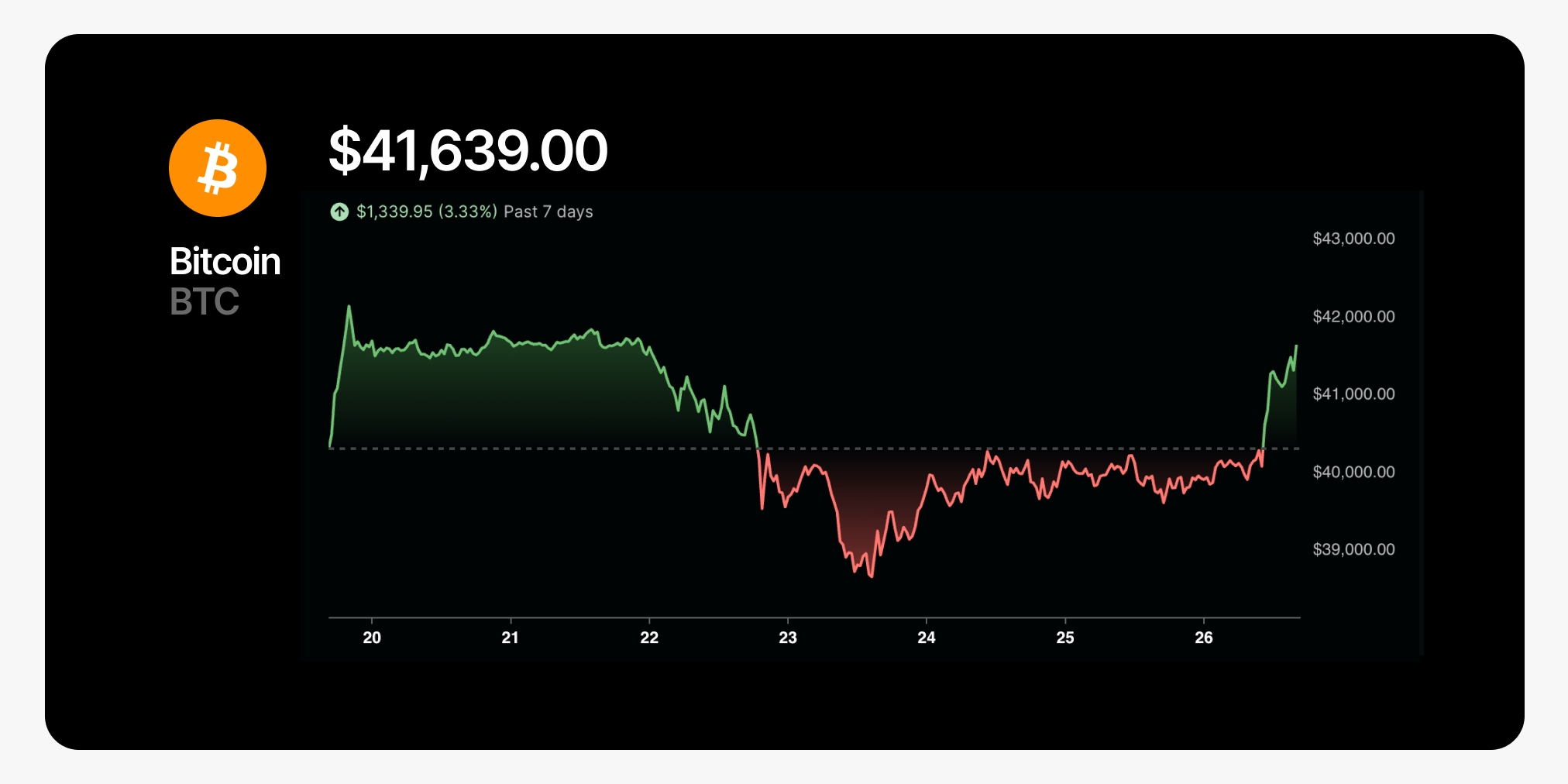

- Bitcoin hangs above $40k as ETF-led rally fizzles: After peaking at $49k immediately after the launch of the ETFs, the price of bitcoin (BTC) has since dropped over 20% in the two weeks following, reaching a low of ~$38.5k on Tuesday. BTC is now trading back at the levels seen at the start of December, retracing the rally experienced in the build up to the anticipated launch of the ETFs.

