Contents

How Does Bitcoin Work?

Learn the importance of Bitcoin in this beginner’s guide. Discover what is Bitcoin, how it works, its uses, and how to get started on Gemini’s secure platform.

Summary

Bitcoin is the most well-known cryptocurrency, making waves in global finance. So, what exactly is it, and how can you take part? This beginner's guide will walk you through the essentials of what Bitcoin is and how it functions in today's digital economy.

Bitcoin 101

What is Bitcoin?

Bitcoin (BTC) is a decentralised digital currency that was created by the pseudonymous developer Satoshi Nakamoto.

It's designed to work without the control of a central bank or government — it operates on a peer-to-peer network where users can make transactions directly with one another, bypassing intermediaries. This independence from traditional financial institutions allows Bitcoin to be both innovative and accessible.

Bitcoin Is a “Virtual” Currency

As a form of virtual currency, Bitcoin exists solely online, functioning through a transparent ledger known as Bitcoin blockchain. Each transaction is recorded on this distributed ledger, ensuring all the transactions remain secure and visible.

The Origins of Bitcoin

Bitcoin emerged in 2008 when an individual or group using the pseudonym Satoshi Nakamoto published a groundbreaking white paper titled "." This document outlined a revolutionary vision for a decentralised digital currency that could operate without intermediaries.

The first Bitcoin block, known as the Genesis Block, was mined on January 3, 2009, marking the official launch of the Bitcoin network. In its early years, Bitcoin was primarily adopted by technology enthusiasts and cryptography experts who recognised its potential to transform monetary systems. The first real-world Bitcoin transaction occurred in May 2010, when programmer Laszlo Hanyecz famously purchased two pizzas for 10,000 BTC, an amount that would be worth hundreds of millions of dollars today.

How Are Bitcoin Transactions Validated?

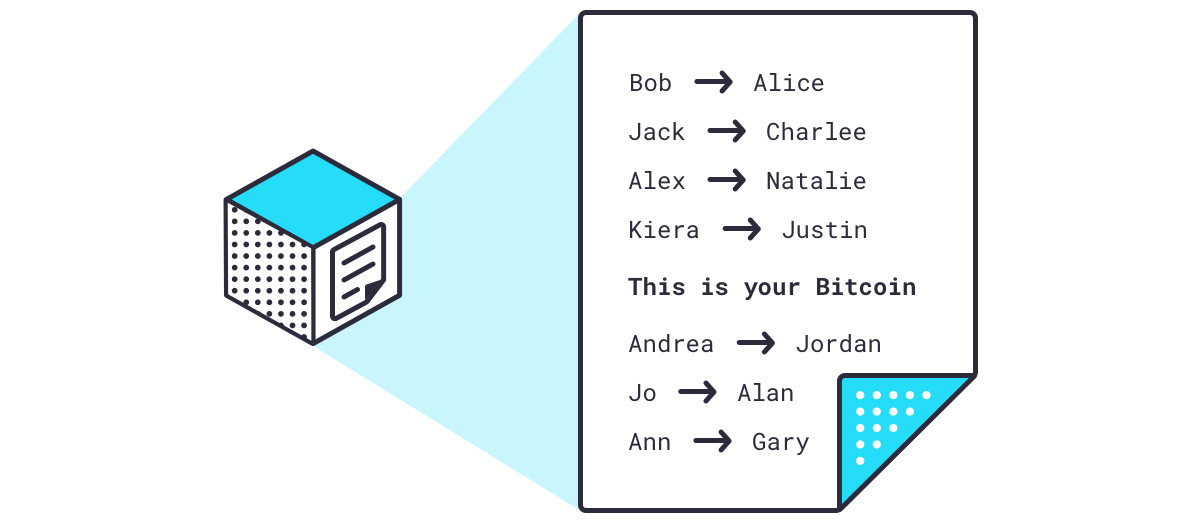

Every Bitcoin transaction is broadcast by the node where the transaction originated to all the nodes in the Bitcoin network. These nodes make sure that the transaction is valid, meaning they scan the entire blockchain to confirm that the person sending money indeed has that money and is authorised to send it. If those two conditions are met the transaction is deemed valid.

