Contents

What Is Compound?

What Makes Compound Unique?

The Compound DeFi Protocol

Earn Interest With Compound Lending

Compound Crypto Borrowing

Why Compound Borrowing and Lending Rates Fluctuate

How Compound Crypto Liquidity Pools Work

The Compound Protocol’s COMP Crypto Asset

What Are the Limitations of Compound?

What’s the Future of Compound?

The Wrap-Up

What Is Compound (COMP) and How Does It Work?

Discover how Compound lets you lend, borrow, and earn interest on crypto assets. Explore how it works and why it’s a key player in DeFi.

Summary

The backbone of today’s is Ethereum, a decentralized blockchain that enables smart contracts upon which other decentralized blockchain-based applications (dApps) with native cryptocurrencies can be built. Compound is one such protocol, primarily concerned with the financial services of borrowing and lending your crypto. This article covers the foundation of Compound, how and why it works, and some of the risk factors with Compound crypto.

What Is Compound?

Founded in 2017 by two entrepreneurs, and Geoffrey Hayes, Compound is a decentralized, blockchain-based protocol that runs on the Ethereum network. Since it operates as a decentralized application, it is compatible with Ethereum, allowing DeFi features on the Ethereum blockchain.

Through an autonomous smart contract, users can perform transactions, such as requesting loans, or earn interest by lending cryptocurrencies they own.

Compound’s native ERC-20 token, COMP, was created with decentralization in mind. The concept was designed with incentives to provide some of the same services and features that banks have, but with a decentralized approach.

Users can borrow and pay interest or lend and earn interest. The Compound protocol removes traditional intermediaries in lending and borrowing, enabling peer-to-protocol transactions through smart contracts.

Interest rates are determined algorithmically and are based on the principle of supply and demand. COMP is remarkable in that it actually enables a democratized and decentralized, autonomous system for borrowing and lending.

Unlike traditional banks, a person’s credit is not considered, and the ability to borrow or lend is tied to the value of assets at any given time. This can come in handy if crypto users have crypto they want to leverage but don’t want to sell it. Instead, they can earn interest by becoming a lender with COMP.

What Makes Compound Unique?

There are many other DeFi protocols or software programs currently running on blockchains. Their core similarity is that they all serve a purpose in decentralizing and democratizing financial services, such as lending, borrowing, and trading.

You may have heard of other DeFi protocols, such as SushiSwap, Aave, or UniSwap. So, what distinguishes COMP from all the others?

Compound has a growing interest due to its unique features. It shares a lot of the same great benefits that other DeFi apps have. However, it has an incentivized approach to decentralized finance where users get rewards in the form of COMP tokens. This type of incentive creates interest for participants.

Additionally, COMP is used as a governance token. This creates loyalty while encouraging users to keep COMP tokens so they can vote on future decisions. This means users get a say on decisions that can impact their future revenue, including but not limited to interest rates.

One other unique capability is that users who hold COMP have the ability to delegate their votes to someone of their choosing. This could come in handy if COMP holders want to solicit expertise from their network.

The Compound DeFi Protocol

First, let’s take a minute to talk briefly about so we can get some context as to where the Compound protocol fits into the broader crypto ecosystem.

Unlock the future of money on Gemini

Start your crypto journey in minutes on the trusted crypto-native finance platform

