DEC 08, 2023

Bitcoin Breaks Through Another Yearly High, Doge Turns 10 and Spurs Memecoin Rally, and Bitcoin-Linked Altcoins Have Strong Showing With ETF Decisions on the Horizon

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we discuss the basics of API trading.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +12.95% | $43,900 |

$43,900

+12.95%

| |

Ether

ETH | +12.72% | $2,359 |

$2,359

+12.72%

| |

Helium

HNT | +60.35% | $5.14 |

$5.14

+60.35%

| |

Samoyedcoin

SAMO | +49.97% | $0.0167 |

$0.0167

+49.97%

| |

AMP

AMP | +41.68% | $0.00347 |

$0.00347

+41.68%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, December 8, 2023, at 11:45am ET. . All prices in USD.

Takeaways

- Multiple 2024 tailwinds drive bitcoin higher: Bitcoin reached new annual highs this week driven by multiple tailwinds, including potentially imminent ETF approvals, the upcoming Bitcoin halving, and a possibly lower interest rate environment. Notably, BTC broke above $40k for the first time in over a year on Monday, with no signs of slowing. BTC was hovering around $44k on Friday morning.

- Robust jobs data and upcoming Fed meeting may bring volatility: The November nonfarm payroll numbers released on Friday pointed to continued strength in the job market with 199k new jobs added, above estimates of 190k. Market participants are also waiting on the outcome of the next FOMC meeting on December 13. Following Friday’s job numbers, investors continue to expect rates to remain unchanged until Q1 next year, but any deviation from those expectations could inject volatility ahead of the usual pre-holiday contraction.

- Dog memecoins hit new highs as Doge turns 10: Doge reached its 10th anniversary on Wednesday and celebrated by posting +18% gains over the past 7 days. Shiba Inu (SHIB) and Solana dog token BONK followed suit with gains of +20% and 225%, respectively.

- Expected ETF approvals lift bitcoin-linked altcoins: The market focus on BTC ahead of a potential bitcoin ETF approval has led several altcoins to move higher. Stacks (STX), which enables smart contracts and decentralized finance (DeFi) applications on the Bitcoin network, posted +40% gains this week. Ordinals (ORDI), a BRC-20 token focused on Bitcoin’s ordinals protocol, saw another huge run up this week, adding +140%.

- Societe Generale stablecoin EURCV lists on Bitstamp: SocGen’s crypto division developed the Ethereum-based Euro stablecoin, EURCV, to bridge the gap between traditional and digital assets and help onboard institutional market participants. The move may increase adoption of non-USD backed stablecoins.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Bitcoin Continues March Higher For Eighth Successive Week

Bitcoin (BTC) this week as it looks to post its eighth successive weekly green candle. Despite an already impressive run, showed no signs of slowing down as it for the first time in over a year on Monday morning.

With perhaps a bit of FOMO starting to creep into the market as we edge closer to a possible US spot BTC ETF approval in January, BTC saw on Tuesday, the first time it hit such levels since April 2022. A , , , — all of which are expected during the first half of 2024 — are providing a strong tailwind to the current price action.

On Tuesday, announced it would open the comment period for its review of applications submitted by asset manager Franklin Templeton and crypto-native firm Hashdex. The news came earlier than expected, and was a surprise to some as the next scheduled deadline for a response from the SEC on the application was more than a month away.

Markets Calm Ahead of Potential Pre-Holiday Volatility

U.S. Indices have remained relatively quiet over the past couple of weeks, with the . However, upcoming market data could inject some increased volatility before the usual contraction as we head into the December holidays and New Year. November nonfarm payroll numbers pointed to continued strength in the job market with 199k new jobs added, above estimates of 190k. Markets reacted mildly to the news in early Friday trading.

The next significant event market participants are tracking is the , and their updated economic and interest rate projections, to be released on December 13th. Investors are currently expecting rates to remain unchanged at next week's meeting, and a next year.