Remember that Bitcoin is decentralised, which means that thousands of Bitcoin nodes in aggregate have to agree that a transaction is valid. Even if a few bad actors validated a transaction falsely, thousands of other nodes would not, and the transaction would not be confirmed. This makes the probability that a valid transaction is recorded extremely high and the probability that a false transaction is recorded extremely low — making Bitcoin incredibly safe and secure to use.

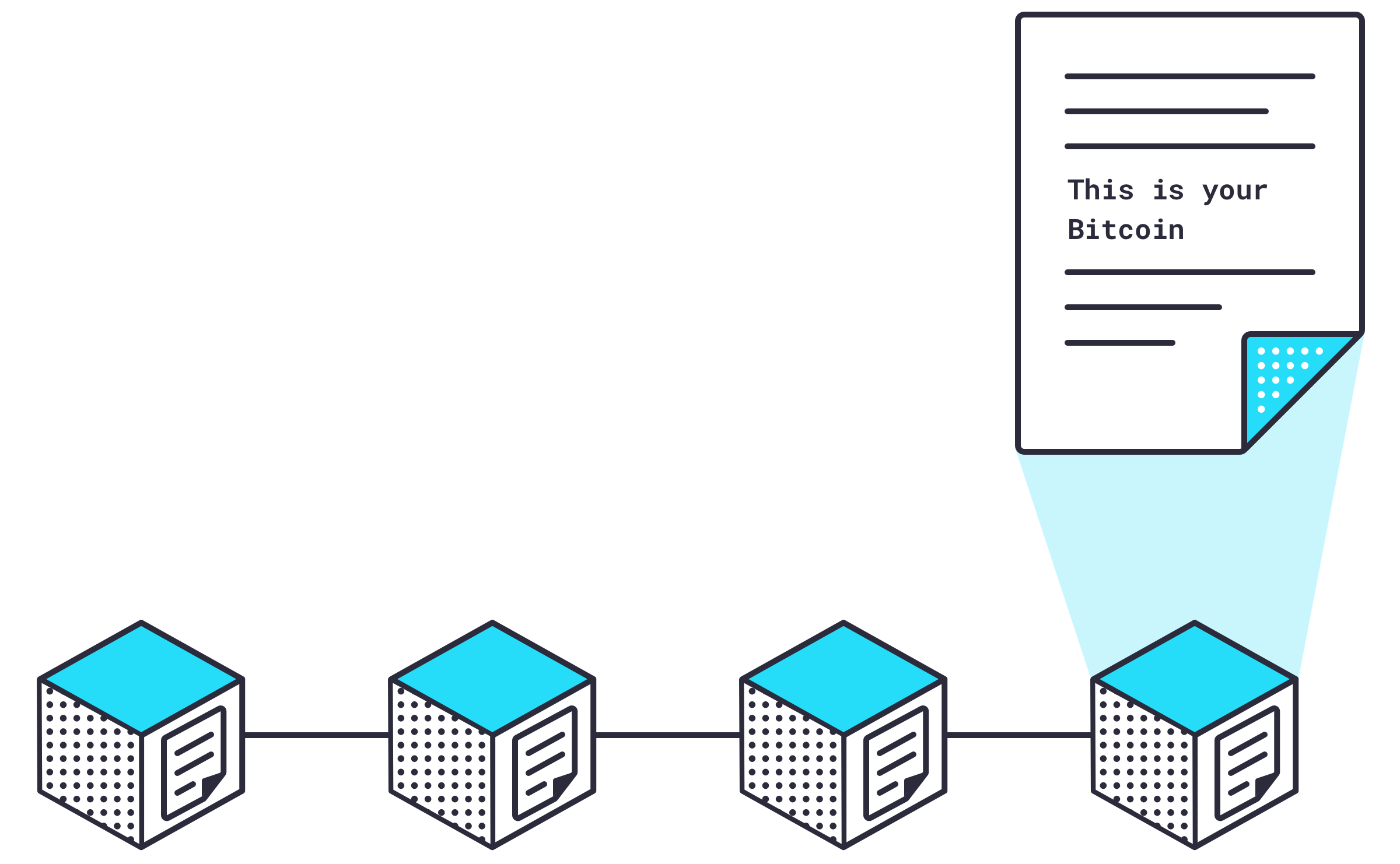

Every 10 minutes or so, all the latest valid transactions are organised into a block of data which is then sent out to the entire network to be secured in the blockchain.

