Contents

Crypto Tax in Singapore (2025 Guide): What Every Investor and Trader Needs to Know

Understanding Singapore’s Tax Framework for Crypto

The first step to navigating crypto tax in Singapore is to understand the country’s tax framework. To determine your tax obligations, you need to know how IRAS classifies your crypto transactions, as this will determine whether your profits are subject to GST or income tax.

Unlock the future of money on Gemini

Start your crypto journey in minutes on the trusted crypto-native finance platform

How IRAS Classifies Crypto Transactions

For Goods and Services Tax (GST) purposes, IRAS categorises crypto transactions based on their nature and date. Since 1 January 2020, to earn interest are GST-exempt. When paying for goods or services with digital payment tokens, GST is applied to these items themselves, not the tokens used for payment.

Separately, IRAS also classifies crypto transactions for . If a business or individual earns crypto in exchange for providing goods or services, that income is taxable.

Resident tax rates range from 0 to 22%, depending on income level.

Non-residents are taxed at 15% on employment income and 22% on other income.

Refer to the table below for a detailed breakdown of applicable rates.

Source:

Real-World Examples

1. Individual Investor

You buy Bitcoin on a crypto exchange and hold it as a personal investment for several months. You later sell it for profit and pay no income tax. This is because the profit earned is treated as .

2. Professional Trader

You are based in Singapore and actively trade crypto, for example, using bots or trading frequently throughout the day. If IRAS determines that your trading activity is systematic, frequent, and profit-driven, it may be classified as business income, and your profits would be subject to income tax.

3. Company Issuing Tokens

A Singapore-registered company develops a blockchain platform and issues its own native utility tokens. Revenue generated from the sale of these tokens is considered sales income and is subject to .

Capital Gains & Personal Crypto Investment

This section outlines how profits from crypto-related activities may (or may not) become taxable income in Singapore.

When You Don’t Owe Taxes

There is no , a benefit many crypto investors enjoy. If you’re holding crypto for personal investment, without engaging in frequent or organised trading, your gains are generally not subject to tax.

Long-term holding or occasional buying and selling for personal use also incurs no tax.

Holding Crypto vs. Realising Gains

Holding incurs no immediate tax, even if its value rises (unrealised gains), because, as mentioned, Singapore does not impose capital gains tax on individuals.

However, tax may apply upon disposal of the crypto if the transaction is considered part of a business activity (as outlined in the next section). Disposal includes selling crypto for fiat (e.g., SGD), trading crypto for another crypto, or using it to purchase goods or services.

In summary, if your crypto use is purely personal and not part of a business, these disposals are typically not taxed. But if IRAS considers your activity as trading or business-related, the profits may be subject to income tax.

Signs You’re Trading as a Business

IRAS may classify your crypto profits as business income – and therefore taxable – if your activities extend past personal investment. Grasping that distinction is key to managing your tax obligations.

To determine if your trading activity is considered a business, IRAS looks at several indicators, also known as “badges of trade”:

Frequency and volume: A higher frequency and high-volume transactions suggest trading activity.

Holding period: Short holding periods can be taken as a speculative intention to profit from quick price movements.

Organisation: Systemic or structured buying and selling may resemble business operations.

Supplementary work: Marketing efforts, for example, suggest commercial intent.

Intention: Refers to your primary purpose when acquiring the crypto.

If one or multiple factors apply, IRAS may treat your activity as a business, and profits may be subject to income tax.

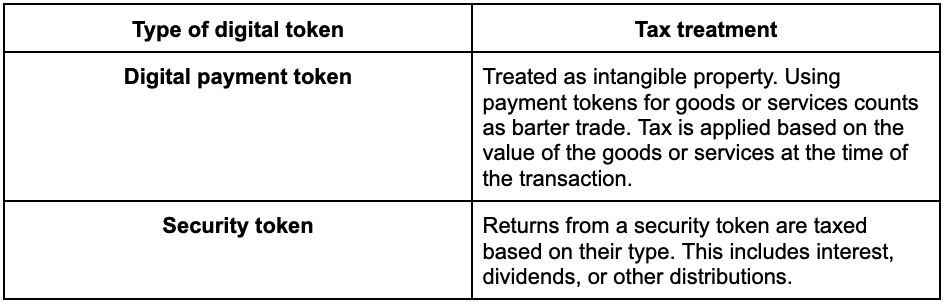

Digital Payment Tokens vs. Security Tokens

IRAS defines digital payment tokens (DPTs) as intended as a medium of exchange. Examples include Bitcoin (BTC), Ether (ETH), and Litecoin (LTC).

In contrast, security tokens (e.g. ) are digital representations of for specific assets. They share traditional securities' regulatory protections.

