BITCOIN ADOPTION,

VOLATILITY, AND MARKET CAP

Exploring the impact of the Strategic Bitcoin Reserve on the broader bitcoin ecosystem.

In March 2025, the U.S. established a Strategic Bitcoin Reserve (SBR), formally recognizing bitcoin as a sovereign-grade asset. The SBR’s launch, alongside the rise of regulated offchain platforms, signals bitcoin’s transition into a macro-financial instrument. These developments are anchoring supply and strengthening institutional confidence—ushering in a new phase of strategic adoption.

Centralized Entities

Growing Adoption

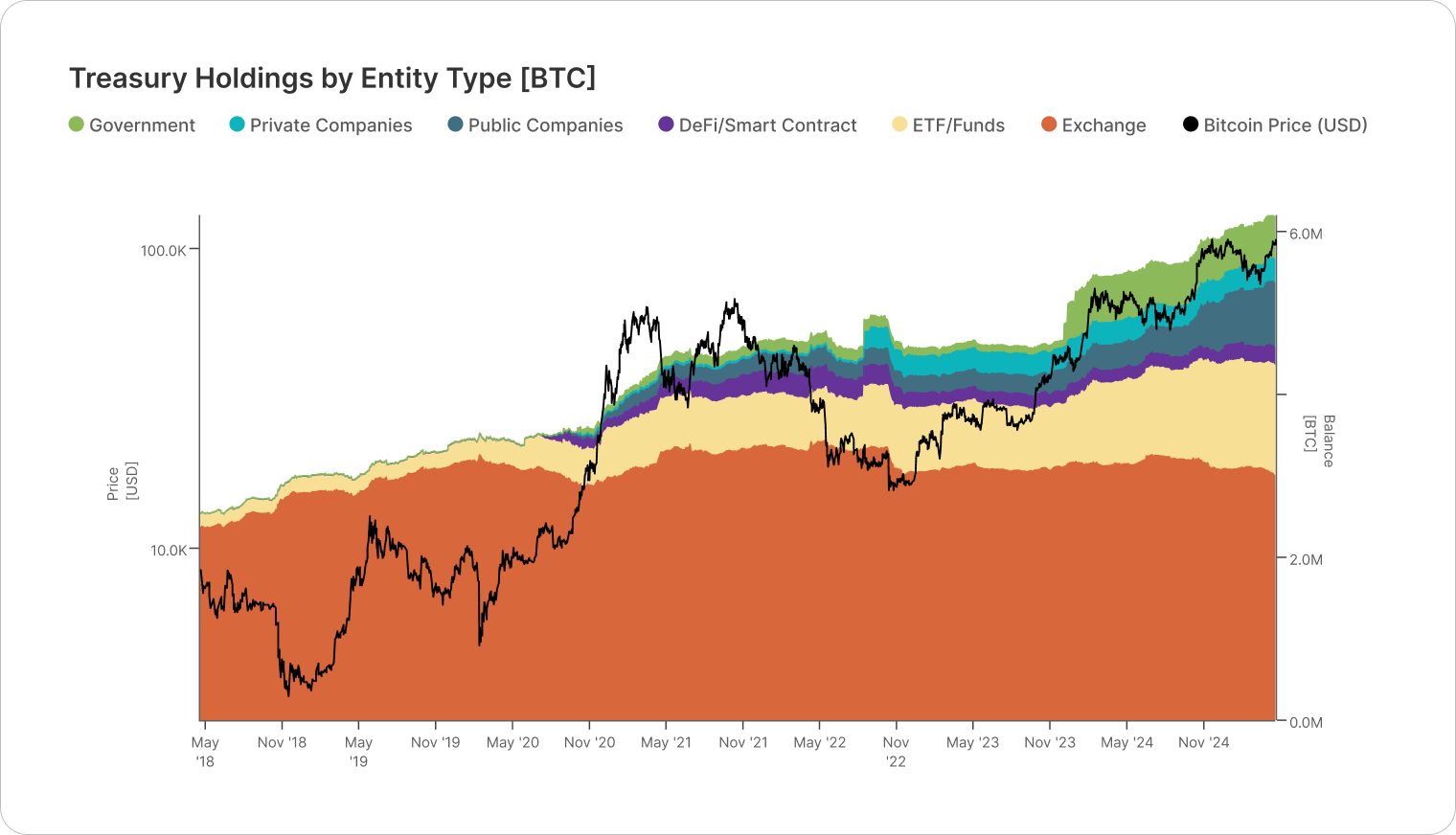

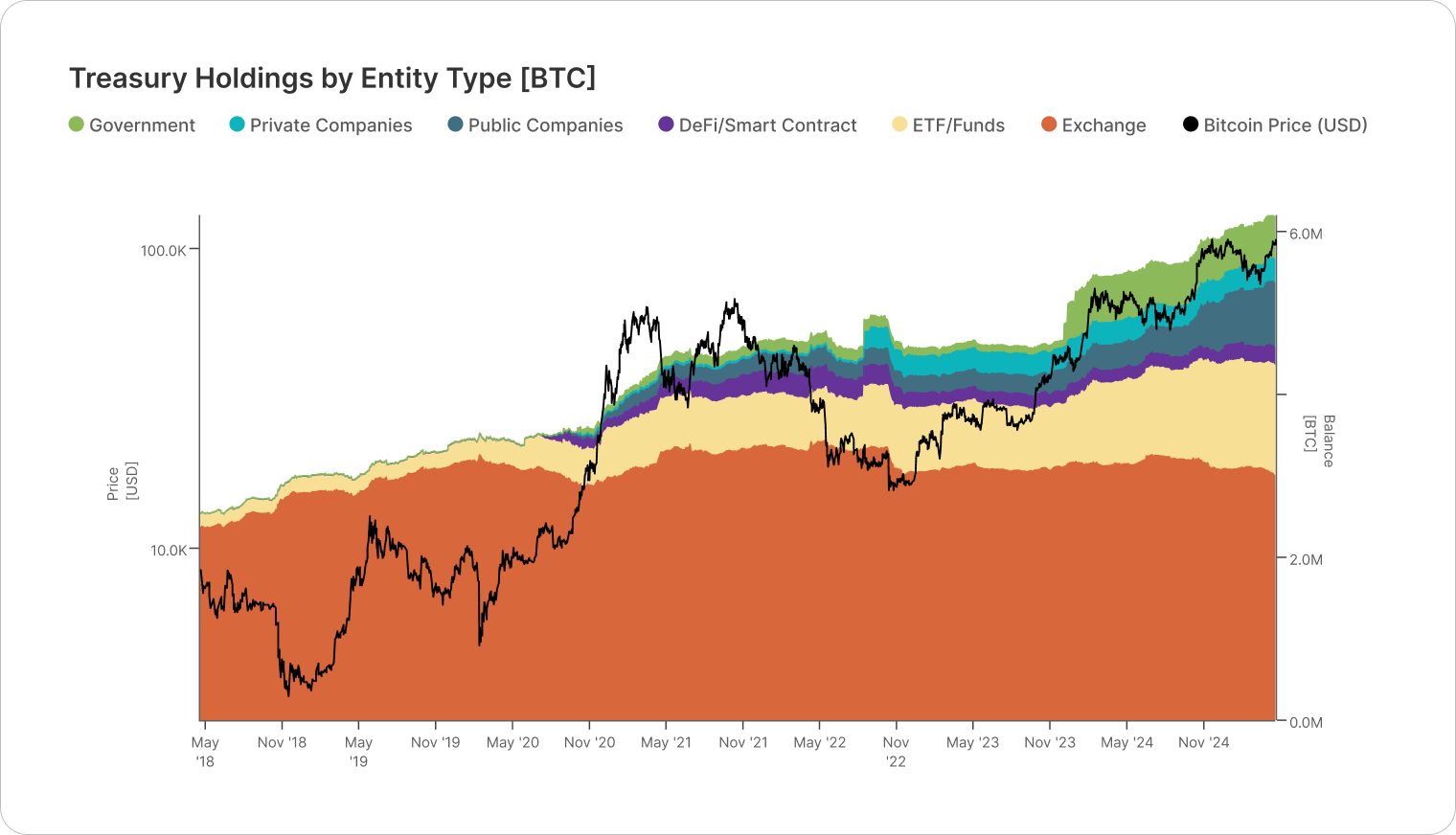

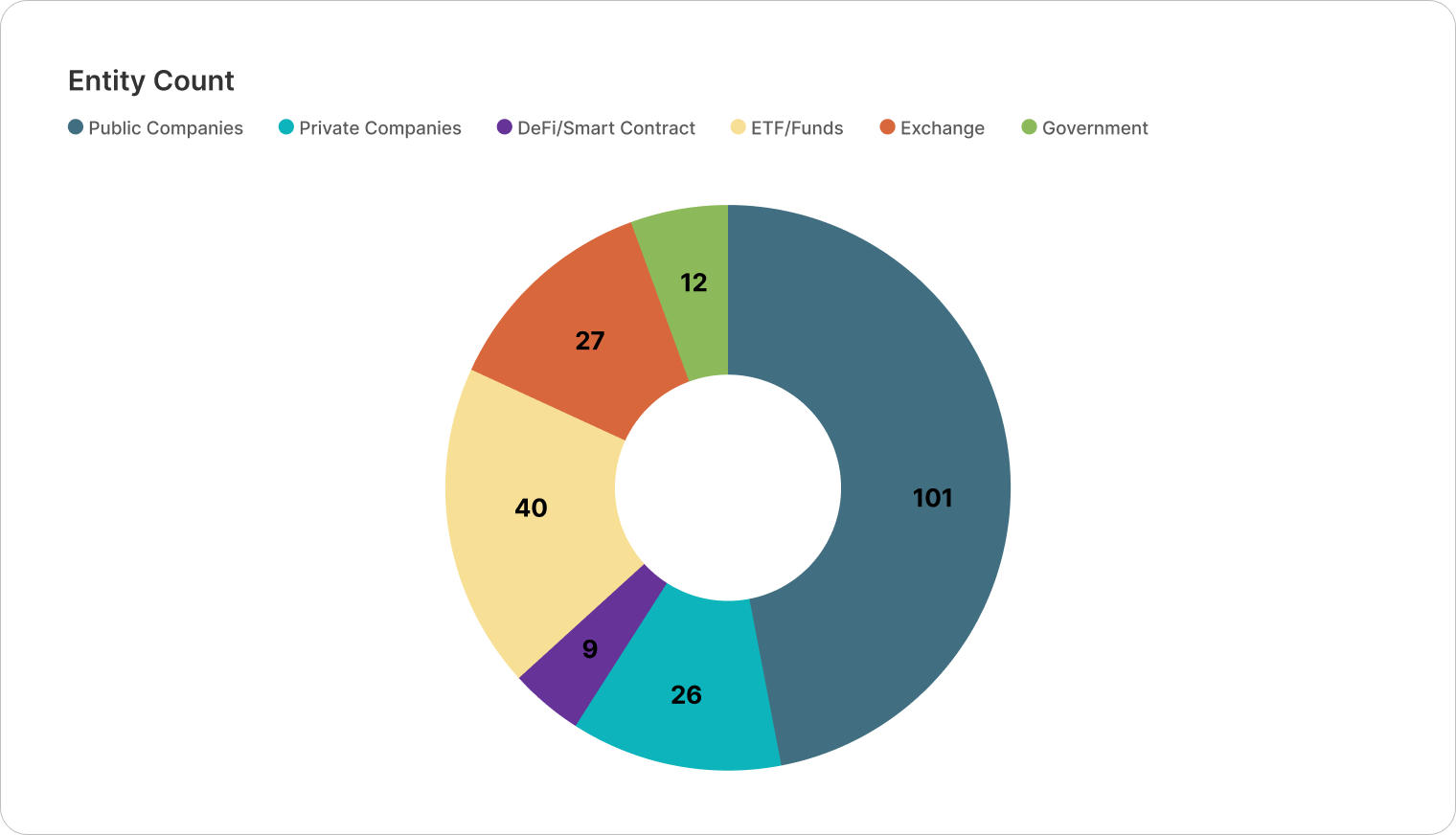

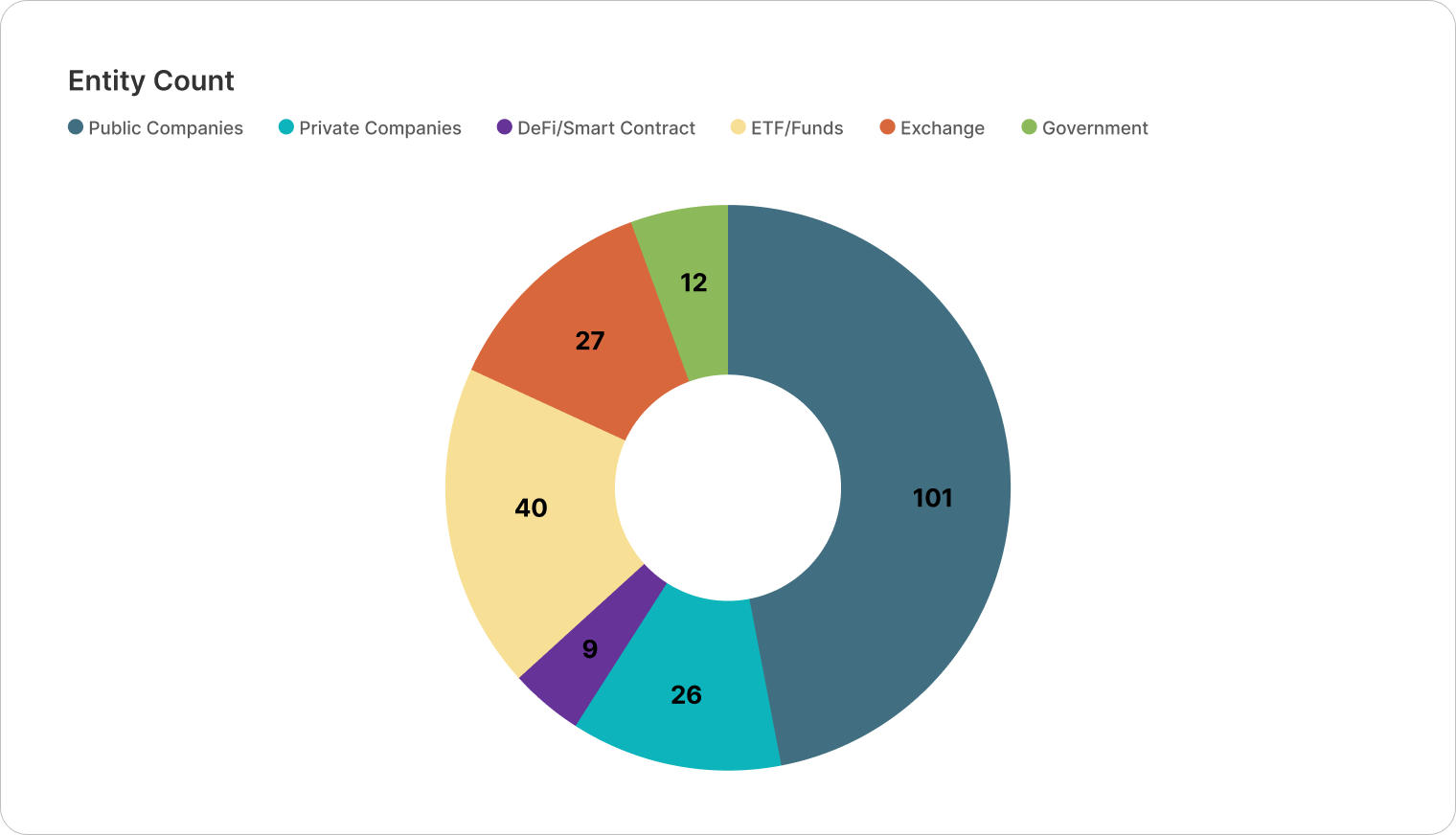

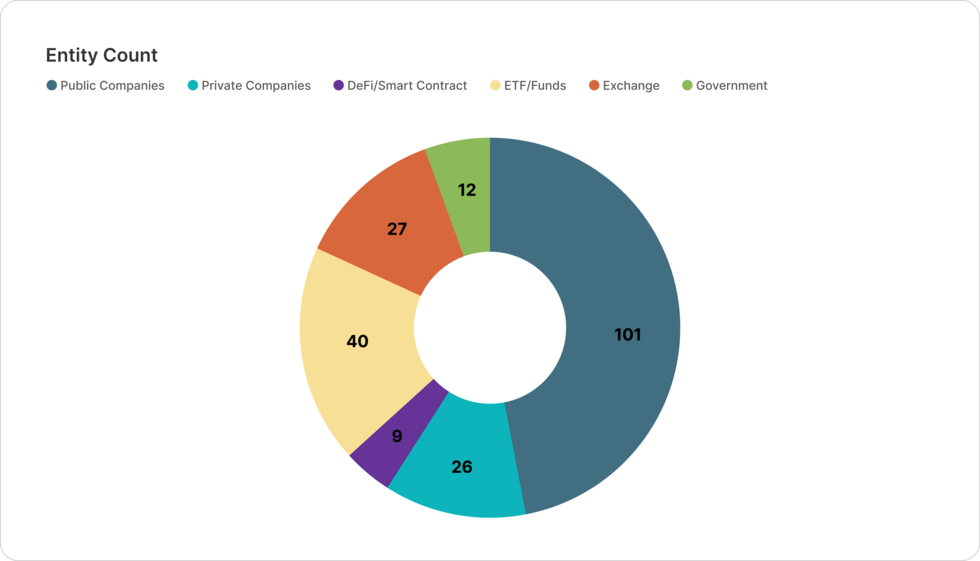

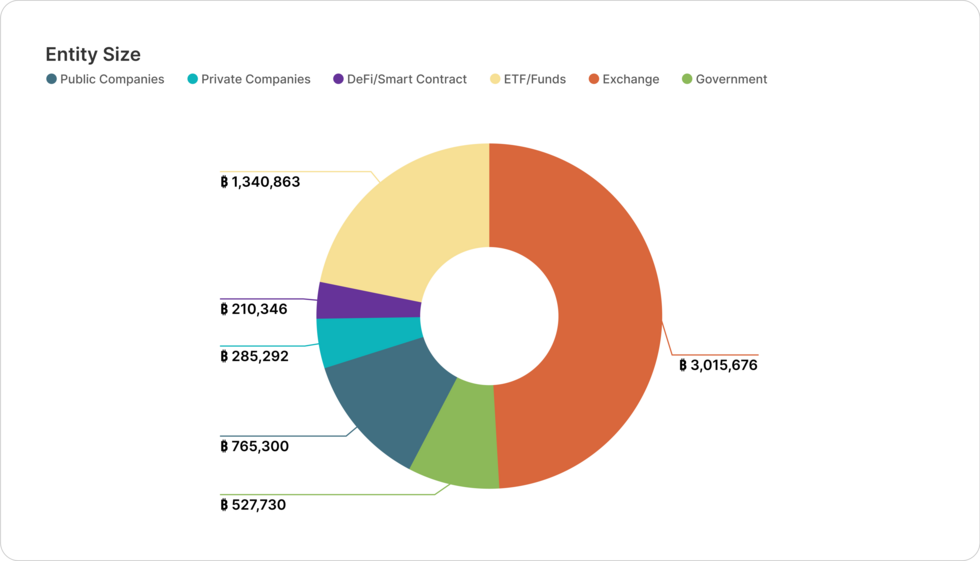

Over 30% of bitcoin’s circulating supply is now held by just 216 centralized entities, reflecting both expanding institutional adoption and deepening custodial centralization.