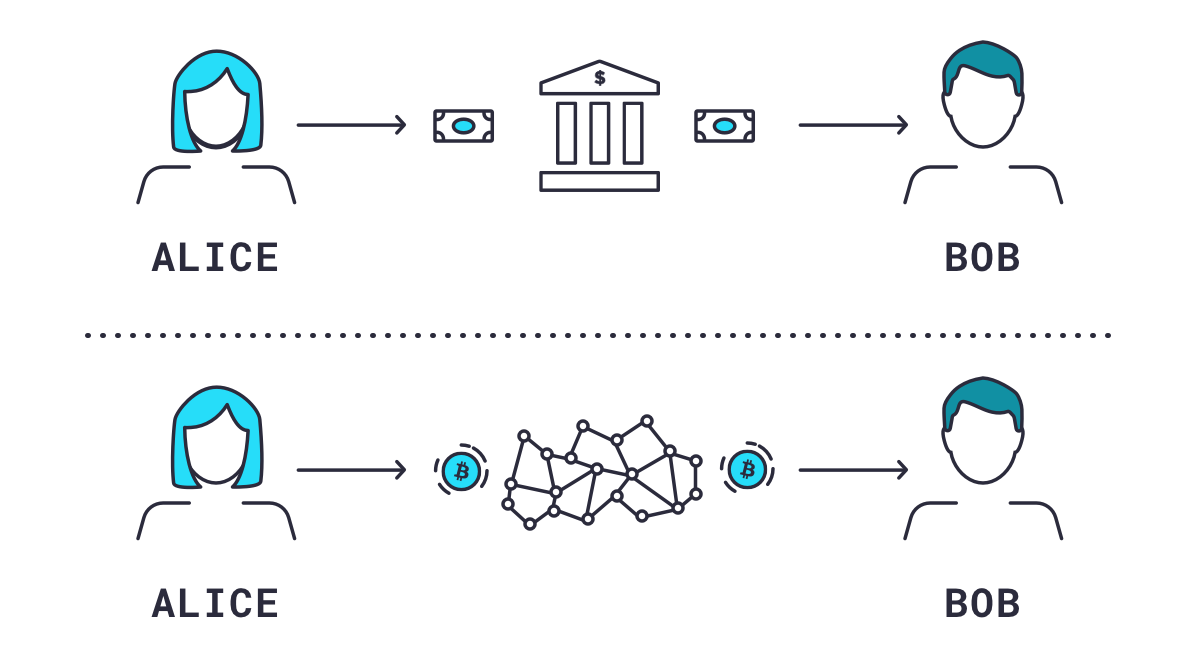

Cryptocurrencies are known for acting as decentralized money with respect to payments. Bitcoin (while many now consider it to be more a store of value similar to gold) is still of course the first and best example. Alice can pay Bob in bitcoin without going through a bank or other financial services intermediary, instead going through the , a decentralized network of independent nodes to validate the transaction.

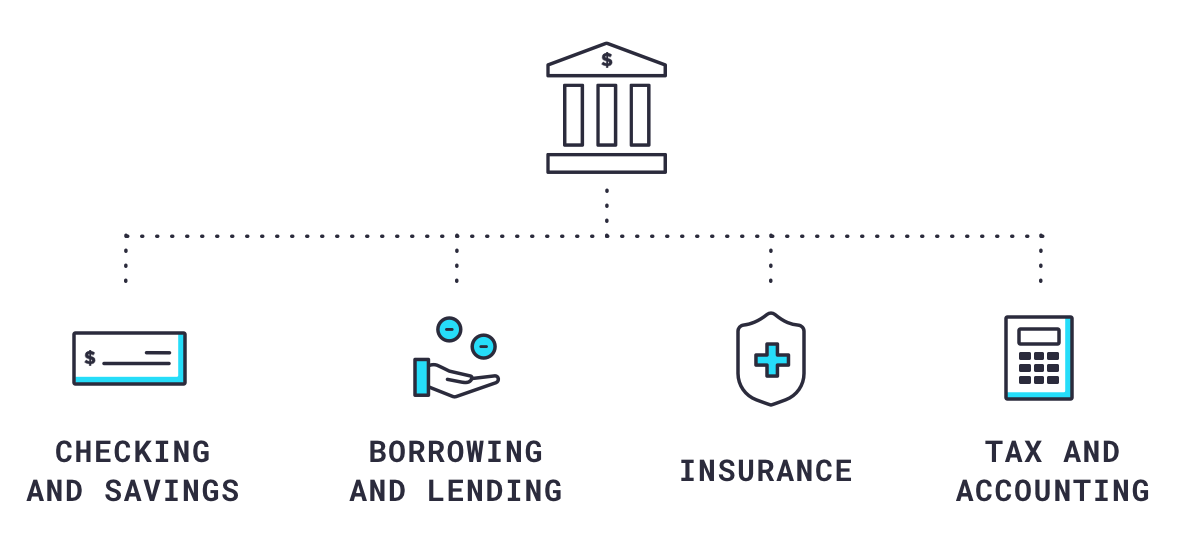

However, financial services go way beyond payments to services such as checking and savings, borrowing and lending, insurance, taxes and accounting and so on. The idea behind DeFi should now be fairly apparent: to decentralize all financial services using blockchain protocols and cryptocurrencies.

The main backbone of today’s DeFi movement is , a decentralized blockchain that enables smart contracts upon which other decentralized blockchain-based applications () with native cryptocurrencies can be built. The Compound protocol is primarily concerned with the financial services of borrowing and lending your crypto.

Earn Interest With Compound Lending

Here’s how it works. Compound supports the borrowing and lending of a specific set of cryptocurrencies. As of this writing, they are: Dai (DAI), Ether (ETH), , Ox (ZRX), Tether (USDT), (WBTC), Basic Attention Token (BAT), Augur (REP), and Sai (SAI). Now anyone with crypto can lend and borrow crypto immediately, without having to spend the time, effort, and cost of dealing with a traditional financial intermediary.

If you own any of the cryptocurrencies mentioned above, you can send, lock, deposit, lend – they all mean the same thing – any amount you wish to the Compound protocol. Locking your crypto in with Compound is just like putting your money in a savings account, but with a decentralized, blockchain-based protocol. Instead of depositing your money into the bank, you are sending your crypto to the Compound wallet. And, just like lending to a bank, you immediately begin to earn interest on your crypto. The interest you earn is denominated in the same token that you lent – meaning, if you sent BAT you earn interest in BAT, if you sent DAI you earn DAI etc. The crypto you send is added into a giant pool of that same token in a smart contract in the Compound protocol, sent by thousands of other people all over the world.