Below is a summary of how to both digital payment tokens and security token transactions:

Tax Treatment of Specific Crypto Activities

Now that we have covered the basics of GST, income, and crypto tax in Singapore, we can examine how specific activities are taxed.

Airdrops, Forks & Token Giveaways

1. Airdrops

An airdrop is a free distribution of cryptocurrency tokens to multiple wallet addresses. Airdrops you acquired without providing anything in exchange (e.g., casual airdrops from holding a token) are generally not taxed upon receipt, as the . Selling unsolicited airdrops, however, is considered payment for work, and those profits are taxable.

2. Forks

A blockchain fork alters its protocol. A hard fork creates a new, incompatible chain and tokens, while a soft fork updates without new ones. In Singapore, unsolicited tokens from a hard fork are not taxable on receipt. Selling these tokens later creates taxable profit only if your activities constitute a business.

3. Token Giveaways

Token giveaways, when provided in exchange for completing specific actions like promoting a project or completing marketing-related tasks, are taxable. This is because IRAS categorises these rewards , which are subject to tax.

Staking and Mining Cryptocurrency Rewards

Tax implications in Singapore for one-off token receipts (e.g. airdrops, forks) are distinguishable from active crypto earnings. Staking involves locking crypto to support a network and earn rewards. Mining uses computing power to validate transactions and mint new crypto. Specific tax rules apply to earnings from these digital assets.

1. Staking Rewards

If your staking rewards exceed SGD 300 annually, you must declare this in your income tax return. IRAS might consider it a business, which means your profits would be assessable as tax.

2. Mining Rewards

If you are mining crypto as a hobby, you will likely not pay taxes on earnings. If you mine systematically, regularly, and develop an income, IRAS may deem it a business. IRAS does ; refer to the badges of trade shown above.

How to Report and Prepare for Crypto Taxes in Singapore

We understand that accurate reporting is essential for meeting your crypto tax obligations. Our step-by-step crypto tax prep guide below simplifies reporting for seamless tax compliance.

Step-by-Step IRAS Crypto Tax Prep

1. Understand Your Tax Residency

Start by determining your Singapore tax residency. Are you a tax resident or non-resident? This affects your obligations and applicable rates.

2. Identify Taxable Income

While individuals are exempt from capital gains tax in Singapore, business activities or service earnings are taxable.

3. Maintain Meticulous Records

Keeping records of all your crypto transactions is vital. Include details like:

Dates and times of all transactions.

Fair Market Value (FMV) of the crypto in SGD at the time of each transaction.

Purpose of the transaction.

The quantity of crypto involved.

Wallet addresses and exchange names.

Any associated fees.

4. Declare Income to IRAS

Individual taxpayers in Singapore typically use Form B1 (residents) or Form M (non-residents) to file returns. The e-filing deadline for annual tax returns is . Declare your crypto income by this date.

5. Consider GST Implications

Businesses supplying digital payment tokens should review GST thresholds and obligations. While digital payment tokens are , GST may still apply to other crypto services.

When to Consult a Tax Professional

Tax laws can be nuanced. We strongly recommend consulting a tax professional or advisory firm operating in Singapore if:

You engage in high-frequency trading or complex crypto activities.

You are unsure if your activities constitute a business.

You have significant crypto holdings or diverse income streams.

You need personalised advice on specific token types or complex financial structures.

Gemini Tools for Accurate Reporting

Gemini supports your tax preparation by providing comprehensive transaction history from our . Access and export all relevant data – including buys, sells, trades, cryptocurrencies, and stablecoins – directly from your Gemini account. A clear audit trail is what you’ll need to comply with Singapore’s tax regulations.

Gemini Digital Payments Singapore, Pte. Ltd has received for a Major Payment Institution license from the Monetary Authority of Singapore (MAS).

FAQ

1. Is cryptocurrency legal in Singapore?

Yes. The under the Payment Services Act 2019.

2. Do I pay crypto tax in Singapore if I only trade once or twice a year?

According to the badges of trade, this would constitute infrequent trading by an individual. This does not trigger income tax.

3. Are staking rewards taxed as income?

Yes, staking rewards are taxed as income if your annual income exceeds SGD 300. You should declare these as part of your assessable income.

4. What about NFTs or GameFi tokens?

The tax treatment for depends on their specific nature and use. Trading them habitually for profit may lead to business income tax. If they confer utility or security-like rights, existing tax rules for those categories may apply.

5. Do I need to declare foreign exchange or offshore wallets?

If your offshore wallets hold crypto that generates taxable income, you must declare it. While Singapore generally taxes income on a territorial basis, if received in or remitted to Singapore.

6. How are crypto derivatives taxed?

based on whether the activity constitutes a business. Income tax applies only if there are business profits from such trading, as individuals face no capital gains tax in Singapore.

Author

Is this article helpful?