JUL 03, 2025

Gemini Releases New Batch of Blue Chip, TradFi, and Other Tokenized Stocks for EU Customers

Gemini has added more than 20 new tokenized stocks for European Union customers1, building on last week’s launch of MicroStrategy (MSTR).

As of Wednesday July 2nd, eligible EU customers can now access a range of additional blue-chip, tradfi, and bitcoin-related tokenized stocks via their Gemini account. More details on the launch are available here:

Newly available tokenized stocks include:

Blue-Chip Companies

- Apple Inc.

- Amazon.com Inc.

- The Walt Disney Company

- Alphabet Inc. Class A

- Microsoft Corp.

- Netflix Inc.

- Intel Corp.

- Dell Technologies Inc.

- Meta Platforms, Inc. Class A

Bitcoin-Related Companies

- Coinbase Global, Inc. Class A

- MARA Holdings, Inc.

- Circle Internet Group, Inc.

Traditional Finance (TradFi)

- SPDR S&P 500 ETF Trust

- Robinhood Markets, Inc. Class A

- Goldman Sachs Group Inc.

American Dynamism

- Boeing Company

- Lockheed Martin Corp.

- Tesla, Inc.

- Nvidia Corp

- Costco Wholesale Corp

Bonus

- Roblox Corporation

What are tokenized stocks?

Tokenized stocks are blockchain-based digital tokens that represent a single share of an underlying company. These tokenized instruments aim to mirror the economic value of the underlying securities and, where permitted, may include rights such as dividends.. Operating on a blockchain network like Arbitrum, they can be traded 24 hours a day in fractional amounts with near-instant settlement on a public or permissioned ledger.

For more information on tokenized stocks and to view the full list of available assets, please visit our Tokenized Stocks page.

Go Where Dollars Won’t!

Team Gemini

1Tokenized stocks or dSharesTM are made available via a platform operated by Gemini Intergalactic EU Artemis, Ltd, (“Gemini”), which is authorised and regulated by the Malta Financial Services Authority (“MFSA”) under the Investment Services Act (Cap. 370, Laws of Malta). Gemini is authorized to provide the following MiFID investment services: dealing on its own account and with the execution of orders on behalf of other persons. Tokenized stocks offered in Europe are digital derivatives linked to public equity securities.

These materials are for general information purposes only and are not investment advice or a recommendation or solicitation to buy, sell, stake, or hold any digital asset or security or to engage in any specific trading strategy. Gemini makes no representation or warranty of any kind, express or implied, as to the accuracy, completeness, timeliness, suitability or validity of any such information and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Derivatives are complex instruments involving a high degree of risk. These products are not suitable for all investors and require a full understanding of the risks involved and should seek independent advice if needed. Tokenized stocks offer risks associated with a direct investment in public securities. They may experience sharp price fluctuations due to market sentiment, economic conditions, earnings announcements, interest rate changes, and geopolitical events. Such volatility can lead to significant and sudden losses in token value. There may be fees and charges associated with the product which you should carefully consider.

ARTICLES CONNEXES

WEEKLY MARKET UPDATE

OCT 23, 2025

Fed Governor Signals “New Era” for Crypto, Evernorth Plots XRP Treasury, and Hong Kong Preps for SOL ETF

COMPANY

OCT 20, 2025

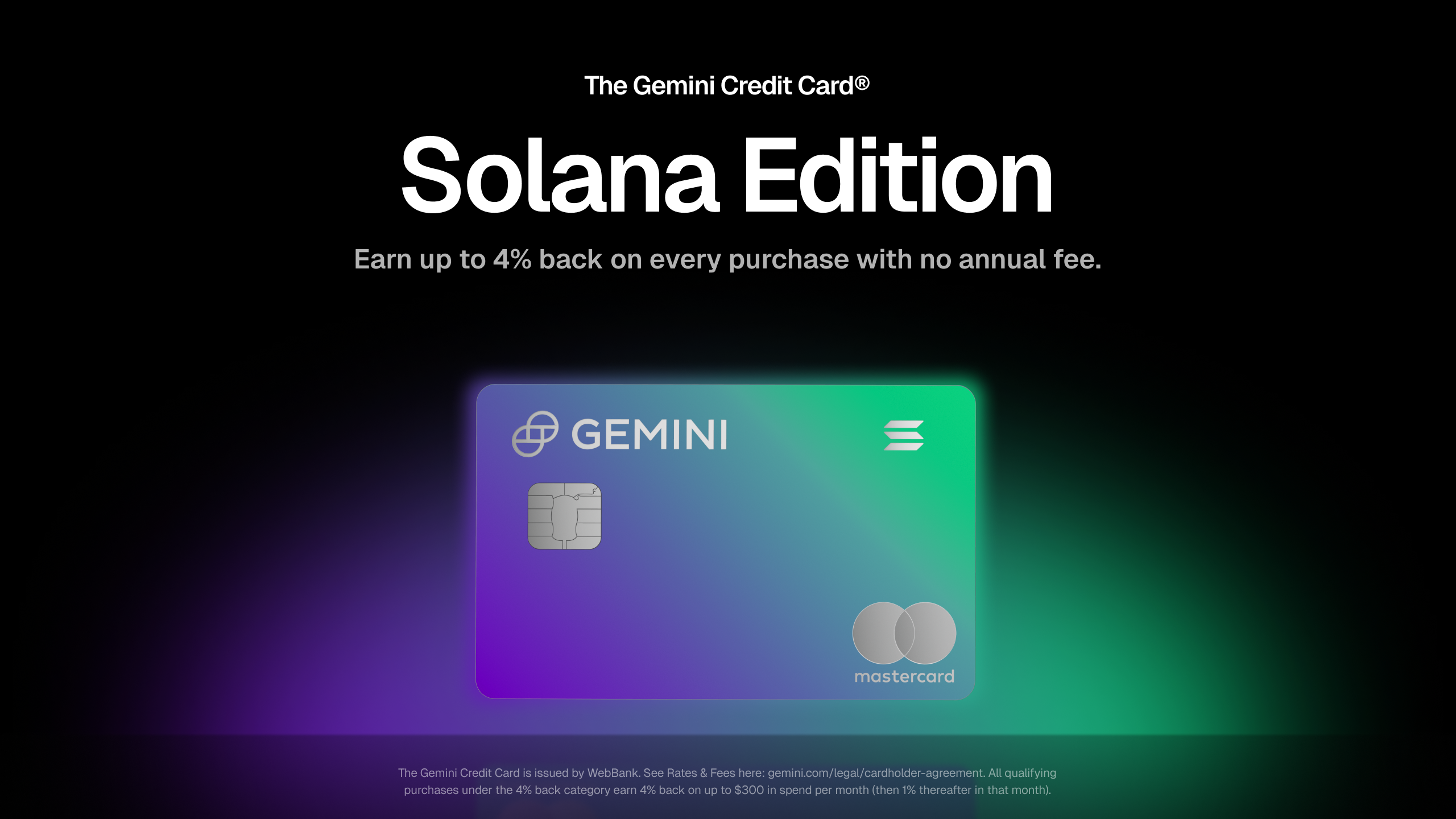

Gemini Releases Solana Edition of the Gemini Credit Card and Automatic Staking for Solana Rewards

WEEKLY MARKET UPDATE

OCT 16, 2025