NOV 19, 2025

New Perpetual Contracts Available: BONK, DOGE, FLOKI, PEPE, SHIB, WIF

Gemini’s European customers can now trade perpetual contracts for BONK, DOGE, FLOKI, PEPE, SHIB, and WIF. This enables users to take long or short positions on some of the most popular memecoins with up to 100x leverage*, and no monthly expiration date within the Gemini platform.

Gemini Perpetuals provide investors with a powerful way to customise their exposure to crypto markets through leverage and explore alternative investment strategies. With cross collateral support, USDC settlements, and industry-leading security**, Gemini offers you the flexibility to easily trade advanced derivatives across multiple currency pairs, in a trusted, regulated environment.

What Are Memecoins?

Memecoins are cryptocurrencies representing some of the biggest memes in popular culture, and are now a major component of the crypto ecosystem. From DOGE powering its own layer-1 proof-of-work blockchain to the viral Solana-based WIF and Ethereum-based PEPE, these tokens show that with enough traction, community movements can turn into economic forces to be reckoned with.

Why Trade Gemini Perpetuals?

- Trade long or short: Hold positions for as long as your margin allows, with no monthly expiration dates.

- Up to 100x leverage*: Increase your exposure with leverage and take advantage of more trading opportunities.

- Cross-collateral support: Use assets from your Gemini spot account to fund your perpetuals trades.

- Denominated in USDC: All profits, losses, and settlements are in USDC, making it easy to manage your positions.

- All-in-one platform: Manage your spot, staking, and perpetual positions within a single interface in your portfolio.

- Trusted and secure: Trade confidently with Gemini’s strong security** standards and institutional-grade infrastructure.

Learn more about perpetual futures .

How Can You Trade Perpetual Contracts?

- Open your Gemini Perpetuals account.

- Fund it using USDC, EUR or USD, or enable cross-collateral to use crypto from your Exchange account.

- Choose a market (e.g. BTC/USDC, ETH/USDC, DOGE/USDC).

- Select Buy (long) or Sell (short).

- Set the size of your trade.

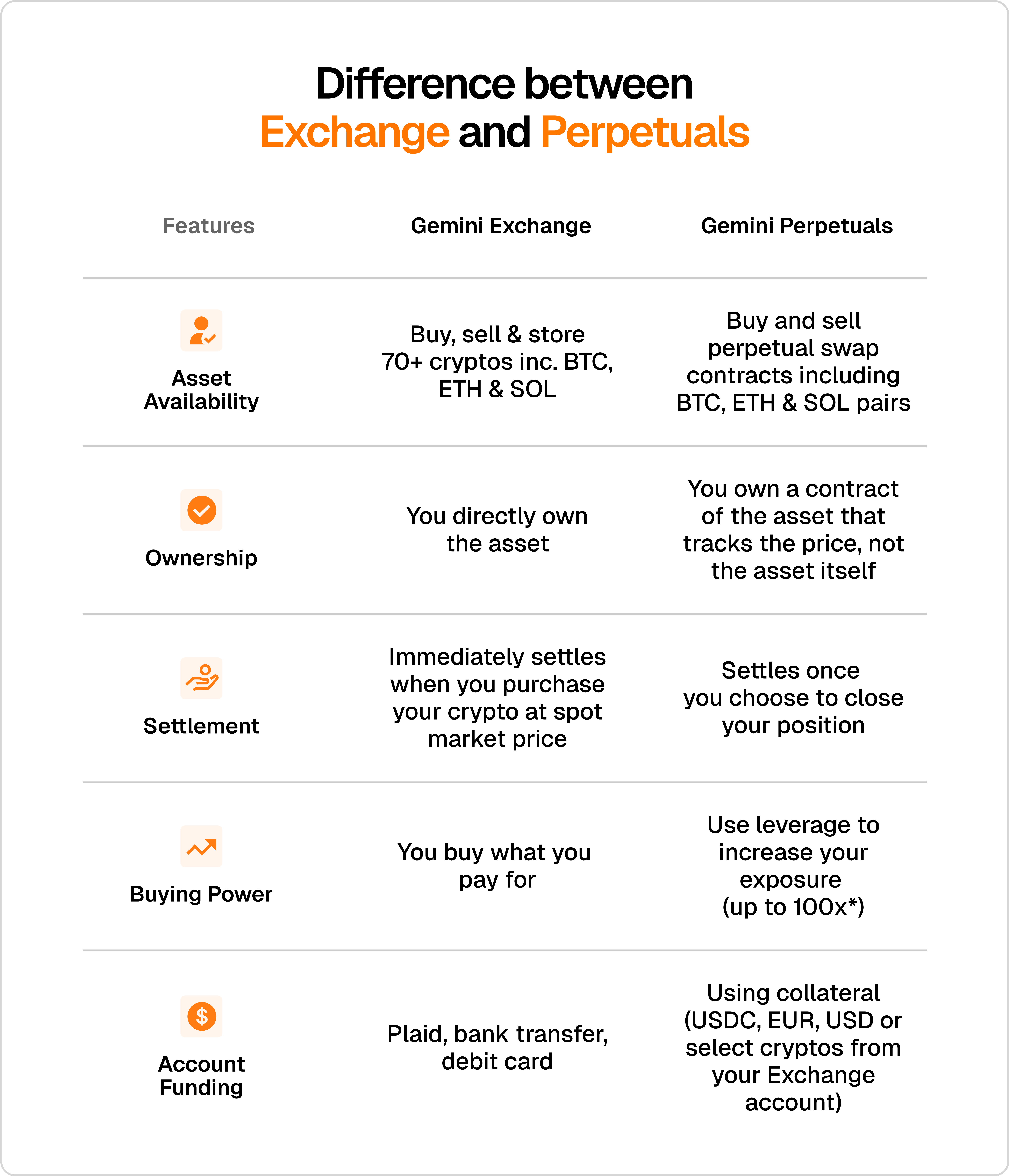

Gemini Exchange and Gemini Perpetulas: What’s the Difference?

Take a look below to learn some of the key differences between using Gemini Exchange and Gemini Perpetuals.

What’s Next?

We’re continuing to expand the list of available perpetuals on Gemini, with new contracts added on a regular basis. Stay tuned for future announcements and explore the growing range of contracts within Gemini Perpetuals.

Onwards and Upwards,

Team Gemini

Trading derivatives involves significant risk. For details on the associated risks, see our .

* Subject to availability. Geographic restrictions apply.

** The term secure refers to the implementation of industry-standard security measures, specifically ISO 27001 and SOC 2 Type II certifications. While these measures are designed to mitigate risk, no system is immune to all threats.

Gemini Intergalactic EU Artemis, Ltd. is incorporated and registered in Malta and is duly authorised and regulated by the Malta Financial Services Authority (“MFSA”) under the Investment Services Act to provide certain investment services.

Derivatives are complex instruments involving a high degree of risk. These products are not suitable for all investors and require a full understanding of the risks involved. Past performance is no guarantee of future results. You should consult a licensed advisor before engaging in any transaction. Trading leveraged products involves a high level of risk and you could lose your entire investment. Refer to the for more information on the associated risks.

Staking services are offered by Gemini Intergalactic EU, Ltd., authorised by the MFSA as a Crypto-Asset Service Provider under the Markets in Crypto Assets Act.

Staking activities are not activities under the Markets in Crypto Assets Act. As such, staking activities are not subject to regulatory oversight, conduct of business rules, or investor protection requirements.