Home del blog

WEEKLY MARKET UPDATE

MAR 15, 2024

BTC Reaches New All-Time Highs Surpassing Silver, ETH Completes Dencun Upgrade, While Memecoins and Altcoins Show Strength

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic —this week we revisit the halving and its impact on crypto markets.

Crypto Movers

Crypto News

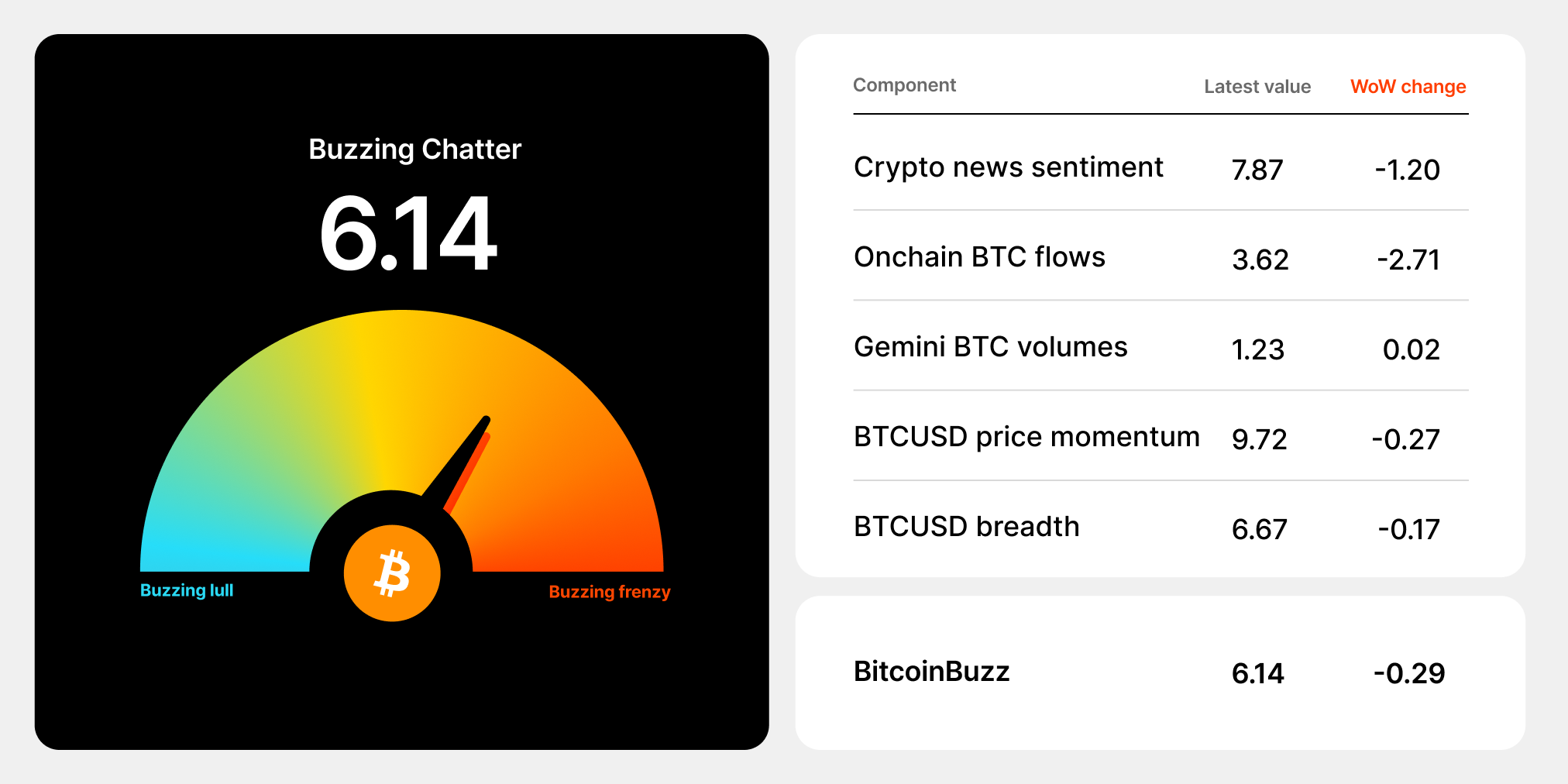

BitcoinBuzz Indicator

Topic of the Week

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, March 15, 2024, at 12:30pm ET. Check out the latest crypto prices here. All prices in USD.

