AUG 19, 2025

How Gemini’s Microservices Architecture Allowed Us To Support Multichain Deposits & Withdrawals

Over the past few years, it’s become clear that users want to interact seamlessly with assets across multiple networks, typically favoring those that offer the quickest and most cost-effective transactions.

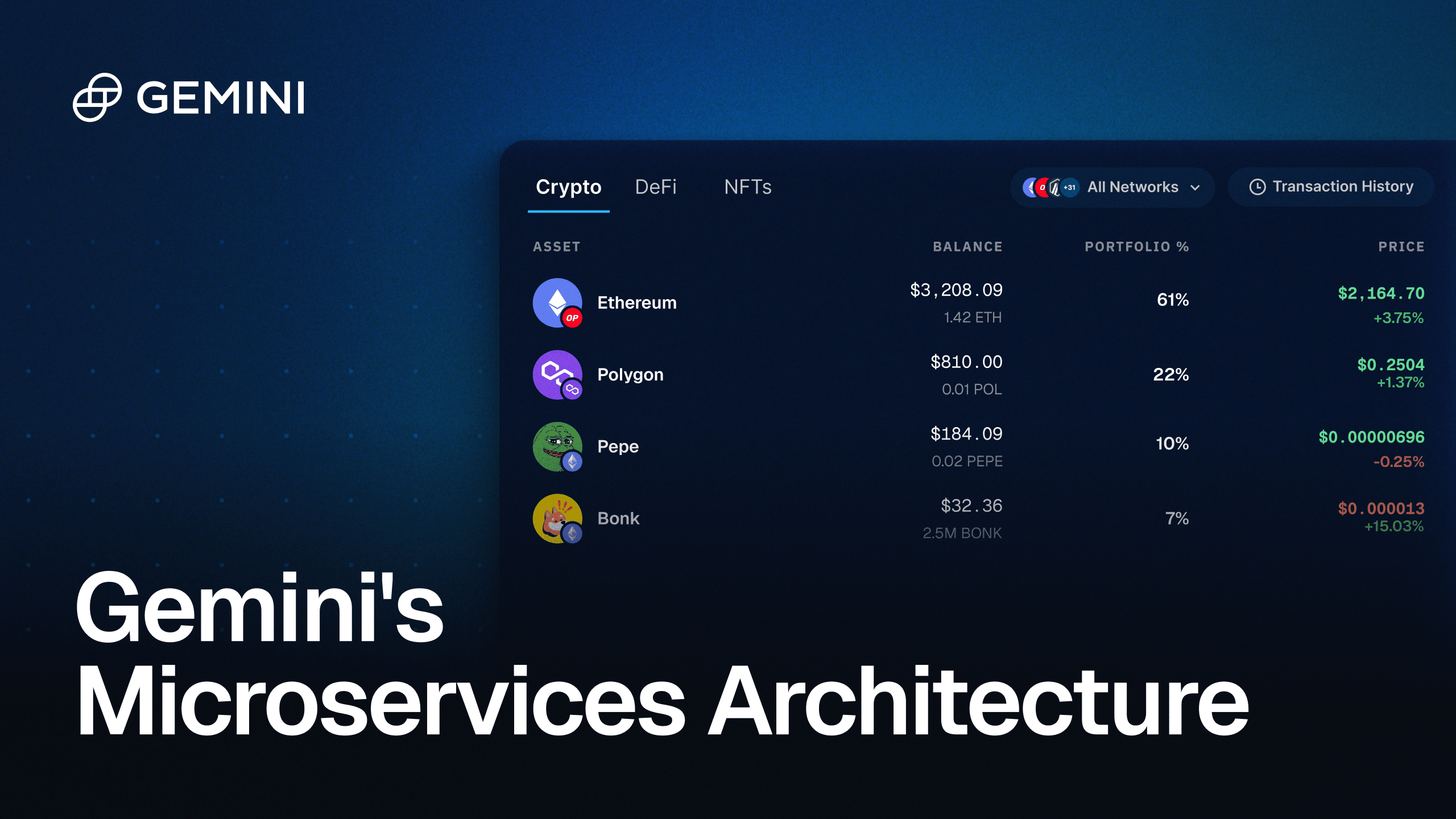

At Gemini, we've observed that customers prefer an easy, seamless experience and aren’t particularly concerned about which network their assets are deposited on. Practically speaking, this means that if you deposit ETH to your Gemini deposit address on Arbitrum, Optimism, or the Ethereum network, you’ll simply be credited with ETH. When withdrawing ETH, you have the freedom to select any supported network, eliminating the need to worry about swaps or tracking specific deposit chains. Gemini now supports ETH deposits and withdrawals across multiple L2 networks, including Arbitrum and Optimism, with many more on the way.

To support this flexibility and stay ahead in a rapidly evolving market, Gemini’s Onchain organization has continued to transition to a microservices architecture. This represents a significant strategic shift for us as we've observed that customers are becoming less network-specific and increasingly asset-specific. By moving toward loosely coupled services that can be independently developed, deployed, and scaled, we're able to rapidly iterate, reduce dependencies, and quickly adapt to changing market demands. At a high level, this approach consists of several clearly defined services:

This service is network-specific, quickly monitoring deposits and executing withdrawals on each network individually. Each instance of Hyperdrive is focused solely on one network, without awareness of other networks or assets. This isolated approach allows each Hyperdrive instance to swiftly support new features such as address types, transaction types, and messaging formats, without needing to consider compatibility with other networks. Because each instance operates independently, we can confidently introduce new functionalities or upgrades without impacting other supported chains. A recent example of this is our support for .

Wallet Layer:

The Wallet Layer is both network and asset specific. It tracks deposits and manages withdrawals with clear visibility into the particular asset and network involved. This capability has been essential for our multichain launch because, although users generally view their ETH as equivalent across multiple L2s, they still want the ability to verify their deposits and withdrawals directly on-chain through network-specific explorer links.

Exchange Layer:

Our Exchange Layer is strictly asset-specific. After thorough analysis and conversations with our core customers and industry participants, it became evident that customers desire flexibility in depositing their assets on any supported chain and withdrawing them to any other supported chain. The Exchange Layer directly interacts with users to meet these preferences, allowing you, for instance, to deposit ETH onto Gemini-supported networks like Optimism, Arbitrum, or Ethereum interchangeably.

This transition to microservices empowers us to focus on creating products that align closely with customer needs. If customer sentiment or market dynamics shift in their perception of assets and networks, our structure enables rapid innovation to meet those new expectations.

ARTICOLI CORRELATI

WEEKLY MARKET UPDATE

OCT 02, 2025

Crypto Prices Surge After Weak Jobs Data, Swift Seeks to Add Blockchain to Tech Stack, and WLFI Explores Tokenizing Real-World Commodities

ENGINEERING

SEP 30, 2025

Leveling Up Gemini’s Websocket API Infrastructure

COMPANY

SEP 29, 2025