- Ether dips against bitcoin as SEC delays ether ETF decision: Ether (ETH)’s rally higher against BTC lost steam this week after failing to break through the 0.06 level in the ETHBTC pair. The US Securities and Exchange Commission (SEC) also postponed its decision on BlackRock’s spot ether ETF until March, and last week it delayed Fidelity's spot ether ETF application. These delays were widely expected.

- Altcoins dip throughout the week, but pick up by Friday: Altcoins faced a difficult start to the week as bitcoin broke down and dipped below $40k briefly, but many retraced losses by Friday. Solana (SOL) was up ~5% over the past seven days after being down throughout the week, Avalanche (AVAX) was up 2%, Injective (INJ) was down just over 2%, and XRP down over 1%. There were some bright spots among altcoins, however, with Chiliz (CHZ) up ~30% on the week, Maker (MKR) up over 8%, and 0x (ZRX) up just under 25% over the same time period.

- US markets rally as tech stocks await earnings next week: The S&P 500 hit another record high on Wednesday, bolstered in part by stronger than expected Gross Domestic Product (GDP) growth numbers released this week. GDP data showed 3.3% growth in the US economy for the fourth quarter of 2023, well above the 2% expected by Dow Jones-polled economists. Tech companies showed continued strength too, with Microsoft’s market capitalization hitting a new all time high above $3 trillion for the first time, and Netflix, Alphabet, and Meta also posting gains as market participants eagerly await earnings slated for next week.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Bitcoin Hovers Above $40k as Traders Take Gains Following ETF-led Rally

After peaking at $49k immediately after the launch of the ETFs, the price of has since dropped over 20% in the two weeks following, reaching a low of ~$38.5k on Tuesday. is now trading back at the levels seen at the start of December, retracing the rally experienced in the build up to the anticipated launch of the ETFs.

The decline could be attributed to investors taking profits following the huge run up over the past few months, while some of the downward pressure on prices could be due to the flows seen over the past couple of weeks. The 10 spot bitcoin ETFs launched have since the launch of trading. Grayscale’s GBTC has seen significant outflows that have offset the inflows of the other 9 funds, possibly due to its higher management fees. Excluding GBTC, the other 9 spot bitcoin ETF funds have to their funds in aggregate.

that has been redeemed from Grayscale’s GBTC, approximately $1 billion worth of shares. With FTX now done selling we have seen volumes ease this week, with ETF analyst Eric Balchunas that GBTC volumes have been trending down throughout this week and “could be sign of some exhaustion in the selling.”

Ether’s Rally Against Bitcoin Cools as SEC Delays Ether ETF Decisions

’s rally higher against BTC lost steam this week after failing to break through the 0.06 level in the . This week, the US Securities and Exchange Commission (SEC) , and Fidelity's spot ether ETF application. These delays were widely expected, however, with noting that “spot Ethereum ETF delays will continue to happen sporadically over the next few months. Next date that matters is May 23rd.”

is now trading just below $2,300 and back within the range seen throughout much of December as we wait to see if the hype that built around the bitcoin ETFs will be reflected in the conversation around ether ETFs.

Altcoins Largely Flat With a Few Bright Spots by Friday

Altcoins faced a difficult start to the week as bitcoin broke down and dipped below $40k briefly, but many retraced losses by Friday. was up ~5% over the past seven days after being down throughout the week, was up 2%, was down just over 2%, and down over 1%.

