Explore Gemini

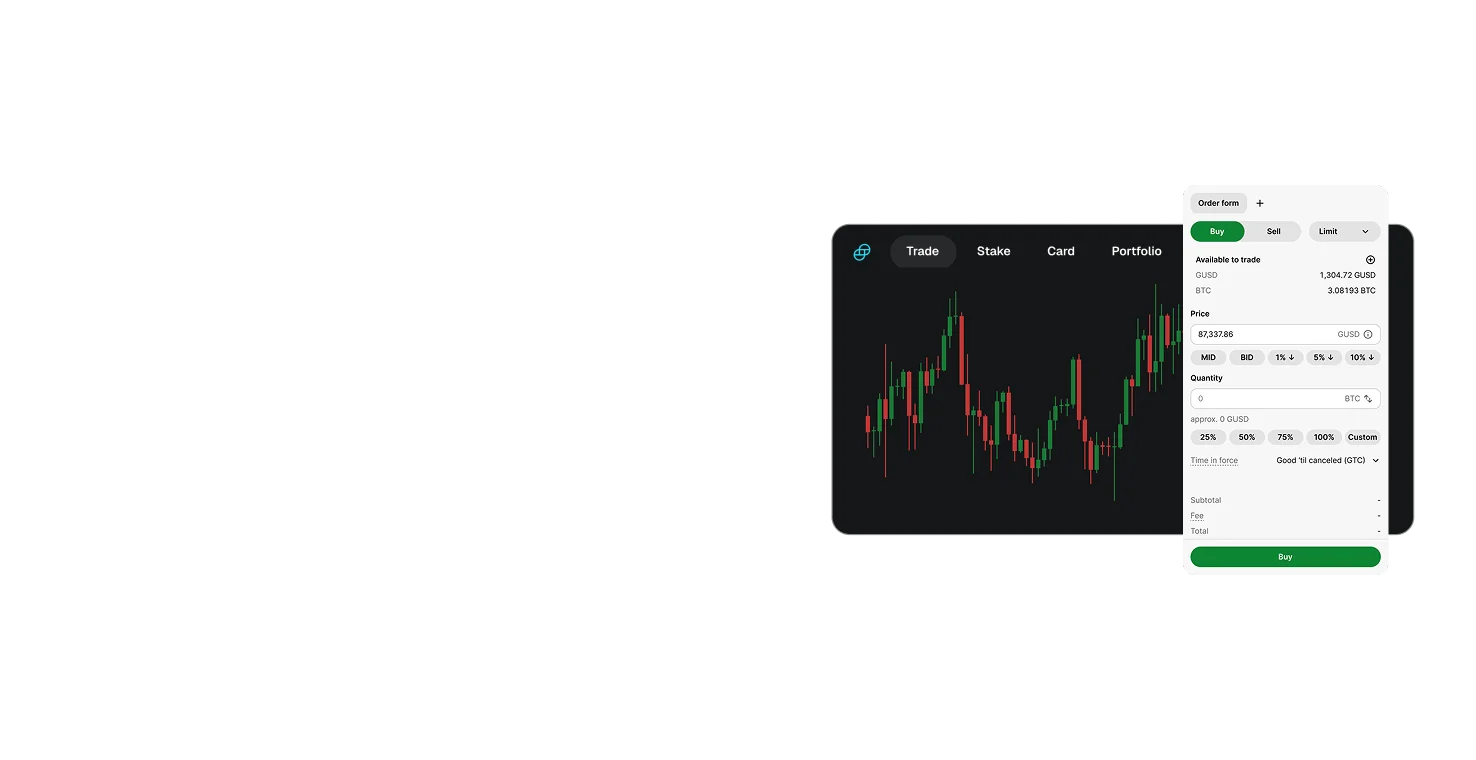

Your bridge to the future of money

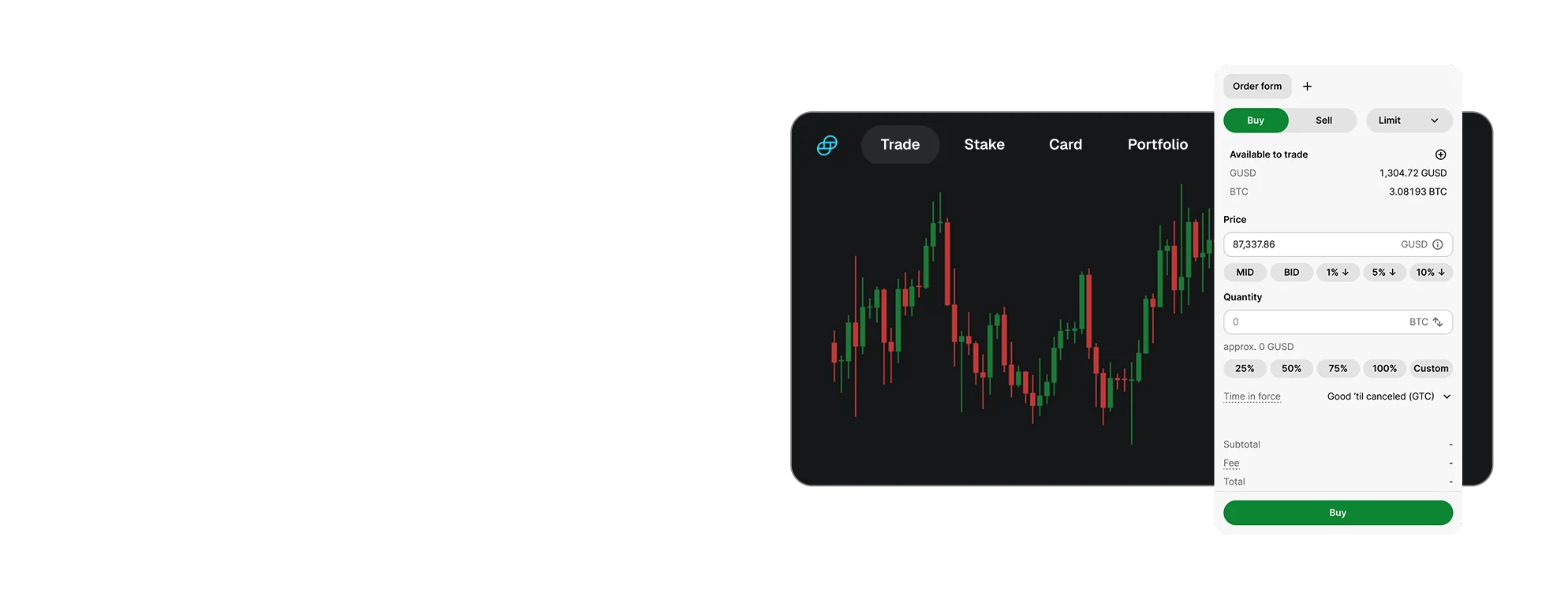

