FEB 22, 2024

A Crypto Spring is Upon Us As ETF Inflows Contribute to BTC Surge and ETH Boosts in Anticipation of ETH ETF Approval

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we discuss the convergence of artificial intelligence (AI) and crypto.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -0.50% | $51,738.88 |

$51,738.88

-0.50%

| |

Ether

ETH | +5.71% | $2,987.98 |

$2,987.98

+5.71%

| |

Alethea AI

ALI | +138.12% | $0.0567 |

$0.0567

+138.12%

| |

Fetch.ai

FET | +59.28% | $1.1209 |

$1.1209

+59.28%

| |

The Graph

GRT | +50.18% | $0.282 |

$0.282

+50.18%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, February 22, 2024, at 1:10pm ET. . All prices in USD.

Takeaways

- Increase in demand for spot BTC ETFs pushes BTC price to its highest level since December 2021: A record $2.5B flowed into bitcoin (BTC) ETFs, with BlackRock's IBIT and Fidelity's FBTC attracting $1.6B and $648M over the past week respectively. These growing inflows suggest demand is heightening for spot-based ETFs, and if this trend continues, investors could be eyeing new all-time highs for BTC later this year.

- ETH hits a short lived $3K amidst market speculation on an incoming ETH ETF approval: Ether (ETH) rose through the $3K mark for the first time since April 2022 as traders bet on the possibility of a spot ETH exchange-traded fund (ETF) approval in the U.S., a move that could significantly boost institutional appeal. Despite the swift pull back to the $2.9K level, the medium term outlook for ETH looks promising amidst market speculation on an ETH ETF approval with Franklin Templeton, BlackRock, Fidelity, Ark and 21Shares, Grayscale, VanEck, Invesco and Galaxy, and Hashdex having all submitted applications for an ETH ETF.

- AI-based crypto projects trend higher as NVDA becomes the third-most-valuable publicly traded company: Nvidia (NVDA), a world leader in artificial intelligence computing, outperformed Amazon (AMZN) and Google parent Alphabet (GOOG, GOOGL) last week, making it the third-most-valuable publicly traded company in the world. NVDA also posted strong earnings results Wednesday. Related to this news, interest in AI-based crypto projects was high this week, with Render (RNDR) and Akash Network (AKT) trading at record highs.

- OpenAI launches Sora, spurring interest in WLD, which saw a near 250% increase in the trading of its token: OpenAI’s launch of Sora, a text-to-video tool, appears to have encouraged trading in Worldcoin (WLD), the controversial crypto project that is also spearheaded by Sam Altman. Following the launch of WLD in 2023, Kenya suspended enrollments, and Hong Kong and French officials opened investigations into the project over privacy concerns. Investors seemed undeterred, despite these concerns, with the token trading up almost 250% from the start of the month to an all-time high of $8 on Monday.

- China battles back against weakening economic growth with key rate cut: Despite a ban on crypto trading and mining in 2021, Chinese investors have historically made up a significant portion of the overall crypto market. China’s increasingly accommodative economic policies, including the recent reduction in the five-year loan prime rate this week, will be important to watch as it could impact local Chinese investors’ attitudes towards crypto.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Record Breaking BTC ETF Inflows Sees BTC Reach Highest Level Since December 2021

The price of has been consolidating over the past 7 days, trading in between the $51K-$53K range, following a huge week in terms of inflows for BTC ETFs. Last week saw a notable acceleration of net inflows and the largest week of inflows since launch, .

This increase in demand for spot BTC ETFs has helped push the price of BTC to its . The market saw a decline in the price of BTC on Wednesday morning, dropping down to the bottom of the recent range at $51K as came in at its lowest level since February 6th at +$135M. Market participants will be keeping a close eye on these numbers going forward to understand how the demand for BTC ETFs is developing.

Potential Approval of ETH ETF Surges ETH Price to Trade Over $3K

The price of ETH has pushed ahead as anticipation builds around the potential approval of a spot ETH ETF later this year. on Tuesday for the first time since April 2022. With the approval of an ETH ETF, institutional investors who currently cannot access ETH could gain exposure, potentially attracting billions of investment dollars similar to the recent BTC activity following the approval and listing of BTC ETFs. However, the excitement of $3K was short-lived as the price of ETH moved lower alongside the rest of the market on Wednesday, back below the $2,900 level. Notably, the ETHBTC trading pair maintained the 0.057 mark, up from 0.053 a week prior.