A special subset of nodes called take unsecured blocks of data and do a couple of things to secure that block in the Bitcoin blockchain.

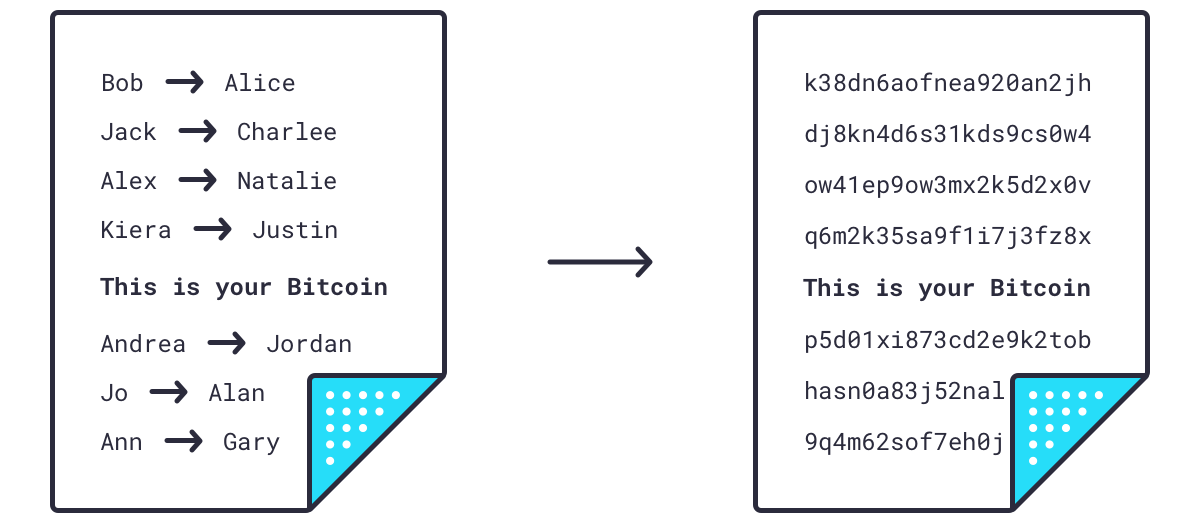

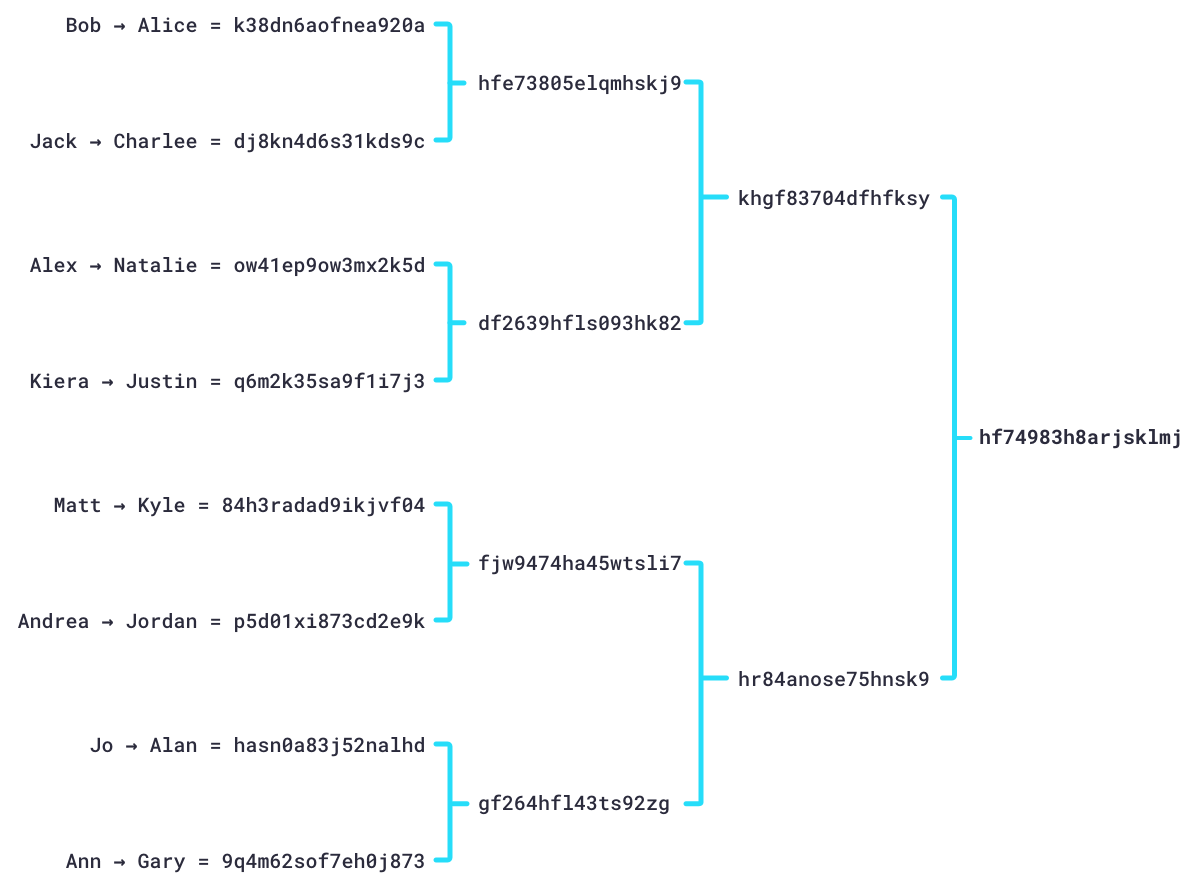

First, they take every transaction in the block and run it through an algorithm that takes each transaction and creates a unique identifying signature of 64 letters and numbers called a .

So now we have a block of transactions that have been compressed into hashes. They are then compressed further by pairing hashes together and creating a new hash for the pair. This is done until the entire block of transactions is represented by a single hash.