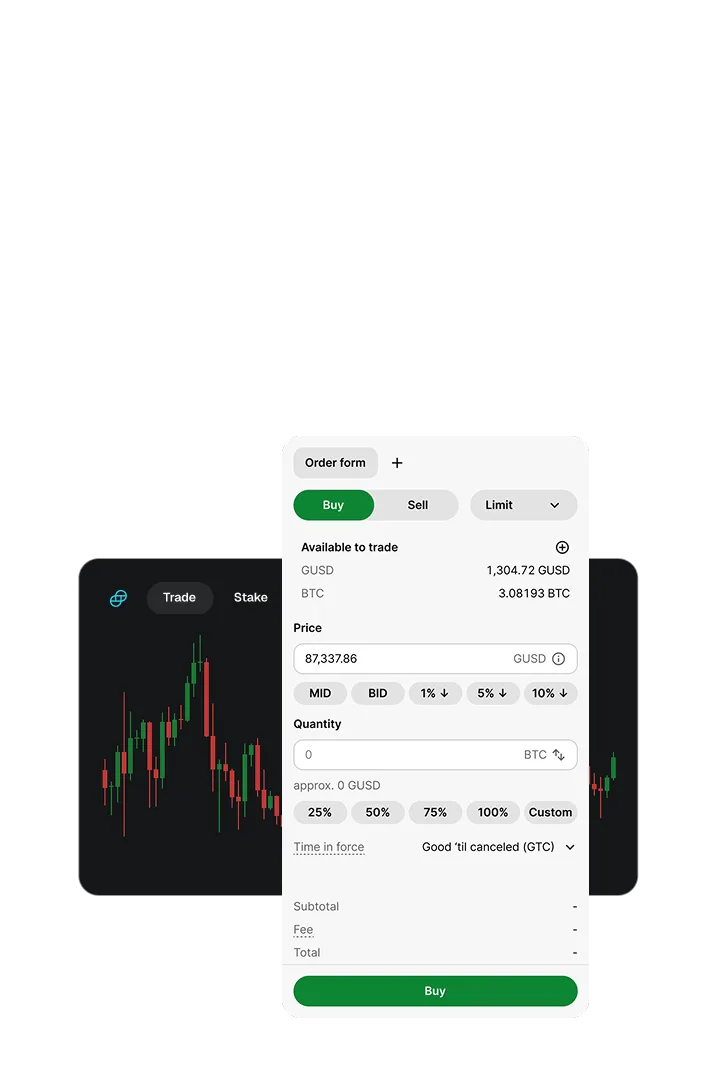

A crypto super app for trading, investing, and earning.