Takeaways

- BTC price hits new all-time high; surpassing silver’s market cap: Bitcoin (BTC) captured new all-time highs hitting $73.6K this week, making it the eighth largest asset by market capitalization globally. On March 12, spot BTC exchange-traded funds (ETFs) saw a record $1B of net inflows; with Blackrock’s IBIT taking in $849M of inflows. Additionally, the London Stock Exchange indicated they will start to accept applications to list BTC and ether (ETH) exchange traded notes during the second quarter of this year.

- Ethereum completes biggest upgrade in almost a year; ETF odds lower: The highly anticipated Ethereum ‘Dencun’ upgrade was successfully implemented on Ethereum’s mainnet. The upgrade is designed to catalyze growth on layer-2 networks by lowering data fees and enhancing scalability. Meanwhile, Bloomberg analysts have significantly lowered the probability of a spot ETH ETF approval by the SEC to 30%, citing the agency's lack of engagement and concerns over ETH’s regulatory classification.

- Consumer prices rise more than expected as inflation persists: In February, prices in the United States for shelter and gas rose more than expected, likely impacting hopes for Fed rate cuts. With the February Consumer Price Index showing a 0.4% monthly increase and a 3.2% annual gain, markets are expecting the Federal Reserve will keep rates unchanged next week and start cutting rates in June, based on implied futures pricing.

- Memecoins and altcoins show strength: PEPE, WIF, and FLOKI led the way for memecoins with double digit percentage performance over the last 7 days. Other altcoins related to artificial intelligence, such as NEAR, RNDR, GRT, THETA, and FET, also posted double digit percentage gains over the same period. Layer one tokens such as AVAX, INJ, and RUNE posted double digit gains, and Solana registered an all-time high in daily new addresses, at over 691K.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

BTC’s new all-time high reaches $73.6K; ETFs see record inflows

BTC notched another new all-time high on Wednesday as significant inflows continue to pile into spot BTC ETFs in the US. For example, on March 12, these ETFs experienced record inflows, with net spot BTC ETF inflows surpassing $1 billion. Blackrock's IBIT product also saw a substantial influx of $849M. VanEck announced it would waive management fees for investors in its HODL ETF for a year up to $1.5B in AUM, and the fund has seen $230M of inflows since the announcement. In total, spot crypto ETFs have seen net inflows of $11.1B since inception. On Tuesday, BTC’s market capitalization reached $1.414T, surpassing that of silver, to become the eighth most valuable asset in the world.

Across the pond, the UK Financial Conduct Authority (FCA) has announced its openness to investment exchanges creating a listed market segment for crypto-asset-backed exchange-traded notes (ETNs), in response to growing demand. London Stock Exchange Group PLC (LSEG) has swiftly responded by confirming that they will start accepting applications to list BTC and ETH crypto ETNs from the second quarter of the year. The news helped BTC reclaim $70K on Monday and pushed ETH above $4K, its highest level since November 2021.

Ethereum successfully completes anticipated ‘Dencun’ upgrade

Ethereum recently implemented its "Dencun" upgrade, aimed at reducing data fees on layer-2 networks like Arbitrum and Polygon to foster growth. This upgrade, marked by a hard fork at Ethereum epoch 269,568, commenced at 13:55 UTC and concluded at 14:10 UTC. The price of ETH remained relatively stable through the upgrade with a slight decrease of 0.5% over the past 24 hours to $3.97K, after increasing approximately 50% in the last month.

Meanwhile, Bloomberg ETF analysts have lowered the probability of a spot ETH ETF being approved by the U.S. Securities and Exchange Commission (SEC) by May. Eric Balchunas, a Senior ETF Analyst at Bloomberg, now estimates a 30% likelihood, down from his earlier prediction of 70% in January.

This revision is due to the SEC's lack of communication and engagement with ETF applicants when benchmarked against the progress that was made at this point for the spot BTC ETFs that eventually were approved. The prolonged silence and inaction from the SEC have dampened hopes for a spot ETH ETF approval by May, which is when many active applications will see their 240-day decision window expire.

