SEP 25, 2025

Crypto Falls After GDP Jumps 3.8%, Tether Tries To Raise $20B, and Morgan Stanley Plans To Launch Crypto Trading

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about common social engineering techniques.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -7.24% | $109,553.90 |

$109,553.90

-7.24%

| |

Ether

ETH | -16.00% | $3,881.57 |

$3,881.57

-16.00%

| |

Uniswap

UNI | -22.80% | $7.4771 |

$7.4771

-22.80%

| |

Solana

SOL | -21.00% | $197.576 |

$197.576

-21.00%

| |

Livepeer

LPT | -18.20% | $5.8517 |

$5.8517

-18.20%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of September 25, 2025 at 2:38 pm ET. . All prices in USD.

Takeaways

- Crypto falls following GDP and jobs revision: The fell below $110,000 and the dropped to around $3,900 on Thursday after a revised GDP estimate from the US government said real GDP grew 3.8% in Q2 and weekless jobless claims dropped to 218,000.

- Tether reportedly eyeing $500B valuation: The stablecoin giant has reportedly engaged in talks with investors for a private placement deal that would raise between $15 billion and $20 billion and value the company at around $500 billion.

- Morgan Stanley to launch crypto trading for E*Trade customers: The firm announced this week it plans to launch bitcoin, ethereum and solana trading for E*Trade customers in early 2026 as part of a broader push into crypto and DeFi.

- Ethereum network overtakes TRON: The Ethereum network overtook Tron this week to become the primary blockchain for stablecoin USDT, with more than $80 billion in total supply on the network. The move marked a major shift in blockchain preferences as tradfi institutions begin launching blockchain products.

- ReserveOne Files for $1B SPAC merger: Digital asset treasury company ReserveOne has registered an S-4 with the SEC for an upcoming SPAC merger that aims to value the company at more than $1 billion. ReserveOne will be led by former Hut 8 CEO Jaime Leverton.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Crypto Prices Decline After GDP and Jobs Revision

Additionally, jobless claims dropped to 218,000 from 232,000 the week prior.

While the revision to GDP and jobless claims signals an economy growing more than previously believed, the GDP revision hurt chances the Federal Reserve cuts interest rates again next month.

The 10-year US Treasury yield increased to 4.20% following the news, with the S&P 500 and Nasdaq dropping 0.5% and Dow dipped 0.4%. Meanwhile, Bitcoin had traded in a bit of a lull in recent weeks before the latest pullback. The price of the world’s largest cryptocurrency is typically viewed as a risk-on asset that pushes higher when rates are low. The good news for crypto investors: Polymarket still puts the chances of a 25-point rate cut in October at 80%.

Tether Aims To Raise $20B at $500B Valuation

The deal would give the investors a roughly 3% stake in the company, though the deal is still in its early stages and the raise could still be much lower, per the report. If it strikes a deal at the $500 billion valuation, it would become one of the world’s most valuable private companies, putting it among late-stage private companies like SpaceX and OpenAI.

In a post on X, Tether CEO Paulo Ardoino confirmed the company was in discussions with investors. “Tether is evaluating a raise from a selected group of high-profile key investors, to maximize the scale of the Company's strategy across all existing and new business lines (stablecoins, distribution ubiquity, AI, commodity trading, energy, communications, media) by several orders of magnitude.”

Based in El Salvador, Tether issues USDT, the world’s largest stablecoin by market cap. In Q2, the company reported $4.9 billion in profit. The company recently announced plans to launch in the US and hired White House digital assets advisor Bo Hines to advise on its US strategy.

Morgan Stanley To Launch Crypto Trading on E*Trade

The firm will partner with crypto infrastructure provider Zerohash to power the launch, with plans to initially offer trading for bitcoin, ethereum, and solana. Morgan Stanley also reportedly plans to launch an onchain wallet after what they’re calling “phase one” of the firm’s push into the crypto ecosystem.

Big banks have recently started scrambling to offer digital asset services for customers after President Donald Trump instituted a crypto-friendly regulatory approach to the sector after taking office in January. Additionally, Congress passed the stablecoin-focused GENIUS Act earlier this year and a comprehensive market structure bill for digital assets could pass by the end of the year. Passage could offer a green light for tradfi institutions to continue to push into the digital asset economy,

Ethereum Retakes Lead for USDT Supply

The Ethereum network again became the primary blockchain for USDT transactions this week, with approximately $80 billion in supply. The development comes months after the Tron network overtook Ethereum in March as the stablecoin’s highest blockchain by volume, signaling a major change in infrastructure preferences.

Ethereum has experienced a resurgence in recent months as tradfi institutions launch their own stablecoins, leveraging the network for payment rails. At the same time, publicly-traded companies have established their own ethereum treasuries in hopes of capitalizing on potential price gains, pushing the price of ethereum up 17% year-to-date.

While some have criticized the Ethereum network for being slower and more expensive than rival blockchains, the surge in USDT volume should help reinforce the network’s position as the preferred settlement layer for tradfi firms pushing into blockchain-based products.

ReserveOne Registers for $1B Nasdaq Listing

ReserveOne plans to raise more than $1 billion through the listing and launch a diversified digital asset portfolio consisting of bitcoin, solana, and other tokens. The company will be led by Jaime Leverton, who previously served as the CEO of bitcoin mining company Hut 8. The deal is expected to close in Q4.

