AUG 19, 2025

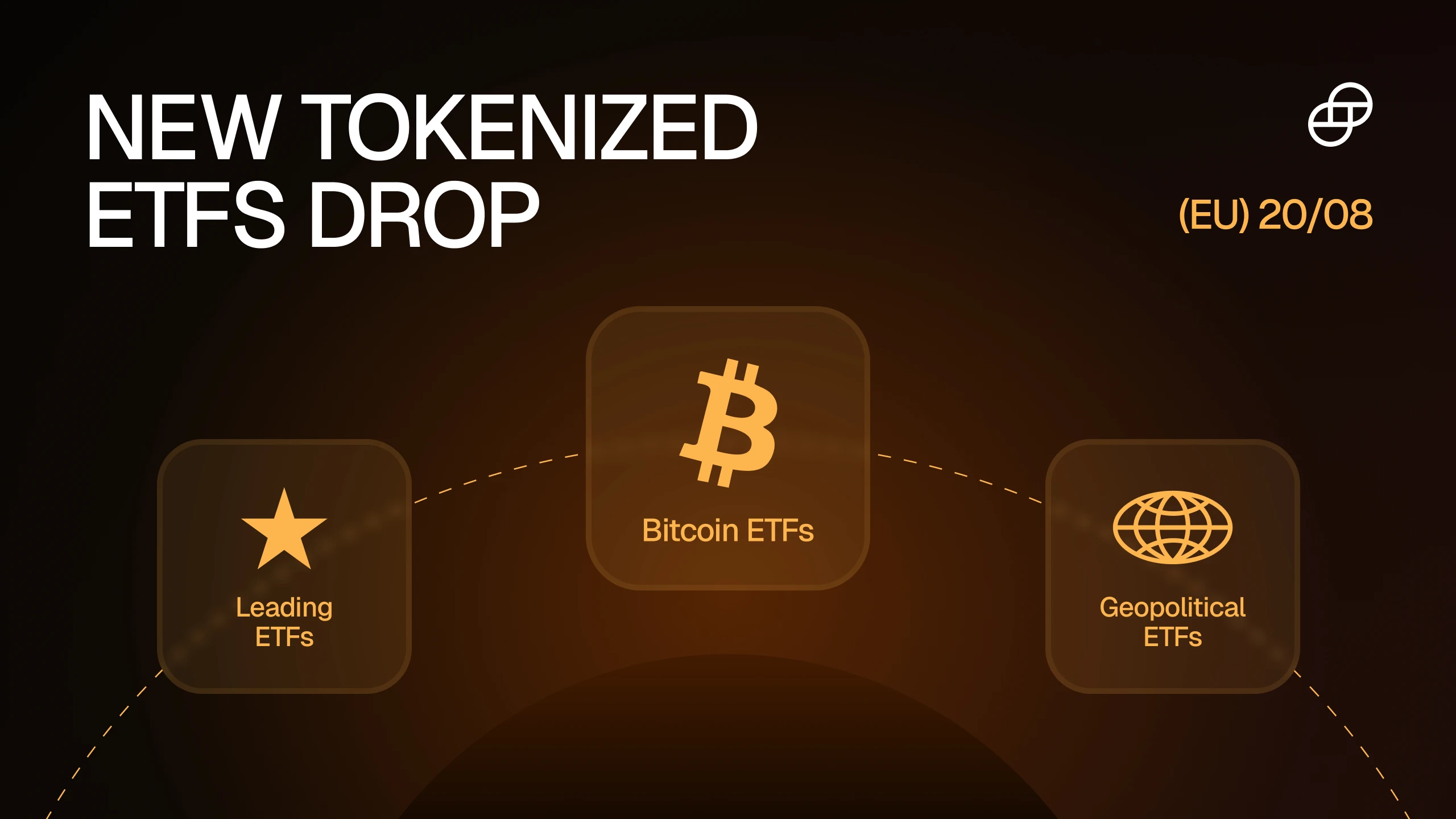

Gemini’s New Tokenized ETF Offerings for EU Users Are Now Live

Gemini customers in the European Union can now access a range of tokenized ETFs on Gemini1 and take their positions fully onchain.

As of August 20, eligible EU users can now trade tokens linked to some of the largest exchange-traded funds, bringing institutional-grade ETF exposure directly into onchain portfolios.

As one of the first centralized crypto exchanges to offer tokenized stocks, these latest additions mean eligible EU-based Gemini users can now trade both tokenized stocks and ETFs, 24/5.

Gemini’s tokenized ETFs are minted through our partner Dinari2, a leading provider of tokenized U.S. public equities. By leveraging Dinari’s framework, Gemini ensures that each tokenized ETF share faithfully tracks the price of the underlying fund while offering a cryptographically secured onchain record.1

Below are some of the tokenized ETFs Now Available:

SPDR S&P 500 ETF Trust (SPY)

iShares Bitcoin Trust ETF (IBIT)

VanEck Bitcoin ETF (HODL)

Fidelity Wise Origin Bitcoin Fund (FBTC)

iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX)

VanEck Steel ETF (SLX)

Visit for more information.

Onward and Upward!

Team Gemini

[1] Tokenized stocks or dSharesTM are made available via a platform operated by Gemini Intergalactic EU Artemis, Ltd, (“Gemini”), which is authorised and regulated by the Malta Financial Services Authority (“MFSA”) under the Investment Services Act (Cap. 370, Laws of Malta). Gemini is authorized to provide the following MiFID investment services: dealing on its own account and with the execution of orders on behalf of other persons. Tokenized stocks offered in Europe are digital derivatives linked to public equity securities.

[2] About Dinari and dShares. Tokenized stocks offered by Dinari, Inc. (“Dinari”) are called dSharesTM. All dSharesTM are backed 1:1 by the corresponding U.S. equity and offer the same economic rights as the underlying security, where permitted. All dSharesTM are held with a regulated custodian and are issued by Dinari, a U.S. SEC‑registered transfer agent. More information about dSharesTM can be found here. Tokenized stocks offered in Europe are digital derivatives linked to public equity securities. dSharesTM are offered for purchase and sale directly from Dinari, which is not affiliated with Gemini or its affiliates.

These materials are for general information purposes only and are not investment advice or a recommendation or solicitation to buy, sell, stake, or hold any digital asset or security or to engage in any specific trading strategy. Gemini makes no representation or warranty of any kind, express or implied, as to the accuracy, completeness, timeliness, suitability or validity of any such information and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Derivatives are complex instruments involving a high degree of risk. These products are not suitable for all investors and require a full understanding of the risks involved and should seek independent advice if needed. Tokenized stocks offer risks associated with a direct investment in public securities. They may experience sharp price fluctuations due to market sentiment, economic conditions, earnings announcements, interest rate changes, and geopolitical events. Such volatility can lead to significant and sudden losses in token value. There may be fees and charges associated with the product which you should carefully consider.

ARTICLES CONNEXES

COMPANY

AUG 25, 2025

Introducing Ethereum & Solana Staking for UK Customers

COMPANY

AUG 25, 2025

Gemini Releases XRP Edition of the Gemini Credit Card and Broadens Availability of RLUSD for U.S. Customers

WEEKLY MARKET UPDATE

AUG 21, 2025