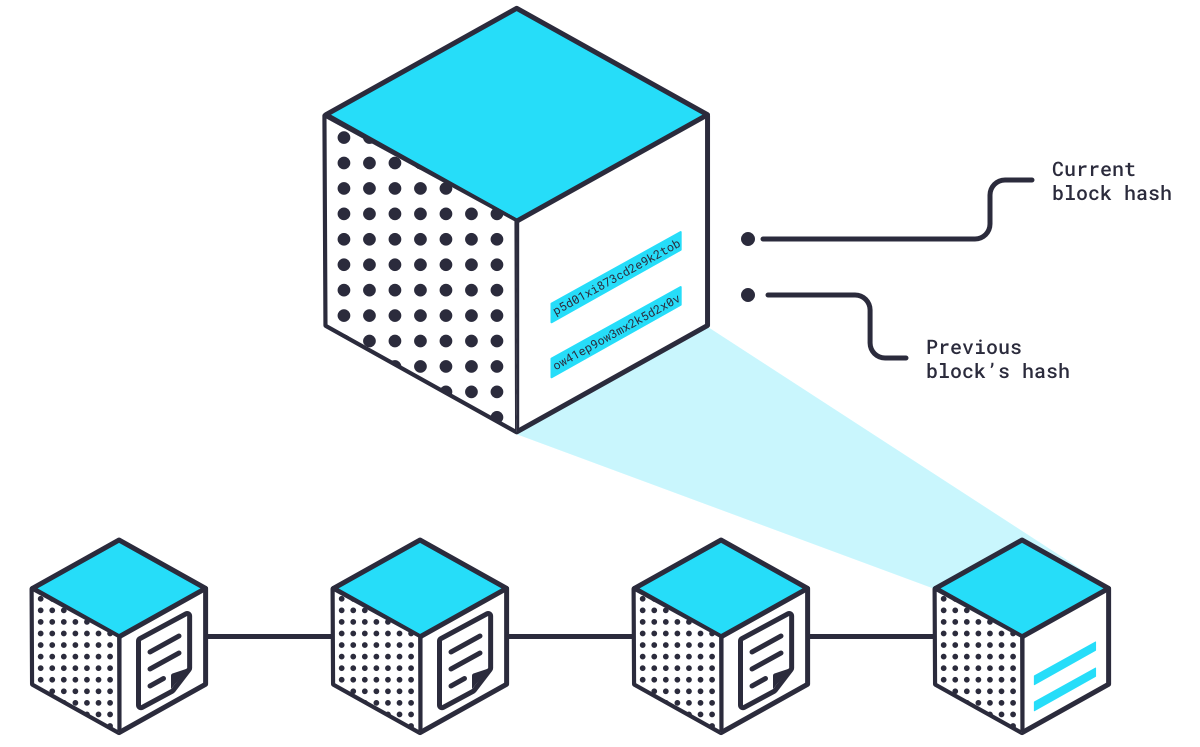

Then, the hash from the previous block is added to the block.

So now our block has the hash that represents all the current transactions in the block and the hash that represents all the transactions from the previous block. This is how the “chain” in “blockchain” is formed. If a