OCT 15, 2025

How Gemini Is Powering Crypto Retirement Planning

While the statement went largely unnoticed, it marked a massive shift for the crypto custody ecosystem. For the first time, a registered investment advisor (RIA), investment fund, or a business development company can consider qualified state-chartered trust companies as a bank, opening up a litany of new potential options to custody their clients’ crypto assets.

Gemini is well-positioned to handle the new guidance. As a registered state-chartered trust company and qualified custodian, we’ve helped RIAs, family offices, retirement plan providers and institutional platforms with crypto investments going back years. And we’re positioned for the upcoming crypto retirement boom.

The Department of Labor will reportedly issue a final recommendation to allow fiduciaries to offer alternative assets including crypto for client 401(k)s by February 2026, potentially opening crypto to a $9.3 trillion US market.

Since Bitcoin launched in 2009, the vast majority of Americans have not benefited from gains in crypto prices. But that could soon change as President Donald Trump’s administration aims to democratize access to alternative asset strategies including crypto, creating more financial upside for a larger segment of the population.

Here’s how Gemini can help your clients plan for retirement:

-

Diversified crypto portfolios suited for any investor: Gemini can build a diversified portfolio of crypto assets for clients. This allows intermediaries to offer espoke portfolios for each of their respective clients.

-

Simple and secure API integrations: Gemini’s flexible APIs help clients build connections across the exchange–all within the company’s secure infrastructure.

-

Subaccounting for more transparency: Gemini’s unique subaccounting infrastructure allows us to segregate client accounts across trading and storage and provide integrated reporting capabilities. The structure also allows clients to monitor balances for each subaccount, manage and collect fees, and meet relevant reporting requirements for each respective subaccount.

-

Dedicated experts: Gemini’s institutional team provides white-glove support from onboarding through execution, allowing clients to focus on serving their end users.

-

Dynamic infrastructure and seamless onboarding: Compliance and onboarding requirements in financial services are vast and time-consuming. Gemini’s dynamic infrastructure helps power a simplified onboarding process that meets all applicable KYC standards.

If you’re an asset manager or other institution seeking to build support for crypto into your platform, we invite you to reach out to to speak with one of our institutional principals.

Go Where Dollars Won’t,

Team Gemini

ARTÍCULOS RELACIONADOS

COMPANY

OCT 20, 2025

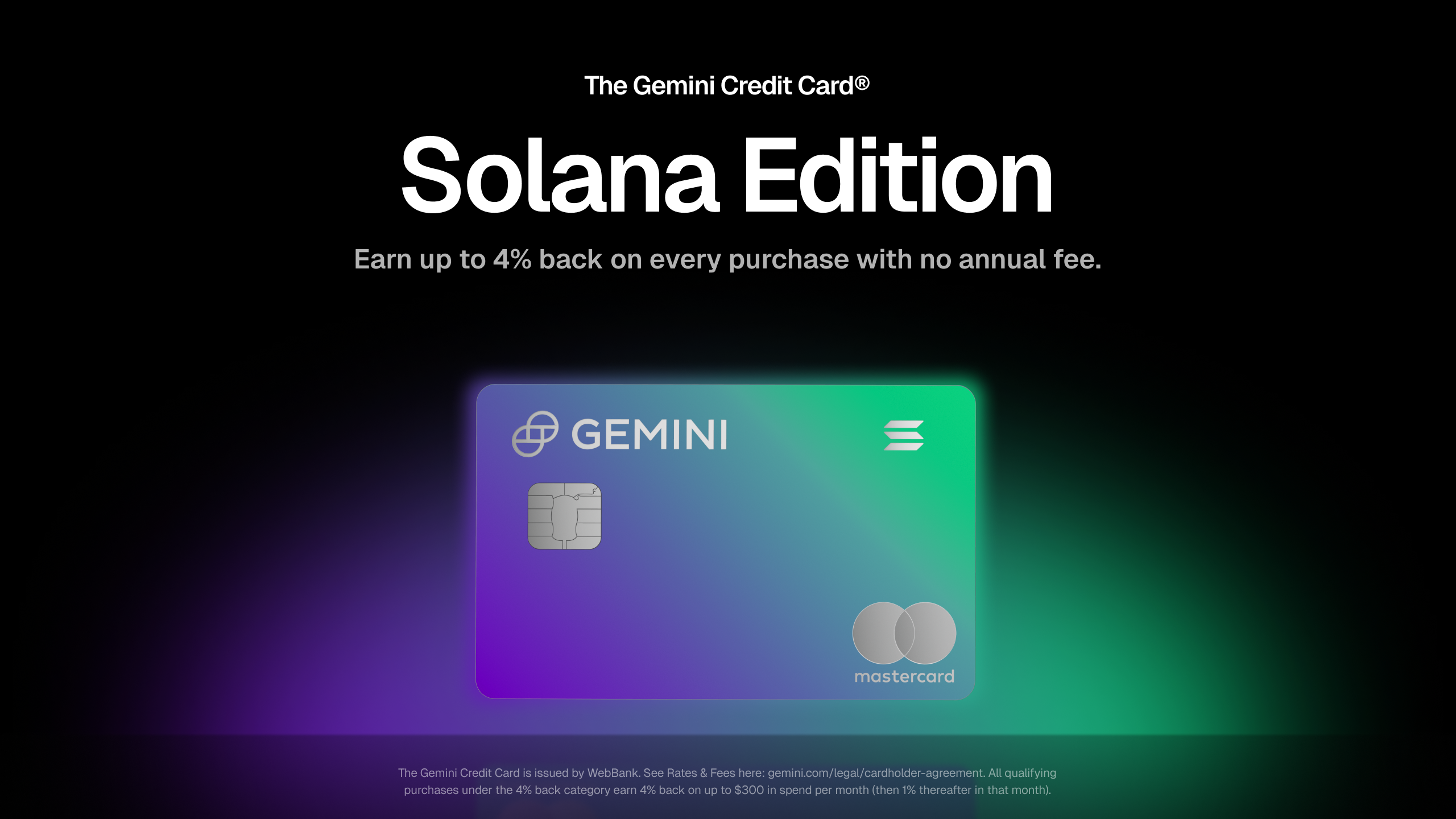

Gemini Releases Solana Edition of the Gemini Credit Card and Automatic Staking for Solana Rewards

WEEKLY MARKET UPDATE

OCT 16, 2025

Spot BTC and ETH ETFs Waver Amid Dwindling Tailwinds, Ripple Announces $1B Deal for GTreasury, and Strategy Resumes Bitcoin Buys

COMPANY

OCT 14, 2025