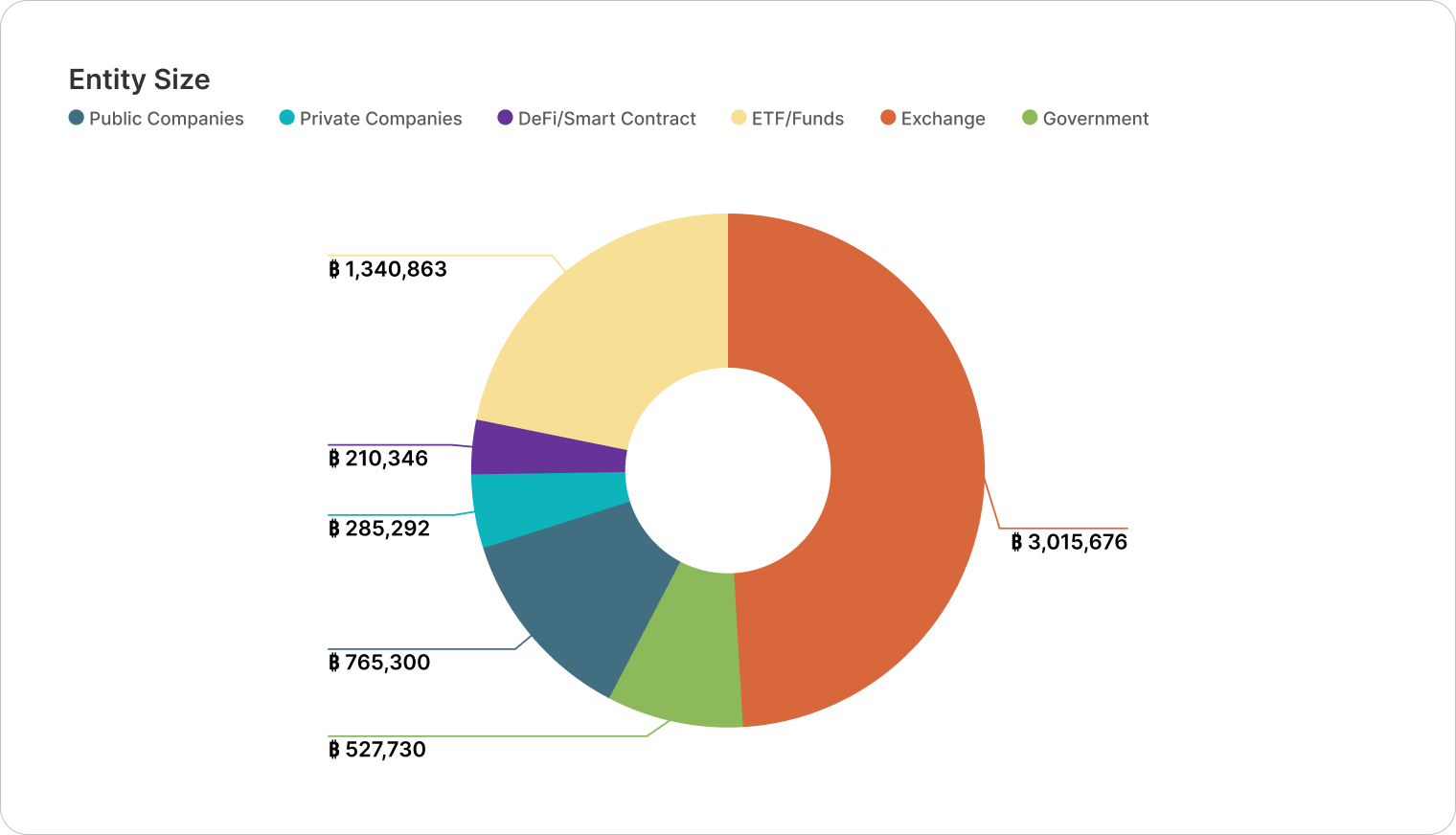

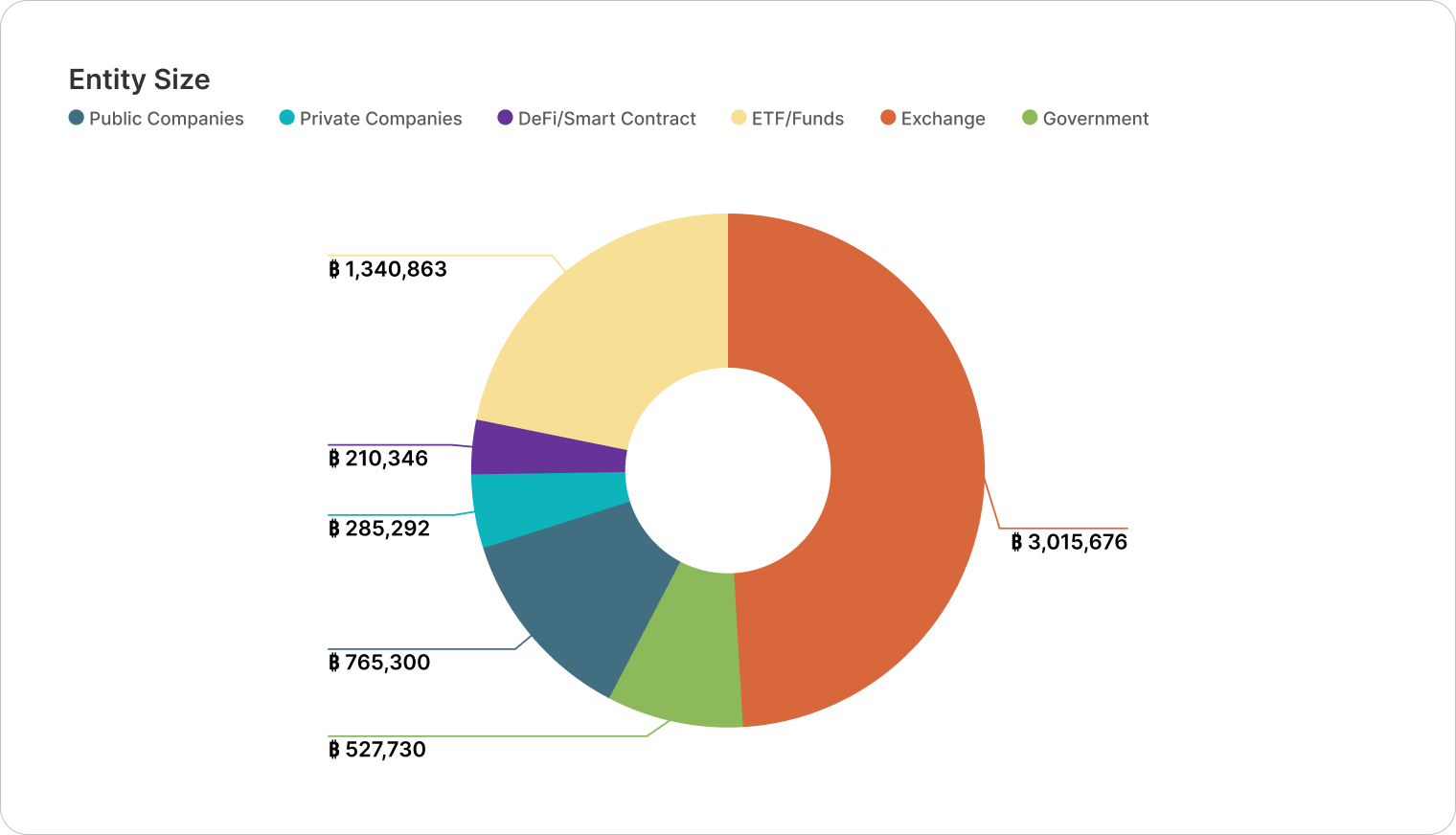

Since early 2015, centralized exchanges have emerged as the dominant custodians of bitcoin, initially holding just under 600K BTC on behalf of their users. Today, the total bitcoin held across major institutional and custodial entities has surged to 6,145,207 BTC, representing an increase of 924% in supply held by centralized entities over the past decade.

During the same period, the spot price of bitcoin has climbed from under $1,000 to over $100,000, reinforcing the thesis that institutions increasingly view bitcoin as a strategic asset. This report analyzes 216 entities spanning six key categories—exchanges, ETFs/funds, public and private companies, DeFi contracts, and governments. While not exhaustive, this dataset captures the most influential players that now collectively hold nearly one-third of all circulating bitcoin.

Since early 2015, centralized exchanges have emerged as the dominant custodians of bitcoin, initially holding just under 600K BTC on behalf of their users. Today, the total bitcoin held across major institutional and custodial entities has surged to 6,145,207 BTC, representing an increase of 924% in supply held by centralized entities over the past decade.

During the same period, the spot price of bitcoin has climbed from under $1,000 to over $100,000, reinforcing the thesis that institutions increasingly view bitcoin as a strategic asset. This report analyzes 216 entities spanning six key categories—exchanges, ETFs/funds, public and private companies, DeFi contracts, and governments. While not exhaustive, this dataset captures the most influential players that now collectively hold nearly one-third of all circulating bitcoin.

Among the 216 entities spanning six categories, exchanges hold the greatest amount of bitcoin, while public companies are the most numerous. These categories are:

- Exchanges

- ETFs/Funds

- Public companies

- Private companies

- DeFi contracts

- Governments

Among the 216 entities spanning six categories, exchanges hold the greatest amount of bitcoin, while public companies are the most numerous. These categories are:

- Exchanges

- ETFs/Funds

- Public companies

- Private companies

- DeFi contracts

- Governments

Centralized Entities

Pioneers at the Helm

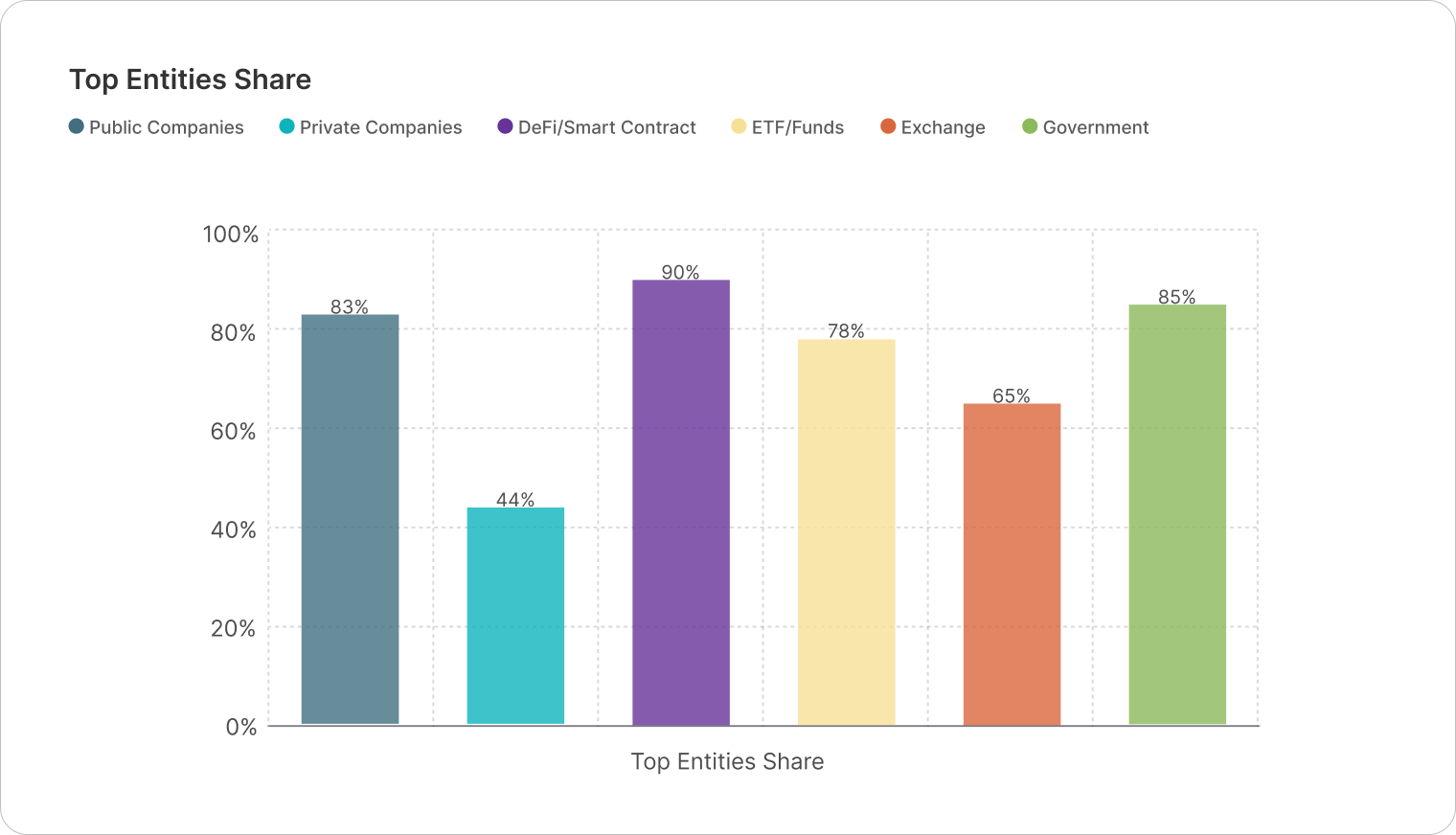

Three entities dominate bitcoin adoption across nearly all respective categories, signaling that early adopters continue to shape institutional market structure.

Across nearly all institutional categories—excluding private companies—the top three entities control between 65% to 90% of total holdings, underscoring the dominance of early adopters in the Bitcoin treasury space. This pattern is particularly stark in the DeFi, public company, and ETF/fund categories, where pioneers have shaped the early trajectory of adoption.

In contrast, private company holdings appear more distributed, reflecting a broader base of engagement. While this dominance is expected to decline as markets mature, these centralized leaders have played a crucial role in channeling capital into bitcoin holdings and legitimizing it as a global macro asset class.

Across nearly all institutional categories—excluding private companies—the top three entities control between 65% to 90% of total holdings, underscoring the dominance of early adopters in the Bitcoin treasury space. This pattern is particularly stark in the DeFi, public company, and ETF/fund categories, where pioneers have shaped the early trajectory of adoption.

In contrast, private company holdings appear more distributed, reflecting a broader base of engagement. While this dominance is expected to decline as markets mature, these centralized leaders have played a crucial role in channeling capital into bitcoin holdings and legitimizing it as a global macro asset class.

Centralized Entities

Spot Custodians: Stable Supply, Growing Impact

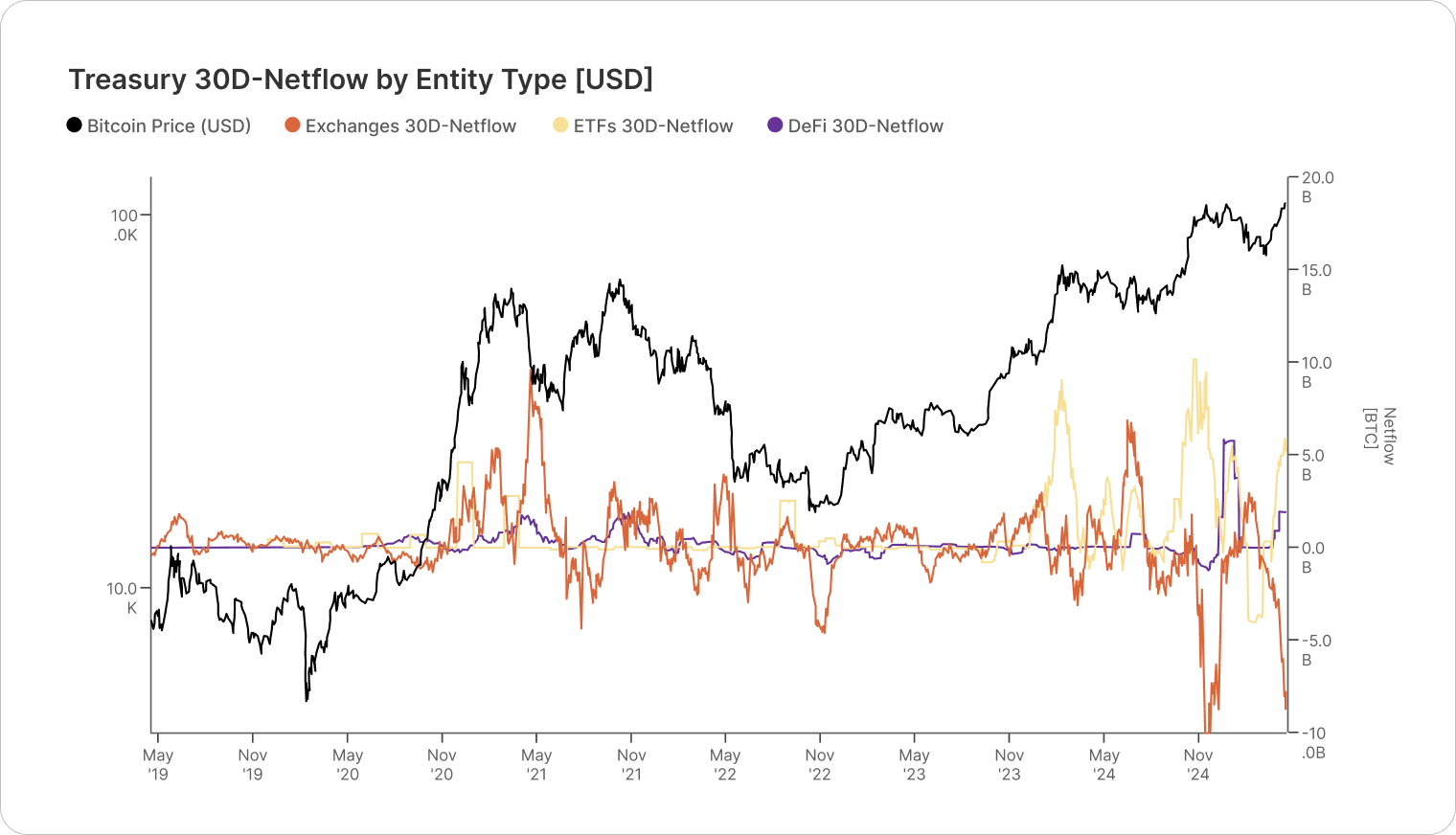

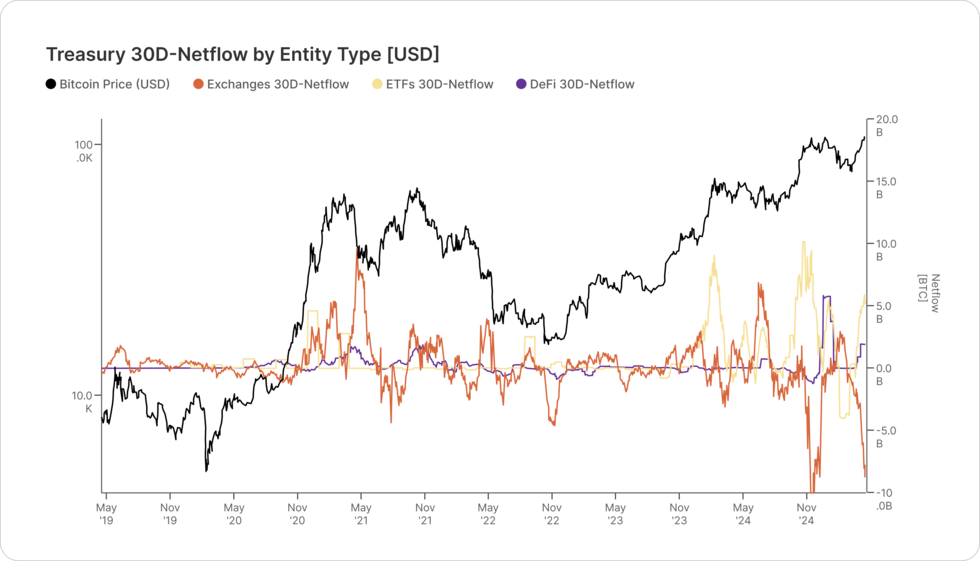

Despite a steady aggregate balance, the spot trading sector exerts growing influence on price, driven by investor flows and the rising dominance of ETFs.

