JUL 24, 2025

Spot ETH ETFs Record More Than $500M In Inflows, Trump Media Pulls in $2B for Bitcoin Treasury, and NFTs Post Best Month Since February

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about blockchain and financial derivatives.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +0.04% | $118,476.32 |

$118,476.32

+0.04%

| |

Ether

ETH | +9.02% | $3,679.52 |

$3,679.52

+9.02%

| |

Uniswap

UNI | +14.10% | $10.0497 |

$10.0497

+14.10%

| |

Litecoin

LTC | +11.10% | $111.54 |

$111.54

+11.10%

| |

Chainlink

LINK | +7.65% | $18.15931 |

$18.15931

+7.65%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of July 24, 2025, at 12:43 pm ET. . All prices in USD.

Takeaways

- US spot Ethereum ETFs drew $534 million on Tuesday, marking their third‑largest single‑day inflow, while US spot bitcoin ETFs saw $68 million in outflows: Institutional interest and broader altcoin momentum is driving renewed interest in the second largest cryptocurrency.

- White House to release crypto report next week: After completing a 180-day study on the crypto industry, the Digital Asset Working Group will release the report on July 30, according to Bo Hines, an executive director in the working group. The report could look at how the US would shape a Stratgic Bitcoin Reserve and a digital asset stockpile, among other initiatives.

- Trump Media & Technology Group’s bitcoin holdings and related securities have reached $2 billion, representing two-thirds of liquid assets: The company has also set aside $300 million for bitcoin‑linked options.

- BitGo has submitted paperwork for a US IPO as the crypto sector’s total market value climbs to $4 trillion: The custody provider joins a wave of firms moving to go public on the back of favorable regulation and unprecedented institutional interest.

- The total NFT market capitalization surged above $6 billion this week, its highest level since early February: A single whale wallet reportedly purchased 45 CryptoPunks for over 2,000 ETH.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Spot Ethereum ETFs Attract $534 Million in Inflows, Continuing Ethereum Boom

BlackRock’s iShares Ethereum Trust led with around $426 million, followed by Grayscale’s Ethereum Mini Trust at just under $73 million.

Conversely, spot bitcoin ETFs experienced $68 million in outflows, continuing a recent influx of capital into ether-based products. Recently increased flows into ether products might suggest investor appetite is being revitalized, after a previously sustained slump.

Some analysts are attributing the shift in appetite to a dip in bitcoin market dominance, perhaps caused by slightly more favorable macroeconomic conditions. Other causes for the shift may include corporate crypto treasuries adding ether to their balance sheets and proposed upgrades to the Ethereum network.

White House To Release Crypto Study Next Week

This comes after President Donald J. Trump issued an executive order in January that set up the working group to look at how to manage Strategic Bitcoin Reserve, a national digital asset stockpile, offer regulatory suggestions, and more.

The report also could look at different cryptocurrencies the government could acquire and offer tax-neutral ways to acquire more bitcoin, as well as set security standards and offer possible crypto banking reforms.

Trump Media’s Bitcoin Treasury Tops $2 Billion

This accounts for roughly two-thirds of the firm’s reported $3 billion in liquid assets. Trump Media also reportedly plans to use an additional $300 million for options on bitcoin‑linked equities.

In May, the company outlined plans to raise $2.5 billion to fund its bitcoin acquisition strategy; this milestone suggests that a substantial share of that capital has since been allocated to its treasury. The bitcoin accumulation strategy places Trump Media among a growing cohort of public companies leveraging digital‑asset holdings as core balance‑sheet assets. Bitcoin is now trading at around $118,500, and the firm has not specified the split between bitcoin and bitcoin-related ETFs.

BitGo Files for US IPO Amid Crypto Market’s $4 Trillion Milestone

after it completed a $100 million raise in 2023 at a $1.75 billion valuation.

The move comes as the market value of the crypto industry surges above a staggering $4 trillion valuation, with macroeconomic factors and regulation looking more favorable. As the industry continues to mature, more firms are moving towards public listings, with Grayscale and Bullish also having announced filings earlier this summer.

The notable resurgence in companies moving to go public comes off the back of much needed clarifications to crypto’s regulatory stance, aided by last week’s landmark stablecoin legislation. Circle, the issuer of the the second largest stablecoin by market cap, USDC, had a highly successful IPO in June, which made clear investor appetite for regulated crypto exposure.

NFT Market Cap Surpasses $6 Billion As Market Shows Renewed Interest

The nearly 17% increase brought the industry’s market valuation to the highest level since February. Trading volumes of NFTs also rose to reach over $41 million in a 24 hour period.

A single address was reported to have executed a purchase of 45 CryptoPunks at a cost of approximately 2080 ETH, lifting the floor price of the highly popular collection to 47.5 ETH.

The sizable acquisition may signal renewed interest from whale investors in the NFT space as they hope to see the price surges reminiscent of the 2021 NFT boom once again. Despite signs of renewed interest, some analysts caution that long‑term NFT market strength will depend on sustained activity. It should also be noted that the boost comes as bitcoin and ether show positive price movements which could be playing a part in recent NFT growth.

