1M+

Users worldwide

24/7

Customer support

100K+

Five star ratings

Earn rewards by staking your crypto

No Minimums. No Transfer Fees.

No Minimums. No Transfer Fees.

Start staking with any amount—there are no minimums, and no transfer or redemption fees. Gemini’s service fee is automatically deducted from the rewards you earn, so there are no surprise charges.

Start staking with any amount—there are no minimums, and no transfer or redemption fees. Gemini’s service fee is automatically deducted from the rewards you earn, so there are no surprise charges.

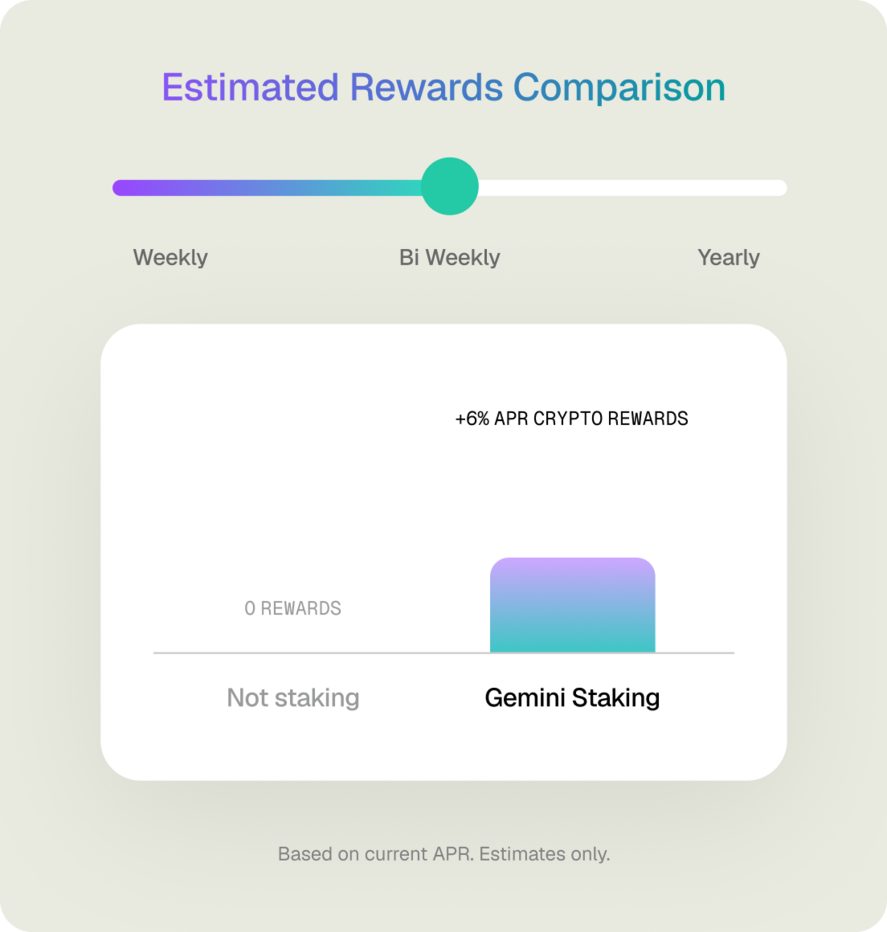

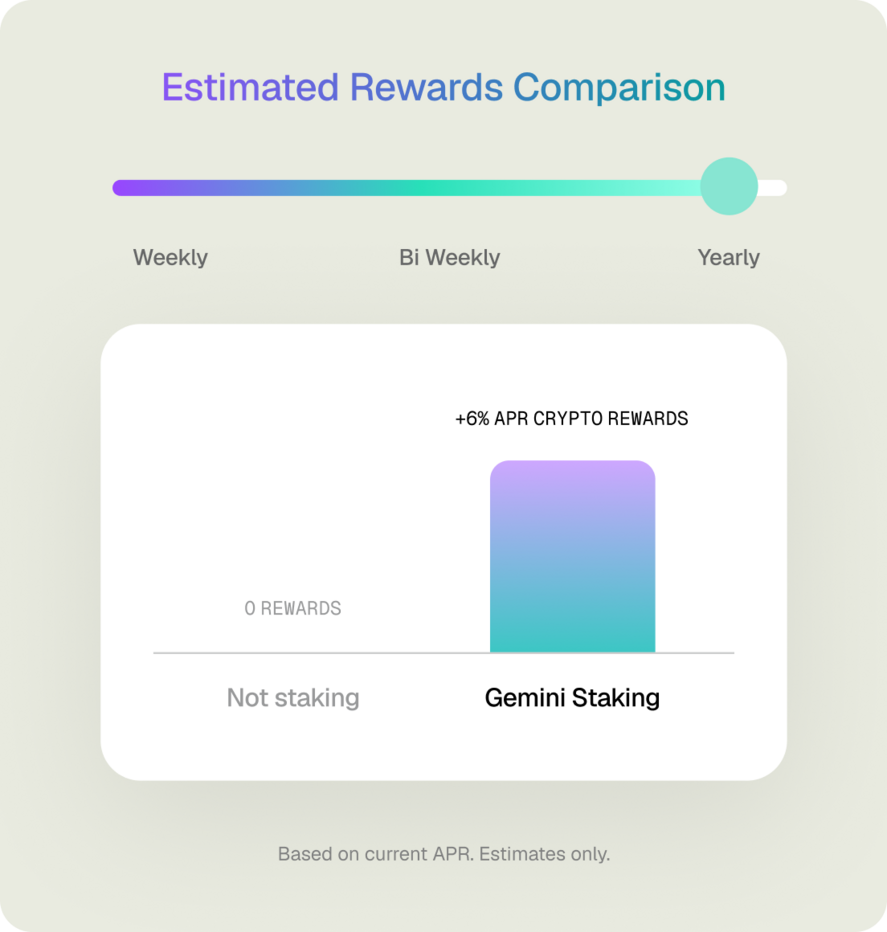

Consistent Rewards, On Your Terms.

Consistent Rewards, On Your Terms.

