Inicio del blog

WEEKLY MARKET UPDATE

SEP 08, 2023

Weekly Market Update - Friday, September 8, 2023 - Spot Ethereum ETF Applications Filed, Visa to Use Solana for USDC Settlement, and New Crypto Accounting Rules Coming

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we explore the basics of wrapped tokens.

Crypto Movers

Crypto News

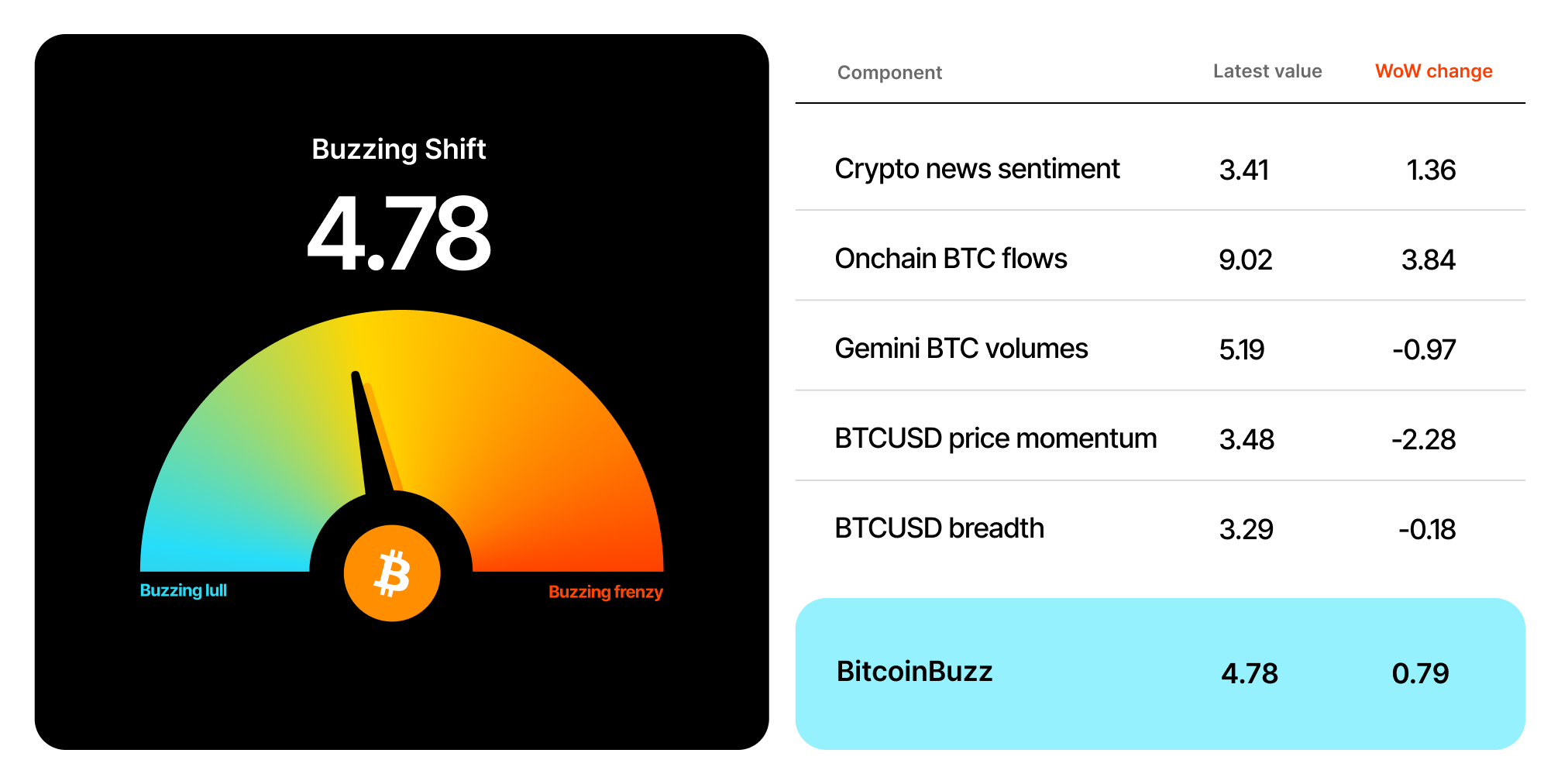

BitcoinBuzz Indicator

Topic of the Week

Community Voices

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, September 8, 2023, at 11:40am ET. Check out the latest crypto prices here. All prices in USD.