Get started

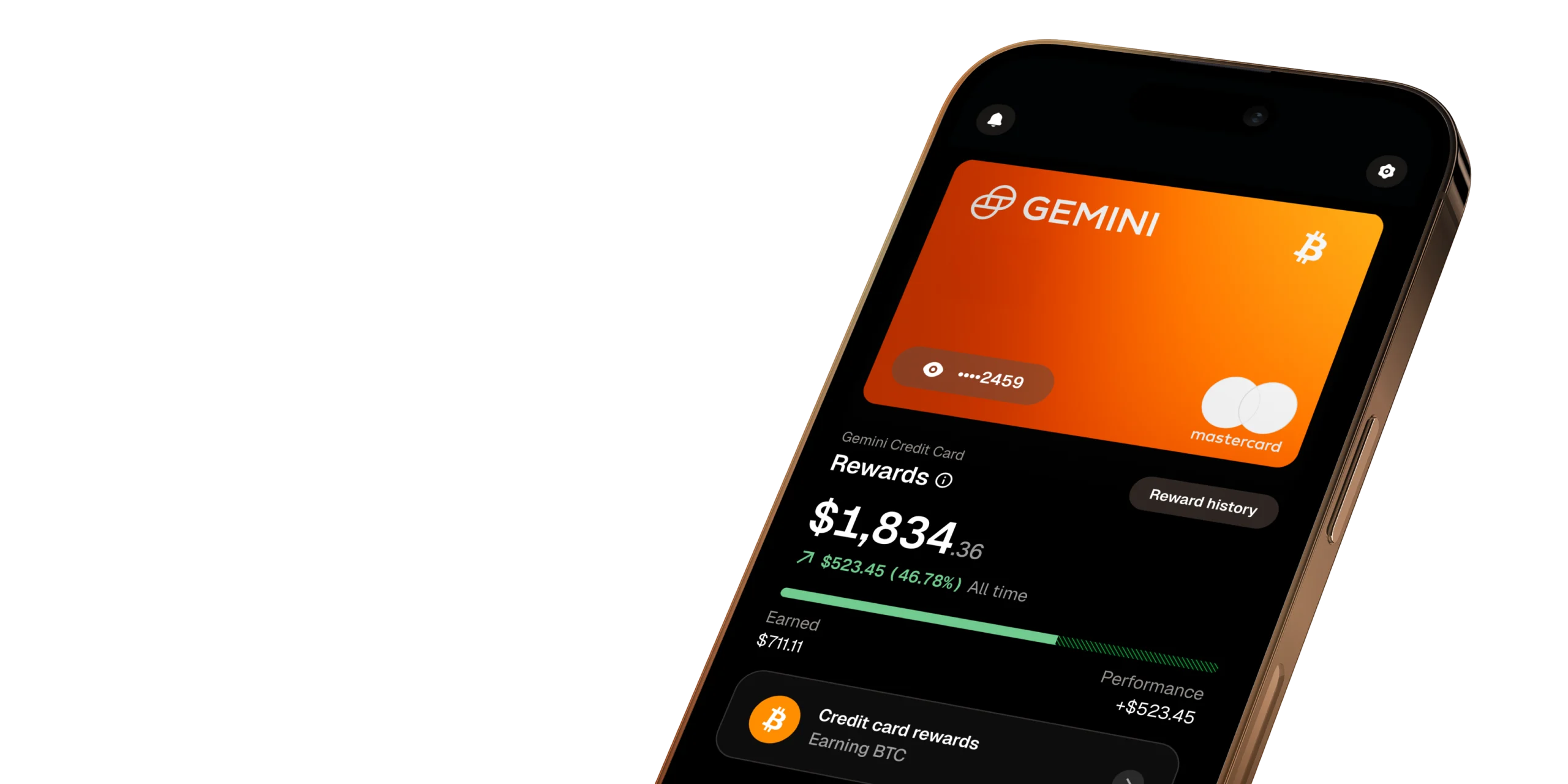

Gemini-branded credit products are issued by WebBank.

Gemini Predictions™

Trade on real-life outcomes with USD.