single byte of data from any previous block were to change, it would invalidate all future blocks because every single hash going forward would change and break the blockchain.

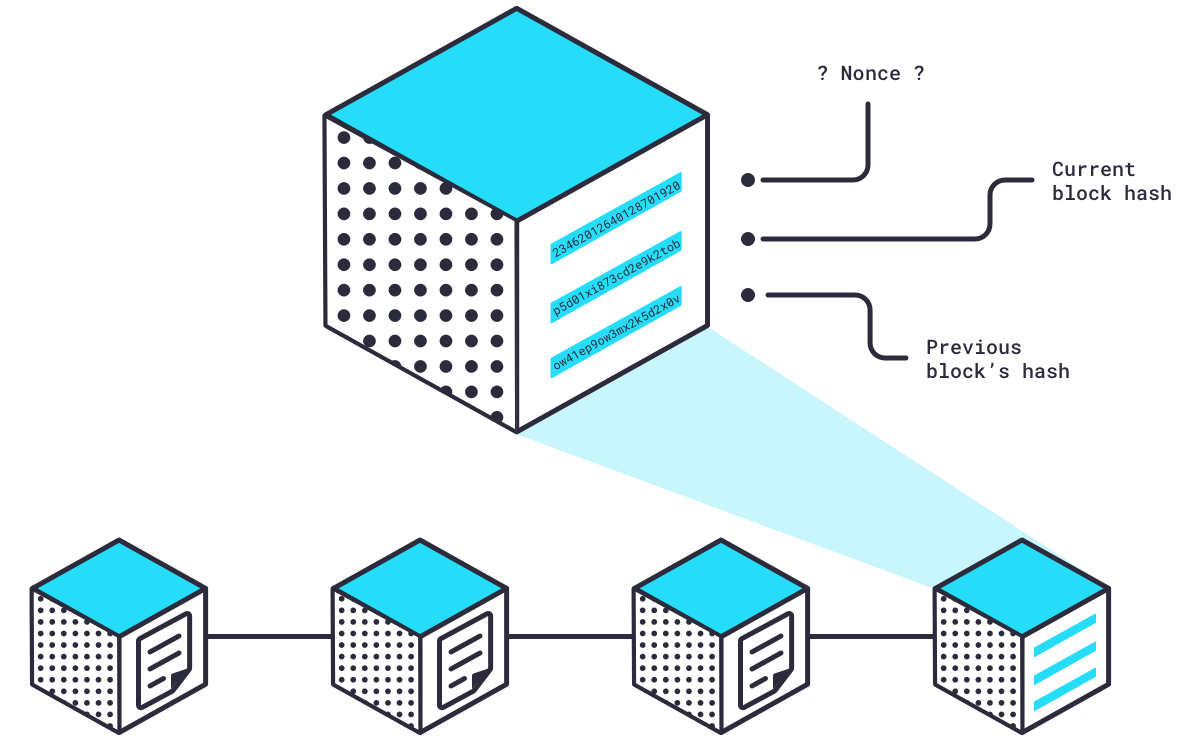

The final piece of the block is a random number called a , and this is where the miners really get to work.