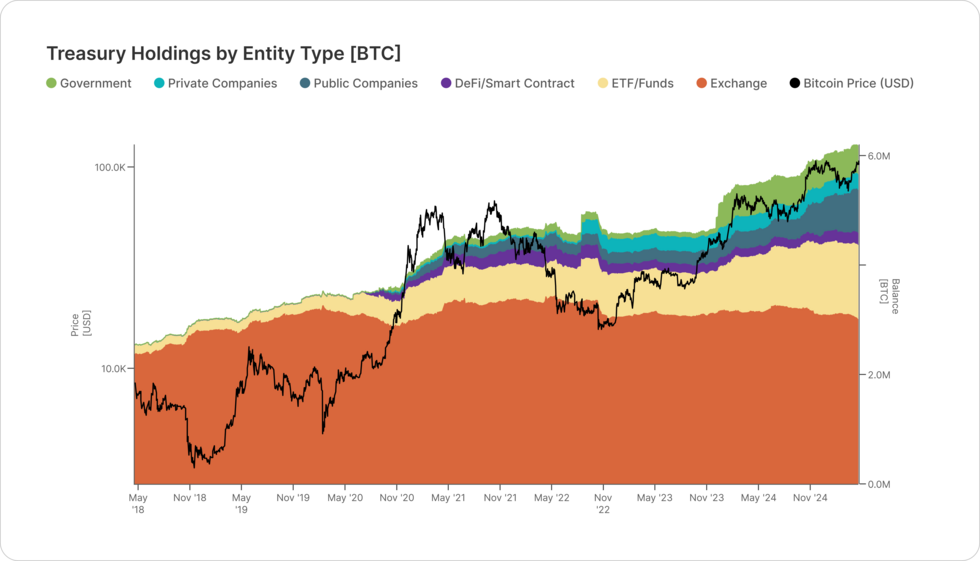

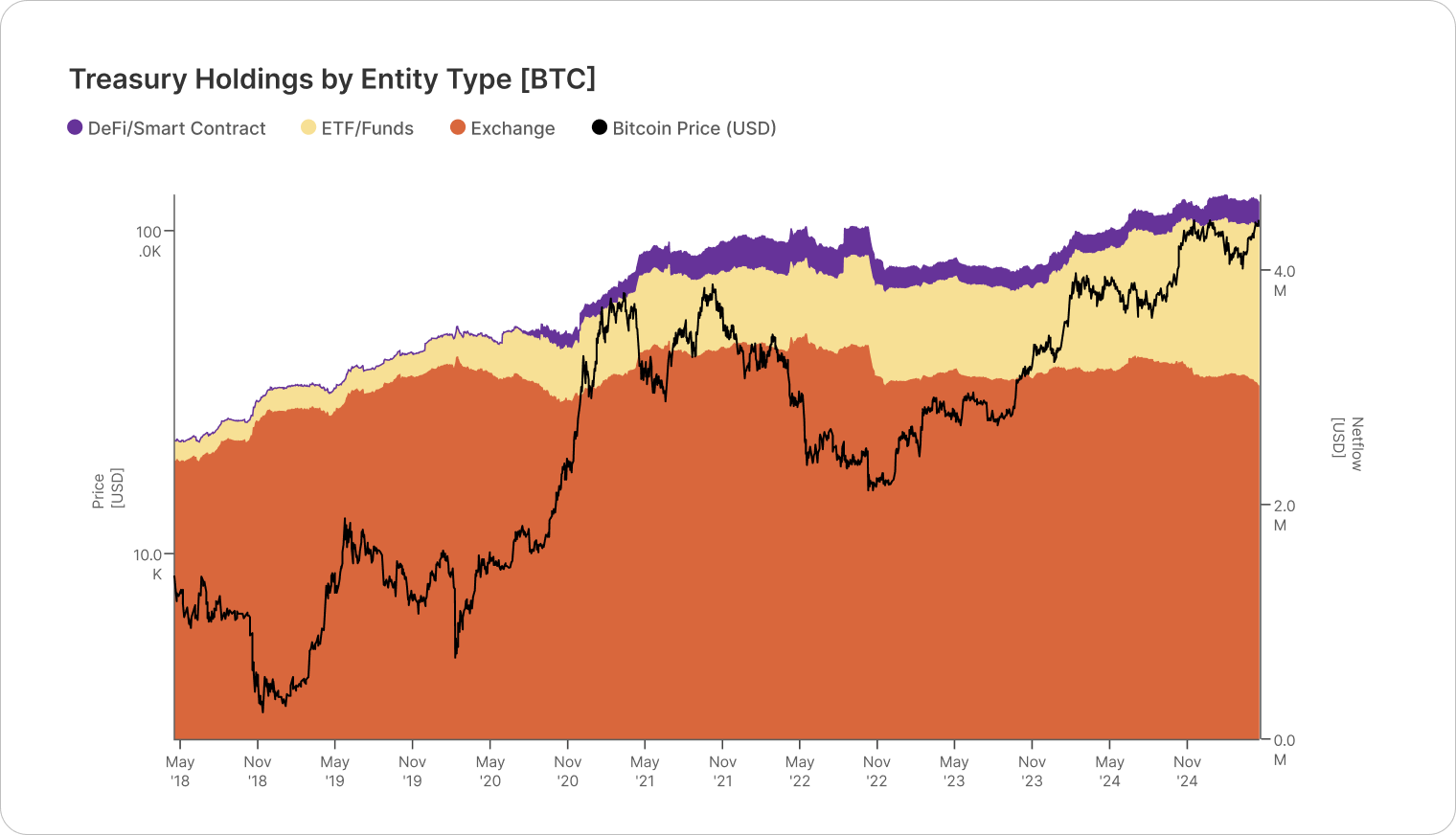

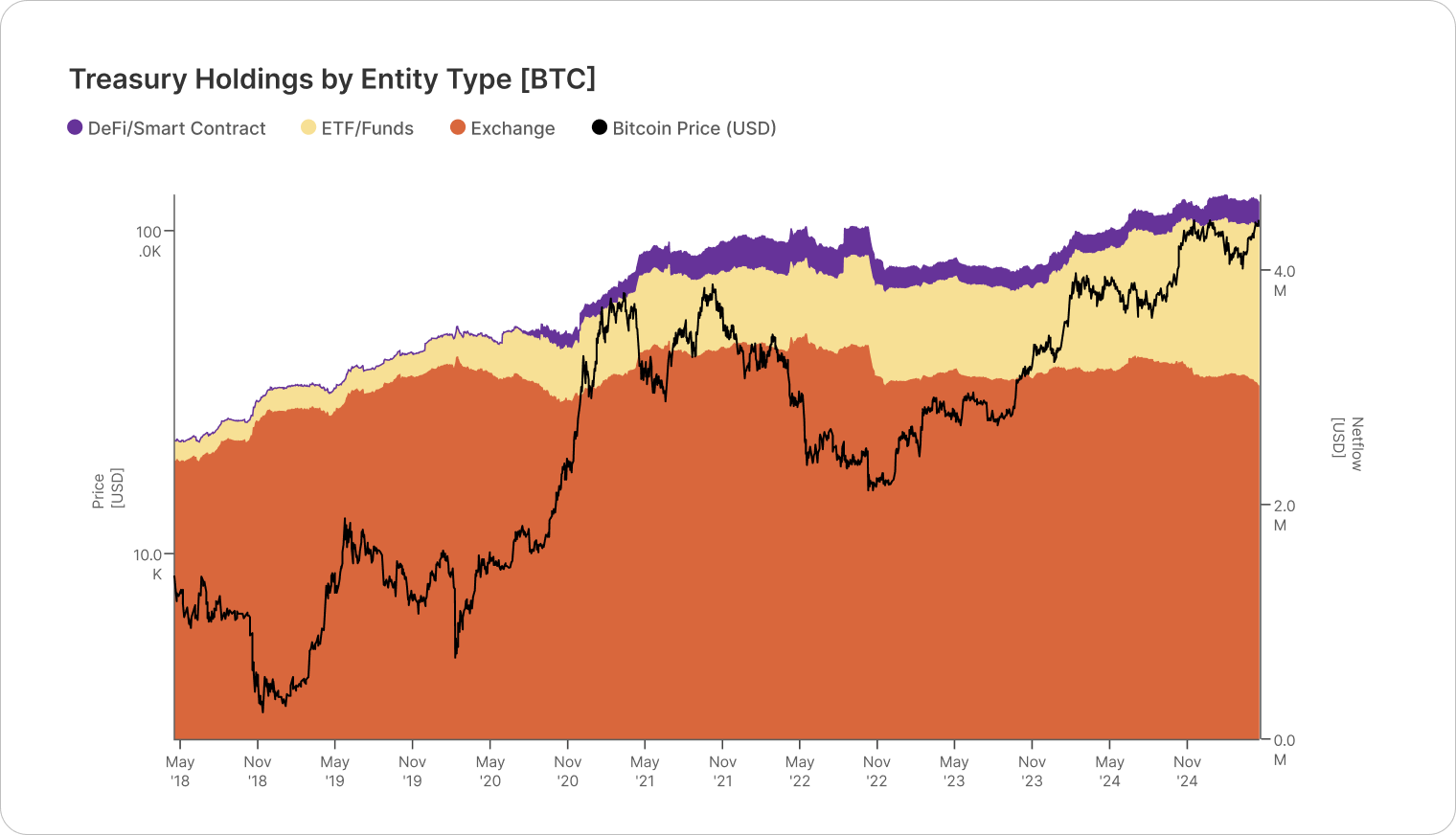

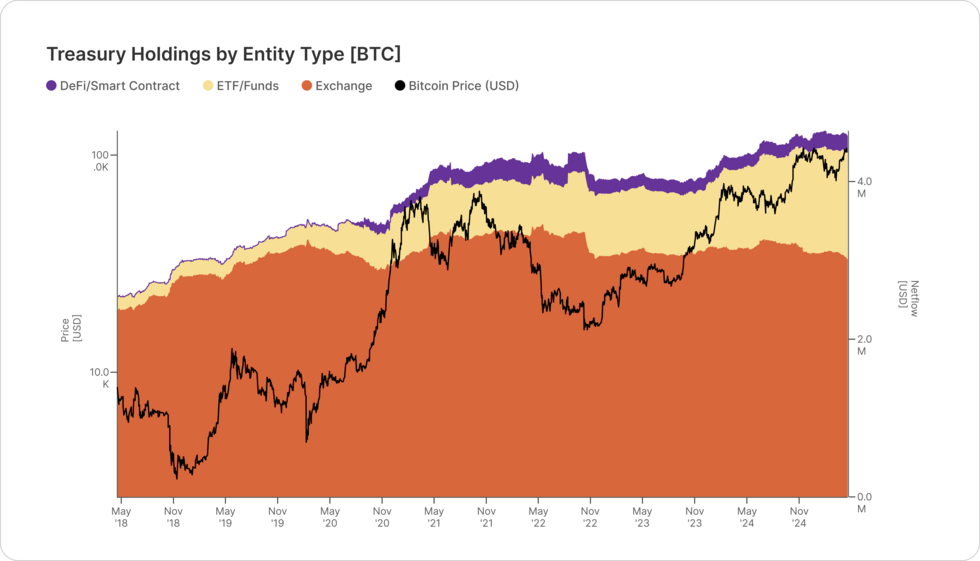

Centralized exchanges, ETFs/Funds, and to a lesser extent, DeFi protocols, serve as custodians for bitcoin held on behalf of clients seeking spot market exposure. While centralized exchange balances have declined over the past two years, this has often been misinterpreted as a looming supply shock.

In reality, most of this bitcoin has migrated to ETFs and funds, particularly U.S. spot ETFs. The total bitcoin held by this spot trading sector has remained relatively stable, ranging between 3.9M-4.2M BTC since June 2021. This stable range suggests that the drop in exchange balances does not imply shrinking supply, but rather a structural reshuffling of custody.

Although the growing ETF share reflects increased TradFi adoption, the aggregate liquidity available to spot buyers remains largely unchanged.

Centralized exchanges, ETFs/Funds, and to a lesser extent, DeFi protocols, serve as custodians for bitcoin held on behalf of clients seeking spot market exposure. While centralized exchange balances have declined over the past two years, this has often been misinterpreted as a looming supply shock.

In reality, most of this bitcoin has migrated to ETFs and funds, particularly U.S. spot ETFs. The total bitcoin held by this spot trading sector has remained relatively stable, ranging between 3.9M-4.2M BTC since June 2021. This stable range suggests that the drop in exchange balances does not imply shrinking supply, but rather a structural reshuffling of custody.

Although the growing ETF share reflects increased TradFi adoption, the aggregate liquidity available to spot buyers remains largely unchanged.

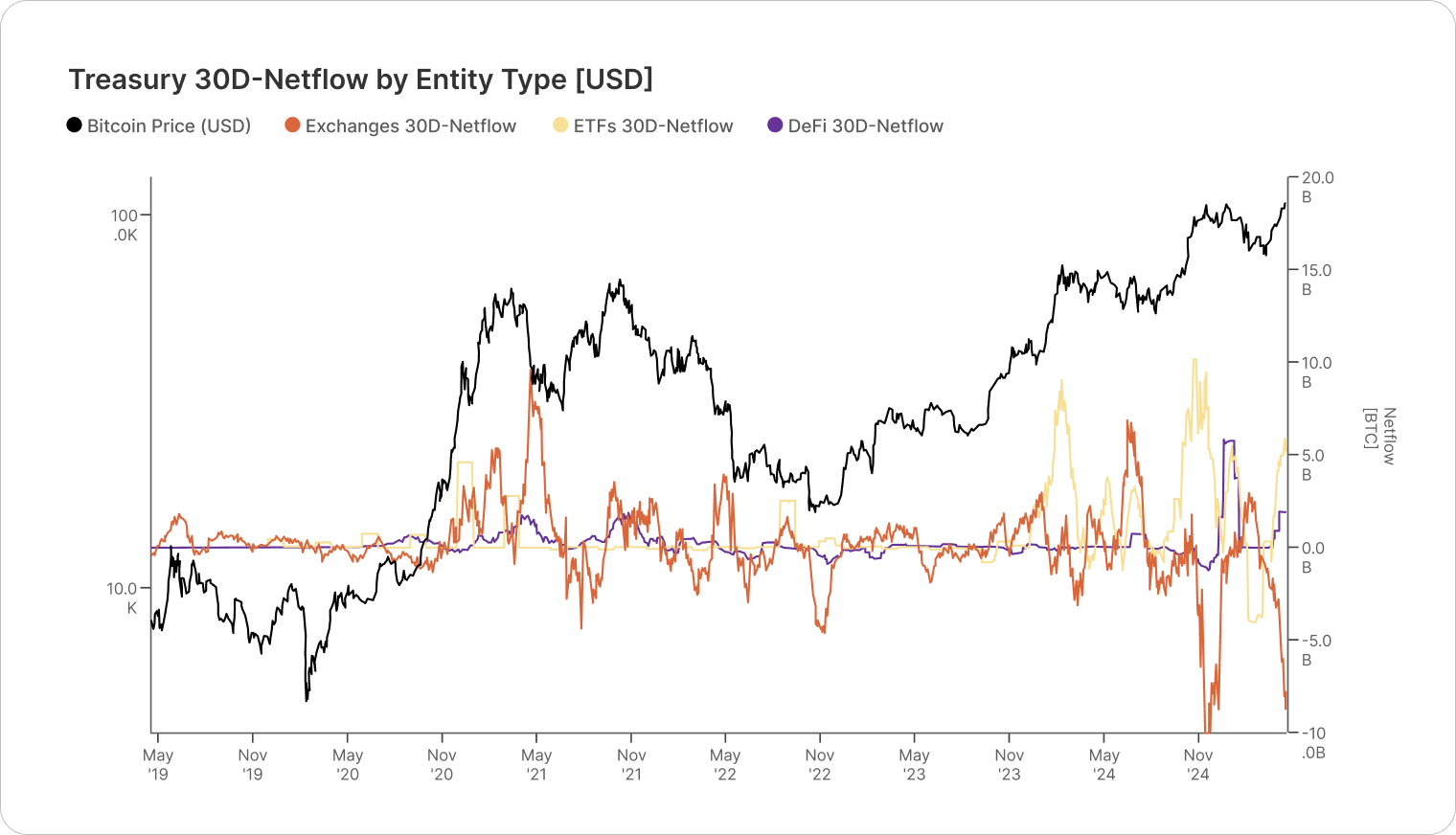

These custodians are highly responsive to market volatility. Net monthly flows can massively swing between ±$10B, underscoring their growing influence on price action despite relatively stable aggregate holdings.

These custodians are highly responsive to market volatility. Net monthly flows can massively swing between ±$10B, underscoring their growing influence on price action despite relatively stable aggregate holdings.