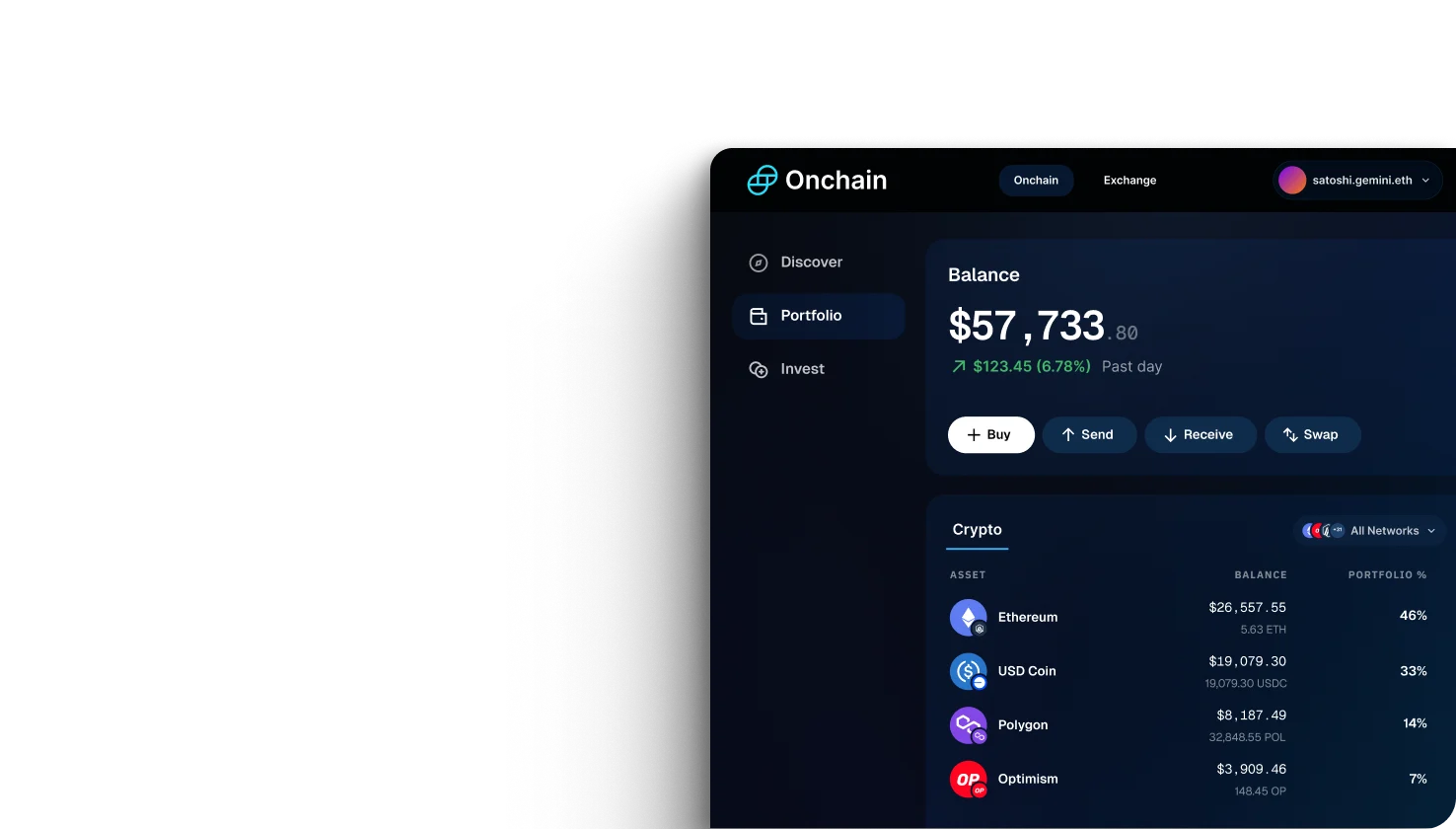

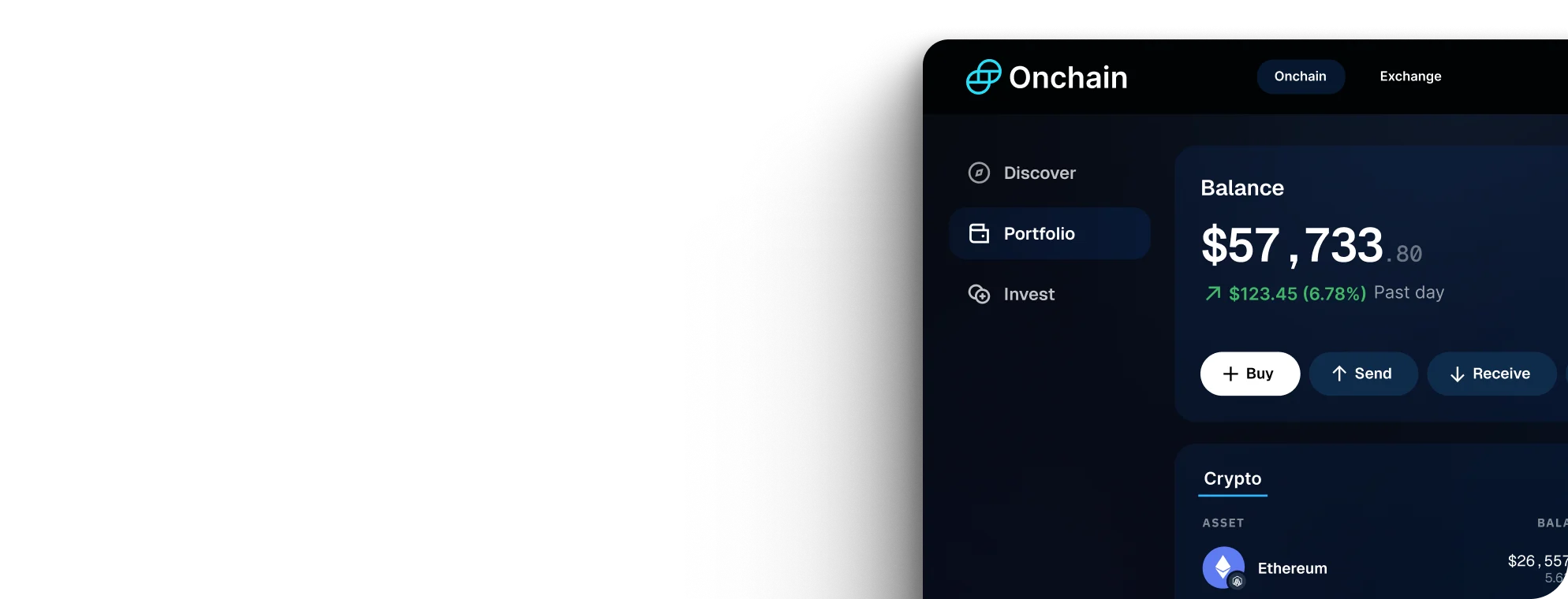

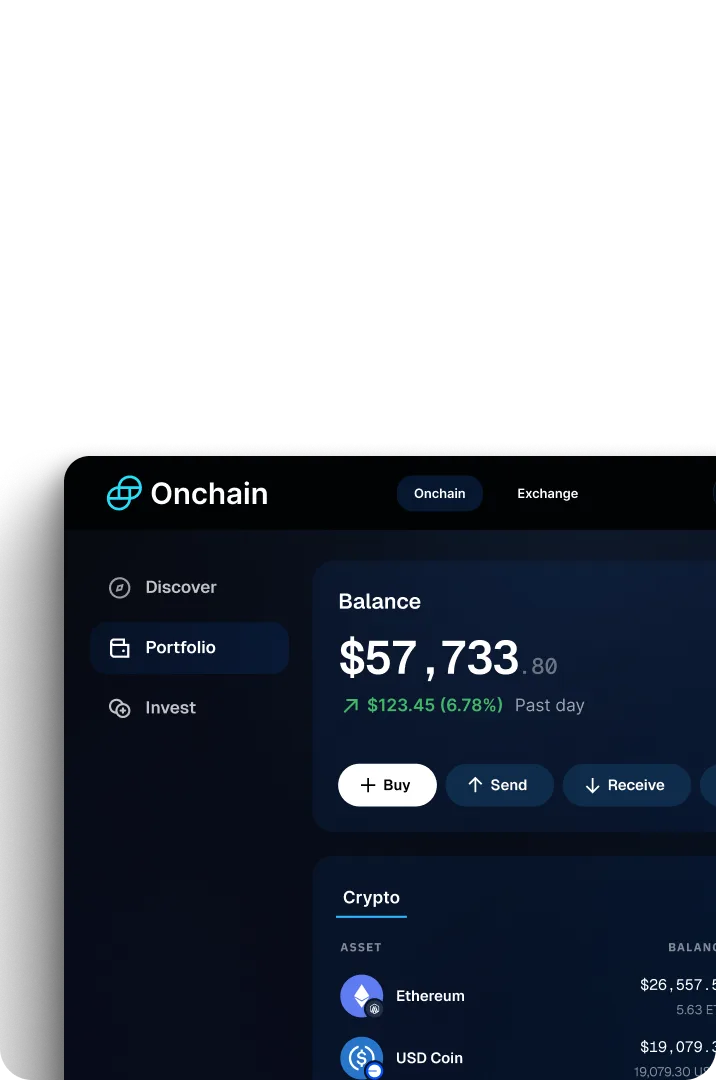

Gemini Wallet®

Onchain access to the world of Web3

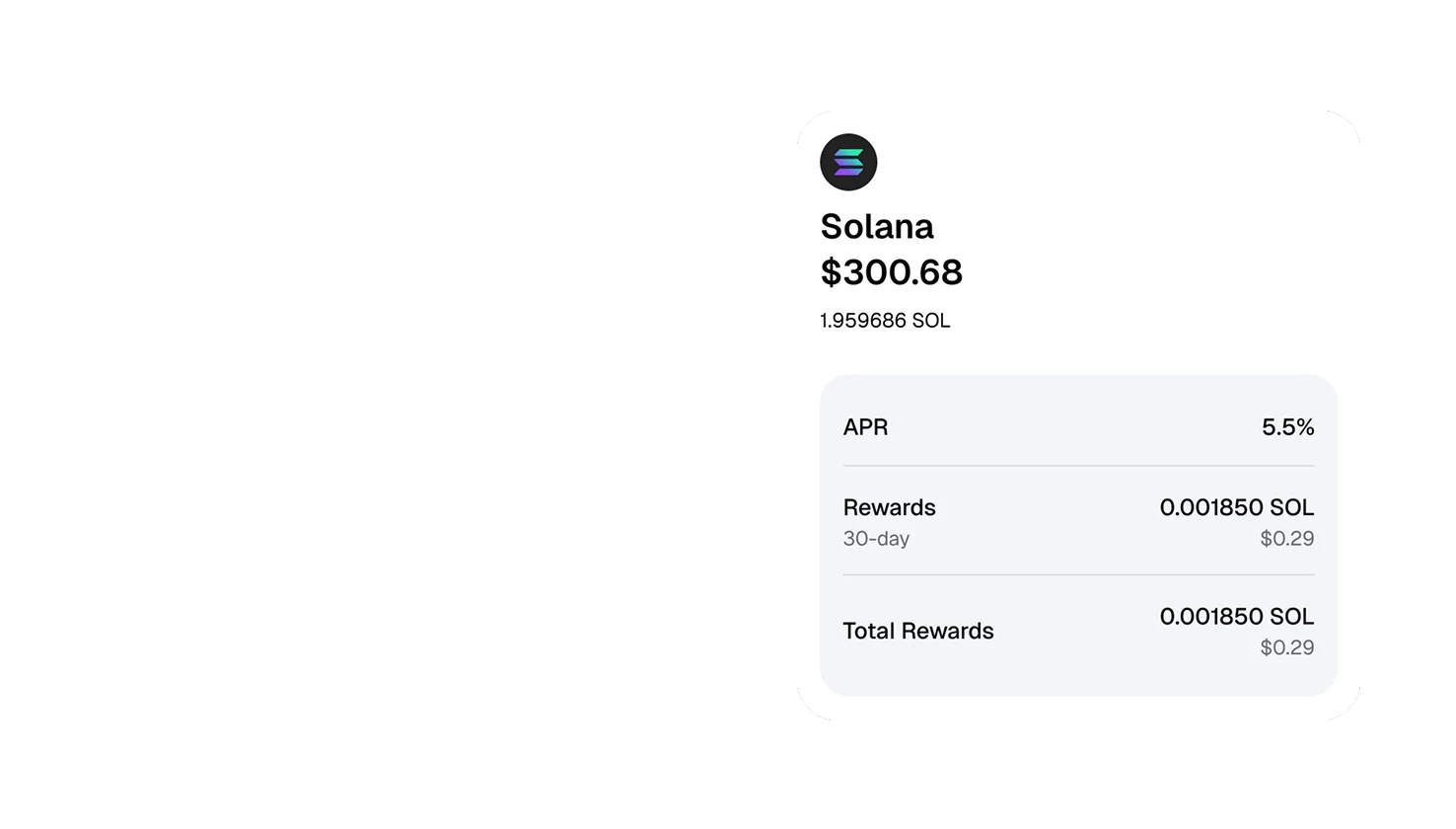

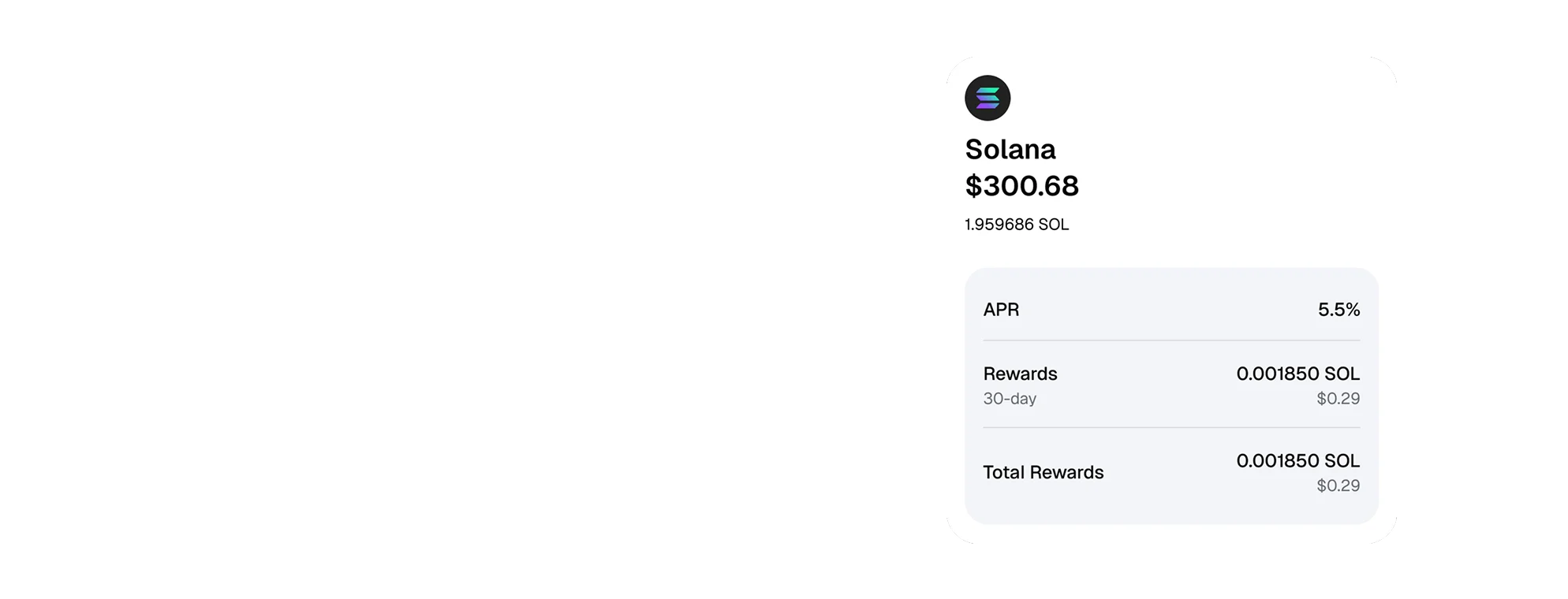