The nonce and the two hashes in the block together need to create a hash that meets a certain set of criteria established by the software that powers the Bitcoin network. The only way to find a valid hash is by trying random nonce numbers until the hash criteria is met.

How Can I Use Bitcoin?

Bitcoin has a range of , from investments to everyday purchases.

Here’s a look at some of the most common ways to use Bitcoin:

Buying Bitcoin

To buy Bitcoin, you’ll need a digital wallet to store your Bitcoin (BTC). After setting up your wallet, the next step is choosing a reliable crypto exchange platform, such as , where you can .

These cryptocurrency exchanges guide you through the process, making it easy to start your crypto journey. For Singaporean users, Gemini offers a straightforward onboarding guide on in Singapore through various payment methods including bank transfers and PayNow.

Spending Bitcoin

Bitcoin is increasingly accepted by both online and physical retailers. In Singapore, adoption is growing steadily with like Charles & Keith now accepting Bitcoin payments.

Additionally, Bitcoin can be used to send international remittances. For Singaporeans with family abroad or businesses with international partners, Bitcoin offers a faster and often more cost-effective alternative to traditional wire transfers, with transactions settling within minutes rather than days.

Legal and Secure Bitcoin Transactions

While Bitcoin is legal in most regions, it’s crucial to understand local regulations and use secure platforms. Singapore has established itself as a progressive cryptocurrency hub in Asia. The Monetary Authority of Singapore (MAS) regulates digital payment token services, including cryptocurrency exchanges, under the Payment Services Act 2019 (PSA).

For added security, use reputable platforms that comply with MAS requirements, such as , and turn on two-factor authentication (2FA) to protect your account.

Note: Gemini holds an.

What Is Blockchain?

, ensuring that every transaction is secure and trustworthy.

Blockchain is a decentralised ledger that securely records each Bitcoin transaction. Each “block" in the chain contains information about multiple transactions, and once added to the blockchain, it cannot be altered. This immutability makes blockchain a reliable backbone for Bitcoin, ensuring each transaction is secure and tamper-resistant.

How Does Blockchain Secure Bitcoin Transactions?

Blockchain utilises cryptography and complex algorithms to secure transactions. The consensus process ensures that each transaction is verified by nodes across the network, reinforcing Bitcoin’s security and transparency.

Blockchain Benefits for Bitcoin Users

The transparency and security that blockchain offers distinguish it from traditional financial systems. Bitcoin users benefit from a secure, accessible network that doesn't rely on intermediaries or banks, granting more freedom in managing their finances.

How Is the Blockchain Secured?

, develop algorithms, and spend a lot of time and energy in the form of electricity to find the nonce that meets this criteria. The first miner to find the nonce and create the hash that meets the criteria broadcasts the hash to the entire network.

While creating the block’s hash is very difficult, checking that it meets the criteria is very simple. Nodes verify that the block’s hash meets the criteria, then add that block to their copy of the blockchain.

Remember, every Bitcoin full node keeps a copy of the entire blockchain, so the only way an invalid block can be added to the blockchain is if 51% of all nodes agree to its addition. While this is possible, it’s highly improbable, demonstrating another way that decentralisation ensures a secure and accurate record of transactions on the blockchain. Valid blocks are added to copies of the blockchain all over the world and Bitcoin miners begin working on the next block.