Centralized Entities

Sovereign Treasuries

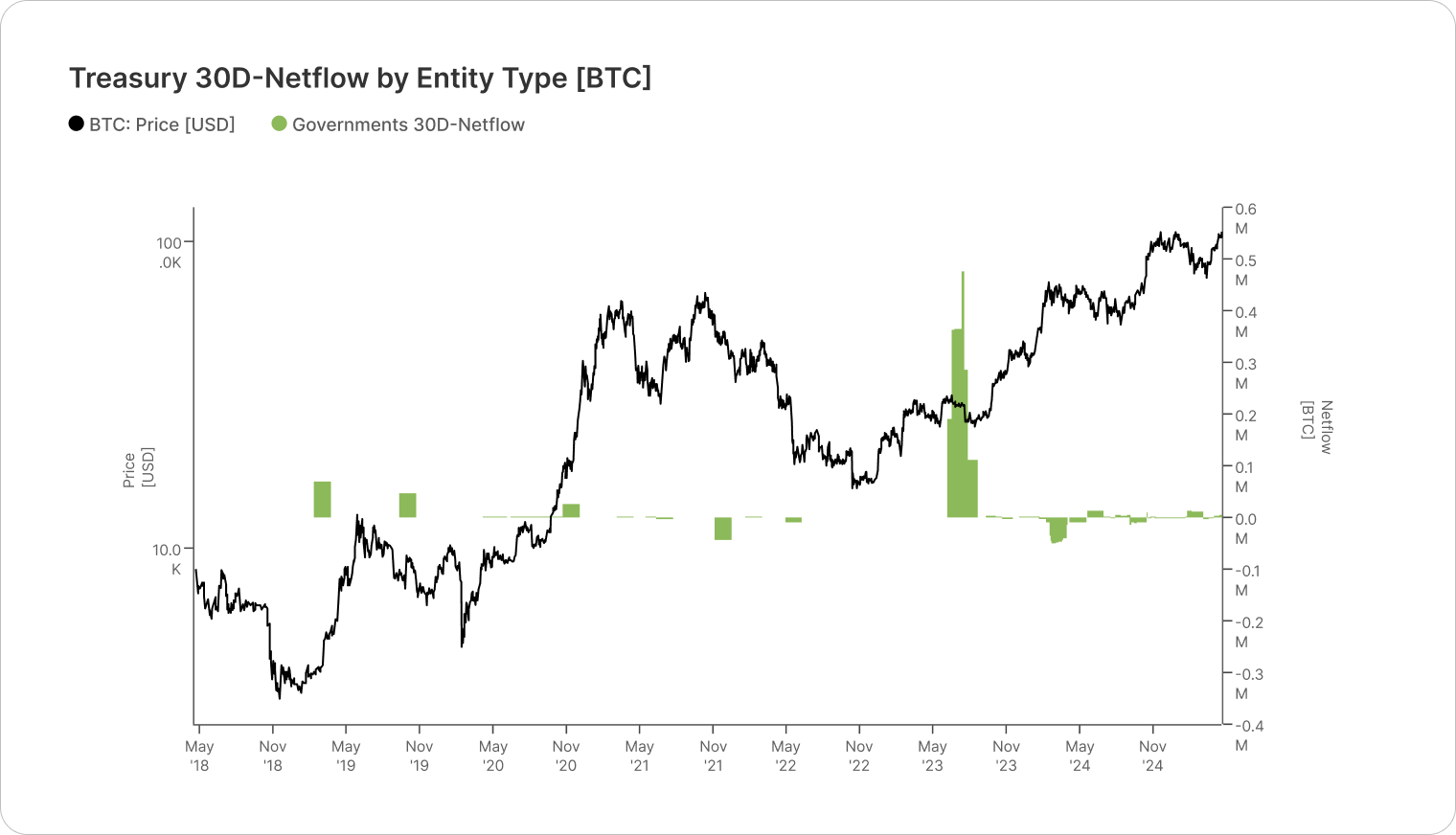

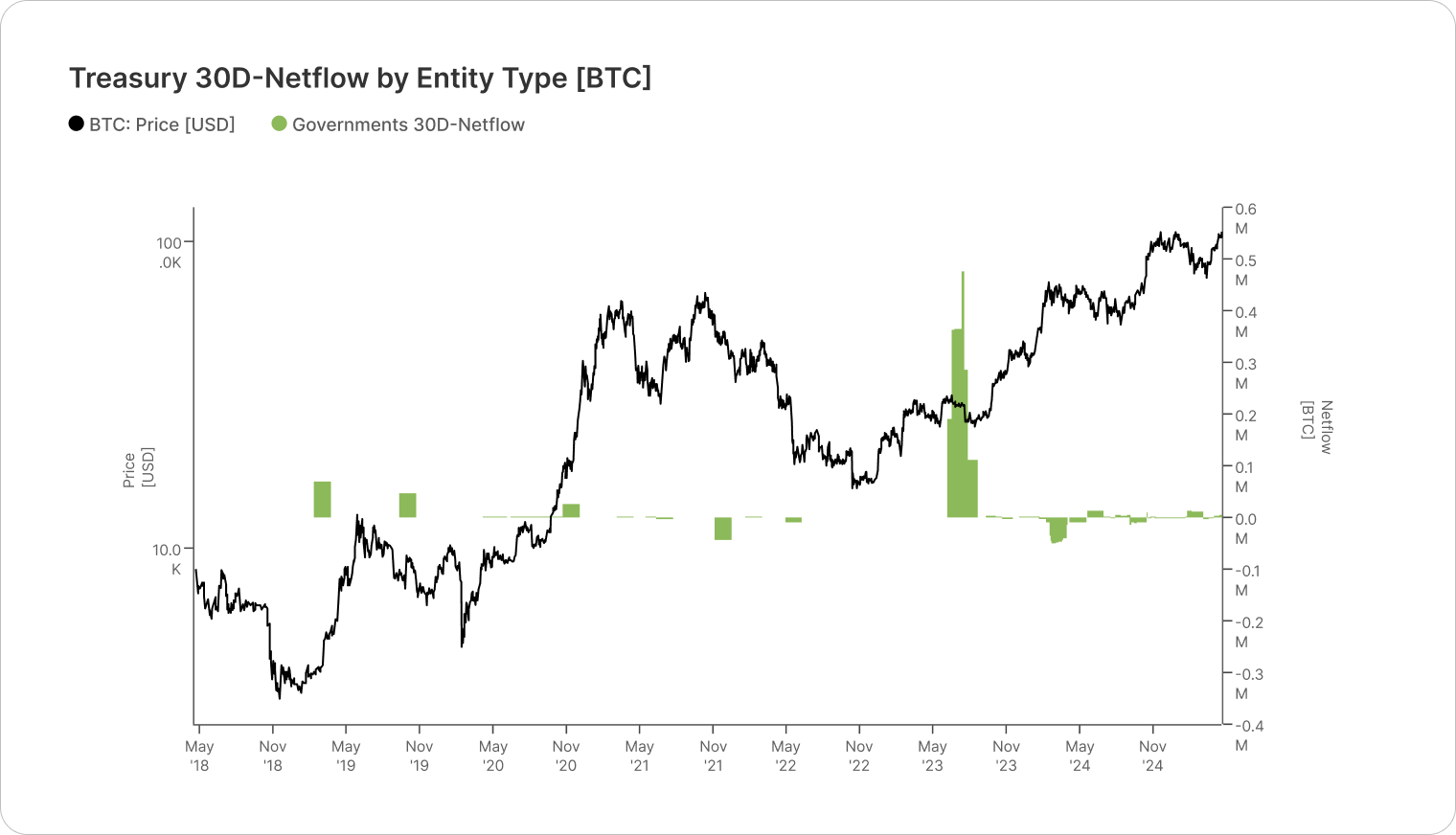

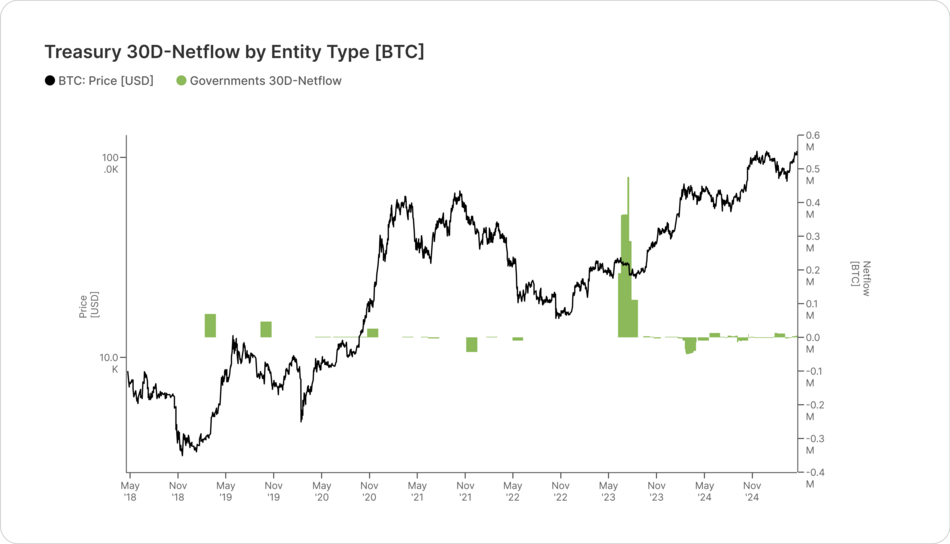

Sovereign treasuries influence markets through passive holdings, legal seizures, and strategic policy signals.

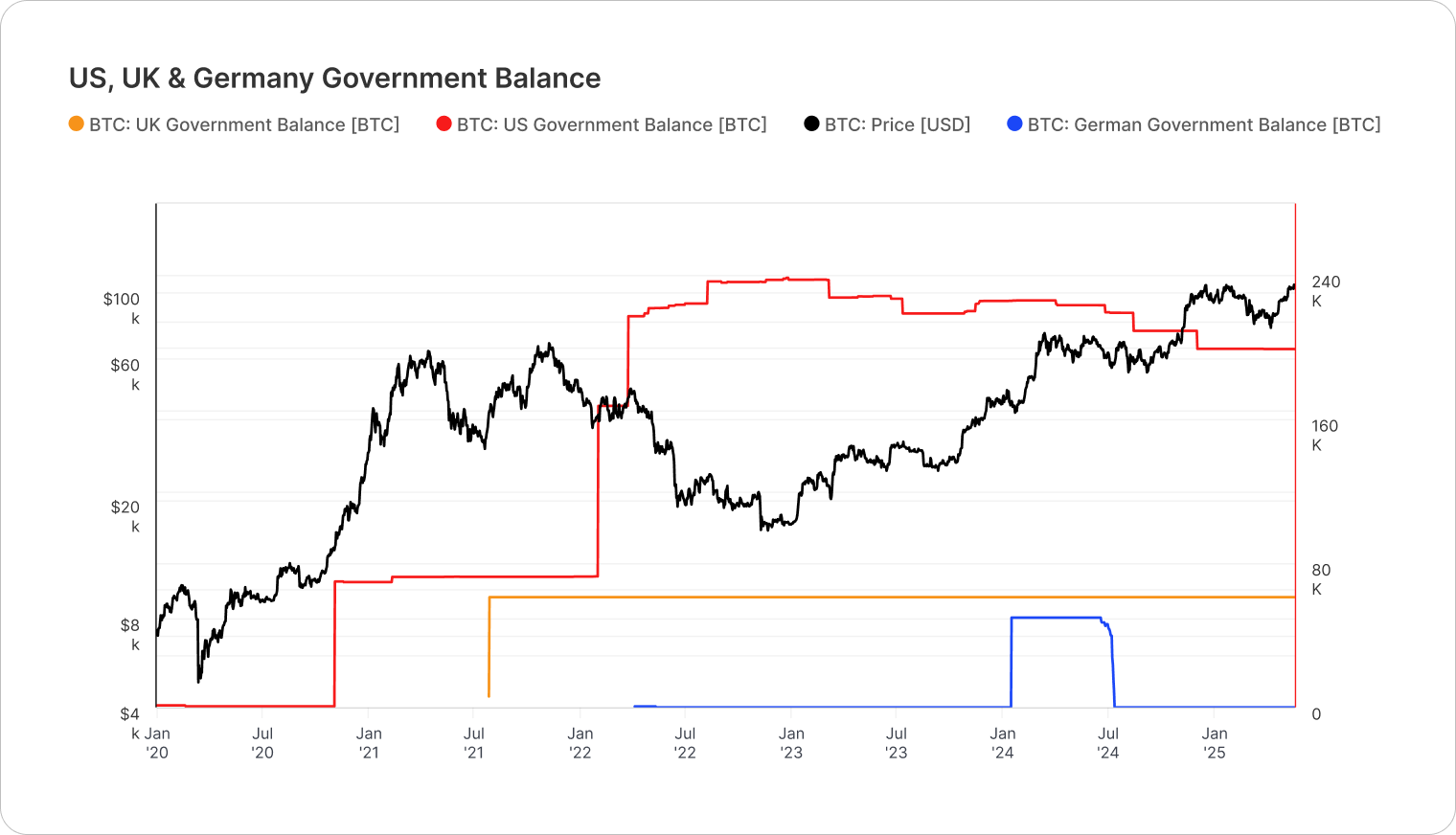

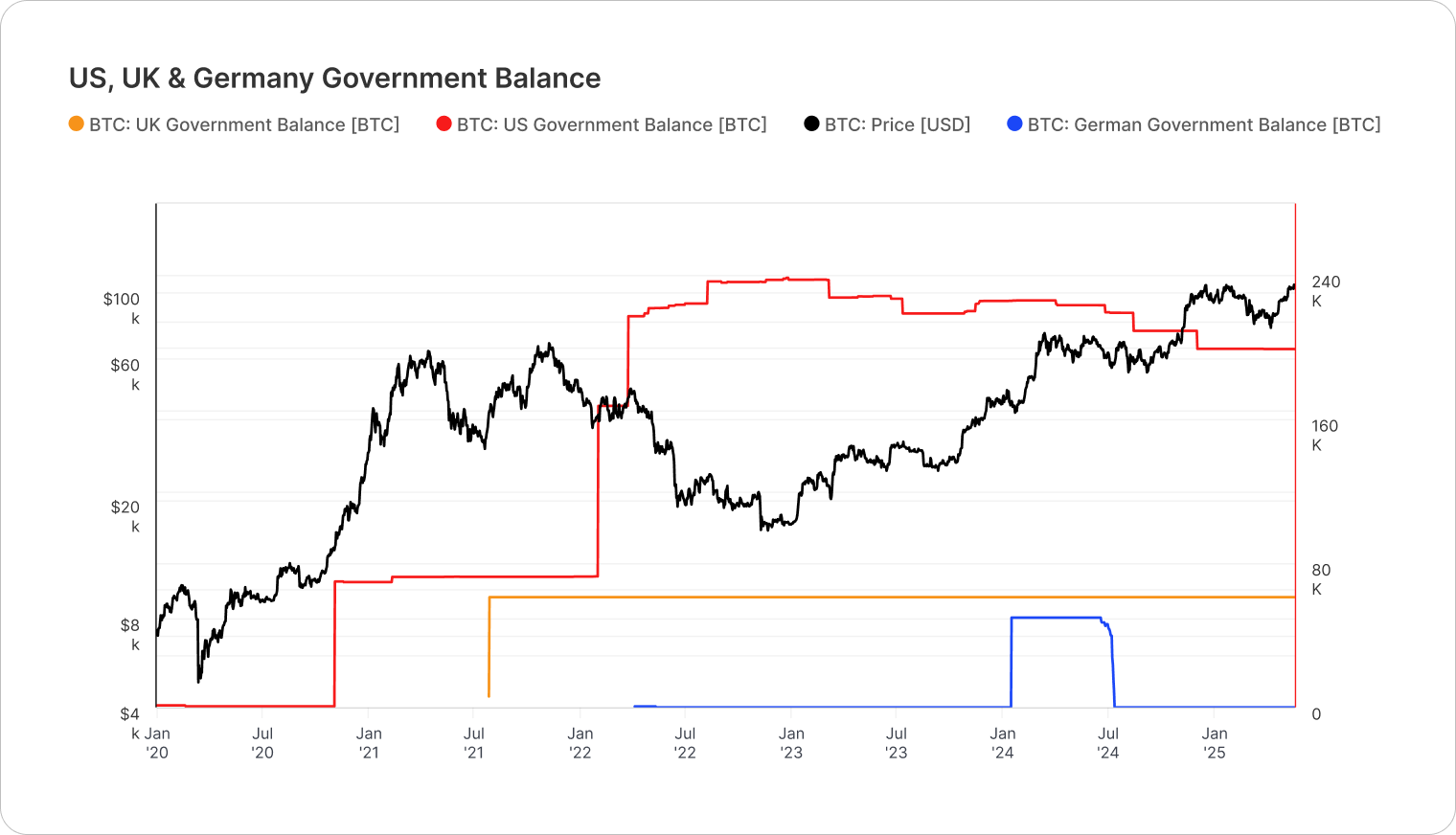

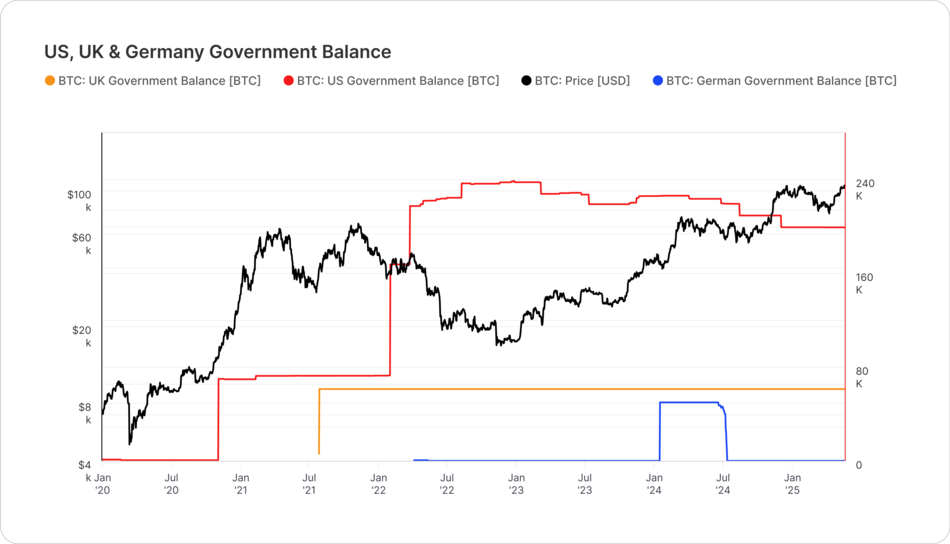

Unlike active market participants, sovereign treasuries rarely rebalance. Their wallets show infrequent movement and little correlation with bitcoin’s price cycles, yet they hold enough to impact markets when coins are moved or sold.

This pattern is particularly evident in Government Treasuries of the U.S., China, Germany and the United Kingdom, where most coins are acquired through legal enforcement actions rather than market participation.

The U.S. holds over ~200k BTC, making it one of the largest sovereign holders. Key seizures include:

- 69,369 BTC from the Silk Road case, seized in November 2020.

- 94,643 BTC from the Bitfinex hack, seized in February 2022.

Unlike active market participants, sovereign treasuries rarely rebalance. Their wallets show infrequent movement and little correlation with bitcoin’s price cycles, yet they hold enough to impact markets when coins are moved or sold.

This pattern is particularly evident in Government Treasuries of the U.S., China, Germany and the United Kingdom, where most coins are acquired through legal enforcement actions rather than market participation.

The U.S. holds over ~200k BTC, making it one of the largest sovereign holders. Key seizures include:

- 69,369 BTC from the Silk Road case, seized in November 2020.

- 94,643 BTC from the Bitfinex hack, seized in February 2022.

After a relatively modest decline in U.S. government-held bitcoin, a significant portion of the remaining balance was designated as the foundation of the Strategic Bitcoin Reserve (SBR) through an executive order issued by President Trump on March 6, 2025.

The United Kingdom has also accumulated bitcoin through its National Crime Agency, targeting cybercrime and illicit activity.

After banning crypto trading and mining, China confiscated over 194,000 BTC in November 2020 from the PlusToken Ponzi scheme — one of the largest law enforcement crypto crackdowns in history.

Germany had actively seized coins in recent years through state-led investigations but officially liquidated all Bitcoin holdings by April 29, 2025.

These holdings represent a structurally distinct class—dormant, but capable of moving markets when activated.

After a relatively modest decline in U.S. government-held bitcoin, a significant portion of the remaining balance was designated as the foundation of the Strategic Bitcoin Reserve (SBR) through an executive order issued by President Trump on March 6, 2025.

The United Kingdom has also accumulated bitcoin through its National Crime Agency, targeting cybercrime and illicit activity.

After banning crypto trading and mining, China confiscated over 194,000 BTC in November 2020 from the PlusToken Ponzi scheme — one of the largest law enforcement crypto crackdowns in history.

Germany had actively seized coins in recent years through state-led investigations but officially liquidated all Bitcoin holdings by April 29, 2025.

These holdings represent a structurally distinct class—dormant, but capable of moving markets when activated.