Dogecoin Hits New Highs On 10th Anniversary

, the original memecoin, reached its 10th anniversary on Wednesday. To celebrate, , which has posed strong resistance over the past year. DOGE briefly , before losing steam along with the rest of the market, but over the past 7 days. In true memecoin style, other popular dog tokens were not left behind with and Solana’s biggest canine token BONK gaining an impressive 20% and respectively over the past seven days.

Altcoins Linked to Bitcoin Gain Ahead of Anticipated ETF Approvals

With much of the market's focus centered around Bitcoin in the build up to the potential launch of a US spot ETF next month, a number of altcoins linked to the market leader have gained traction recently. , a project whose goal is to enable smart contracts and decentralized finance (DeFI) applications on Bitcoin, . In addition, , a BRC-20 focused on Bitcoins ordinals protocol, saw another huge run up this week adding +140%. The price of ORDI is now trading up +320% over the past month, with the token making the initial move higher following a listing on Binance.

EURCV Launches on Bitstamp To Aid Institutional Adoption

Societe Generale’s (SocGen) Euro stablecoin EUR Coinvertible (EURCV), which was first announced back in April, was this week. SocGen’s crypto division developed the Ethereum-based Euro stablecoin in an attempt to bridge the gap between traditional and digital assets and help onboard more institutional capital. The move may also increase adoption of other stablecoins outside of the currently dominant USD-backed stablecoins.

-From the Gemini Trading Desk

data as of 5:10pm ET on December 7, 2023.

