DEC 01, 2023

Bitcoin Hits Yearly High as Spot ETF Expectations Continue to Build, Fed Governors Talk Interest Rates Ahead of December Meeting, and FTX Set to Sell Off Trust Assets

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we discuss interest rates.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +2.98% | $38,879 |

$38,879

+2.98%

| |

Ether

ETH | +0.48% | $2,107 |

$2,107

+0.48%

| |

SuperRare

RARE | +60% | $0.122 |

$0.122

+60%

| |

Samoyedcoin

SAMO | +38.70% | $0.0102 |

$0.0102

+38.70%

| |

Alethea Artificial Liquid Intelligence

ALI | +23.64% | $0.0214 |

$0.0214

+23.64%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, December 1, 2023, at 11:45am ET. . All prices in USD.

Takeaways

- Bitcoin climbs as SEC speeds up spot bitcoin ETF review process: Bitcoin (BTC) continued to grind higher this week, reaching a new yearly high of over $38.5k as market participants continued accumulating BTC ahead of the potential ETF approvals at the start of next year. The SEC announced it would open the comment period for its review of applications submitted by asset manager Franklin Templeton and crypto-native firm Hashdex, leading to speculation that the regulator may be lining up “every applicant up for potential approval by the Jan 10, 2024 deadline.” Investors continued to accumulate BTC, including an unidentified whale that has been gaining attention after purchasing ~12,000 BTC, worth more than $450 million, over the past month. Microstrategy also announced that it bought another ~$600 million worth of BTC in November, bringing its total holdings to 174,530 BTC.

- Federal Reserve Governors appear to diverge on interest rate hikes ahead of December meeting: The Federal Open Market Committee (FOMC) is set to have its last meeting of the year on December 13, with the market widely expecting rates to remain unchanged. On Tuesday, two separate speeches from Federal Reserve governors differed on how they see the path forward on inflation and interest rates. Fed governor Michelle Bowman suggested that more rate hikes may be necessary to bring inflation back down to 2%, and notably hawkish Fed governor Christopher Waller appeared to ease his stance, suggesting that more hikes are not needed.

- USTC and LUNC skyrocket amid Binance perps listing and airdrop news: Following rumors that there may be a Terra Classic USD (USTC) revamp backed by bitcoin and news that Binance listed a USTC perpetuals contract, USTC and LUNC unexpectedly gained investor attention this week.

- FTX estate given approval to sell off trust assets: The FTX bankruptcy reached a key milestone this week as the estate was granted approval to sell its trust assets worth roughly $873 million at current prices. The added supply from these sell orders could cap price action for some of the assets. Notably, Solana (SOL) continued its rally to ~$60 despite FTX rumored to be selling SOL from its estate in early November.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Bitcoin Touches New Yearly High Amid ETF Anticipation

continued to grind higher this week, of just over $38.5k, as market participants appear to continue accumulating BTC ahead of the potential ETF approvals at the start of next year.

One whale in particular has gained attention, since early November, , with the average purchase price falling in the $36k-$38k range. This large buying spree has made this wallet the world’s 67th largest holder of BTC as of Friday, . Microstrategy also announced that it in November, bringing its total holdings to 174,530 BTC.

On Tuesday, announced it would open the comment period for its review of applications submitted by asset manager Franklin Templeton and crypto-native firm Hashdex. The news came earlier than expected, and was a surprise to some as the next scheduled deadline for a response from the SEC on the application was more than a month away.

Commentators suggested that the SEC’s decision to open the comment period early could mean the regulator is seeking to speed up the review process and By approving all applications at the same time, the SEC would reduce any first mover advantage a particular issuer may gain. According to reports, there are that have filed for a US spot Bitcoin ETF, with Swiss firm Pando Asset being the latest joiner this week.

Federal Reserve Governors Send Mixed Messages on Interest Rate Increases

On Tuesday, from Federal Reserve governors differed on how they see inflation and interest rates changing in the near future. Fed governor Michelle Bowman suggested that more rate hikes may be necessary to bring inflation back down to the 2% target. In contrast, notably hawkish Fed governor Christopher Waller said that he was “increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%.”

