Gemini Margin Trading

Amplify your trading power with up to 5x leverage.

Amplify your trading power with up to 5x leverage.

Assets available for margin trading

Margin trading is available on a curated selection of crypto pairs. More pairs are coming soon.

Margin trading is available on a curated selection of crypto pairs. More pairs are coming soon.

Asset

Leverage

Bitcoin

BTC

5x

Bitcoin Cash

BCH

5x

Dogecoin

DOGE

2x

Ether

ETH

5x

Shiba Inu

SHIB

2x

Solana

SOL

5x

XRP

XRP

5x

Up to 5x Leverage.

Greater capital efficiency.

Multiply your buying power with margin. No external transfers needed.

Multiply your buying power with margin. No external transfers needed.

Coming soon: More flexibility

Currently we offer long-only margin trading. Soon you will be able to take a short position to optimize profits in falling markets

Currently we offer long-only margin trading. Soon you will be able to take a short position to optimize profits in falling markets

Margin 101

What is crypto margin trading?

Margin trading allows you to borrow money from a broker or exchange to trade assets. In crypto, this means you can control a larger position than what your initial capital would allow. Borrowed funds amplify your trade size, and the ratio between the amount you trade and the amount you borrow is known as leverage.

What are the advantages of margin trading?

Margin trading offers several advantages, particularly for traders looking to maximize their returns. One of the main benefits is the ability to amplify profits. Using leverage, traders can control a larger position than they would with their own capital alone. This can lead to substantial gains if the market moves in your favor.

What are the risks of margin trading in crypto?

Crypto markets are notoriously volatile, which can make margin trading particularly risky.

Volatility in the cryptocurrency market can cause sudden price swings, increasing the likelihood of a margin call or liquidation. Traders need to be prepared for rapid price fluctuations, as even small changes in the market can have a significant impact when leverage is involved.

Frequently asked questions

Who is eligible to trade using margin on Gemini?

Margin trading is currently only available to Gemini Moonbase customers who qualify as Eligible Contract Participants (ECPs) in eligible jurisdictions.