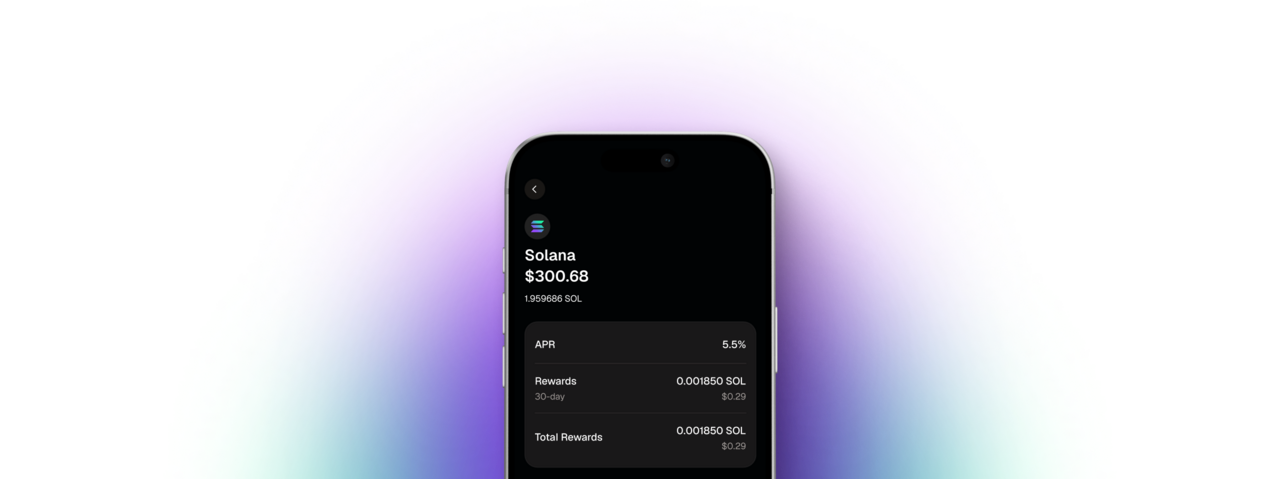

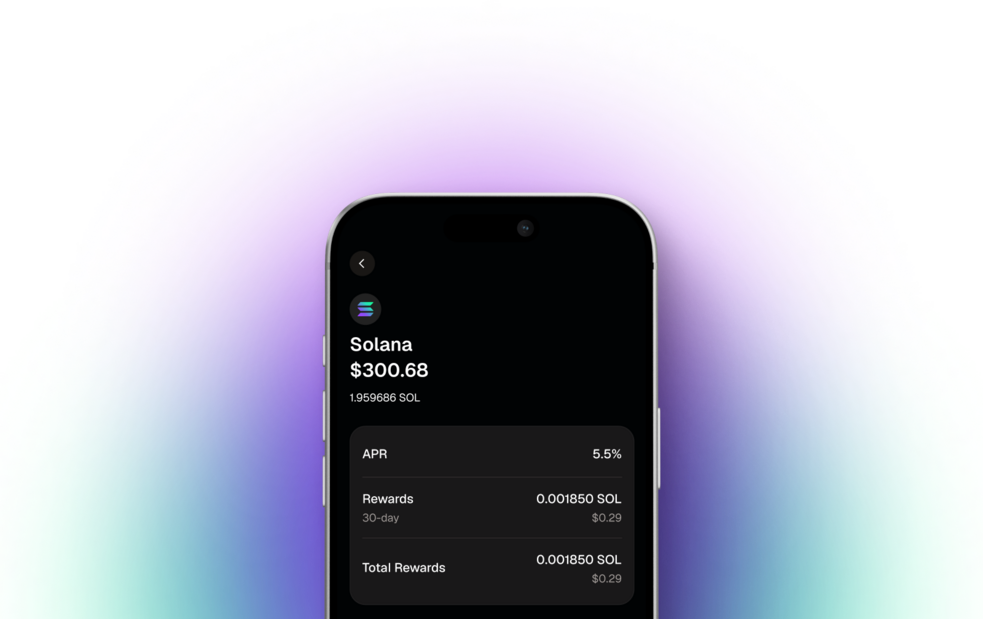

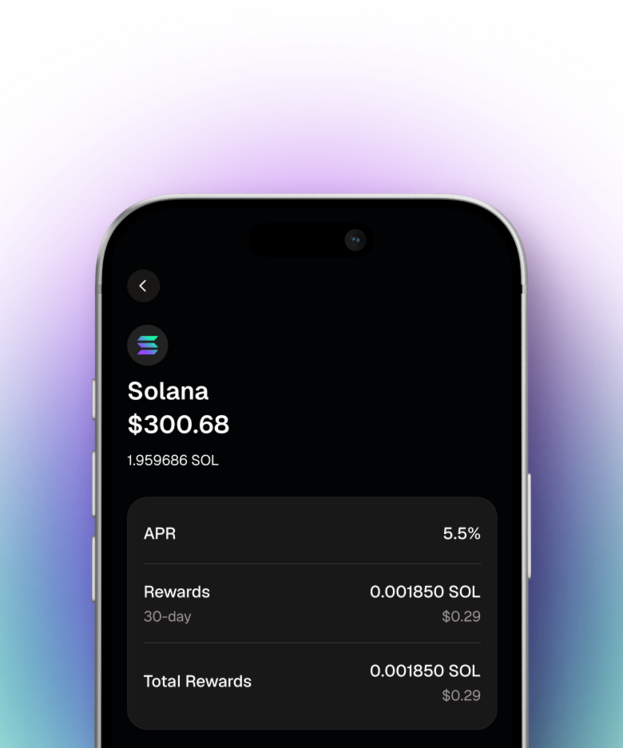

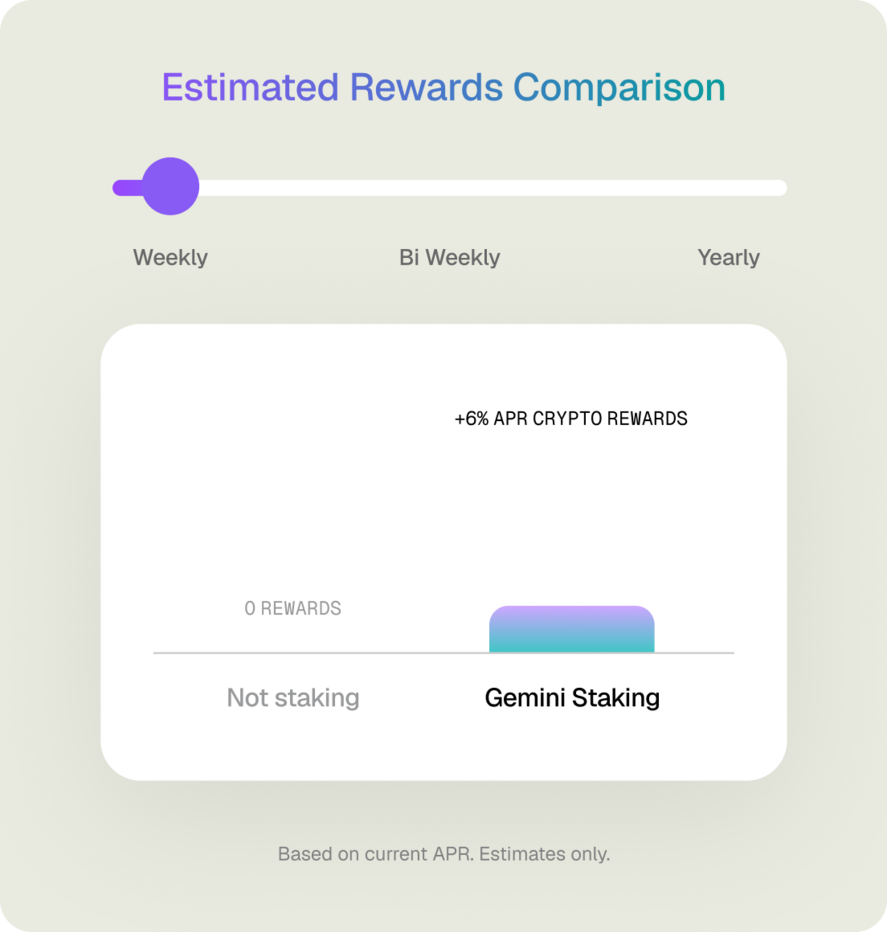

Put your crypto to work with competitive APRs. Gemini Staking is designed for steady rewards and a simple experience, with transparent reward tracking directly in the Gemini app.

Put your crypto to work with competitive APRs. Gemini Staking is designed for steady rewards and a simple experience, with transparent reward tracking directly in the Gemini app.

Assets available for staking on Gemini

Why choose Gemini?

Security-first infrastructure

Security-first infrastructure*

Gemini’s platform is supported by controls aligned to recognised security standards, including ISO 27001 and SOC 1 Type 2 and SOC 2 Type 2.

Gemini’s platform is supported by controls aligned to recognised security standards, including ISO 27001 and SOC 1 Type 2 and SOC 2 Type 2.

Staking made simple

Crypto security

Gemini manages staking operations and reward distribution for you, so no technical setup is required.

Gemini manages staking operations and reward distribution for you, so no technical setup is required.

Account protection

Account protection

Multi-Factor Authentication (MFA) is required for logins and withdrawals to keep your account secure*.

Multi-Factor Authentication (MFA) is required for logins and withdrawals to keep your account secure*.

FAQs

What is Staking?