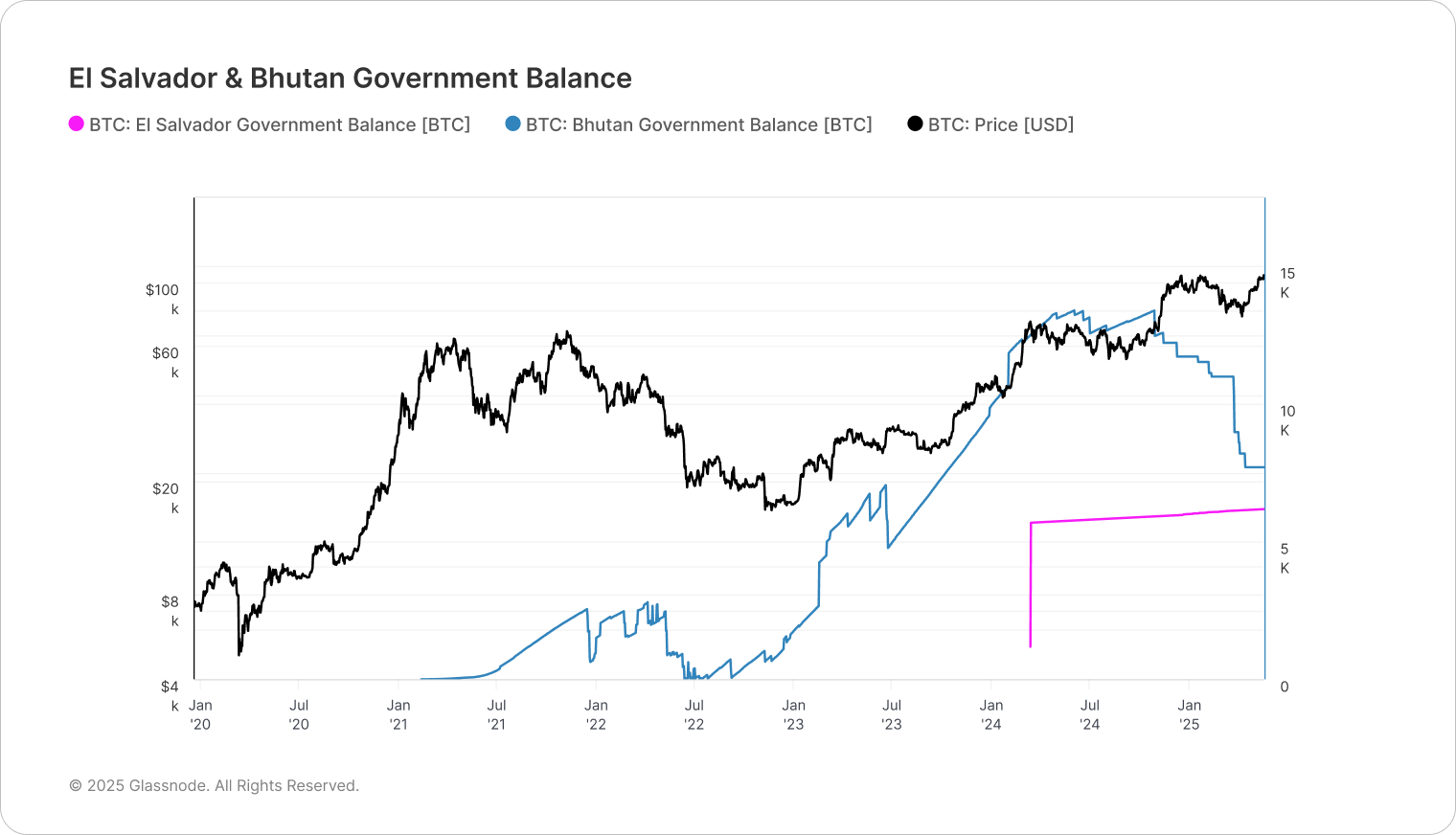

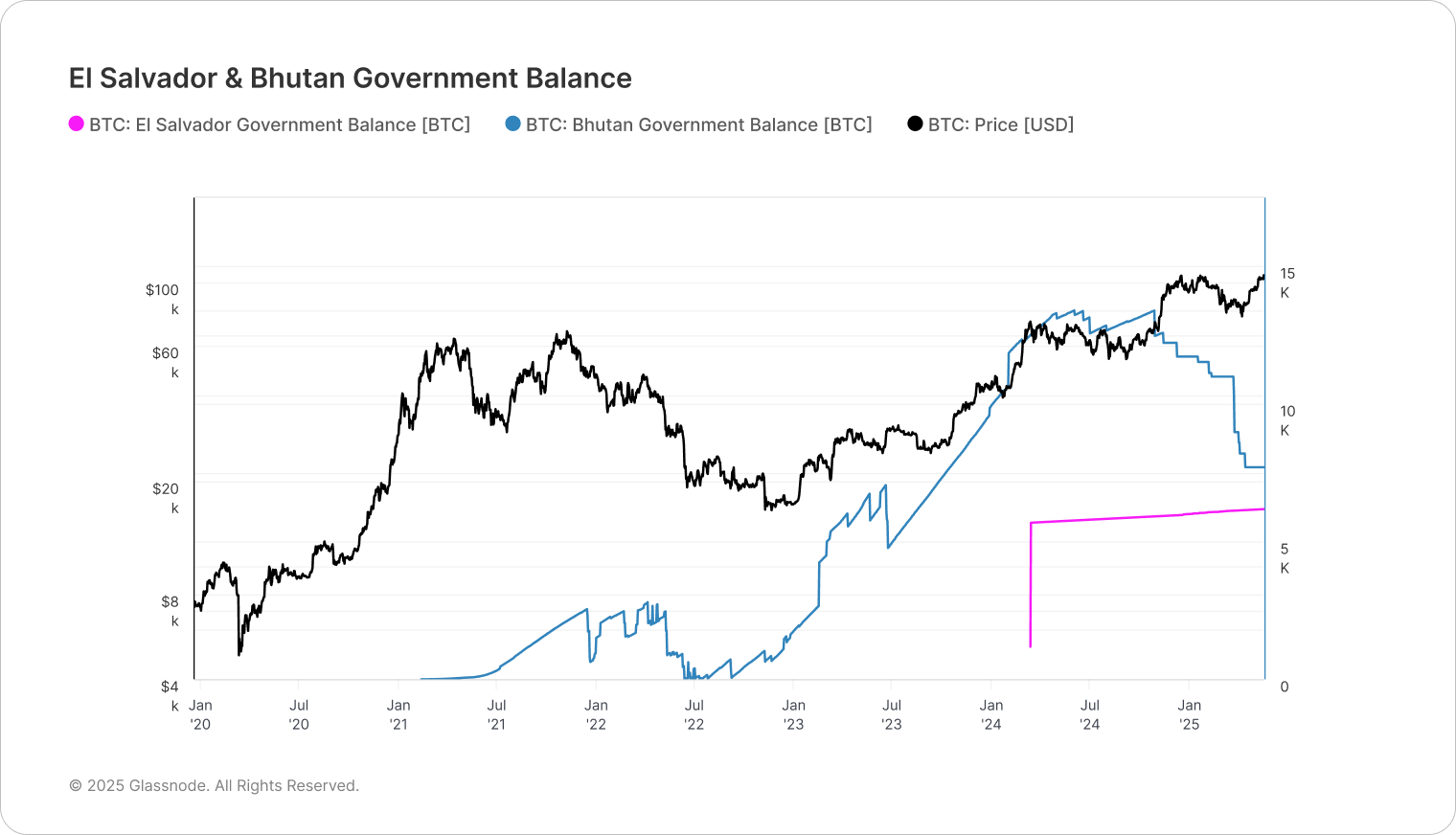

In contrast, El Salvador and Bhutan accumulate bitcoin via intentional, ongoing purchases—often through dollar-cost averaging. While smaller in size, these strategic allocations signal long-term commitment and reinforce investor confidence. Their actions provide legitimacy to bitcoin as a sovereign-grade asset, encouraging broader institutional participation and market stability.

In contrast, El Salvador and Bhutan accumulate bitcoin via intentional, ongoing purchases—often through dollar-cost averaging. While smaller in size, these strategic allocations signal long-term commitment and reinforce investor confidence. Their actions provide legitimacy to bitcoin as a sovereign-grade asset, encouraging broader institutional participation and market stability.

Centralized Entities

Maturation &

Growth Patterns

Maturation &

Growth Patterns

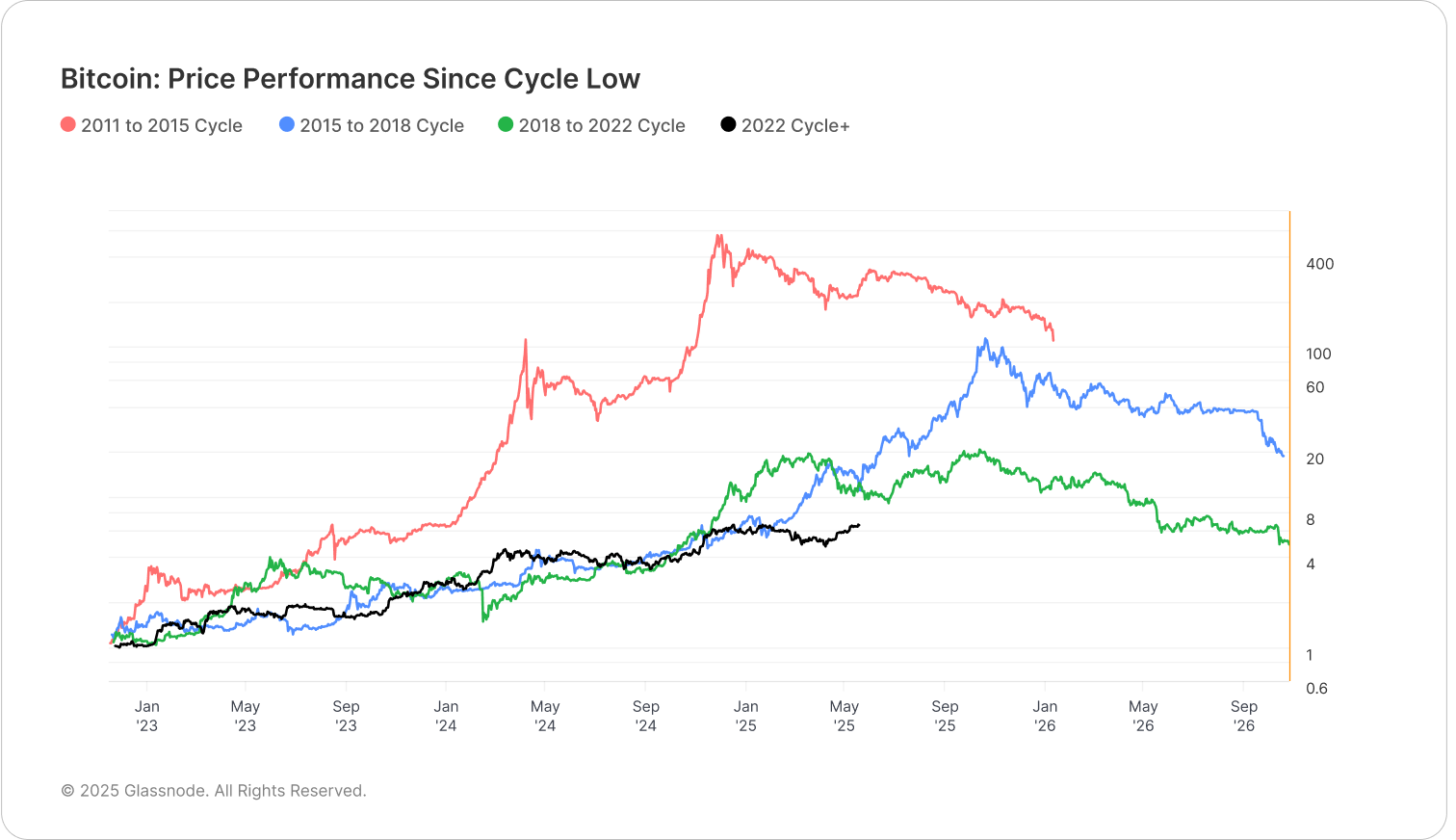

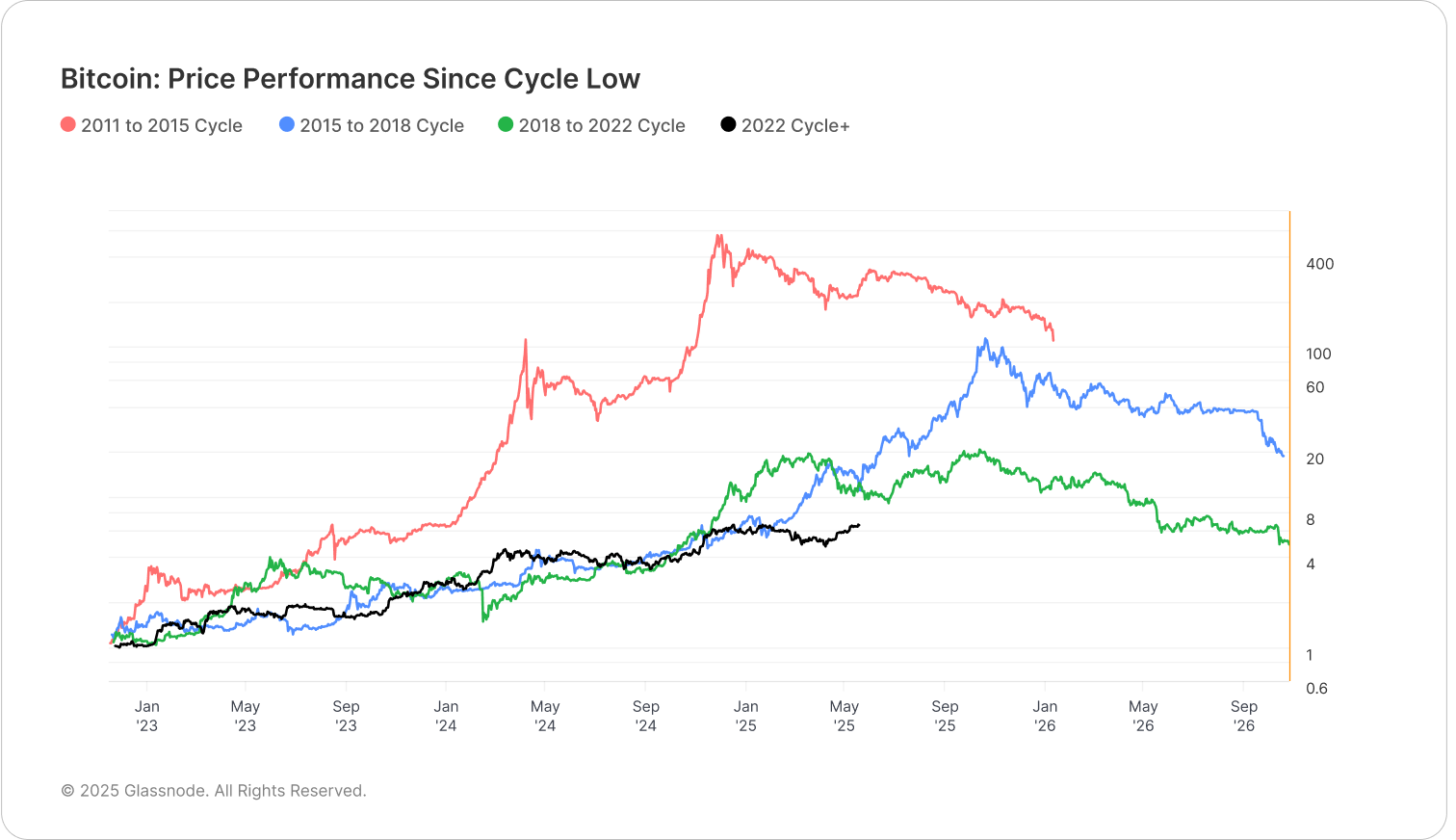

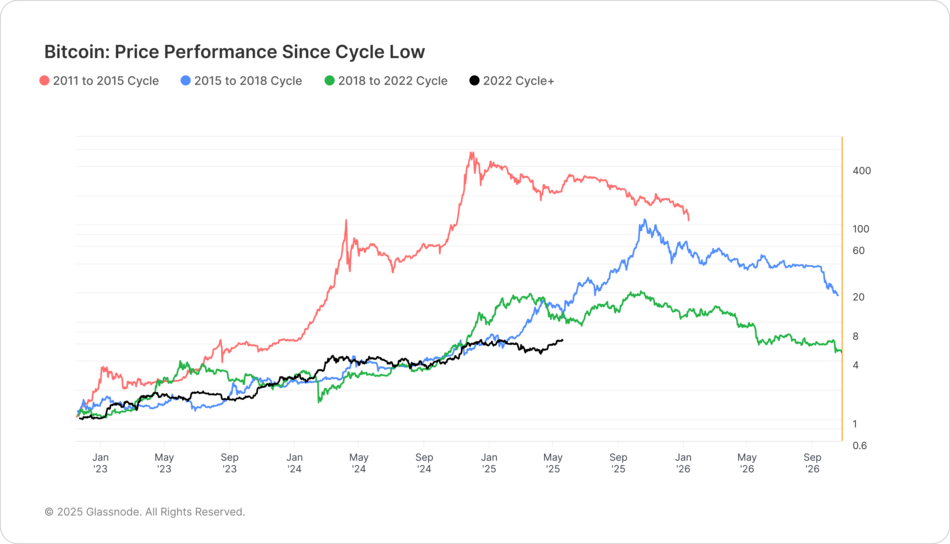

As bitcoin adoption expands across institutions, market behavior is becoming more stable, offering greater predictability and confidence for long-term investors.

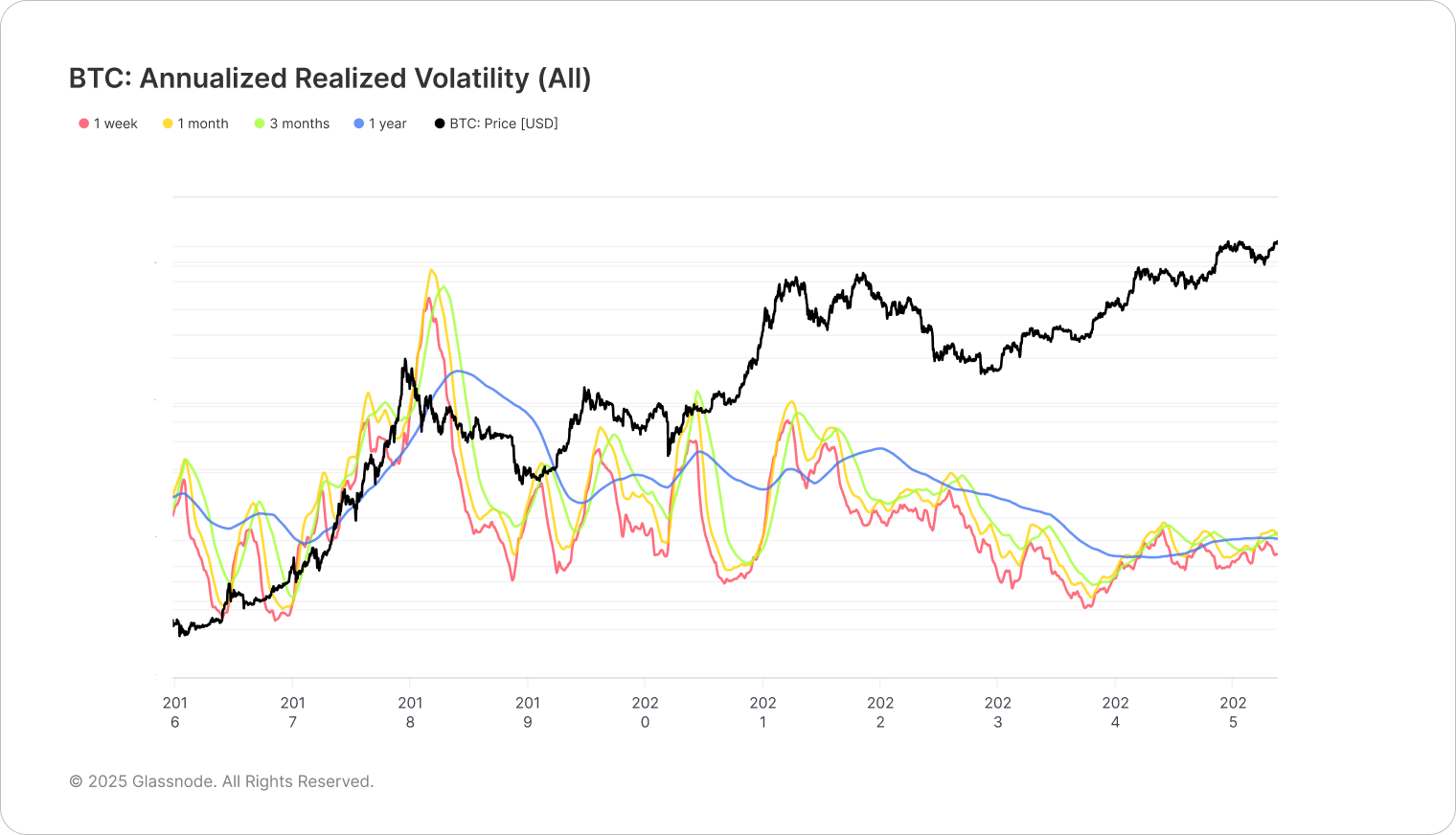

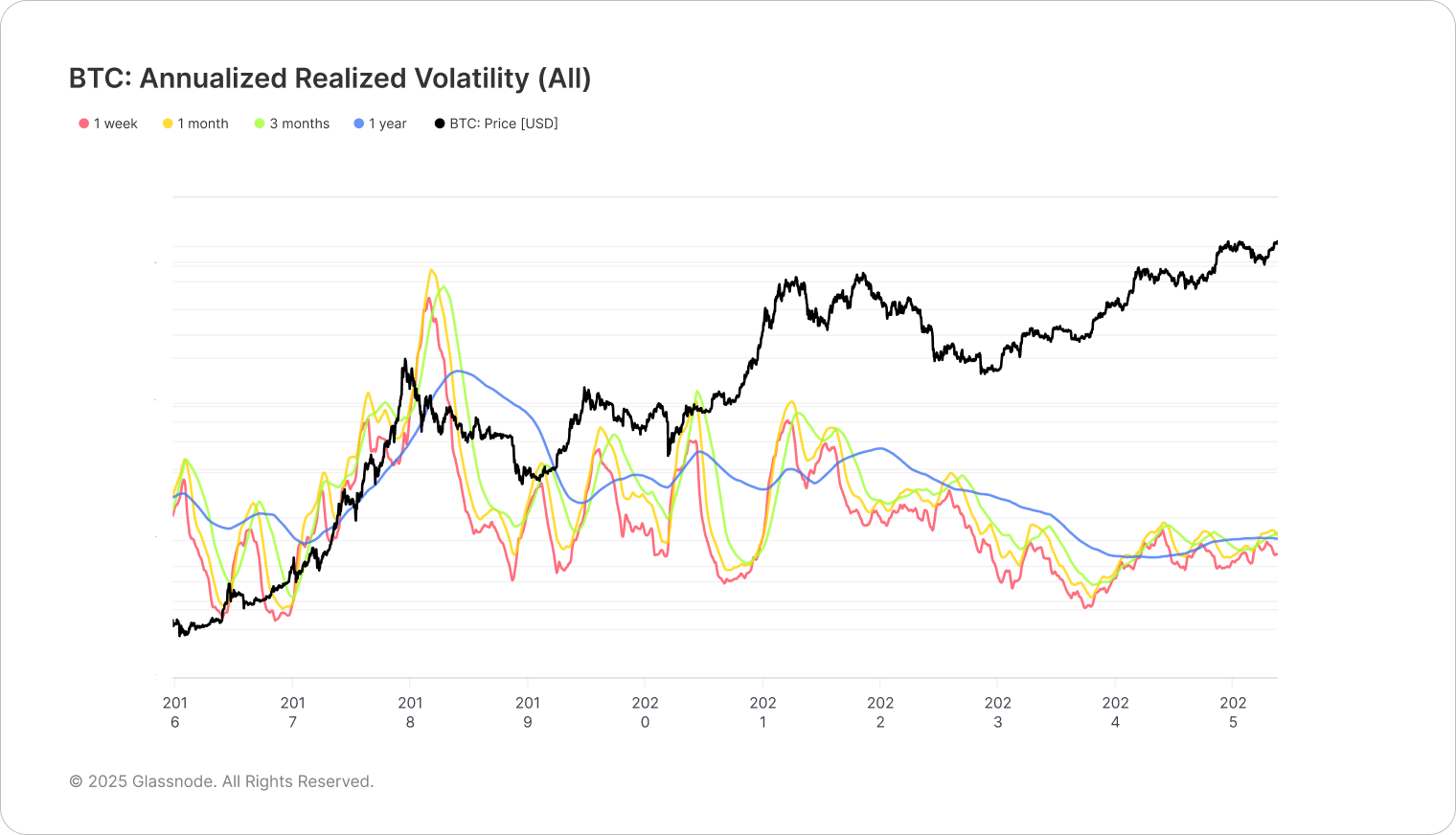

With 30.9% of bitcoin’s circulating supply now held in centralized treasuries—including governments, ETFs, public companies, and centralized exchanges—the market has undergone a structural transformation toward institutional maturity. As adoption has broadened, particularly across sovereign and regulated financial entities, annualized realized volatility across all time frames—from 1-week to 1-year—has declined consistently since 2018.