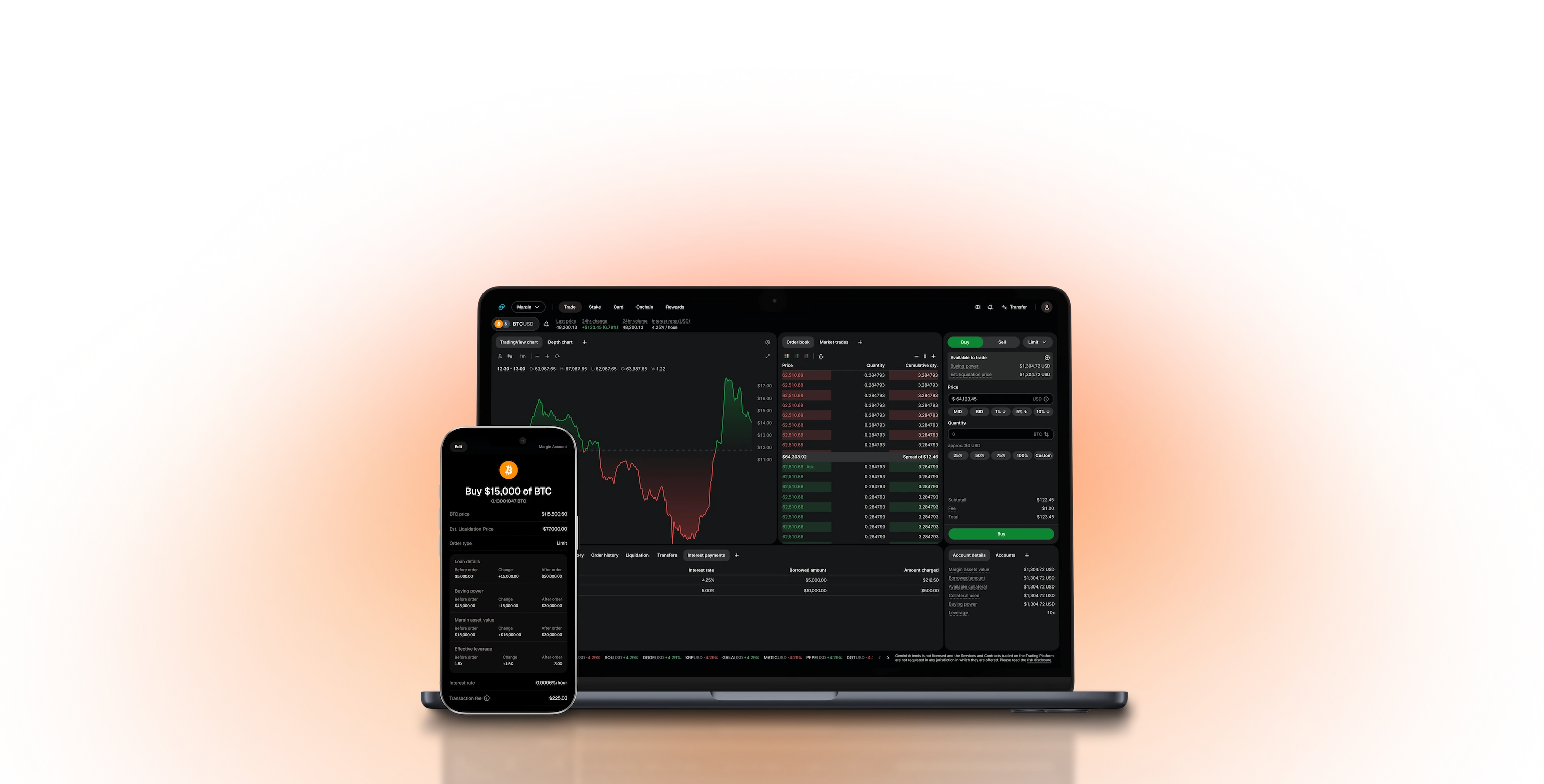

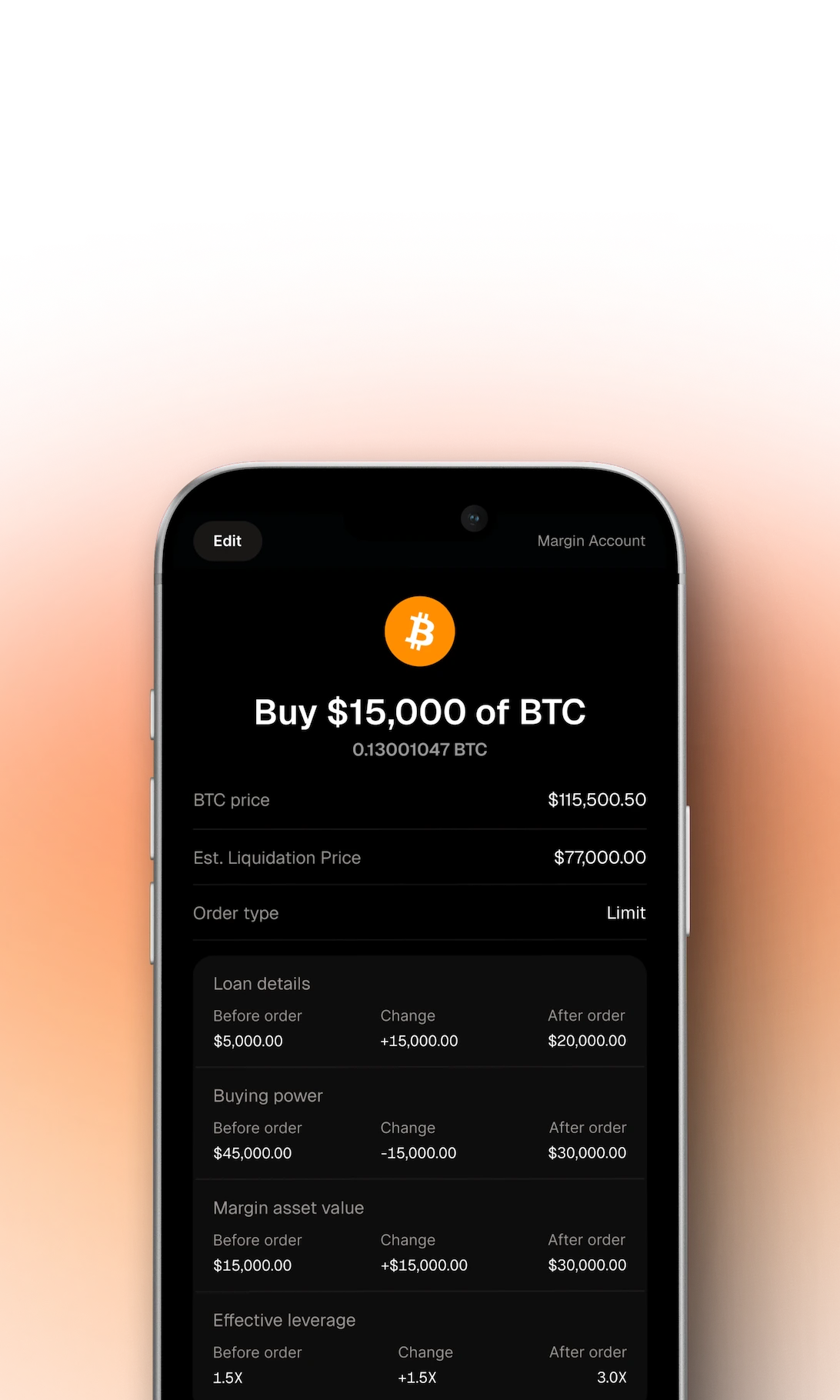

Can I trade margin using mobile, web or API?

Currently margin trading is available using ActiveTrader mode on Gemini web or mobile or via API. You can access your account from the account drop-down selector on the main ActiveTrader trading screen.

What is the maximum leverage available when trading using margin on Gemini?

Currently Gemini offers a maximum leverage of 5x when trading using margin.

What are the current assets available to loan for margin trading on Gemini?

Currently Gemini offers USD as the available loan asset.

What are the current assets available as collateral for margin trading on Gemini?

Currently Gemini allows BCH, BTC, DOGE, ETH, SHIB, SOL and XRP as eligible collateral.

What fees are associated with trading using margin on Gemini?

Margin trading will incur the same transaction fees as regular spot trading. The only additional fees are the interest rates charged on any loan balance and the liquidation fee that is charged should we need to liquidate any of your collateral assets. You are not charged transaction fees in addition to liquidation fees for liquidated events. Please see for more details on fees.

How do I know how much I can buy using margin trading on a pair?

The buying power that you have on a pair represents the max amount that you can buy using margin trading. It is calculated based on your available collateral, the asset maximum leverage as well as the maximum account leverage.

Buying power (pair specific) = Available collateral * min(1 / Collateral haircut for asset, Maximum account leverage)

Example (Capped by asset maximum leverage)

Using the example above, when checking the buying power of BTCUSD pair

Buying power = 4,000 * (1 / 20%, 10x) = 20,000

