JUN 05, 2025

Circle Raises $1.1B in Upsized IPO, Strategy To Sell 2.5 Million Shares, and Trump Media Continues BTC Treasury Boom

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn about perpetual futures.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -3.53% | $103,004.20 |

$103,004.20

-3.53%

| |

Ether

ETH | -3.43% | $2,572.69 |

$2,572.69

-3.43%

| |

Livepeer

LPT | +53.60% | $8.4006 |

$8.4006

+53.60%

| |

Helium

HNT | -19.60% | $2.9223 |

$2.9223

-19.60%

| |

Avalanche

AVAX | -14.80% | $19.697 |

$19.697

-14.80%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of June 5, 2025, at 2:16 pm ET. . All prices in USD.

Takeaways

- Circle stock jumps more than 200% on first day of trading: Stablecoin company Circle raised approximately $1.1 billion by selling 34 million shares at $31 apiece in its long-awaited IPO, then shares surged on their first day of trading, climbing as high as $103.75 on Thursday before settling around $85.

- In a major reshuffle, the Ethereum Foundation has merged its protocol research teams into a single “Protocol” division to focus on scaling Layer 1: Some researchers will depart from the organization, while new leadership takes charge of each strategic area.

- Strategy plans to sell 2.5 million perpetual preferred shares called Stride to raise capital for additional bitcoin purchases: The offering follows prior Strike and Strife share issuances. Proceeds will go toward the company’s bitcoin acquisition strategy.

- Trump Media has successfully closed its $2.44 billion raise to build a bitcoin treasury: The company will use $2.32 billion from its capital raise to , aiming to become one of the largest publicly traded BTC holders in the US.

- World Liberty Financial has distributed USD1 tokens to each wallet that participated in its WLFI token sale: The stablecoin now reaches over 85,000 WLFI investors amid continuing demand for the digital tokens.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Circle Brings In $1.1B As Demand for Stablecoins Surge

After the company sold 34 million shares at $31 apiece to raise almost $1.1 billion, demand for shares exploded. The company opened trading on Thursday at around $69 apiece, valuing it at almost $18 billion. Overall, Circle surged as much as 235% from the high end of its range, trading as high as $103.75 before settling at above $80 shortly before Thursday’s close.

The debut represented a hopeful shift for an IPO market that’s been largely muted in recent years. And it indicated there’s huge appetite for a growing cryptocurrency company in an industry aided by significant macroeconomic tailwinds thanks to pending stablecoin legislation and the Trump administration’s move to encourage digital asset innovation.

Circle previously attempted to go public via SPAC in 2021 before cancelling the offering. And it recently reportedly fielded takeover offers from Ripple and Coinbase. But demand for stablecoins has continued to rise amid increased institutional adoption in recent months, paving the way for the IPO.

The New York-based company issues USDC, the world’s second largest stablecoin, with a market cap of roughly $62 billion. In 2024, Circle earned $156 million in net income on $1.68 billion in revenue, after posting $268 million in income and $1.45 billion in revenue the year prior.

Trump Media Eyes $3 Billion Raise for Crypto Purchases

The funding round will reportedly mix a new share issuance with a convertible bond offering. The initiative follows the trend set by Strategy, which has leveraged equity and debt issuances to amass over $62 billion in bitcoin.

Trump Media’s proposed raise would similarly inject significant crypto exposure onto its balance sheet. Earlier this year, the company revealed plans for a financial services arm centered on digital assets. By combining fresh capital with debt financing, the firm seeks to emulate Michael Saylor’s treasury strategy while expanding into asset management. With bitcoin reaching a new all-time high of more than $112,000 last week before pulling back this week, more companies might begin to follow suit this year.

Ethereum Foundation Reorganizes R&D Under New Protocol Division

Less than a month after the Pectra Upgrade, the Ethereum Foundation has announced a major restructure of its protocol research operations. The previously separate groups will now be a unified “Protocol” division, aiming to rethink how Ethereum is designed, developed, and maintained as adoption grows.

The organization said it is consolidating efforts into three strategic initiatives: Scaling the main blockchain infrastructure, refining data storages, and enhancing overall user experience. In recent years, issues regarding the Ethereum’s network’s comparatively low levels of scalability have been at the forefront of DeFi discussions.

The restructuring is aimed at helping the network stay competitive against the likes of Solana, as networks battle over on-chain value, and it comes at a time when more users are as activity grows across the ecosystem. As part of the move, some existing researchers will reportedly not continue with the organization after the reshuffle.

Strategy to Issue 2.5M ‘Stride’ Preferred Shares to Fund Bitcoin Purchases

Proceeds from the STRD offering will apparently be used for general corporate purposes, including further bitcoin purchases and working capital needs.

Previously, Strategy has raised funds through convertible preferred shares, Strike (STRK) and Strife (STRF). However, STRD and STRF preferred shares are non-convertible and pay a fixed 10% annual dividend.

The company also outlined redemption rights, allowing it to redeem all outstanding STRD shares if their total falls below 25% of the originally issued amount or upon certain tax events. This approach might help ensure flexibility in managing its capital structure. Strategy’s bitcoin treasury is now 580,250 BTC, valued at over $60 billion.

Trump Media Closes $2.44B Raise to Build One Large Bitcoin Treasury

The funding includes $1.44 billion in common stock sales and $1 billion in convertible notes, sold to roughly 50 institutional investors.

According to a press release, DJT plans to allocate $2.32 billion of the net proceeds to purchase bitcoin, with the deal led by Yorkville Securities and Clear Street, with Cantor Fitzgerald acting as financial advisor. This aggressive bitcoin acquisition strategy mirrors the playbook used by Strategy, which has amassed over $60 billion BTC using a mix of debt and equity raises. The announcement had a positive effect on DJT shares on the day, reversing early losses.The company has also indicated plans to launch a crypto-focused financial services platform to develop customized exchange-traded fund (ETF) products.