Blockchain.com, Kraken, Galaxy Digital, and Pantera Capital will reportedly participate in the transaction, investing up to $750 million in equity and debt offerings. When the company announced the SPAC deal earlier this year, it said the digital asset treasury strategy would mirror a US Strategic Crypto Reserve instituted by the US government.

-Team Gemini

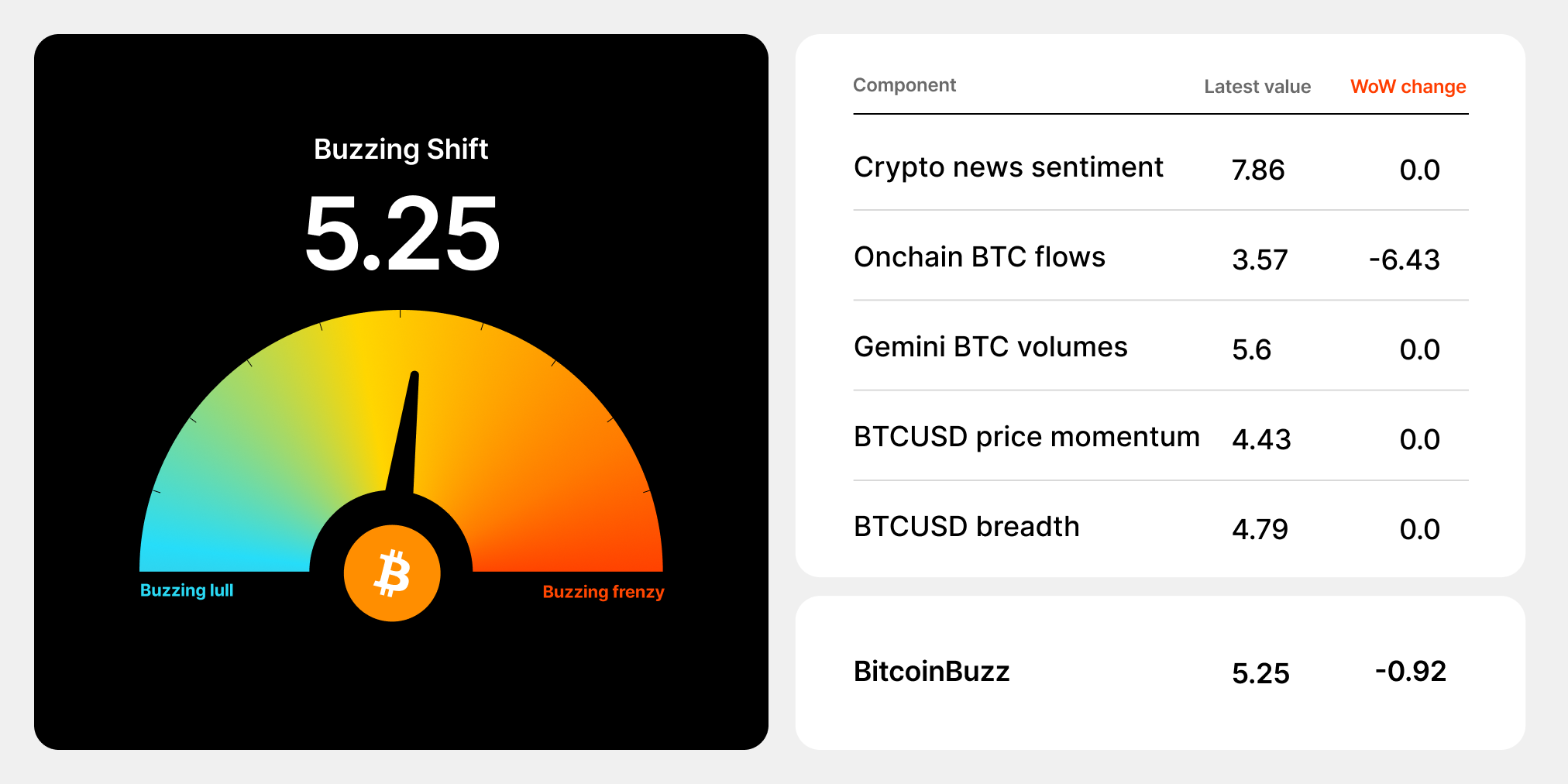

data as of 5:16 pm ET on September 24, 2025.

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

Common Social Engineering Techniques

Social engineering techniques rely on human vulnerabilities, not the technical prowess of a potential hacker. Social engineering is used to gain unauthorized access to sensitive data, cryptocurrency wallets or accounts, or to induce victims to download malware onto computers and networks to enact further damage. Such techniques include phishing, baiting, quid pro quo attacks, pretexting, and tailgating.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

ARTICLES CONNEXES

WEEKLY MARKET UPDATE

OCT 30, 2025

Federal Reserve Cuts Rates Again, Altcoin ETFs Go Live, and Mt. Gox Delays Creditor Repayment

COMPANY

OCT 30, 2025

Worldcoin (WLD) and Doublezero (2Z) Are Now Available On Gemini

COMPANY

OCT 27, 2025