There were some bright spots among altcoins, however, with up ~30% on the week, up over 8%, and up just under 25% over the same time period.

US Stock Markets Continue to Rise as GDP Growth Tops Expectations

hit another record high on Wednesday, bolstered in part by numbers released this week. GDP data showed 3.3% growth in the US economy for the fourth quarter of 2023, well above the 2% expected by Dow Jones-polled economists.

Tech stocks also rose this week, including Neftlix, which following its recent crackdown on shared login credentials. Other large tech companies showed continued strength too, with Microsoft’s market capitalization hitting a new all time high for the first time, and and also posting further gains as market participants eagerly await earnings slated for next week.

Two surveys this week suggested that the U.S. economy has started the year strongly, with steady growth helping to push stock prices higher. The hit 52.9 in January, up from 51.4 the month before and the highest reading since June. Meanwhile, the flash U.S. manufacturing PMI also saw a jump, and its first positive reading in over a year.

-From the Gemini Trading Desk

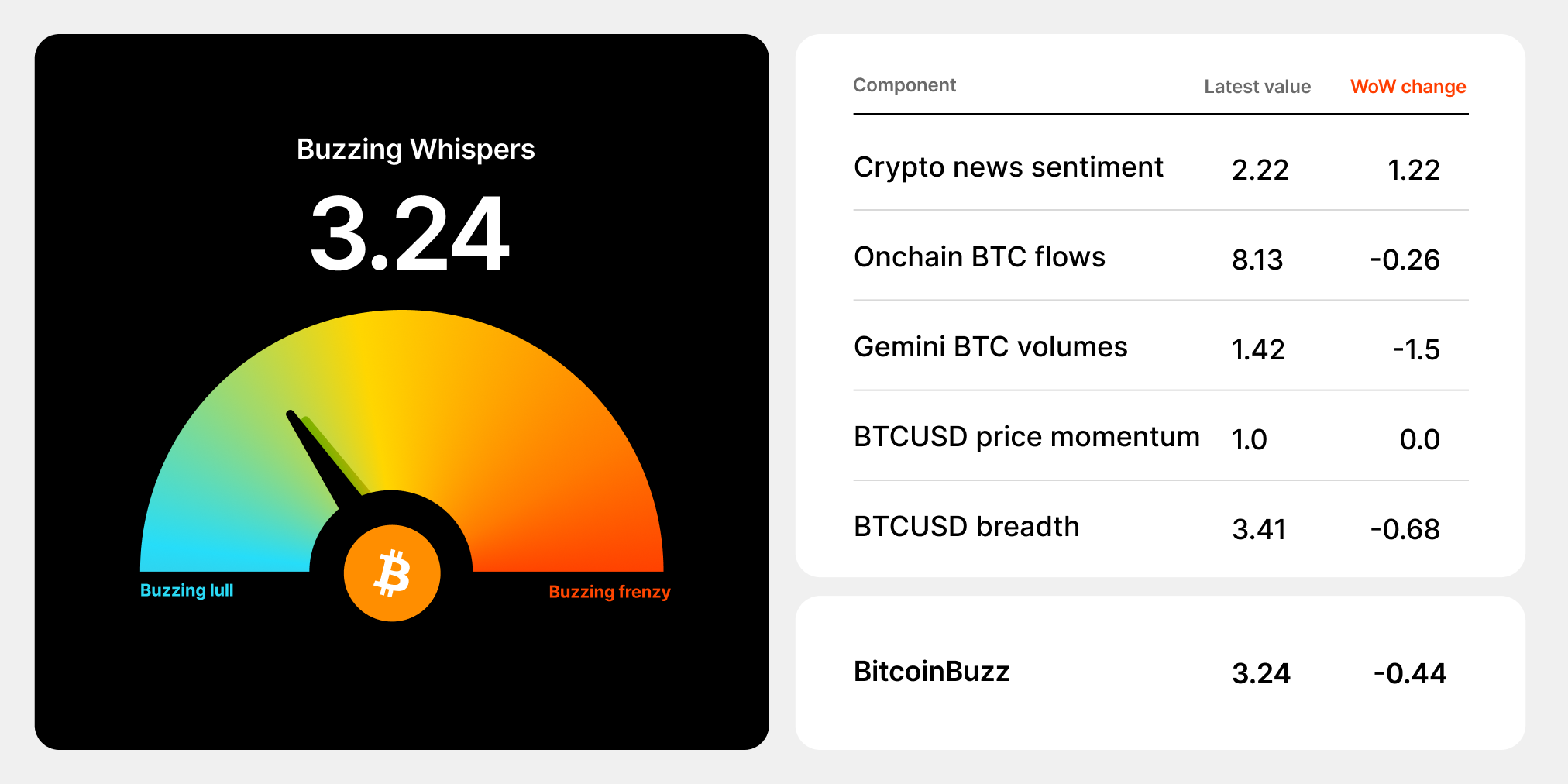

data as of 5:10pm ET on January 25, 2024.

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

The Double-Spending Problem

Double-spending is simply the process of making two payments with the same currency or funds in order to deceive the recipient of those funds. With physical currency, this really isn’t possible. You can’t give two people the same $20 bill or silver coin. With most online payments, you trust a third party to make sure funds are sent and received properly. Banks, credit card companies, and payment processors validate the transactions themselves and minimize the risk of double-spending. With cryptocurrency, however, there’s no third-party intermediary — just the sender and the recipient. How can crypto holders protect themselves against double-spending? The answer is on the blockchain.

Bitcoin and Double-Spending

The Bitcoin blockchain is a public ledger of transactions that’s secured by miners who receive as an incentive to protect the blockchain. When you initially make a transaction, it’s an unconfirmed, or pending, transaction waiting to be included in a block. New blocks are added to the Bitcoin blockchain approximately every 10 minutes.