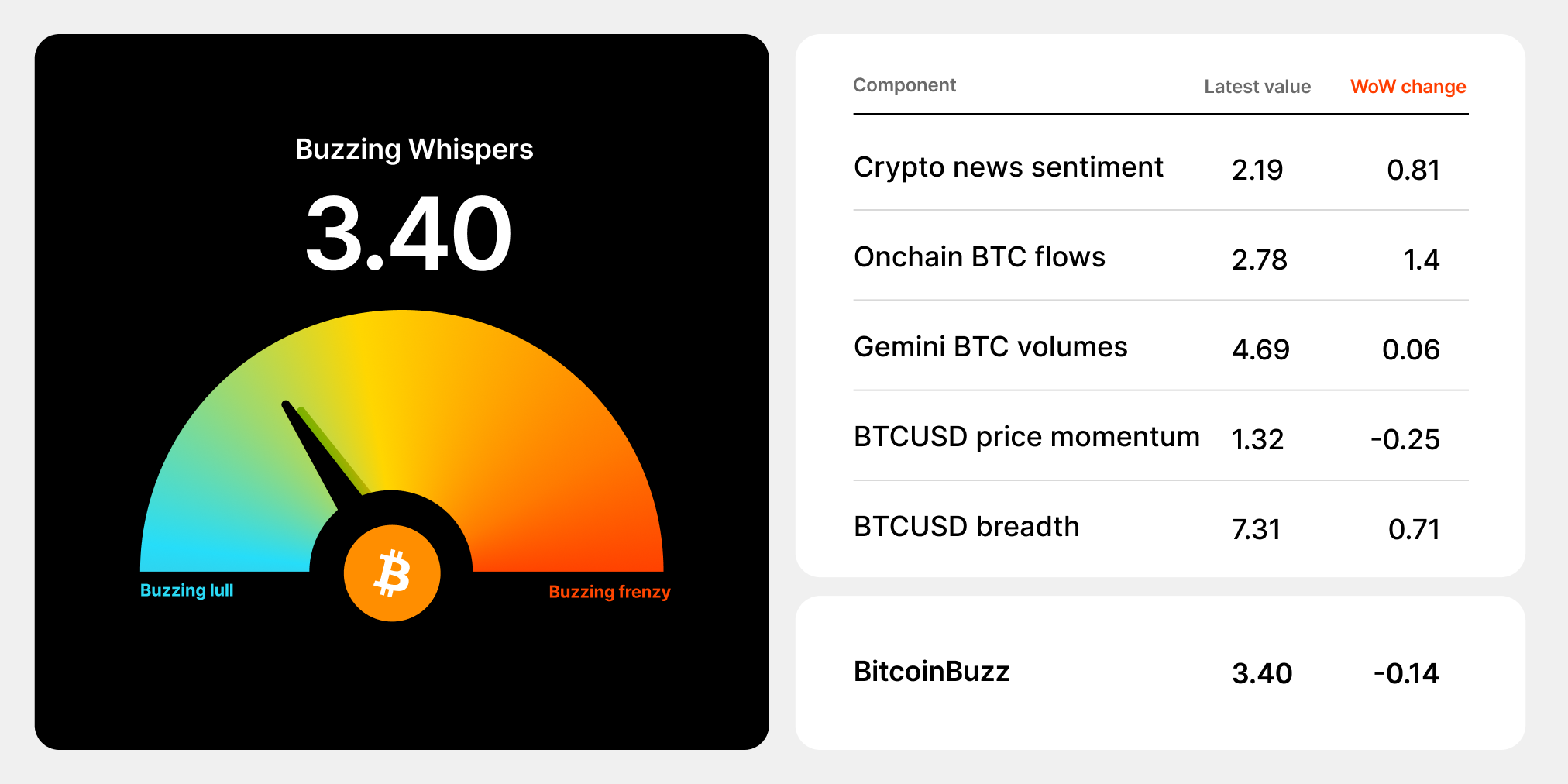

To learn more about the BitcoinBuzz Indicator and its components, . Check back every Friday for an updated score!

Introduction to Trading APIs

An is a software bridge that allows computers to communicate and execute tasks with each other. You can think of it as a language translator for computers. An API links a trader’s account with a broker’s automated trading system to execute trades quickly and efficiently, and to perform or programmable trades in certain scenarios.

APIs have gained popularity as traders realize the benefits of automated trading tools, which allow them to hedge bets into the future, and abandon traditional manual trades. Whether it’s a stock trading API or a bitcoin trading API, the key functions and benefits remain the same.

What Can an API Do?

A crypto exchange’s API acts as an intermediary between you and your broker so you can perform various transactions. These may include buying and selling assets, viewing real-time market data, and executing more sophisticated trading strategies. Crypto exchanges, for instance, use APIs to offer customers the ability to trade cryptocurrency pairs and carry out basic to high-performance trading through premium trading platforms. Experienced day traders can engage in advanced charting, multiple order types, auctions, and block trading, among other functions.

Who Can Use API Trading?

Anyone interested in trading can use APIs. Traders can use APIs to trade stocks, crypto, commodities, and virtually every other asset under the sun. To develop trading strategies from scratch, traders often use coding software such as Python, C++, or Java.

Algorithmic Trading: Welcome to Robo-Trades

The next level in API trading is algorithmic, or algo, trading where traders define a certain set of instructions or complex mathematical equations (algorithms). Sometimes called “black box”’ trading in reference to heavily guarded and proprietary trading strategies, of equity trades are thought to be executed by machines. Algo trading has also provided the building blocks for . As its name implies, HFT involves very rapid execution — faster than the blink of an eye — of large orders using powerful computer algorithms.

Artificial Intelligence (AI) and API Trading

We can’t discuss algo trading without considering and its growing role in automated trading. You pre-set certain conditions such as price, volume, volatility, and so on for a computer to execute, then use AI machines to track these strategies’ results in order to fine tune them for higher future profits. As AI provides new insights from analyzing historical data and trading patterns, a growing number of brokers are marrying algo trading with AI — so much so that some wonder whether robots will completely replace human traders in the future.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

JAN 16, 2026

Five Crypto Market Predictions for 2026

WEEKLY MARKET UPDATE

JAN 15, 2026

Bitcoin’s Rally Forces $700M in Short Liquidations, Market Structure Bill Stalls, and Tether Freezes $182M in USDT

COMPANY

JAN 08, 2026