Contents

The TLDR on Trading vs. Investing

The Investor's Toolkit

Investment Products: Vehicles and Instruments

Investment Products in Singapore

Legacy Trading 101: Profiting From Market Swings

Crypto Investing and Trading

Crypto Trading vs. Investing: Which Is Right for You?

Trading vs. Investing in Singapore: What to Know

What’s the Difference Between Trading and Investing?

Understand the crucial difference between trading vs. investing, and how to leverage crypto to build your wealth in Singapore.

Summary

Investing and trading are two different approaches to profiting from the financial markets. Investing is a long-term strategy focused on building wealth gradually, while trading is a short-term method aimed at generating quicker, more frequent profits. This article breaks down trading vs. investing, specifically in their goals and time horizons to help you understand which approach might be right for you.

The TLDR on Trading vs. Investing

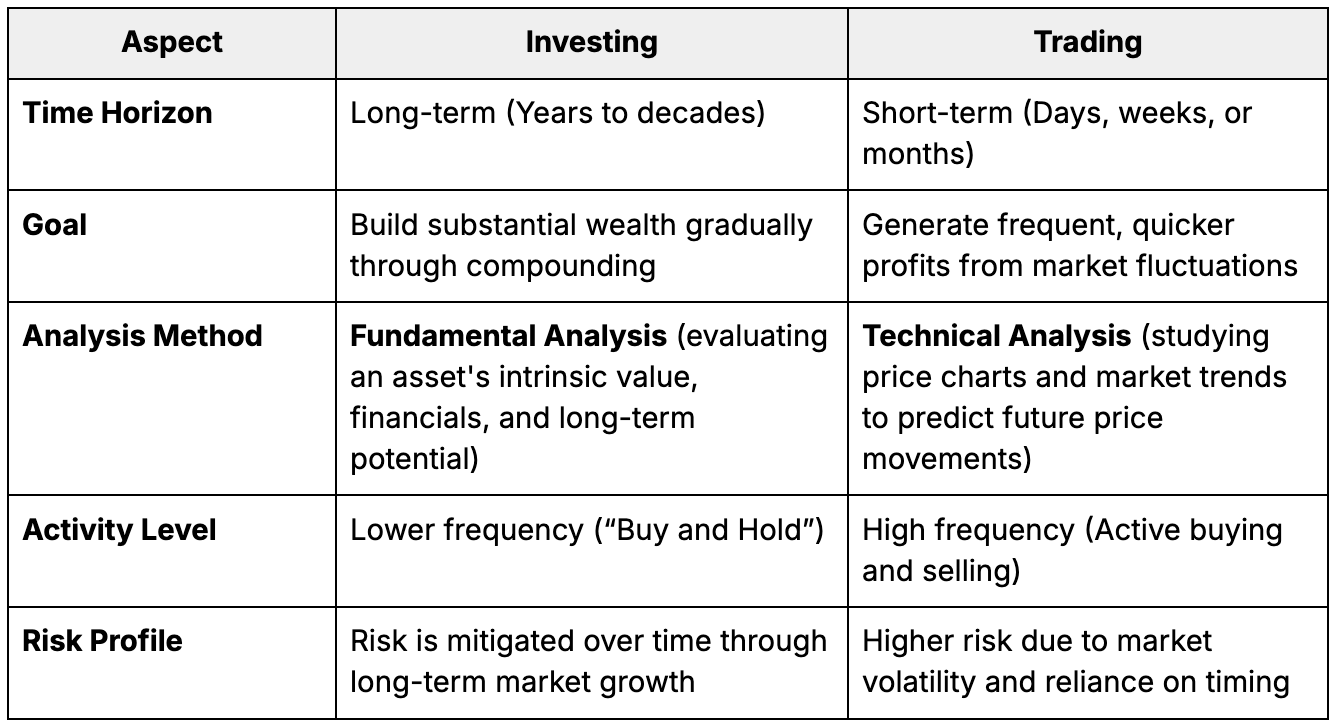

While both investors and traders aim to build wealth, their approaches are drastically different. Here’s a breakdown:

Legacy Investing 101: Building Wealth Over Time

The core idea of investing is to allocate capital into assets or projects you believe have strong long-term potential. It’s about understanding fundamentals, such as the scarcity and industrial demand for a commodity, the utility and network adoption of a blockchain, or the business model of a company, rather than reacting to short-term price swings.

This long-term conviction is associated with investors like Warren Buffett. He famously reminds people that investing isn’t about chasing numbers on a screen, but about owning something with real intrinsic value.