Once an is included in a block, it’s been “written” to the blockchain’s public ledger and is now a “confirmed” transaction. A confirmed transaction is assigned to the recipient and is verified by the network through specialized cryptographic proofs, meaning it can’t be double-spent, or “copied.” You don’t need permission from anyone to send the transaction; all you need is a and an internet connection.

With a market capitalization over $750 billion U.S. dollars, there’s a big incentive to double-spend bitcoin. Double-spending would seriously damage the network and remove one of its most important features: trustless, immutable, and decentralized transactions. Thanks to , double-spending confirmed transactions is all but impossible.

Types of Double-Spending Attacks

Although many consider the double-spending problem largely solved by the blockchain, there have been some attempts to exploit the Bitcoin protocol, via , , and .

In a race attack, the hacker sends two transactions in quick succession and only one is later confirmed on the blockchain. The goal is to purchase something with the unconfirmed transaction and then invalidate it before it’s confirmed. This is possible only if the recipient or merchant accepts an unconfirmed transaction.

Only miners can perform Finney attacks. The miner pre-mines a transaction into a block from one wallet to another. Then, they use the first wallet to make a second transaction and broadcast the pre-mined block, which includes the first transaction. This requires a very specific sequence to work. Like a race attack, a Finney attack is possible only if the recipient accepts an unconfirmed transaction.

A 51% attack occurs when a group or individual controls more than 50% of a network’s hashing power in order to alter a blockchain. With this control, the hacker(s) can launch a . However, because of Bitcoin’s enormous , this scenario is highly improbable on the Bitcoin protocol.

While Bitcoin has mostly been immune to these attacks, other cryptocurrencies with less hashing power have been double-spent via 51% attacks. Because 51% attacks are very expensive to pull off, they’ve mainly targeted large exchanges with sizable holdings. The attackers need to successfully double-spend more than the cost of the attack in order to make a profit.

.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

COMPANY

FEB 05, 2026