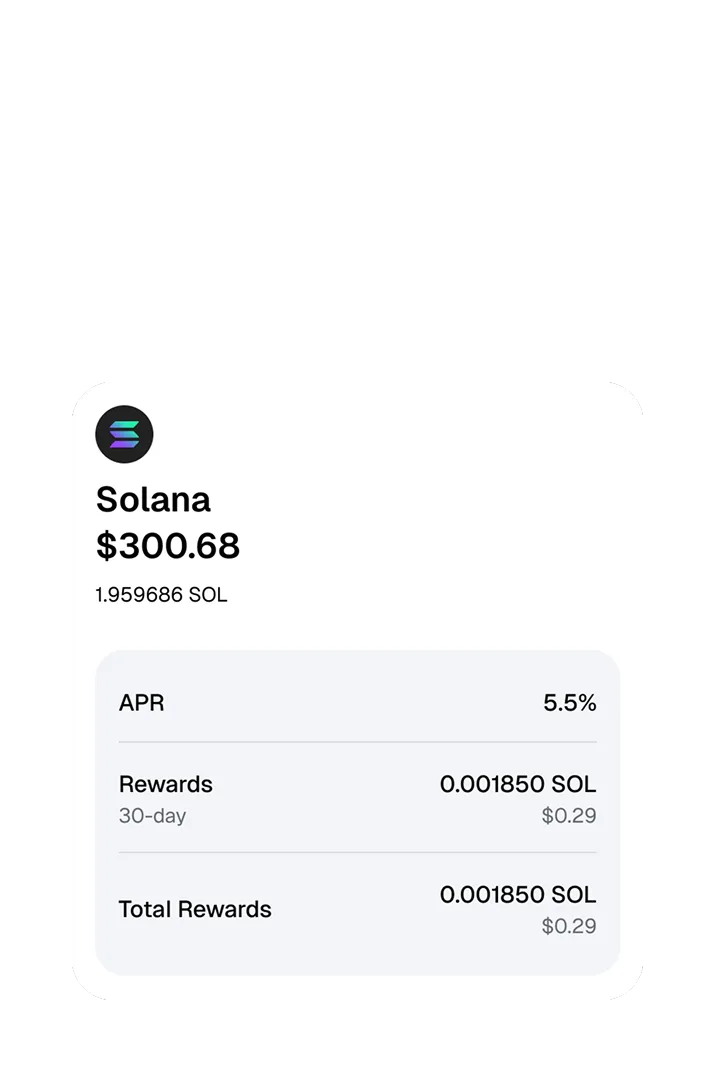

Gemini Staking®

Stake Solana and earn up to 6% APR

Gemini Institutional

When crypto is your business

Gemini works with the best. We're partnered with leading institutions both large and small.

We're here. For good.

Gemini is a registered full-reserve and highly-regulated cryptocurrency exchange and custodian

ISO/IEC 27001:2013

Validates that Gemini operates an Information Security Management System (ISMS) that conforms to the requirements of ISO/IEC 27001:2013.

SOC 1 Type 2 Exam SOC 2 Type 2 Exam

We were the first crypto exchange and custodian in the world to obtain our SOC 1 Type 2 and SOC 2 Type 2 certifications. This exam was conducted by Deloitte.

PCI DSS ROC AOC and Attested SAQ

Evidence of our commitment to maintaining compliance with an information security standard that protects cardholder data both when we accept debit cards on our platform and when we issue the Gemini Credit Card.

Open a Gemini account for free today