World Liberty Financial Airdrops USD1 Stablecoin to WLFI Holders

More than 85,000 WLFI purchasers, who underwent a KYC process, reportedly received the airdrop. The project, however, did not formally announce the distribution.

USD1, introduced amid a wave of stablecoin regulatory reforms such as the GENIUS Act, claims full backing by short-term US Treasuries, dollar deposits, and cash equivalents.

A snapshot vote on the airdrop proposal saw 99.96% approval, reflecting strong community enthusiasm as World Liberty continues to expand the stablecoin's reach. As regulatory guidelines for stablecoins continue to make progress in the US, supporters hope that USD1 will be able to offer a dependable payment option for retail and institutional participants.

-Team Gemini

data as of 5:17 pm ET on June 4, 2025.

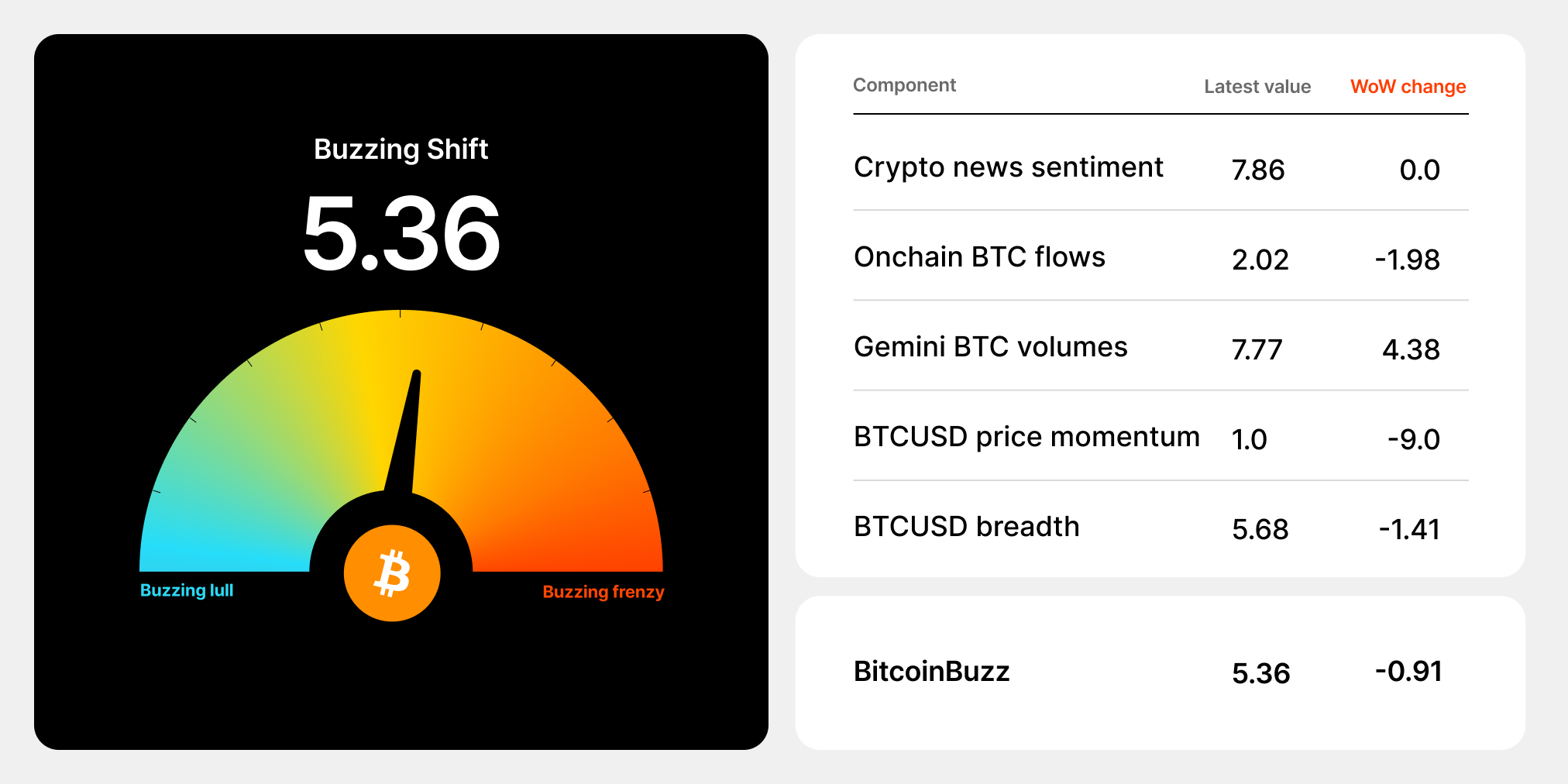

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

What are Perpetual Futures?

Perpetual futures (or perps) are a type of derivative contract that enables traders to speculate on the price movements of cryptocurrencies or other assets, without owning the underlying assets. These contracts are called "perpetual" because they do not have a set expiration date, allowing traders to hold positions for as long as they choose.

This feature sets them apart from traditional futures contracts, which have predefined expiration dates requiring the settlement of positions. With the cumulative trading volume of crypto perpetual contracts since 2020 surpassing $60 trillion, let’s take a look at how they can be used.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

FEB 05, 2026

Gemini 2.0: A Bridge to the Future of Money and Markets

COMPANY

FEB 04, 2026

Gemini To Sponsor WM Phoenix Open, Launch Golf Event Contracts

WEEKLY MARKET UPDATE

JAN 29, 2026