Takeaways

- Bitcoin edges lower as SEC delays ETF decisions: Following a rush of excitement after Grayscale’s legal win against the SEC last week, bitcoin prices retraced below $26k USD as the SEC delayed its decisions on spot bitcoin ETF applications as expected.

- Spot ether ETF applications filed: ARK Invest and VanEck filed applications to launch a spot ether ETF with the CBOE. The applications are not expected to be considered until the SEC makes a decision on existing ether futures ETF applications.

- Visa boosts Solana, expanding USDC settlement to the network: Expanding USDC settlement to the Solana network will improve cross-border payment speeds, Visa said. The news pushed SOL prices higher.

- New crypto accounting rules ask for fair-value reporting: New rules are expected to be finalized by the end of 2023, and be implemented by the end of 2024. Microstrategy founder Michael Sayor said the move would reduce barriers for corporations holding crypto in their treasuries.

- Interest rates expected to remain at current levels: The market is expecting the Fed to keep interest rates steady at its next meeting later this month. In traditional markets, equities were pushed lower this week by rising oil prices as Saudi Arabia and Russia continue production cuts.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Bitcoin Returns to Pre-Grayscale Levels, as SEC Delays ETF Decisions

The initial enthusiasm from Grayscale’s legal victory over the U.S. Securities and Exchange Commission (SEC) waned this week as the market digested the full extent of the news and the immediate impact of the court's decision.

The SEC also postponed its decisions on all outstanding spot bitcoin exchange-traded fund (ETF) applications until mid-October at the earliest. The move was widely expected given the SEC has multiple deadlines and can open active ETF applications to public comments, but led to a retracement in bitcoin (BTC) prices nonetheless.

After hitting $28k USD, BTC has since returned to pre-Grayscale news levels, sitting around $25.9k USD as of Friday, reflecting the range we have seen over the past few weeks.

Spot Ether ETF Applications Filed With the SEC as Crypto ETF Push Continues

ARK Invest and VanEck filed applications with the SEC for a US-based spot ether ETF on Wednesday. The ETFs would be listed on the CBOE’s BZX Exchange. ARK’s application was submitted jointly with 21Shares.

The applications are similar to those filed for the spot bitcoin ETFs earlier this year. Using the bitcoin futures ETF approval as precedent, The SEC would likely approve ether futures ETFs before the spot ETFs are considered.

Ether (ETH) prices moved briefly higher on the news, reaching ~$1,670 USD and 0.0641 on the ETHBTC pair, before seeing a reversal shortly after.

Visa Expands USDC Settlement to Solana

On Tuesday, Visa announced that it will expand its settlement of USDC to the Solana network. Visa has been using USDC since 2021, but up until now, its stablecoin capabilities have been limited to Ethereum. Visa’s Head of Crypto, Cuy Sheffield, said that Solana will help “to improve the speed of cross-border settlement” and will provide a “modern option for our clients to easily send or receive funds from Visa’s treasury.”

On Tuesday, Solana (SOL) prices rallied from a low of ~$19.05 USD to a high ~of $20.59 USD, an around 8% jump, although SOL has since retraced back below the $20 USD mark.

New Crypto Accounting Rules to Require Fair-Value Reporting

On Wednesday, The United States Financial Accounting Standards Board (FASB) unanimously approved changes to how companies value their crypto holdings. The new rules will mean that companies holding BTC and certain other cryptos will have to report their holdings at fair value.

Under previous practice, companies were required to keep impairment losses on their balance sheets even if the token had regained its value. The new measures aim to capture the most up-to-date value for the digital assets, including if the price recovers after a dip. Microstrategy founder and former CEO, Michael Saylor, tweeted following the news saying that the move “eliminates a major impediment to corporate adoption of BTC as a treasury asset.”