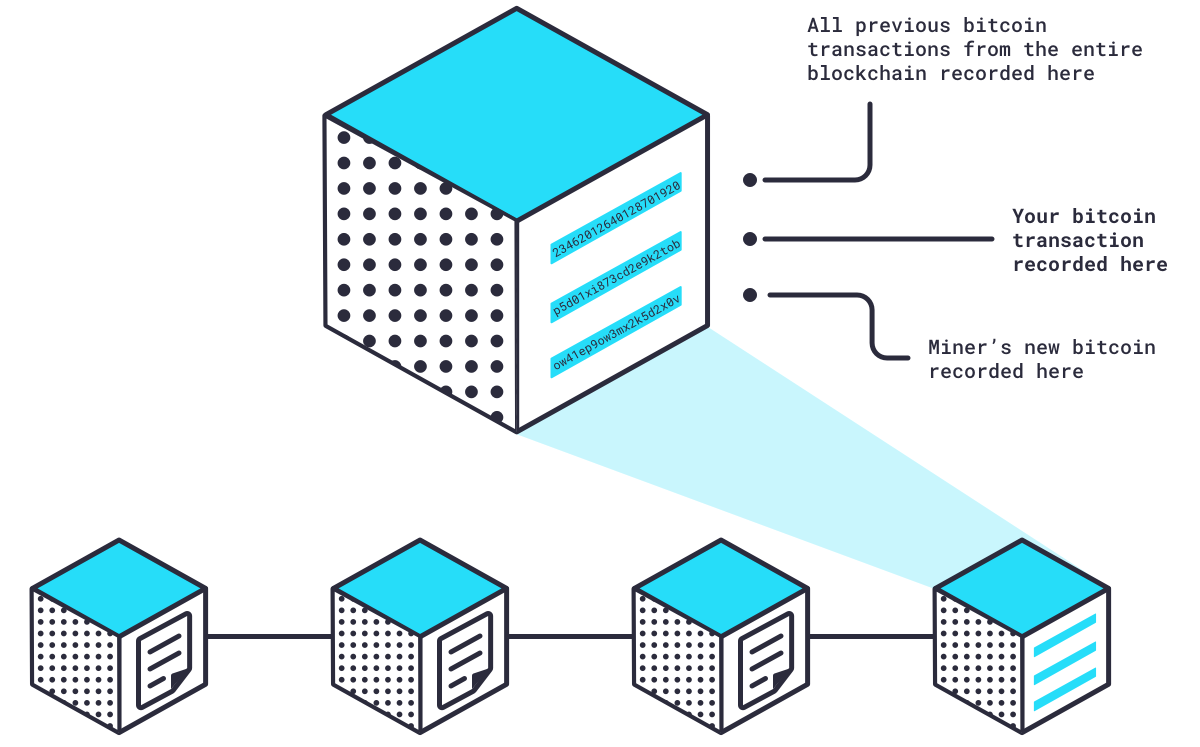

In exchange for their effort, which is called , miners are rewarded with new bitcoin. This is the only way bitcoin is created.

So, another quick recap.

Transactions are turned into multiple hashes.

Those hashes are turned into a single hash.

That hash is combined with the hash from the previous block.

Those two hashes are combined with a nonce to create a unique hash for the new block.

The new block’s hash is verified by the network, added to all copies of the blockchain, and miners get paid in bitcoin.

The way that miners get their Bitcoin is every mining team adds a transaction to the block in their node that states that they receive the pre-determined Bitcoin for successfully mining that block. The team that actually does it, gets the Bitcoin because their block is added to their copy of the blockchain, and subsequently all copies of the blockchain across the world. All other mining teams’ blocks are discarded.

What Is Bitcoin Mining?

Bitcoin mining plays a vital role in maintaining the network and verifying transactions.

How Do Miners Verify Bitcoin Transactions?

using a process known as Proof of Work (PoW), where they solve complex mathematical problems. This adds new blocks of transactions to the blockchain, keeping the network secure and accurate.

The Mining Reward: Financial Incentives

To incentivise mining, miners receive new Bitcoins as a reward. Over time, this reward decreases through , slowing the creation of new Bitcoin and reinforcing its scarcity.

However, the computing power required for mining is significant, and sustainability efforts are increasingly focused on making Bitcoin mining eco-friendly.

Energy Use and Environmental Considerations

Bitcoin mining's energy consumption has raised environmental concerns, as the Proof of Work consensus mechanism requires substantial computational power and electricity usage.