Momentum Regarding AI-Based Crypto Projects Grows, With NVDA Now the Third Most Valuable Publicly Traded Company

Nvidia (NVDA), a world leader in artificial intelligence computing, has seen its share price skyrocket over the past 15 months, as the AI narrative has been heating up, pushing the company to become the third most valuable publicly traded company last week. NVDA has exceeded revenue guidance in the previous few quarters and , providing further momentum for AI-based trades.

AI-based crypto projects have seen another push higher over the past week with at $6.66, and of $4.23 on Monday.

Worldcoin (WLD) Sees a Near 250% Increase in Token Trading Amidst Launch of OpenAI’s Sora

Another AI-related token that has seen its price soar this week is , a text-to-video tool created by OpenAI. Although Sora has no direct link to WLD, it appears the involvement of Sam Altman in both projects has led to renewed interest in the digital identity protocol which launched back in July 2023.

The controversial project that involves scanning users' irises saw some pushback at launch over privacy concerns, with Kenya suspending enrolments and Hong Kong and French officials opening investigations into the project. Investors seem undeterred as demonstrated by the recent price rise, with the token trading up over 250% from the start of the month to its all-time high of nearly $8 on Monday.

China Makes Aggressive Lending Rate Cut in Latest Effort To Battle Economic Slump

On Tuesday, China’s major banks to a new low of 3.95%, from 4.2%. This move was part of a broader campaign to battle China’s slumping economy, which has been bruised by deflation, slowing exports, and lower consumer confidence. China’s economy expanded 5.2% in 2023, which represents one of the weakest growth rates in decades, not including the years impacted by the COVID-19 pandemic.

It will be interesting to see how more accommodative monetary policy affects local Chinese investors’ attitudes towards crypto. In the past, has made up a significant portion of the crypto market, despite a ban on trading and mining crypto in China since 2021.

-From the Gemini Trading Desk

data as of 10:25am ET on February 22, 2024.