In response, treasury yields fell on Wednesday, and is on track for its largest monthly drop . Looking ahead, the FOMC is set to have its last meeting of the year on December 13, with the market to remain unchanged.

Terra Classic USD and Terra Luna Classic Gain Attention Following Binance Perps Listing, LUNA and UST Airdrop News

and , the forgotten tokens from the collapse of the Terra ecosystem during the summer of 2022, rallied ~300% and ~90%, respectively, this week after perpetuals were reported to be .

After languishing just above the 1 cent mark for months, jumped to over 7 cents on Monday, before settling around the 5 cent level by the end of the week. that there could be a Bitcoin-backed USTC revamp plan, and that the previously popular Anchor protocol would be making a return, followed by airdrops for pre-crash LUNA and TerraUSD (UST) holders. The confluence of news drove huge speculation and sent prices and volumes skyrocketing.

FTX Receives Approval To Sell Off Trust Assets

FTX was granted to sell off $873 million worth of trust assets, including shares of Grayscale Bitcoin and Ethereum Trusts, Bitwise Crypto Index Fund, and three smaller Grayscale Trusts. The total value of the assets was set to be around $873M at current market prices, and the supply from these sell orders could cap price action for some of the assets. Notably, has to ~$60 this year despite FTX rumored to be selling SOL from its estate .

-From the Gemini Trading Desk

data as of 5:10pm ET on November 31, 2023.