The final rules are expected to be finalized and approved by the end of 2023, and go into effect at the end of 2024.

Interest Rates Expected to Hold Steady, Oil Prices Weigh on Equities

Interest rates and inflation remain the main economic concerns for investors, with a strong majority expecting the Federal Reserve to hold rates steady at the Federal Open Market Committee (FOMC) meeting later this month. While economic data on consumer confidence, jobs, and inflation last week increased the likelihood of rates remaining steady, market participants will keep an eye on more updates on inflation and retail sales set to be released before the FOMC for further assurances.

Rising oil prices have impacted equities this week after Russia and Saudi Arabia announced that they would continue production cuts through to the end of 2023, pushing Brent crude oil prices to their highest level since last November.

-From the Gemini Trading Desk

BitcoinBuzz data as of 5:00pm ET on September 7, 2023.

To learn more about the BitcoinBuzz Indicator and its components, read our introduction here. Check back every Friday for an updated score!

Wrapped Tokens

This week we explore wrapped tokens, and the role they play in the crypto ecosystem.

Wrapped cryptos enable crypto assets to be used on blockchains to which they are not native. This interoperability feature has brought bitcoin (BTC) and other popular cryptocurrencies to smart contract platforms, including Ethereum.

Wrapped cryptocurrencies increase the utility and liquidity of smart contract platforms and popular decentralized finance (DeFi) applications. Other use cases for wrapped cryptos may include ERC-20 token swapping or taking advantage of blockchain functions that a cryptos native chain might not have.

Wrapped Cryptos and DeFi Interoperability

Interoperability, or the capacity for different blockchain protocols to interact and exchange value with each other, has long been an important feature to address in the crypto space. The need for interoperability became even more salient with the rise of the decentralized finance (DeFi) ecosystem, as the community clamors to put non-Ethereum-based assets to work in DeFi protocols.

One emerging solution is the use of wrapped cryptos: tokens that are 1:1 representations of other crypto assets, such as bitcoin (BTC). Wrapped cryptos track the value of the asset they represent and can often be redeemed for that asset. They usually take the form of an ERC-20 token or other smart contract platform token. They can, therefore, be used within a smart contract platform ecosystem (such as Ethereum), and exchanged for other tokens within that ecosystem.

In short, wrapped cryptos allow crypto assets to be used on non-native blockchains. This means, for example, that bitcoin in its wrapped form can be used to interact with Ethereum’s ecosystem of decentralized applications (dApps) and smart contracts, or as collateral for a loan on MakerDAO — all of which might have been difficult or impossible given the fundamental structural differences between the Ethereum and Bitcoin networks. Tokenizing bitcoin as an ERC-20 token allows the Ethereum ecosystem to benefit more fully from bitcoin’s liquidity.

Examples of Wrapped Cryptos

There are a variety of wrapped cryptos, and often different wrapped versions of the same one. Several tokenized representations of bitcoin exist, for example, including wBTC, sBTC, and tBTC, among others.

Even though ether (ETH) is the native currency of the Ethereum blockchain, it is not compatible with Ethereum’s ERC-20 tokens. Users cannot directly trade ETH for ERC-20 tokens without using a trusted third party, such as a centralized exchange. To address this friction, wETH was created to serve as a wrapped version of ETH.

To create wETH, for example, a user locks ETH in a smart contract. The smart contract then returns wETH tokens at a 1:1 ratio. To redeem locked ETH, users can send the wETH back to the smart contract.

Dig deeper into wrapped tokens here.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

ARTÍCULOS RELACIONADOS

WEEKLY MARKET UPDATE

JUN 12, 2025

SEC Chair Announces Plans for DeFi Innovation Exemptions, Ethereum Mounts Rally, and Banks Push Forward With Stablecoins

INSTITUTIONAL

JUN 11, 2025

Introducing Gemini and Glassnode’s Report on the Impact of a Strategic Bitcoin Reserve

INDUSTRY

JUN 10, 2025