The launch of U.S. spot ETFs in early 2024 reinforced this trend, introducing steady capital inflows and improving liquidity depth. Although bitcoin remains a risk-on asset, its integration into traditional finance has made price action more reliable and less driven by speculative extremes.

With 30.9% of bitcoin’s circulating supply now held in centralized treasuries—including governments, ETFs, public companies, and centralized exchanges—the market has undergone a structural transformation toward institutional maturity. As adoption has broadened, particularly across sovereign and regulated financial entities, annualized realized volatility across all time frames—from 1-week to 1-year—has declined consistently since 2018.

The launch of U.S. spot ETFs in early 2024 reinforced this trend, introducing steady capital inflows and improving liquidity depth. Although bitcoin remains a risk-on asset, its integration into traditional finance has made price action more reliable and less driven by speculative extremes.

This structural evolution has not eliminated upside, but it has reshaped its profile. Rather than explosive spikes, recent cycles have produced more sustained and orderly rallies. This consistency strengthens institutional confidence and positions bitcoin as a long-term macro asset, suitable for strategic allocation alongside traditional stores of value.

This structural evolution has not eliminated upside, but it has reshaped its profile. Rather than explosive spikes, recent cycles have produced more sustained and orderly rallies. This consistency strengthens institutional confidence and positions bitcoin as a long-term macro asset, suitable for strategic allocation alongside traditional stores of value.

Centralized Entities

The Institutional Shift to Offchain Markets

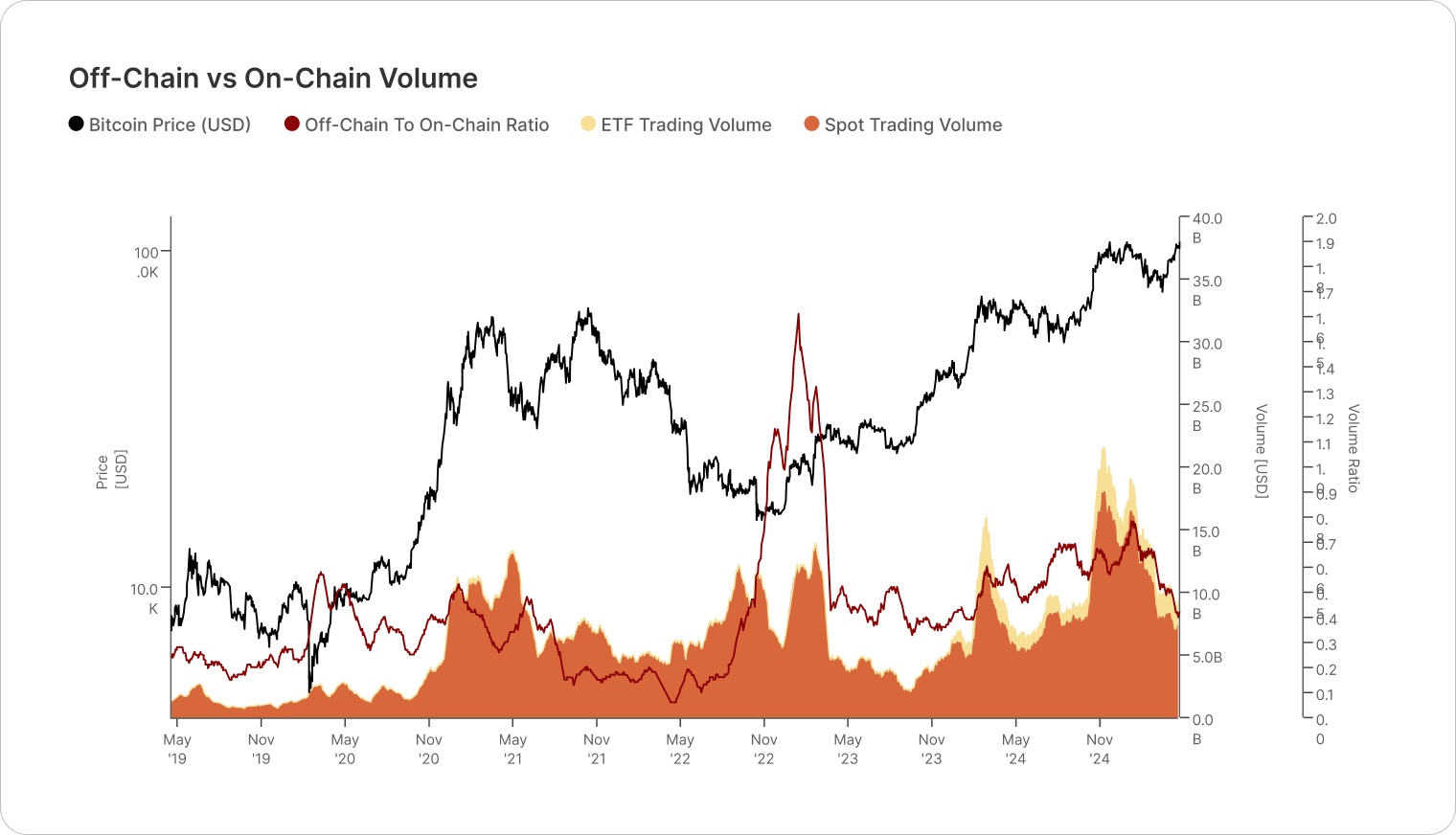

The majority of bitcoin trading volume now flows through centralized exchanges, ETFs, and derivatives platforms—highlighting a structural shift driven by institutional adoption.

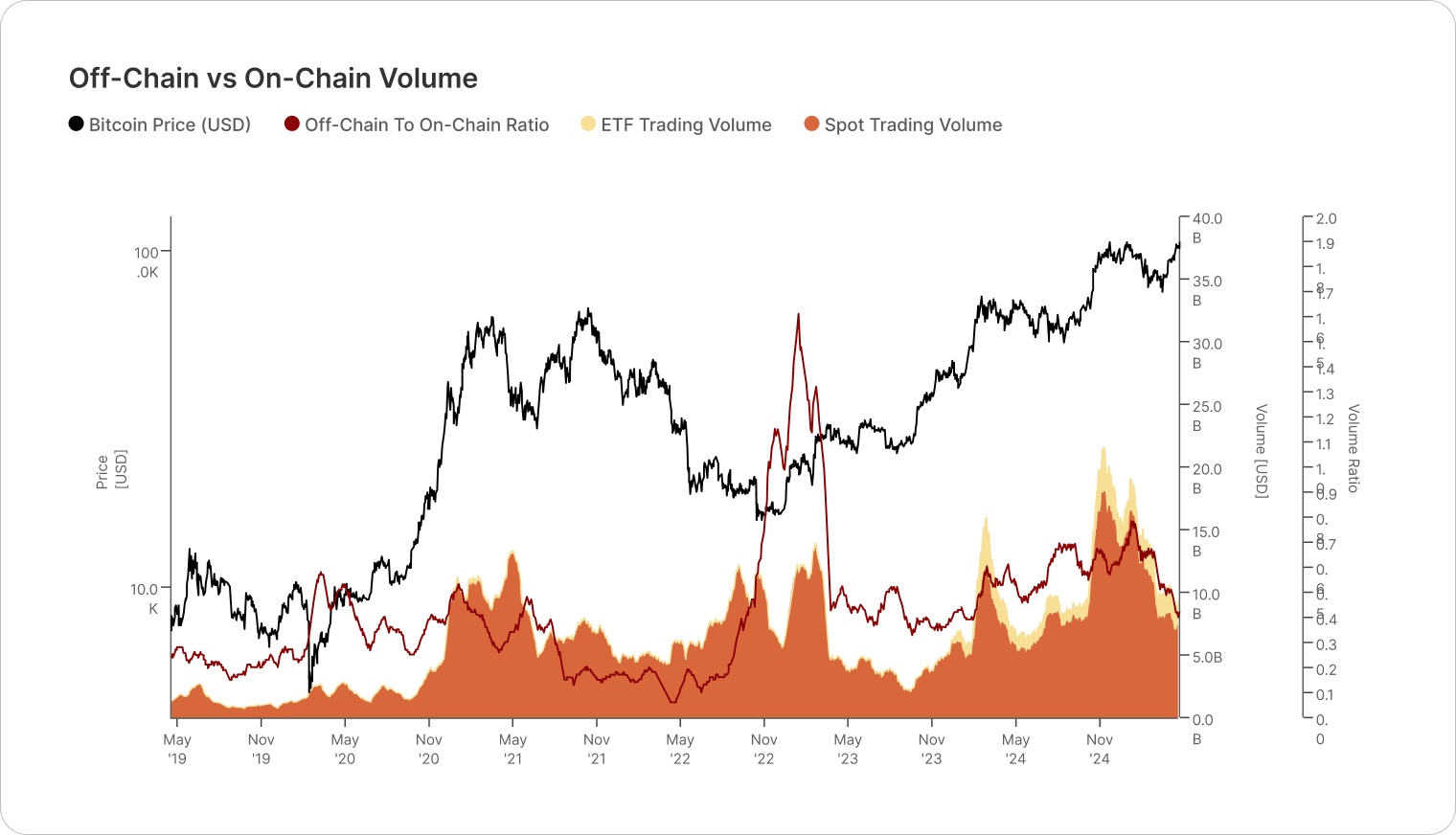

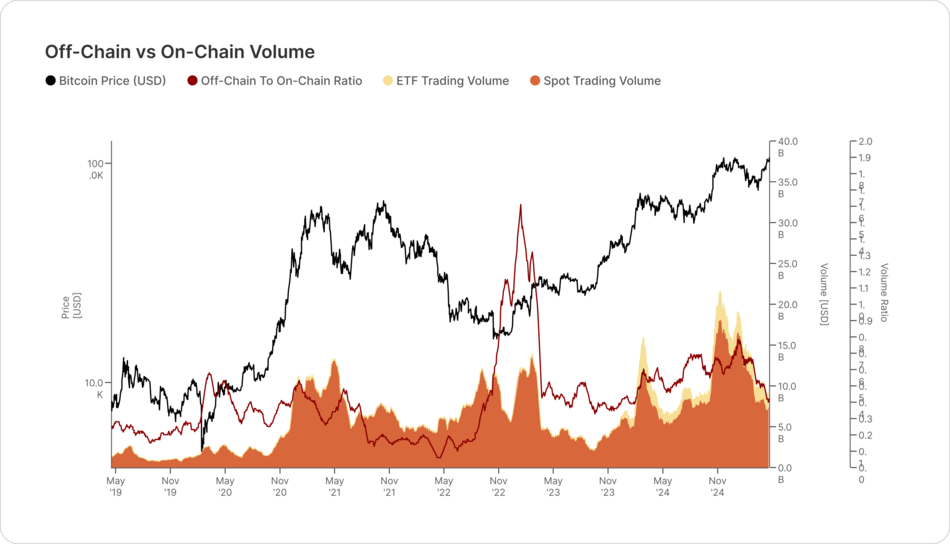

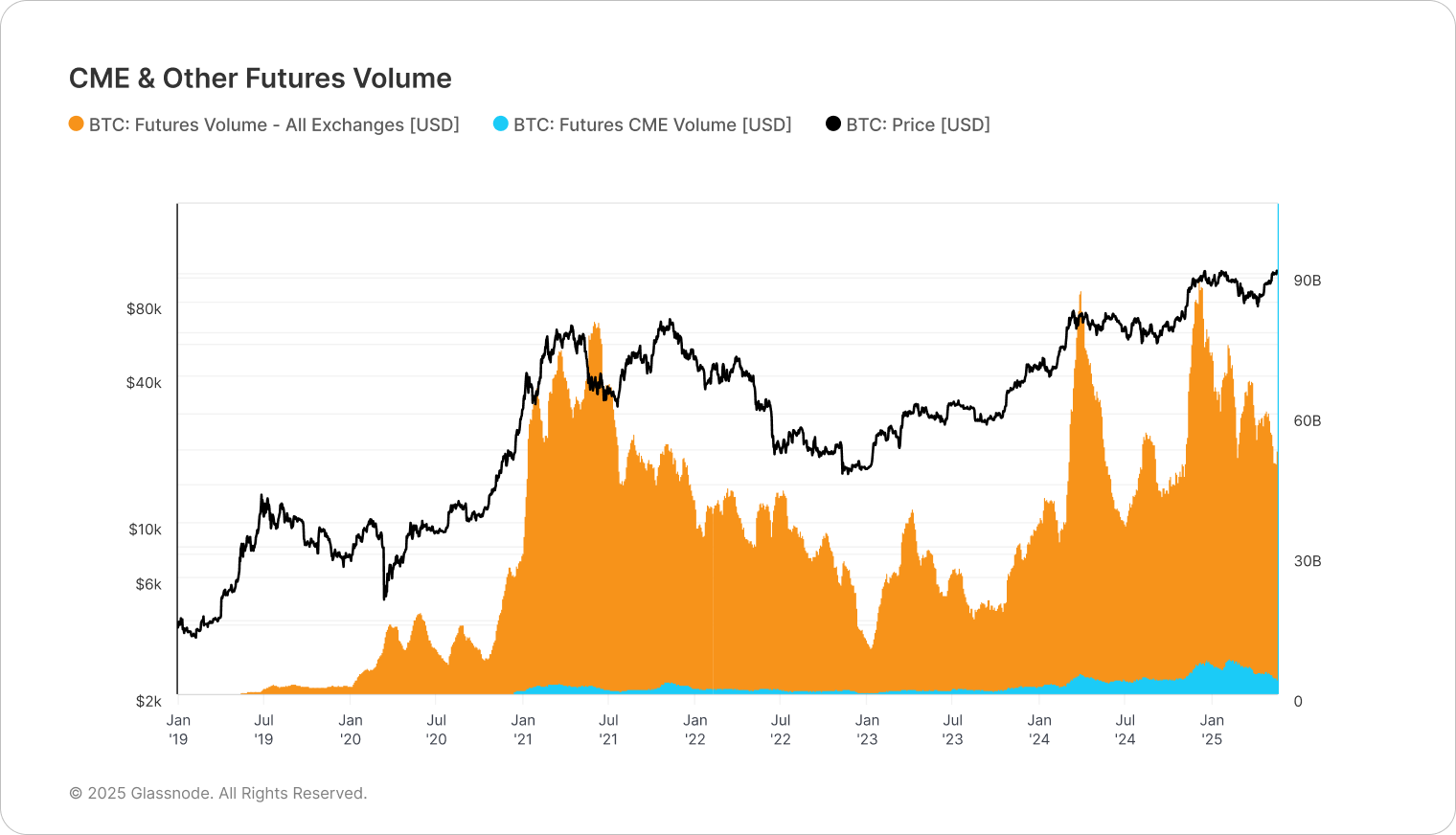

As institutional players have entered the space, bitcoin market activity has increasingly migrated from onchain settlement to offchain infrastructure. Centralized exchanges, U.S. spot ETFs, and regulated derivatives platforms now account for the majority of trading volume, serving as the primary venues for both liquidity provision and risk management.

As institutional players have entered the space, bitcoin market activity has increasingly migrated from onchain settlement to offchain infrastructure. Centralized exchanges, U.S. spot ETFs, and regulated derivatives platforms now account for the majority of trading volume, serving as the primary venues for both liquidity provision and risk management.