Although Buffett deals in traditional stocks, this philosophy can help crypto investors navigate volatility. In a market where 20% drops are routine, the key is distinguishing between market panic and fundamental failure. If the asset's utility and adoption remain sound, the daily price action shouldn't shake your resolve.

Buffett sets a good example of long-term investing: From 1996 to 2014, Berkshire Hathaway’s (Buffett’s company) stake in two of its star holdings, American Express and Coca-Cola, grew by more than $13 billion and $17 billion, respectively. How? By doing nothing — nothing, that is, except buying and holding these shares for decades.

This buy-and-hold philosophy is also reflected in Temasek Holdings’ approach, Singapore’s state investor. Their decades-long positions in foundational companies like DBS Bank and Singtel have helped build a record portfolio. Of this, 41% is invested in Singapore-based companies that collectively generate over S$150 billion in annual revenue.

The Investor's Toolkit

So, how do investors decide which companies to invest in? They primarily use a method called fundamental analysis – a structured way of assessing an asset’s financial health to determine its long-term value.

If an investor was interested in investing in a specific company, they would conduct a qualitative analysis, where they would look at the general health of the company. They would consider the company’s management, business goals, strategies, and heavily analyse its quarterly and annual reports submitted to the exchange it’s listed on, like the Singapore Exchange (SGX). Fundamental analysis also uses quantitative tools such as a company’s market capitalisation, price-to-earnings (P/E) ratio, dividend payout ratio, dividend yield, return on equity (ROE), and many other variables, both projected and historical, to make an informed decision.

Beyond Stocks and Bonds: A Look at Asset Classes

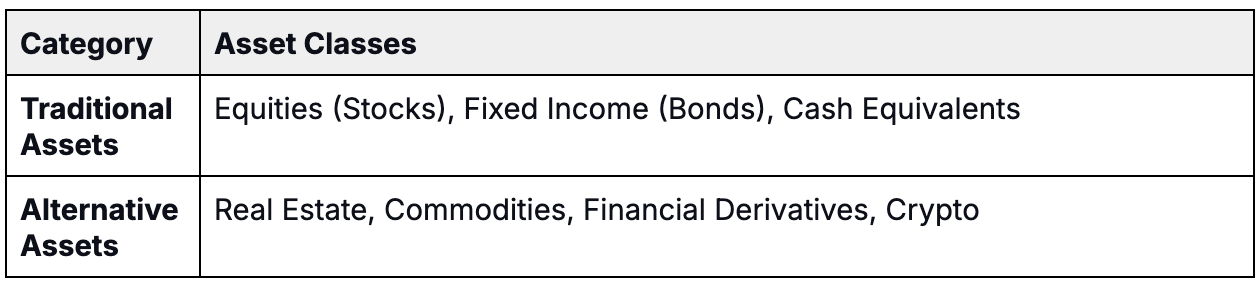

Investing, of course, is not just about stocks. Historically, the three main classes of investable assets have been equities (stocks), fixed income (bonds), cash equivalents, or money market instruments.

Today, however, there are more asset classes including real estate, commodities, futures, other financial derivatives, and crypto investments. Within these asset classes, there are many types of investment products.

Investment Products: Vehicles and Instruments

Investment products refer to all of the stocks, bonds, options, derivatives, commodities, and other financial instruments that you, as an investor, can buy. These products may be classified further by how they are structured.

For example, if you’re buying stocks, are they in the form of mutual funds, index funds, or standalone shares of a company? If you use your Central Provident Fund (CPF) to invest through the the CPF Investment Scheme (CPFIS), then you are already investing — in approved standalone shares as well as baskets of shares, like .

There are different products for institutional and individual investors, and they may be customized to reflect various investing styles, risk tolerances, goals, and time horizons. Regardless of their product mix, investors purchase investment vehicles for their potential to appreciate capital and pay distributions over an extended period.

Investment Products in Singapore

1. Stocks (or Equities)

When you buy a stock, you’re purchasing a small ownership stake in a publicly listed company - think of household names like DBS, UOB, or Singtel. Stocks are popular among investors seeking long-term growth (capital appreciation) or a steady income through dividends.

In Singapore, you can buy stocks through a brokerage using either a custodian account or a CDP (Central Depository) account. A key advantage of a CDP account is that your shares are held directly in your own name. When evaluating stocks, it’s important to consider the quality of the business, its dividend track record, and how easily the shares can be bought or sold (liquidity).

2. Real Estate Investment Trusts (REITs)

REITs allow you to invest in an extensive portfolio of properties—such as shopping malls, offices, or warehouses—without having to buy the properties yourself. Singapore is a major hub for REITs, with popular options like CapitaLand Integrated Commercial Trust. They are especially favoured by investors seeking regular income, as REITs distribute a portion of the rental income they collect to shareholders.