Compound Crypto Borrowing

On the other side of the equation is borrowing. Once you’ve locked your crypto to Compound, you are able to borrow against it. Compound does not require a credit check so anybody anywhere in the world with crypto has the ability to borrow. Compound determines how much you are allowed to borrow based on the quality of the asset. So, for example, if you sent 1000 BAT worth $500 and Compound has set the borrowing limit (aka collateral factor) for BAT at 50%, you can borrow $250 worth of any other crypto that the Compound protocol supports (see list above). And, just like borrowing money from a bank, you need to pay interest on the money you borrow.

So, we have lending and we have borrowing, both of which concern themselves with interest rates. For lending, you earn interest. For borrowing you pay interest. Let’s take a minute to talk about how those interest rates are calculated and automatically implemented by the Compound protocol.

Why Compound Borrowing and Lending Rates Fluctuate

Remember that regardless of whether you are lending or borrowing, you first have to lock in crypto with Compound. When you do, you get Compound tokens (cTokens), which represent the balance of your crypto, in return. are created from Ethereum as and are one of the great benefits and innovations of a blockchain-based crypto money market; they can be transferred, traded, or programmed into other Dapps in the DeFi ecosystem similar to other Ethereum tokens, all while earning (or paying) interest. You control these cTokens just like you would control any digital asset on the Ethereum blockchain, with your public and private keys.

Interest rates are a function of the amount of crypto available (aka liquidity) in each market and fluctuate in real-time based on supply and demand to always reflect current market conditions. The interest rates you see are quoted as annual interest rates and accrue each time an Ethereum block is mined. Every 15 seconds the value of your cTokens will increase by 1/2102400 (which is the number of 15 second blocks in a year) of the quoted annual interest rate at that time.

How Compound Crypto Liquidity Pools Work

When there is a large pool of crypto locked in Compound, interest rates are low because there’s plenty there to be borrowed so you’re not getting paid a lot to add to that large pool. If the pool is small, interest rates are higher and you earn more. Fluctuating (aka floating) interest rates incentivizes lending new crypto to small pools (to earn higher interest), and repaying borrowed crypto into small pools and borrowing from large pools (to pay less interest).

As we’ve mentioned above, every time you borrow from Compound you have to lock in crypto that’s worth more than what you borrow as collateral so that the loan you take is over collateralized. Since the crypto you deposit as collateral is also volatile, it could drop in value. As it approaches the value of the crypto you’ve borrowed the cToken smart contract automatically closes the position. This is called liquidation (or, margin call). In that case, you get to keep what you borrowed but you lose your collateral.

The Compound Protocol’s COMP Crypto Asset

COMP is the of the Compound protocol and a predetermined amount is distributed to all lenders and borrowers on the Compound protocol every day. distributions happen every time an Ethereum block is mined (every 15 seconds) in an amount proportional to the interest accrued by each asset. COMP token-holders propose and vote on changes to the protocol, and oversee the protocol’s reserves and treasury; every COMP token represents one vote, which can even be delegated to another party on your behalf.

Compound governance proposals are executable code which is subject to a three-day voting period. If a governance change to the protocol is passed by the community it will take effect two days later giving anyone a chance to close any open positions before the changes go into effect. In this way, Compound is an entirely self-governed ecosystem.

What Are the Limitations of Compound?

We’ve covered the benefits of COMP and we did a deep dive into how earning interest works with COMP. Every investment has risks and limitations. Below are a few risks to consider with COMP.

Collateral Volatility

Since all loans with COMP require over-collateralization, you should keep in mind that crypto assets are volatile, and the value of your assets can change quickly. This could potentially cause an unexpected liquidation event.

This is a risk factor to consider, and depending on the volume of assets, it could prove to be very costly. If you are a borrower on COMP, keep an eye on the value of your assets used for collateral.

Sharp Interest Rate Changes

As mentioned, the interest rate is determined by supply and demand. This means that

Rates can increase or decrease without notice and this can make it challenging to plan on earnings as part of your overall financial plan.

If supply is up, your interest rates will follow this trend. If market conditions spur a sharp decline in demand, you may experience an equally sharp decline in your interest rate and your earnings.

Future Uncertainty With Regulations

DeFi protocols, including Compound, are facing increasing scrutiny from global regulators, and the regulatory landscape remains uncertain. However, DeFi is a bit under the radar from a legal standpoint. This perceived lack of regulatory oversight is one of the things that appeals to some users who are tired of the heavily regulated banks.

However, no one knows the future, and it’s possible that regulations could come into play in the future, which could have an impact on operations and access.

What’s the Future of Compound?

There are many factors that could impact COMP in the future. Growth is dependent on supply and demand and COMP continues to grow in popularity. Factors such as competition and the continuing need to innovate for greater interoperability will play a role in the future of COMP.

Maintaining a high level of security will be in the hands of the users through the governance provided to them via incentives. Regulatory factors could cause changes to COMP and this will be watched most closely in the U.S. with ongoing conversations about regulatory concerns and needs.

The Wrap-Up

There are pros and cons with COMP, as with any cryptocurrency. Users can reap the benefits of COMP and earn passive income, but they must acknowledge and be informed about the risks and limitations. There is a limited supply cap of COMP and perhaps the biggest predictor of COMP’s future comes down to the supply and demand of this fast-growing DeFi protocol.

Author

Is this article helpful?