What is the maximum amount that I can borrow?

The amount that you can borrow is limited by the available collateral in your account as well as the loan capital available on the platform. You will not be able to place orders to borrow more if doing so results in your available collateral becoming less than or equal to 0. Also, if there is insufficient loan capital on the platform, you will also not be able to place orders to borrow more.

How does liquidation work for margin trading on Gemini?

When the Margin Asset Value in your account is less than or equal to 0, liquidation occurs.

The liquidation process is as follows:

- Cancel all existing open orders. If this means that the Margin Assets Value is greater than 0 then the liquidation process will stop.

- An Immediate-Or-Cancel order will be sent at the Zero Price for 50% of the position size will be sent on behalf of the account in liquidation. If the position size is smaller than $10,000 notional then 100% of the position size will be sent. If the execution of this order results in the Margin Assets Value being greater than the Margin Maintenance Limit then the liquidation process will stop.

- The process will continue to send orders until the Margin Assets Value is greater than the Margin Maintenance Limit or until the entire position has been closed.

Should the execution of the liquidation orders occur at a price better than the Zero Price then the improvement is kept by the account. Any liquidation orders that are executed will be charged the liquidation fee of 0.5%, no other trading fees are charged.

The liquidation orders are sent to the order book for that instrument in order to be liquidated. If this is not possible due to a lack of liquidity at the desired price then the positions are passed to the Gemini Insurance Fund at the Zero Price.