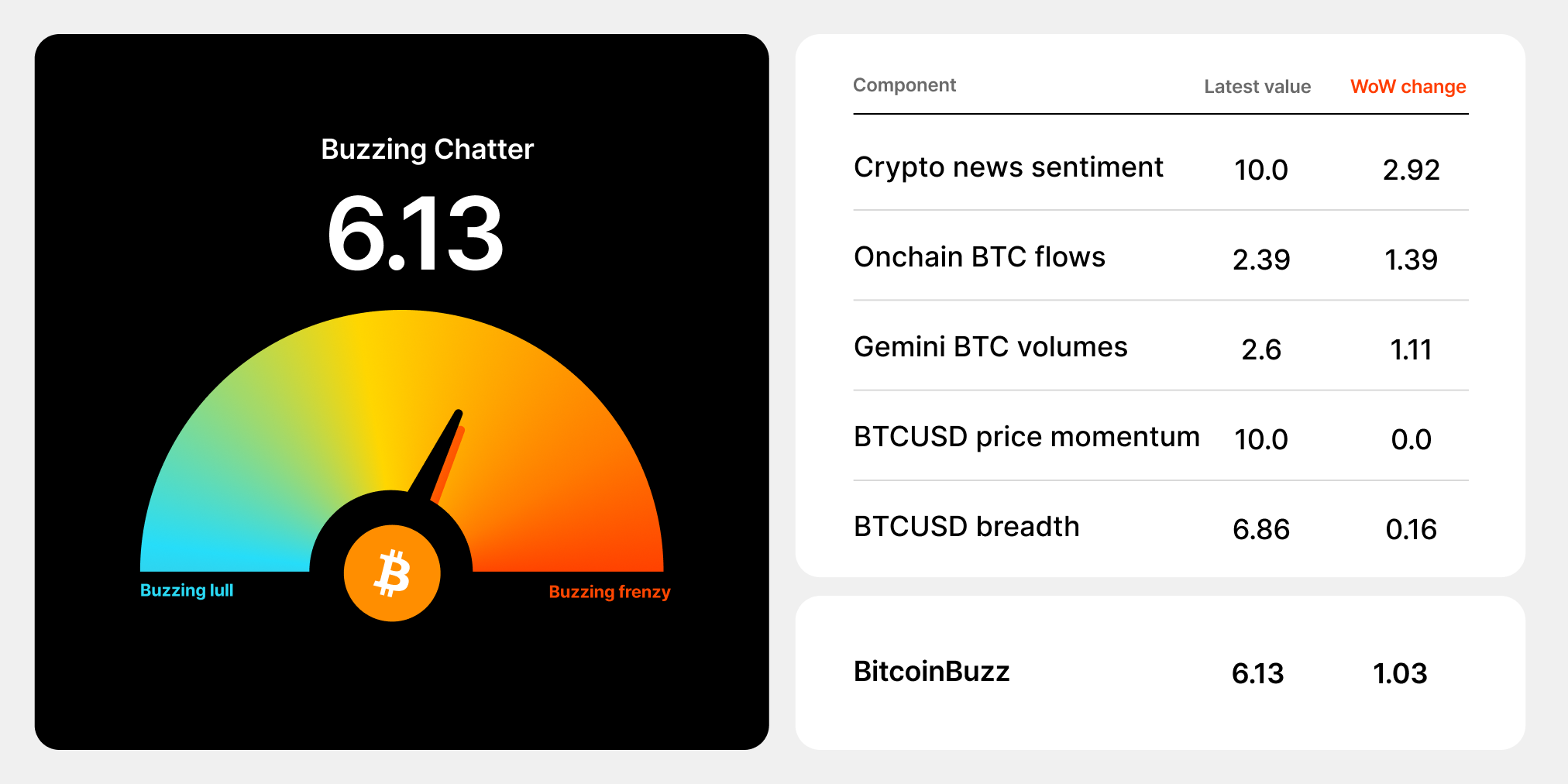

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

The Convergence of AI and Crypto: The tensions, trade offs, and tremendous opportunity

As artificial intelligence (AI) continues its seemingly inexorable advance into all corners of society, an equally powerful innovation has emerged seeking to empower individuals over institutions: crypto.

Our team the immense potential emerging at the convergence of AI and crypto through a thought-provoking discussion highlighting the tensions, trade offs, and tremendous opportunities that exist if we get the balance right.

Bringing Privacy to AI

The sheer scale and sophistication of modern AI comes at a steep cost to user privacy, security, and autonomy. However, innovations inspired by crypto's ethos of decentralization can counterbalance these weaknesses and create more equitable outcomes.

The vast centralized data aggregation required for training AI models inherently conflicts with individual privacy rights. Cryptographic proofs like can allow privacy-enabled machine learning without exposing sensitive user data. While beneficial for privacy, disadvantages around compute efficiency, model accuracy, and debugging still remain relative to today's mass data pooling practices. But, rapid progress in zero-knowledge cryptography offers hope these gaps will narrow over coming years.

Humans vs. AI

In a world where there will undoubtedly be a proliferation of deep fakes and an abundance of AI-generated content, identifying what is generated by humans rather than AI will be critical. Leveraging the immutable nature of blockchain technology offers a methodological approach for identifying and storing what is AI-generated content as opposed to that which is human-generated. The challenge here will be to create a solution that can scale while maintaining privacy-preserving features.

Replacing Big Cloud With Decentralized Development

Another antidote to centralized AI is decentralizing development itself — distributing the tasks of sourcing data, contributing computational resources, building models, and even defining objectives to a broad community of participants. Trusted third-party intermediaries can be replaced with peer-to-peer consensus mechanisms, ensuring no single entity exploits an oversight position. A protocol called Gensyn is already pioneering this approach — provisioning a decentralized marketplace where anyone can monetize spare GPU capacity for collective model training.

The potential is enormous, with new possibilities organically stemming from grassroots developer communities and creating the equitable application of technology for all.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

MAR 06, 2026

Sui Is Now Available On Gemini

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026