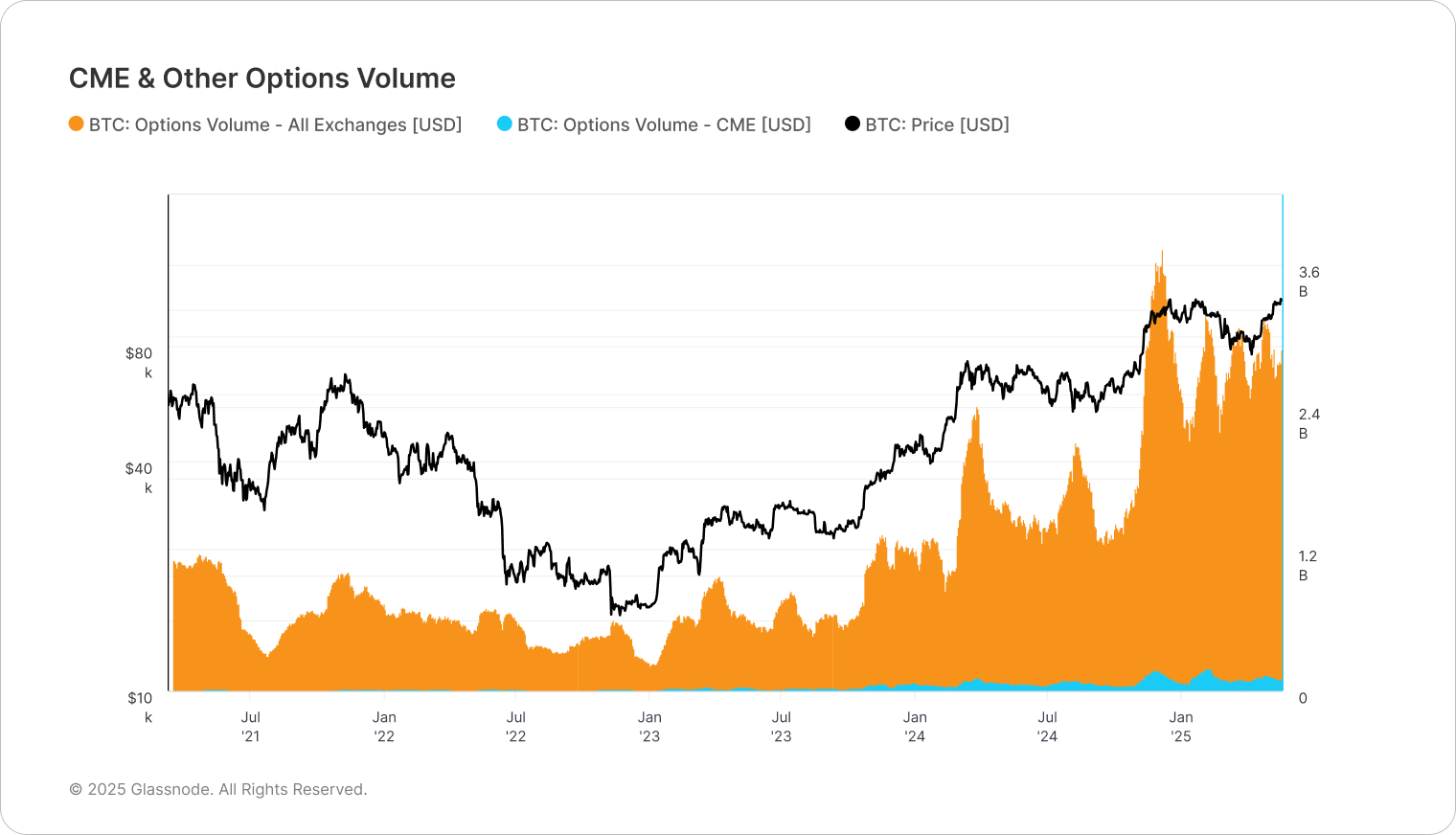

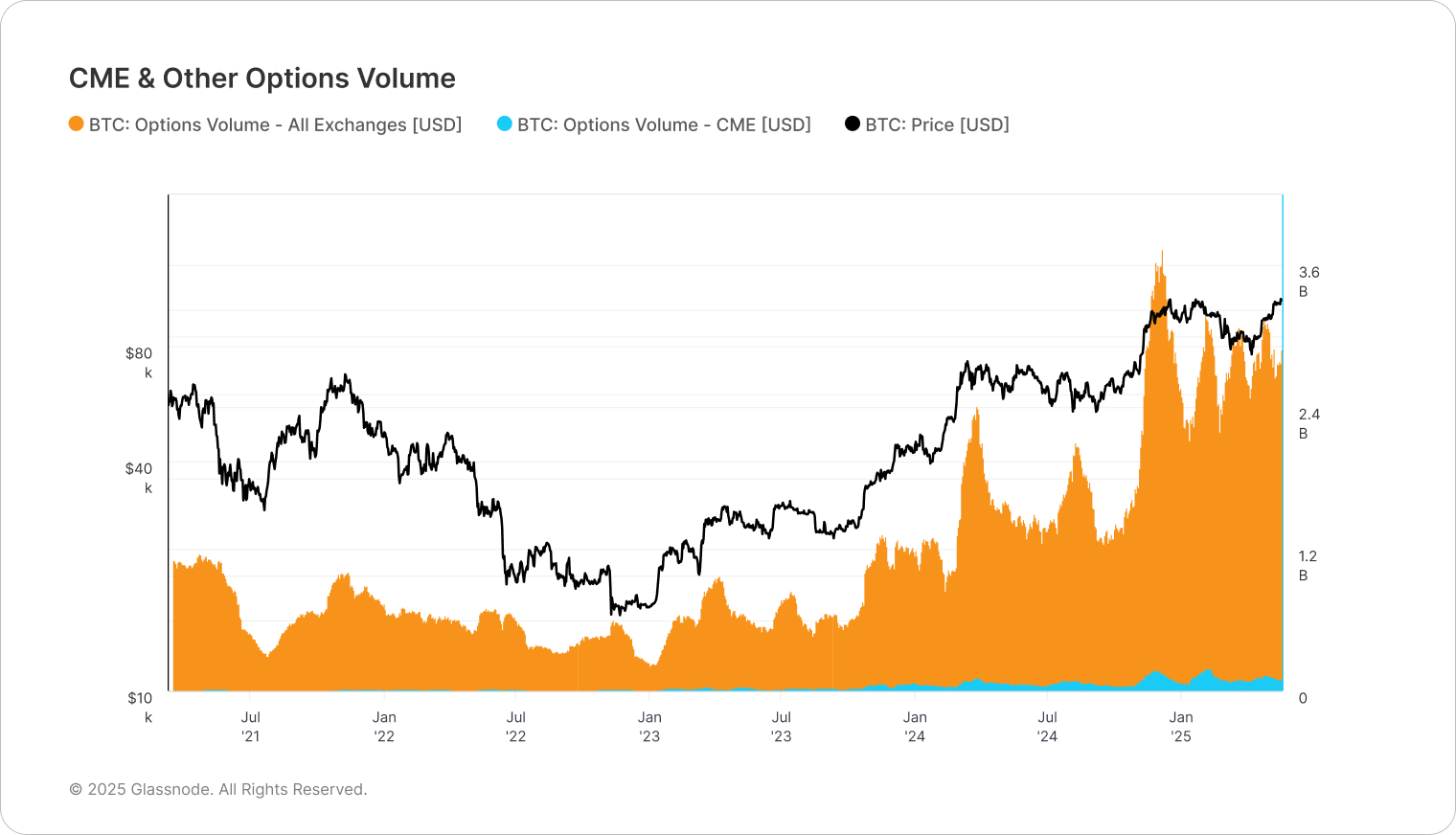

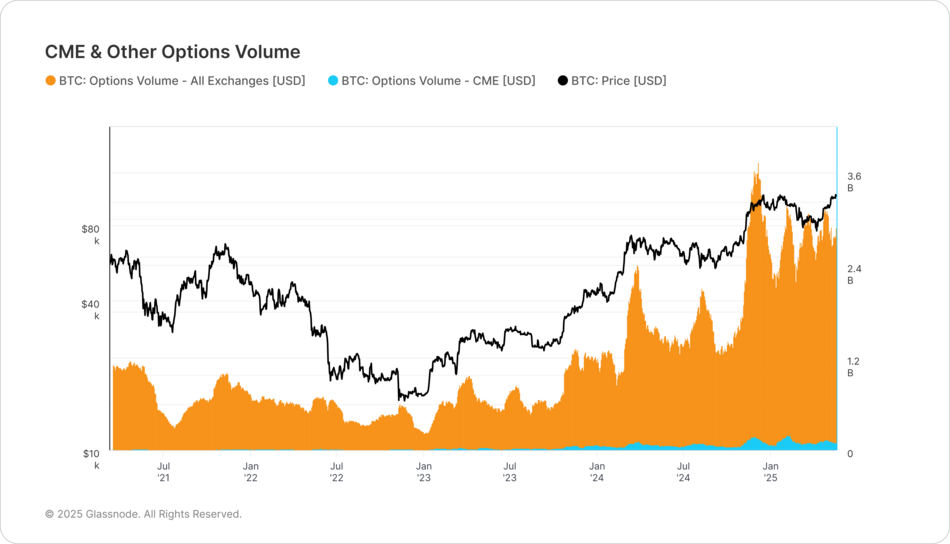

Since 2017, the share of bitcoin-related activity occurring offchain has steadily grown. As of 2025, centralized exchanges and ETFs facilitate over 75% of adjusted transfer volumes, while derivatives markets—especially CME options and futures—have expanded more than tenfold since 2023 as measured by open interest and volume. This surge reflects institutional demand for scalable, regulated instruments to express directional views and hedge exposure.

While these platforms do not fully determine bitcoin’s price, they have changed how the market functions. Liquidity is now deeper, trade execution is more standardized, and investor behavior increasingly resembles that of traditional financial markets.

Since 2017, the share of bitcoin-related activity occurring offchain has steadily grown. As of 2025, centralized exchanges and ETFs facilitate over 75% of adjusted transfer volumes, while derivatives markets—especially CME options and futures—have expanded more than tenfold since 2023 as measured by open interest and volume. This surge reflects institutional demand for scalable, regulated instruments to express directional views and hedge exposure.

While these platforms do not fully determine bitcoin’s price, they have changed how the market functions. Liquidity is now deeper, trade execution is more standardized, and investor behavior increasingly resembles that of traditional financial markets.

This evolution marks a key phase in bitcoin’s maturation. Institutional capital has introduced new dynamics, and understanding both offchain flows and onchain fundamentals is essential to navigating the modern bitcoin market.

This evolution marks a key phase in bitcoin’s maturation. Institutional capital has introduced new dynamics, and understanding both offchain flows and onchain fundamentals is essential to navigating the modern bitcoin market.

Impact Estimation

Public & Private Companies

The launch of the Strategic Bitcoin Reserve (SBR) has reshaped perception, transforming seized assets into sovereign reserves and catalyzing renewed institutional confidence in Bitcoin.

On March 6, 2025, President Donald J. Trump signed Executive Order 14096, titled “Establishment of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile”. This order repurposed over ~200k BTC, previously seized through criminal and civil asset forfeiture proceedings, into a federally managed reserve. The executive order explicitly states:

“The United States will not sell bitcoin deposited into this Strategic Bitcoin Reserve, which will be maintained as a store of reserve assets.”

While the reserve currently comprises only

confiscated assets, the order authorizes the Treasury and Commerce Departments to develop budget-neutral strategies for acquiring additional bitcoin, provided these strategies impose no incremental costs on American taxpayers.

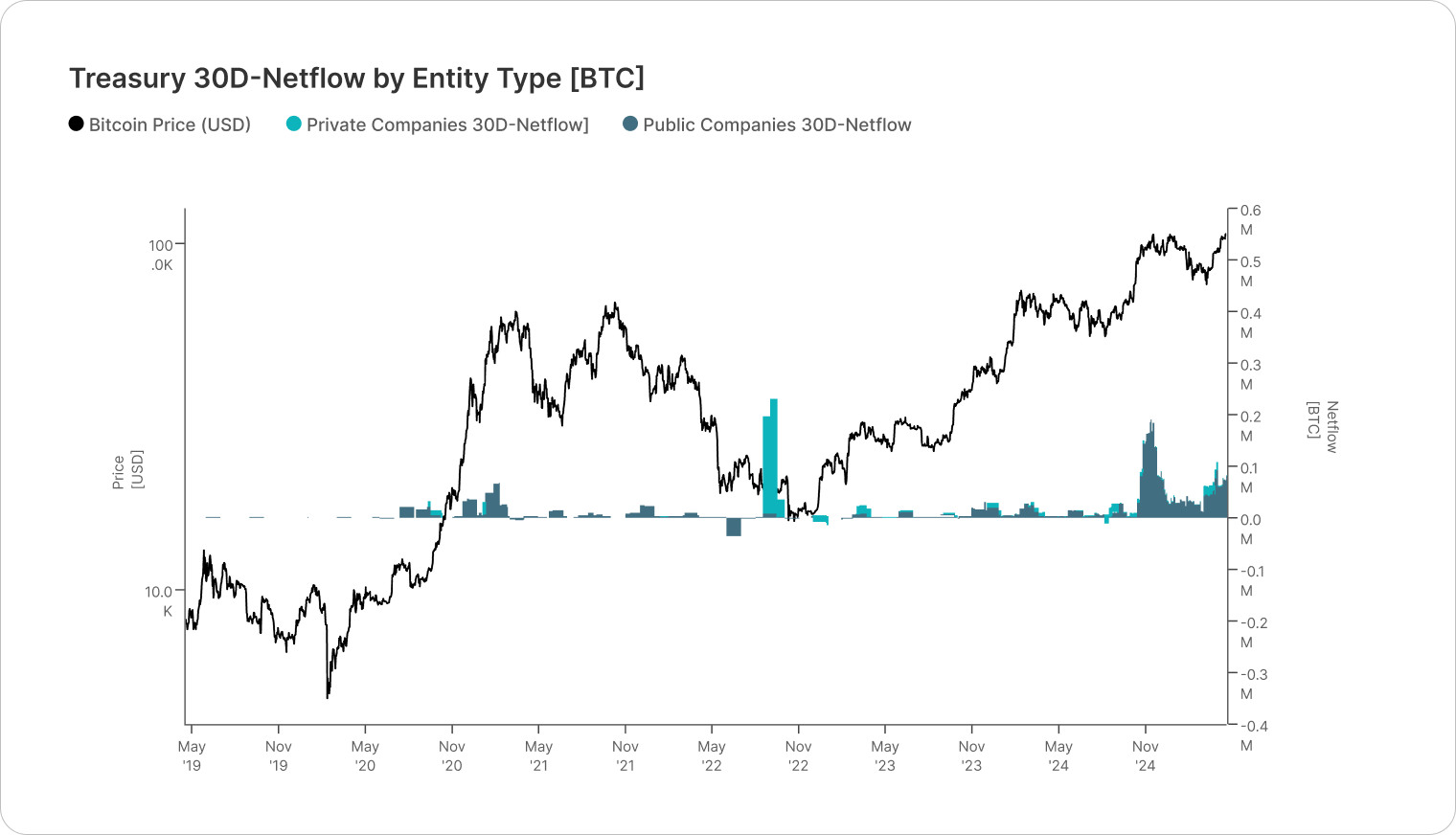

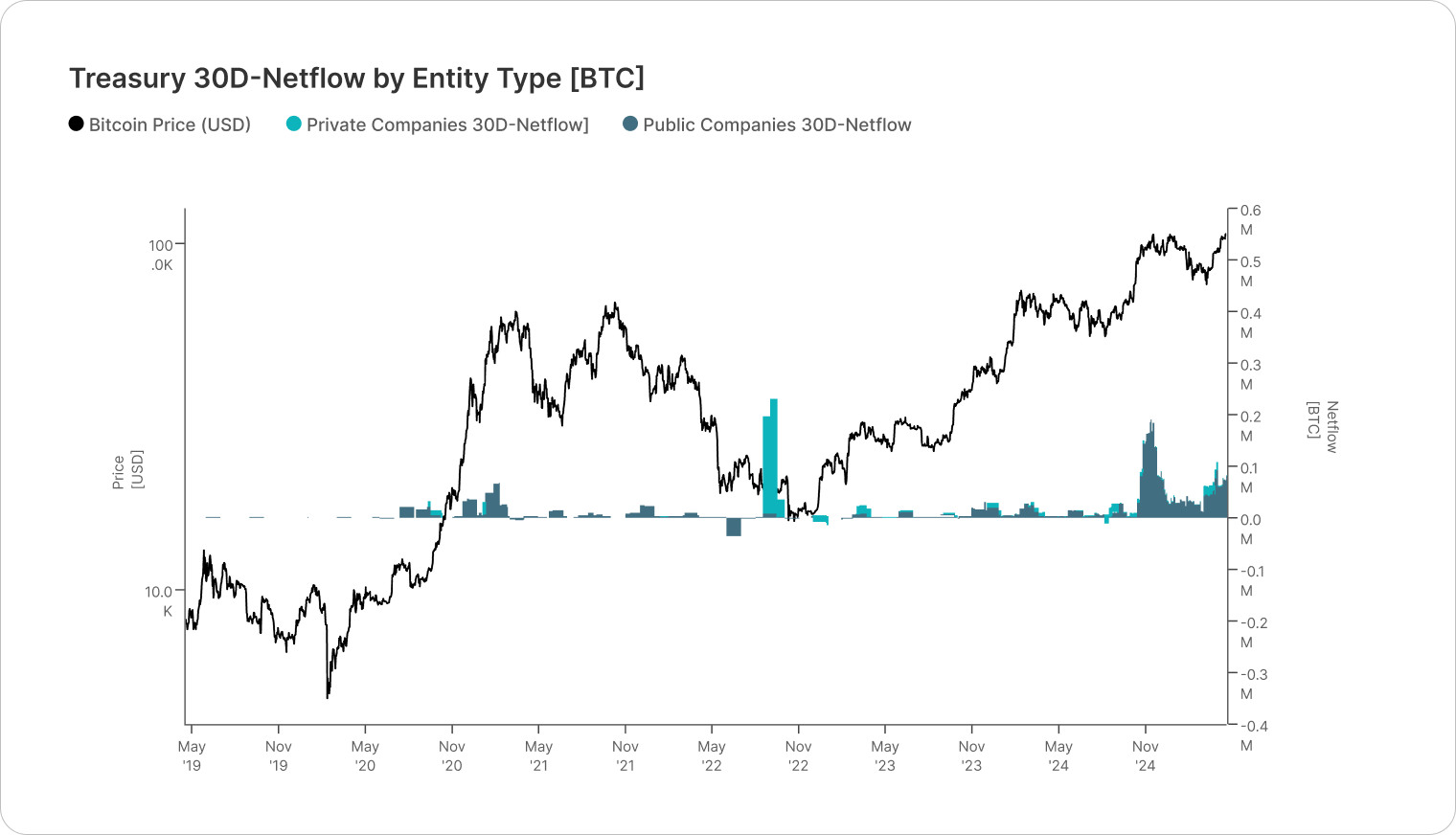

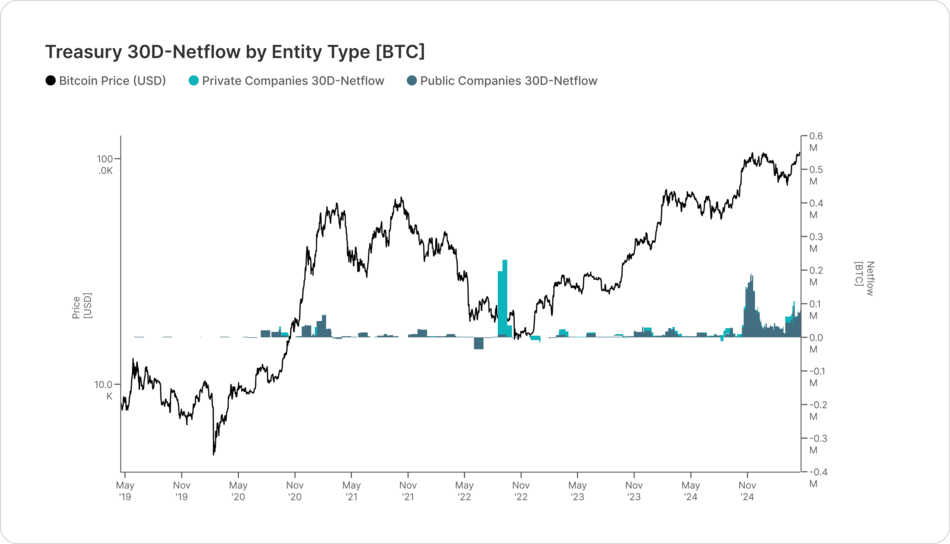

The establishment of the SBR has had a profound signaling effect across various sectors. Notably, following the announcement, public and private companies began accumulating over 20,000 BTC per month, marking one of the most aggressive institutional inflow periods since 2021. This surge suggests that the SBR's formal recognition of bitcoin as a strategic asset has bolstered institutional confidence, encouraging entities to view bitcoin as a legitimate component of their treasury reserves.

On March 6, 2025, President Donald J. Trump signed Executive Order 14096, titled “Establishment of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile”. This order repurposed over ~200k BTC, previously seized through criminal and civil asset forfeiture proceedings, into a federally managed reserve. The executive order explicitly states:

“The United States will not sell bitcoin deposited into this Strategic Bitcoin Reserve, which will be maintained as a store of reserve assets.”

While the reserve currently comprises only confiscated assets, the order authorizes the Treasury and Commerce Departments to develop budget-neutral strategies for acquiring additional bitcoin, provided these strategies impose no incremental costs on American taxpayers.

The establishment of the SBR has had a profound signaling effect across various sectors. Notably, following the announcement, public and private companies began accumulating over 20,000 BTC per month, marking one of the most aggressive institutional inflow periods since 2021. This surge suggests that the SBR's formal recognition of bitcoin as a strategic asset has bolstered institutional confidence, encouraging entities to view bitcoin as a legitimate component of their treasury reserves.