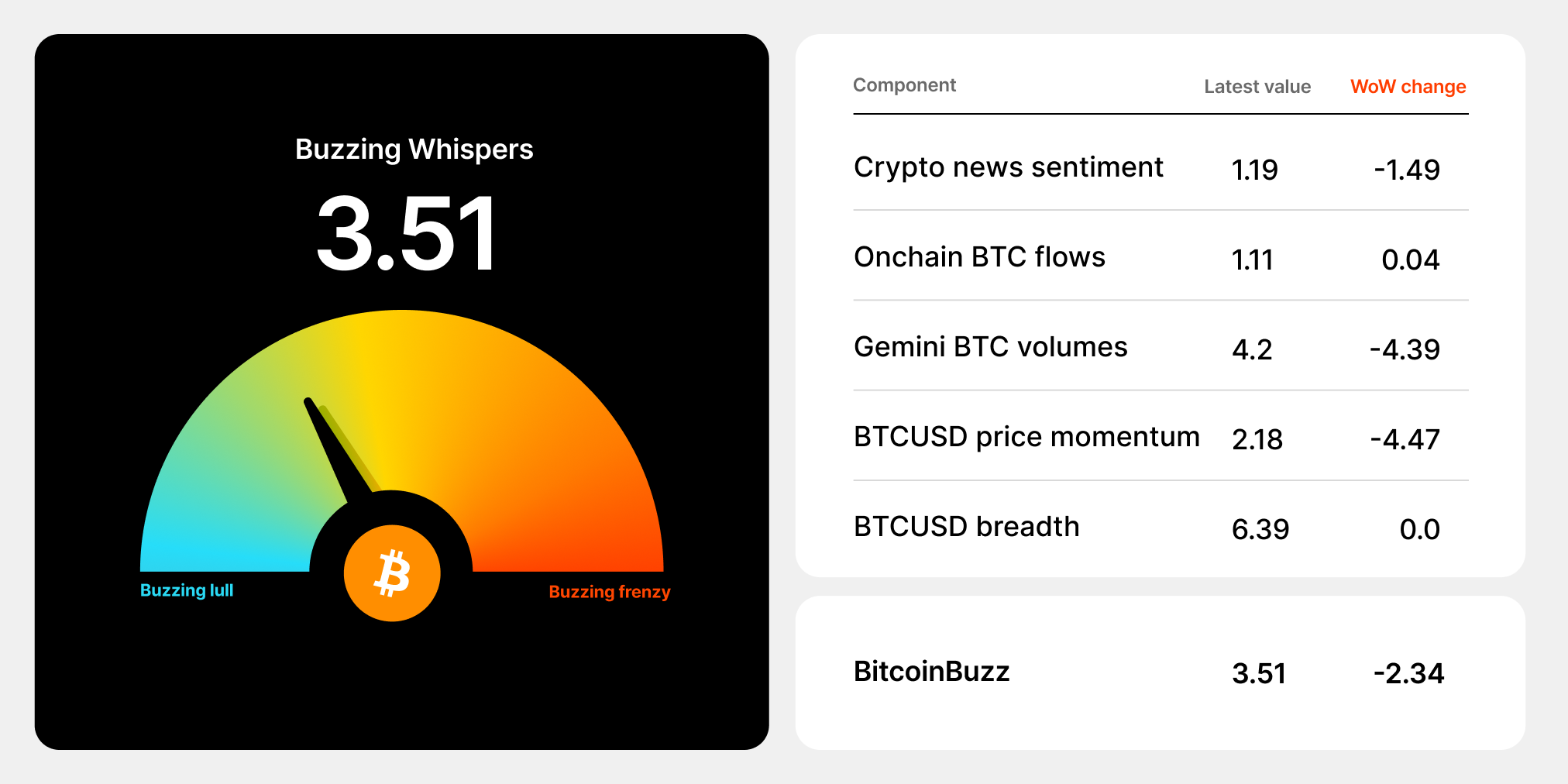

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

Interest Rates

Today, with the last Federal Open Market Committee (FOMC) meeting coming up later this month, we resurface our discussion of interest rates. Interest rates can significantly impact the crypto and wider financial markets, as we’ve seen over the past months. As one of the most important monetary policy tools governments have at their disposal, this week, we provide a high-level overview of what interest rates are and why they matter.

Interest rates represent the cost of borrowing money, or the return lenders receive for lending money. Central banks, like the US Federal Reserve, generally set target interest rates which influence rates throughout financial markets. Based on the number they set, lending institutions — commercial banks, credit unions, and the like — will calculate the interest rate they charge their customers. When setting their rates, lending institutions will also take other variables into consideration, such as a borrower's credit score.

Interest rates are generally quoted as an annual percentage rate (APR) or annual percentage yield (APY). These reflect the rate that a lender charges a borrower for a consumer loan (APR), or the amount a consumer receives from a financial institution when storing their money in different vehicles (APY). Most industries pay close attention to interest rate changes, as they affect consumer and corporate debt, the health of financial markets, and the economy as a whole.

Why do interest rates matter? As an important tool used by governments and central banks to influence economic activity, interest rates matter for a variety of reasons. We touch on some of the main impacts below.

Borrowing and lending: The immediate impact of interest rates is on the cost of borrowing money, and the return on lending money, as explained above. When interest rates are low, borrowing is cheaper, potentially encouraging individuals and businesses to take out loans to invest or spend. Conversely, high interest rates often have the opposite effect, leading to less spending and lower demand.

Consumer and business spending: Lowering interest rates, which we saw the Fed do throughout much of the early 2020s , can stimulate spending and boost economic activity. Keeping rates low for long periods of time, however, can increase inflation as more economic activity pushes prices higher.

Investing: Interest rates can also play a role in investment decisions. Low interest rates often drive individuals and businesses to invest in assets like equities, and crypto, as the potential returns may be higher than other investments. This dynamic could be playing out in real time, as recent signals from the Fed that it may slow rate increases has been accompanied with equities and crypto running higher.

Currency impacts: While this is certainly not an exhaustive list of how interest rates can impact financial markets, another final major impact they have is on the value of fiat currencies. Central banks set their national interest rates at different levels, depending on the economics of each. When a country's interest rates are higher than those of others, its currency may become more attractive to foreign investors seeking higher returns. This can lead to an increase in demand for the country's currency, driving up its value relative to other currencies.

.

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

FEB 05, 2026

Gemini 2.0: A Bridge to the Future of Money and Markets

COMPANY

FEB 04, 2026

Gemini To Sponsor WM Phoenix Open, Launch Golf Event Contracts

WEEKLY MARKET UPDATE

JAN 29, 2026