Staking is an essential feature of Proof-of-Stake (PoS) protocols. Large PoS protocols including Polygon, Solana, and Polkadot allow users to stake their native tokens and earn rewards. Blockchain node operators must pledge their tokens, also known as staking, to a network in order to be selected as a block validator. As a reward for correctly adding valid blocks to the blockchain, node operators receive newly minted tokens and/or a portion of transaction fees (i.e., gas fees) as rewards, known as staking rewards. Node operators who perform invalid functions (e.g., adding a corrupted block to the blockchain) could lose a portion of their pledged tokens, a function known as slashing. Our staking validators are highly effective, and have never been slashed.

There are various iterations of and a host of features that accompany them. For a deep dive into how Proof-of-Stake works, check out .

What crypto can you stake on Gemini?

Customers can currently stake ETH, SOL and MON.

What are the fees associated with Staking?

Gemini will distribute any earned rewards to you after receipt by Gemini, minus a Staking Services Fee of up to 25% of the rewards determined by the protocol. Some of the Staking Services Fee is used to pay ‘gas’ fees, third party fees, or infrastructure costs associated with staking and the remainder may be retained by Gemini.

Why are Staking rewards not fixed?

Staking rewards are a function of several supply and demand factors on the network, and the actual reward granted to staking participants is determined at the time rewards are granted. For example, because the number of newly minted tokens is usually a fixed amount in a specific timeframe, staking rewards are higher with fewer node operators and vice-versa. These rewards are distributed proportionately on each successful checkpoint submission to each delegator based on their stake relative to the overall staking pool of all validators and delegators.

How do networks stay secure?

To protect the network, PoS chains penalize validators for malicious or negligent behavior through a process called slashing, which can reduce their staked assets. At Gemini, we only partner with trusted, top-tier validators—and if slashing ever occurs due to our infrastructure, you may be reimbursed. See the for details.

What is Proof-of-Stake (PoS)?

Proof-of-Stake (PoS) networks like Ethereum and Solana use staking to validate transactions and maintain network security. By staking your crypto, you're helping secure the blockchain— and in return, you can earn staking rewards.

How does Staking power validators?

Validators are selected to add new blocks to the blockchain based on the amount of tokens they've staked. When they successfully validate transactions, they earn rewards. These rewards are then shared with users who delegate their tokens.

Where do the Staking rewards come from?

Node operators pledge tokens to a network as a guarantee for correctly performing block validation operations. These node operators receive newly minted tokens and transaction fees as rewards for adding valid blocks to the network. Those newly minted tokens and transaction fees are the rewards for staking and will be passed onwards to those who have staked their tokens.

Where is Staking available?

Gemini staking is available in Argentina, Australia, Austria, Bahamas, Belgium, Bermuda, Bhutan, Brazil, British Virgin Islands, Bulgaria, Cayman Islands, Chile, Croatia, Cyprus, Czech Republic, Denmark, Egypt, El Salvador, Estonia, Finland, France, Germany, Greece, Guernsey, Hong Kong, Hungary, India, Ireland, Israel, Italy, Jersey, Latvia, Lithuania, Luxembourg, Malaysia, Malta, Mexico, Myanmar, Netherlands, New Zealand, Nigeria, Panama, Peru, Philippines, Poland, Portugal, Puerto Rico, Romania, Saint Lucia, Saint Vincent and the Grenadines, Slovakia, Singapore, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, United Kingdom, U.S. Virgin Islands, certain jurisdictions in the United States, Uruguay, and Vietnam.

How long does unstaking take?

Unstaking times vary by asset and network conditions. When you initiate unstaking, your crypto goes through a network-defined process before it becomes available again in your account. The unbonding period on ETH is variable and can be anywhere between 6 days to 60 days. The unbonding period on SOL is usually around 3 to 4 days. During this time, you won’t be able to sell, transfer, or withdraw your unstaked assets, and they remain exposed to market price movements. Any staking rewards you’ve earned are credited directly to your Gemini account and will appear in your portfolio.

Elevate your trading strategy today