Impact Estimation

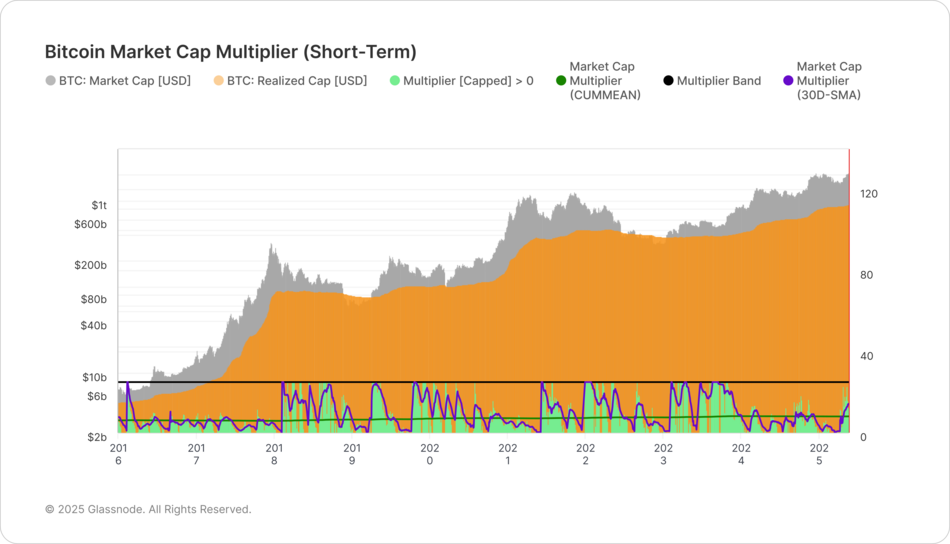

Market Cap Multiplier

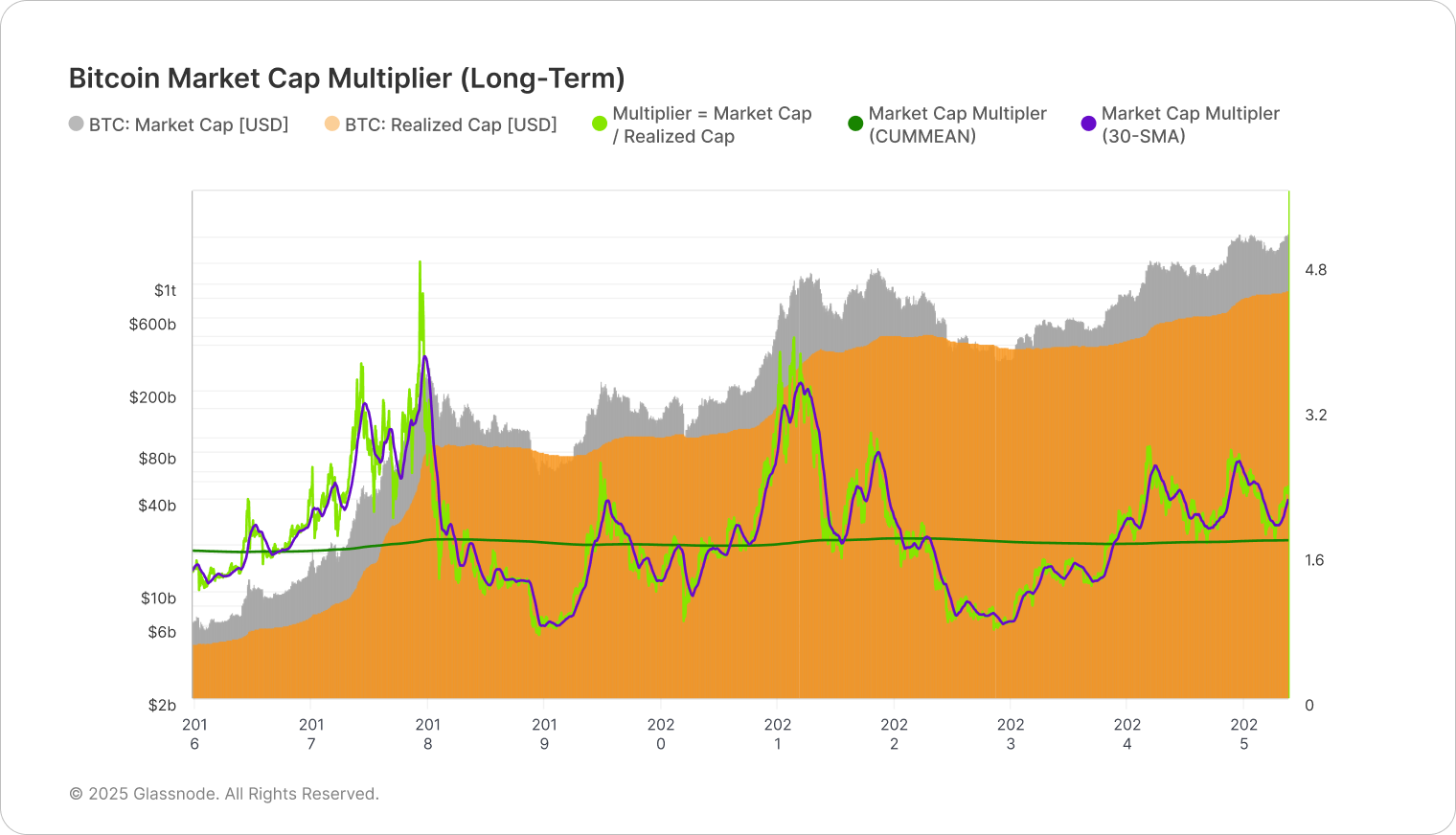

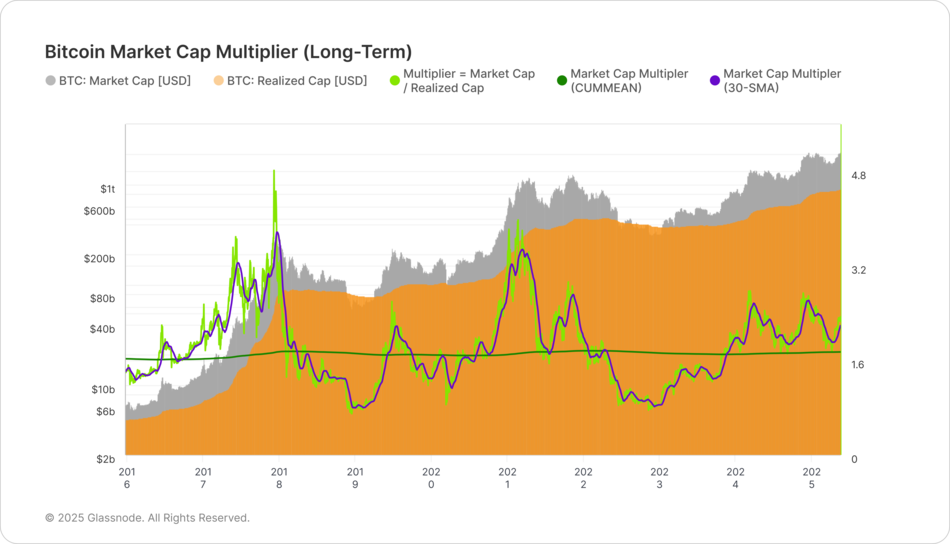

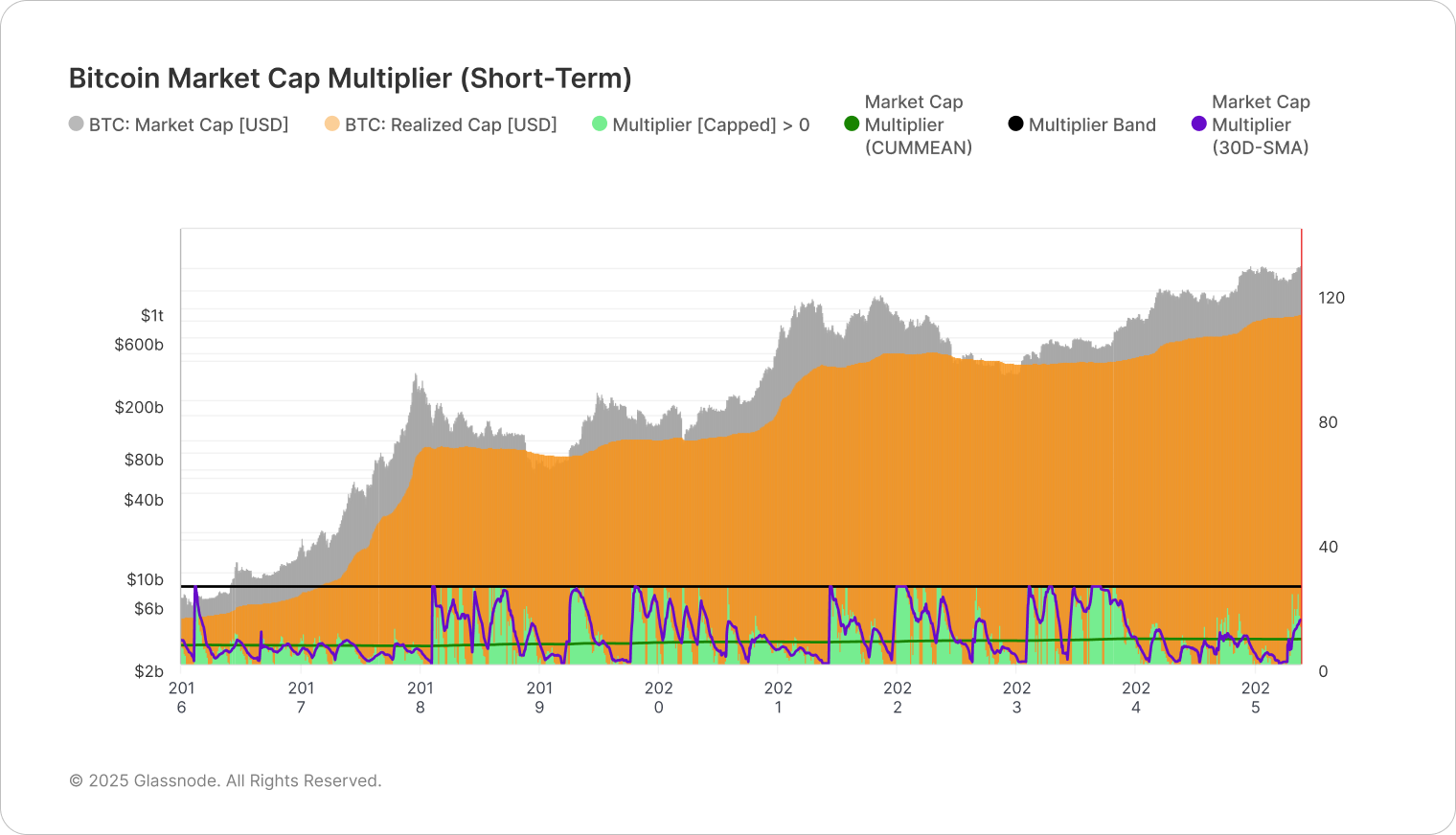

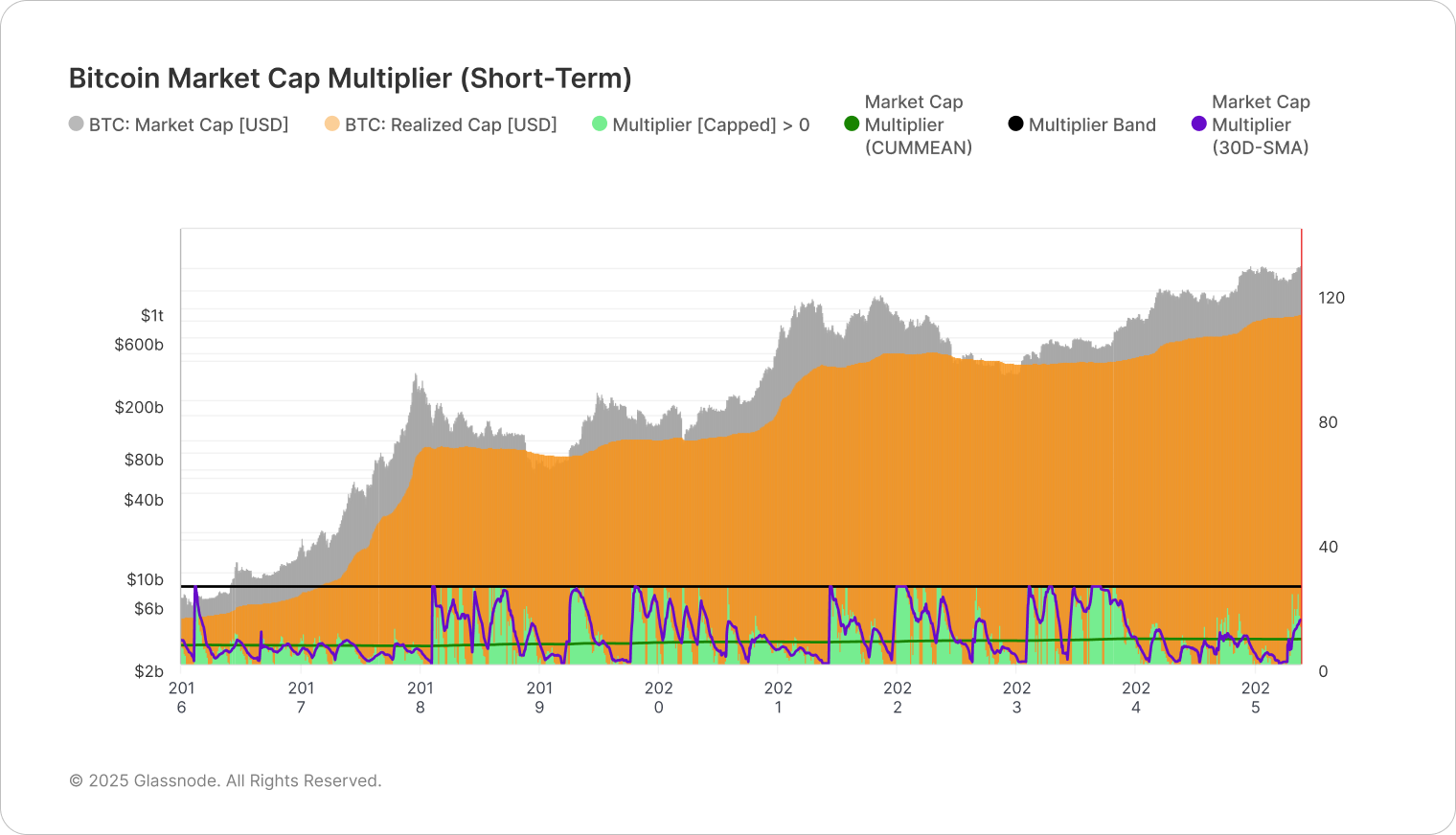

Each dollar deployed into bitcoin can move the market by $1.70 over time—or up to $25 in the short term—depending on timing, volatility, and conviction.

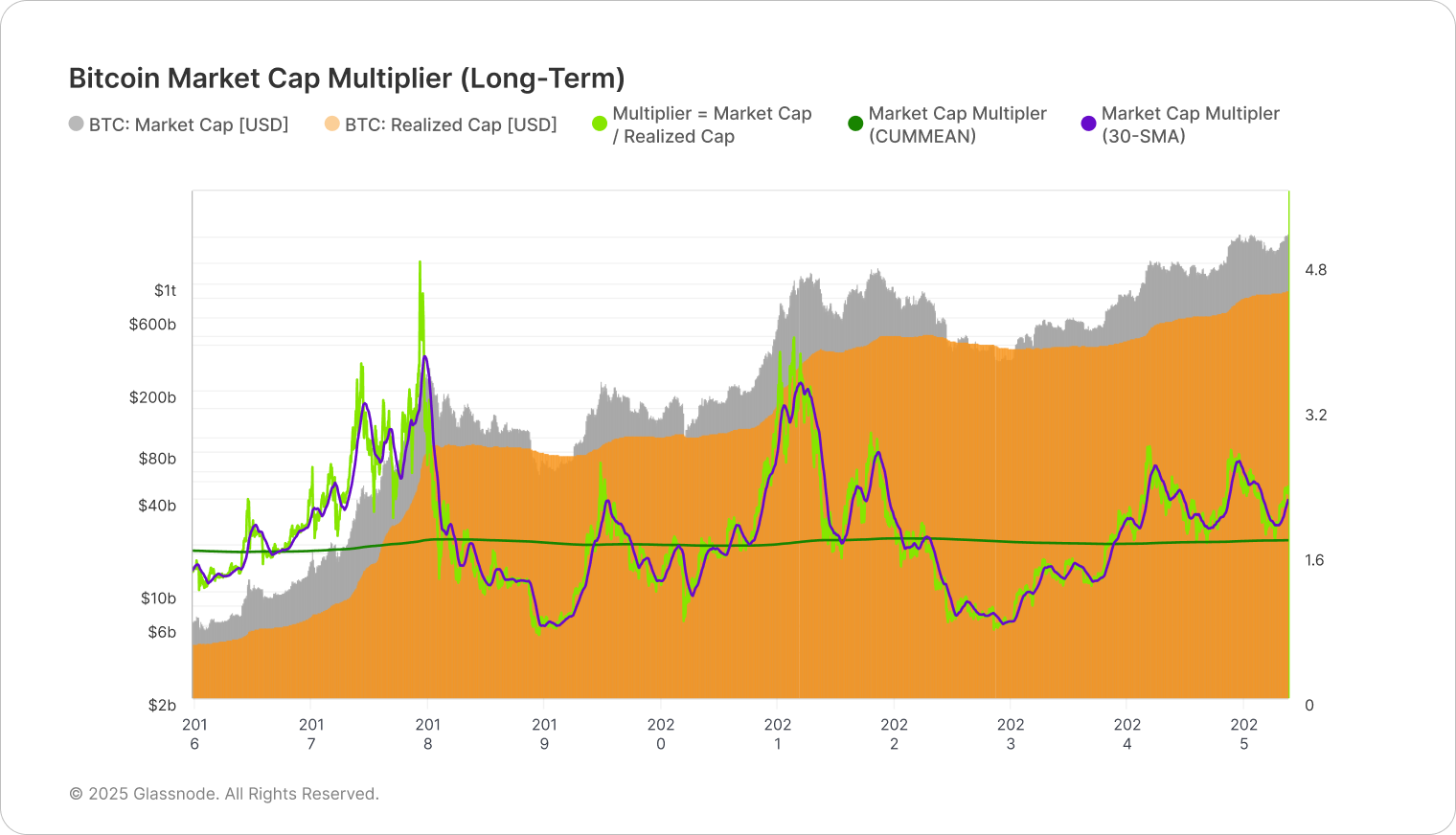

The Strategic Bitcoin Reserve (SBR) underscores a core dynamic in bitcoin markets: capital inflows are highly reflexive. That is, the market value tends to rise by more than the actual capital invested, particularly during periods of elevated demand and volatility.

This effect is quantified through the Market Cap Multiplier (MCM)—the ratio of change in market capitalization to net realized capital inflows. Using this framework, we estimate the short-term and long-term MCM under both bull and bear market conditions:

Cyclical MCM, varies significantly with trend momentum, ranging between:

- ~0.7 in bear markets: every $1 of inflow, if held until next bear market, leads to increasing market cap by just $0.70

- ~3.7 in bull markets: every $1 of inflow, if held until the next bull market, results in increasing market cap by up to $3.70.

Ultimate MCM, when measured cumulatively from Bitcoin’s Genesis block, stabilizes around:

- ~1.7, implying that each $1 permanently deployed into BTC has historically resulted in ~$1.70 residue in market cap.

The Strategic Bitcoin Reserve (SBR) underscores a core dynamic in bitcoin markets: capital inflows are highly reflexive. That is, the market value tends to rise by more than the actual capital invested, particularly during periods of elevated demand and volatility.

This effect is quantified through the Market Cap Multiplier (MCM)—the ratio of change in market capitalization to net realized capital inflows. Using this framework, we estimate the short-term and long-term MCM under both bull and bear market conditions:

Cyclical MCM, varies significantly with trend momentum, ranging between:

- ~0.7 in bear markets: every $1 of inflow, if held until next bear market, leads to increasing market cap by just $0.70

- ~3.7 in bull markets: every $1 of inflow, if held until the next bull market, results in increasing market cap by up to $3.70.

Ultimate MCM, when measured cumulatively from Bitcoin’s Genesis block, stabilizes around:

- ~1.7, implying that each $1 permanently deployed into BTC has historically resulted in ~$1.70 residue in market cap.

For short-term impacts, the 30-day MCM can range from near-zero to 25×, especially during high-volatility periods. On average, the short-term multiplier is ~8×, meaning $1 of capital can briefly move the market by $8.

These dynamics are particularly relevant for sovereign allocators. Even passive SBR activity can amplify price through both liquidity effects and psychological signaling. This framework also aligns with valuation models like MVRV, supporting the view that conviction, not just capital, drives long-term impact.

For short-term impacts, the 30-day MCM can range from near-zero to 25×, especially during high-volatility periods. On average, the short-term multiplier is ~8×, meaning $1 of capital can briefly move the market by $8.

These dynamics are particularly relevant for sovereign allocators. Even passive SBR activity can amplify price through both liquidity effects and psychological signaling. This framework also aligns with valuation models like MVRV, supporting the view that conviction, not just capital, drives long-term impact.