-Team Gemini

data as of 5:15 pm ET on July 23, 2025.

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

Blockchain and Financial Derivatives

Blockchain is increasingly demonstrating its potential to transform traditional systems in a way that can improve operational efficiency, expand optionality, and reduce costs. Nowhere is this more apparent than in the financial services industry, with cryptocurrency markets and blockchain-enabled financial products gradually gaining traction over their conventional counterparts. As more on-chain synthetic assets continue to be developed, the range of derivatives being offered on blockchain platforms appears limitless.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

ARTICLES CONNEXES

COMPANY

OCT 20, 2025

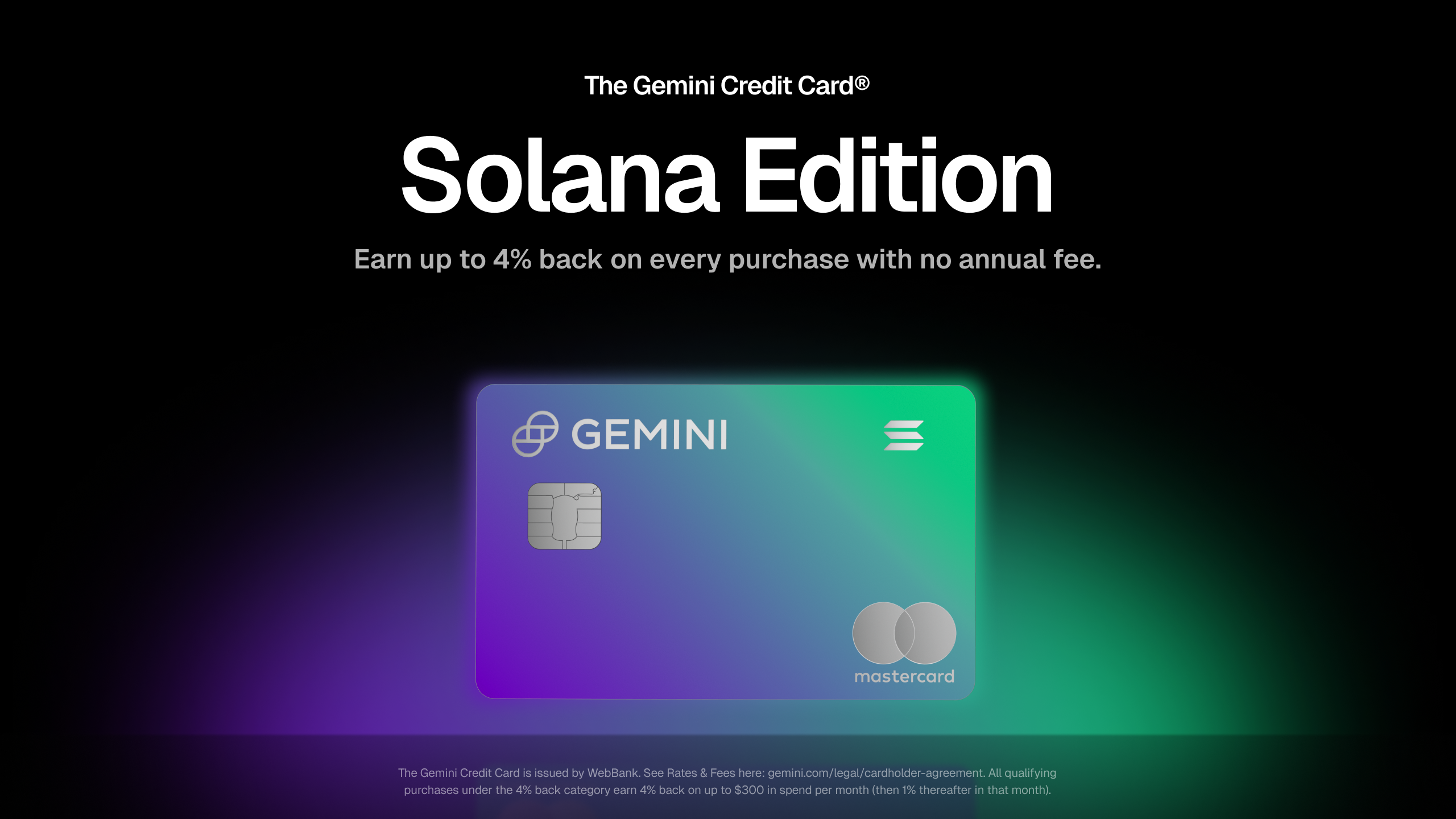

Gemini Releases Solana Edition of the Gemini Credit Card and Automatic Staking for Solana Rewards

WEEKLY MARKET UPDATE

OCT 16, 2025

Spot BTC and ETH ETFs Waver Amid Dwindling Tailwinds, Ripple Announces $1B Deal for GTreasury, and Strategy Resumes Bitcoin Buys

INSTITUTIONAL

OCT 15, 2025