However, the industry is evolving toward sustainability. Many mining operations now utilise renewable energy sources like hydroelectric, solar, and wind power, While Singapore's climate and electricity costs make local mining unfeasible, Singaporean investors can support eco-friendly mining initiatives through their investment choices.

Is Bitcoin Mining Decentralised?

One of Bitcoin's defining features is its decentralised nature, which sets it apart from traditional financial systems.

Bitcoin Is Independent of Central Banks

In a decentralised network like Bitcoin, no central authority — such as a bank or government—controls the currency. Instead, thousands of maintain the network, ensuring its continued operation and security.

Advantages of a Decentralised System

Bitcoin’s decentralisation means users have more freedom and security. Without central bank involvement, Bitcoin operates independently, offering financial freedom and resistance to censorship.

Challenges of Decentralisation

While decentralisation provides significant benefits, it can also present challenges, such as scalability and limited regulatory oversight. Nonetheless, Bitcoin’s structure is a powerful advantage for users seeking an alternative to centralised finance.

Investing in Bitcoin

Bitcoin has become increasingly popular as an investment asset, appreciated both for its potential high returns and as a store of value.

Due to its limited supply, Bitcoin is often seen as “digital gold.” Many investors view it as a way to protect their assets from inflation, offering a safe harbour in volatile markets.

Are There Risks to Investing in Bitcoin?

Like any investment, Bitcoin (BTC) comes with risks that potential investors must carefully consider. Understanding these risks is essential for making informed decisions about Bitcoin investment.

Market Volatility: Bitcoin is known for its significant price fluctuations. The cryptocurrency market can experience dramatic swings within short periods, with prices potentially dropping 20-30% or more in a single day during market corrections. This volatility can be stressful for investors and requires strong risk tolerance.

Regulatory Uncertainties: While Singapore maintains a relatively , global regulatory landscapes continue to evolve. Changes in regulations, whether in Singapore or major markets like the United States, European Union, or China, can significantly impact Bitcoin's price and accessibility.

Security Risks: Despite blockchain's robust security, individual investors face several risks. Exchange hacks or platform failures could result in loss of funds, while losing private keys or seed phrases means permanent loss of access to your Bitcoin investment. Phishing scams and fraudulent schemes targeting cryptocurrency holders remain prevalent, and technical errors in transactions may be irreversible.

Limited Historical Data: Bitcoin has only existed since 2009, providing less than two decades of performance data. This limited history makes it difficult to predict long-term performance with confidence, unlike traditional assets with centuries of market behavior to analyse.

Liquidity Risks: While Bitcoin has generally good liquidity on major exchanges, during extreme market stress, you may find it difficult to sell at desired prices. Additionally, very large positions might be challenging to liquidate without impacting market prices.

Mitigation Strategies for Singapore Investors

Singapore investors can mitigate these risks with the following best practices:

Start Small: Only invest what you can afford to lose, typically recommended as no more than 5-10% of your investment portfolio

Dollar-Cost Averaging (DCA): Invest fixed amounts regularly rather than lump sums to reduce timing risk

Diversification: Don't concentrate all investments in Bitcoin; maintain a balanced portfolio across different asset classes

Continuous Education: Stay informed about market developments, regulatory changes, and security best practices

Tax Planning: Understand your tax obligations through resources like Gemini's

For beginners, it’s essential to approach Bitcoin with a long-term mindset and consider diversifying to minimise risk. Understanding the market can provide deeper insights into its potential.

Bitcoin’s history has shown significant , but long-term trends indicate growing adoption and value. As more institutions and users adopt Bitcoin, its role in the financial landscape is likely to expand.

The Future of Bitcoin

Bitcoin's influence on global finance continues to grow, with its decentralised structure paving the way for a new era of digital currency. It is positioned to play a significant role in reshaping the world of finances, bringing freedom and innovation to users worldwide.

today and take control of your financial future with Bitcoin. Gemini offers a trusted and secure platform to buy, store, and trade Bitcoin and other digital assets in Singapore.

Author

Is this article helpful?