Insiders have noted that some of the discussions between the SEC and fund issuers have centered around the lack of correlation between the ETH spot and futures market. Additional factors, such as the SEC's classification of ETH as a security and previous political challenges faced by SEC Chair Gary Gensler, may also influence the regulatory decision-making process.

Note that a rejection for this current batch of spot ETH ETFs doesn’t necessarily mean it will not be approved in the future. For context, consider that the SEC's approval of the spot BTC ETF happened after federal courts ruled that the SEC should not prevent Grayscale from converting its closed-end GBTC to an ETF.

Consumer prices rise more than expected

In February, inflation persisted as the Consumer Price Index (CPI) indicated a 0.4% increase over the previous month and a 3.2% rise from the previous year. These figures exceeded economist forecasts slightly and marked the largest monthly increase since September, primarily driven by higher prices in shelter and gas. Notably, the shelter index rose 5.7% annually, contributing to elevated core inflation readings.

Despite expectations for potential interest rate cuts by the Federal Reserve, recent data suggests a slight slowdown in inflation, with the Fed's preferred inflation gauge, the core PCE price index, coming in below the target rate. Market analysts anticipate the Fed to monitor further data before committing to any rate adjustments, with some suggesting a potential delay in rate cuts if inflation trends persist.

While inflation numbers were a touch high vs. expectations, traditional markets shook off any headwinds as the S&P 500 notched a new all-time high for the 17th time this year on Tuesday, the same day US CPI numbers were released. Semiconductors, including market darling Nvidia, have been particularly volatile. Nvidia is set to host its semiannual GTC conference, which is focused on artificial intelligence for developers, business leaders, and researchers on March 18.

Memecoin mania continues, and altcoins show strength

Memecoin frenzy returned this week, with the total market value of memecoins reaching over $60 billion on Wednesday. Trading volumes for the top memecoins reached nearly $80 billion over the last 7 days. PEPE and WIF continued to break new highs, while FLOKI has rallied close to 100%.

Layer one tokens such as INJ, AVAX, and RUNE posted 24%, 32%, and 99% gains respectively earlier in the week. And many cryptocurrencies related to artificial intelligence, such as NEAR, RNDR, GRT, THETA, and FET, have seen double digit gains over the last 7 days. There is some speculation that Nvidia’s semiannual GTC conference on March 18 could serve as a catalyst for some of these companies, and the broader AI sector.

Attention around these altcoins and memecoins, versus Bitcoin reaching all-time highs and Ethereum hovering around $4,000, shows that retail and crypto-native traders continue to show interest in speculating on lower market capitalization tokens.

-From the Gemini Trading Desk

BitcoinBuzz data as of 5:13pm ET on March 15, 2024.

To learn more about the BitcoinBuzz Indicator and its components, read our introduction here. Check back every week for an updated score!

Passkeys: Industry-leading security for your crypto account

Gemini recently added passkeys on web and iOS mobile devices for two-factor authentication (2FA). Passkeys provide two major advantages over other account authentication methods–increased security and ease of use–and have been adopted by industry leaders like Microsoft, Apple, and Google.

Why use passkeys?

Passkeys offer two major advantages over other account authentication methods like traditional 2FA: added security and ease of use.

Added Security: Passkeys provide an extra layer of protection for your account, making it more difficult for unauthorized users to gain access.

Ease of Use: Once set up, passkeys offer a seamless authentication experience, with no need to enter a code received via SMS or through an authenticator app.

What are Passkeys?

Passkeys are a new form of 2FA developed by FIDO, and embraced by technology industry leaders, that add a higher level of security to your account. Unlike other 2FA methods, like receiving one-time codes via an authenticator app or SMS, accounts registered with passkeys are resistant to phishing, significantly increasing account security.

On a technical level, a passkey is an asymmetric key pair (similar to a public and private key used to secure a crypto wallet), stored securely on a device's Secure Enclave.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

ARTICOLI CORRELATI

WEEKLY MARKET UPDATE

MAY 09, 2024

FTX Customers To Be Paid Back, Robinhood Receives Wells Notice, and Marathon Digital To Join S&P SmallCap 600

WEEKLY MARKET UPDATE

MAY 02, 2024

Crypto Market Slides, Then Rallies After Federal Reserve Holds Steady

DERIVATIVES

MAY 02, 2024