You can buy REITs on the Singapore Exchange (SGX) through any brokerage account. Key things to look for include how full the properties are (occupancy rates), the amount of debt the trust has (gearing ratio), and the reputation of the company managing the properties (sponsor strength).

3. Exchange-Traded Funds (ETFs) & Unit Trusts

Think of these as “all-in-one” investment baskets that provide instant diversification. Instead of picking a single stock, you can buy an ETF or Unit Trust that holds hundreds of different stocks or bonds.

ETFs typically track a market index (for example, the Straits Times Index ETF tracks the top 30 companies in Singapore), while a professional fund manager actively manages Unit Trusts. They are easily accessible through brokerage accounts, robo-advisors, and banks. The most crucial factor to consider is the annual fee, known as the expense ratio, as this directly impacts your returns.

4. Government-Backed Bonds

These are loans you give to the Singapore government, making them one of the safest investment options available. They include Singapore Savings Bonds (SSBs), Singapore Government Securities (SGS) Bonds, and Treasury Bills (T-bills). SSBs are particularly popular with beginners because they are very low-risk and highly flexible—you can redeem them any month without penalty. You can typically purchase these through local banks. When considering bonds, you’ll want to look at the interest you’ll receive (coupon rate) and when you’ll get your principal back (maturity date).

Legacy Trading 101: Profiting From Market Swings

While investing focuses on long-term growth, trading is a faster, more action-oriented discipline aimed at profiting from short-term market movements. This approach requires a different mindset, skillset, and toolkit.

The core idea of trading is to capitalize on short-term price movements. Instead of focusing on a company’s long-term health, a trader is more interested in market trends, supply and demand, and price volatility to generate quicker, more frequent profits.

For instance, a trader might buy shares of a company just before an expected positive announcement, just to sell them for a quick profit days (or even hours) later, regardless of the company’s fundamentals.

This focus on timing means traders are often categorised by how long they hold their positions, which can range from months to mere seconds:

: Holds positions from months to years

: Holds positions from days to weeks

: Holds positions throughout the day only; no overnight positions

: Holds positions for seconds to minutes; no overnight positions

So, what does this mean for you? If you choose to trade, your approach will be more active, technical, and quantitative, often requiring you to analyse charts and data while monitoring markets closely. It can be riskier, but for Singapore-based traders, a key advantage is the lack of capital gains tax on profits.

Crypto Investing and Trading

The reason we call the above sections “legacy” is that they refer to the traditional disciplines of investing and trading — that is, before the existence of crypto. Investing and trading in cryptocurrencies differ from the older tradition in many ways, including the following:

With crypto, you usually don’t own a piece of a company like you do with stock. The rare exceptions to this are , which could potentially grant the owner an equity share of a company.

Purchasing traditional securities is a much slower and more complex process than buying and selling crypto. For example, in less than ten minutes, you can transfer digital assets from an exchange to your private wallet.

In Singapore, crypto asset trading is regulated under the Payment Services Act 2019, overseen by the Monetary Authority of Singapore (MAS). While not as heavily regulated as traditional securities, this provides a clear framework for licensed and regulated crypto trading platforms.

Here’s a closer look at how the two approaches are applied in the crypto world:

Crypto Investing (“HODLing”)

This is the crypto equivalent of long-term stock investing. A crypto investor focuses on the fundamental technology and long-term potential of a blockchain project.

Strategy: Crypto investors buy digital assets like Bitcoin (BTC) or Ether (ETH) and hold them for years—a practice known as “HODLing.” Many use a strategy to invest a fixed amount regularly, smoothing out the impact of volatility. Their belief is in the asset’s future use case, such as Bitcoin as a store of value or Ethereum as a global settlement layer.

Crypto Trading

This is the crypto version of short-term stock trading. A crypto trader uses the market’s inherent volatility to generate profits.

Strategy: They analyse price charts to predict short-term movements and actively buy and sell various cryptocurrencies. The 24/7 nature of crypto markets provides continuous opportunities that don’t exist in traditional stock markets.

Ultimately, it’s more accurate to see crypto as a maturing class that blends the old with the new. While it runs on novel blockchain technology—enabling crypto-native methods like staking and liquidity provision—it still relies heavily on traditional finance infrastructure like order books and proven strategies like momentum trading. This fusion of traditional finance and new technology is what truly defines crypto investment trading today.

Crypto Trading vs. Investing: Which Is Right for You?

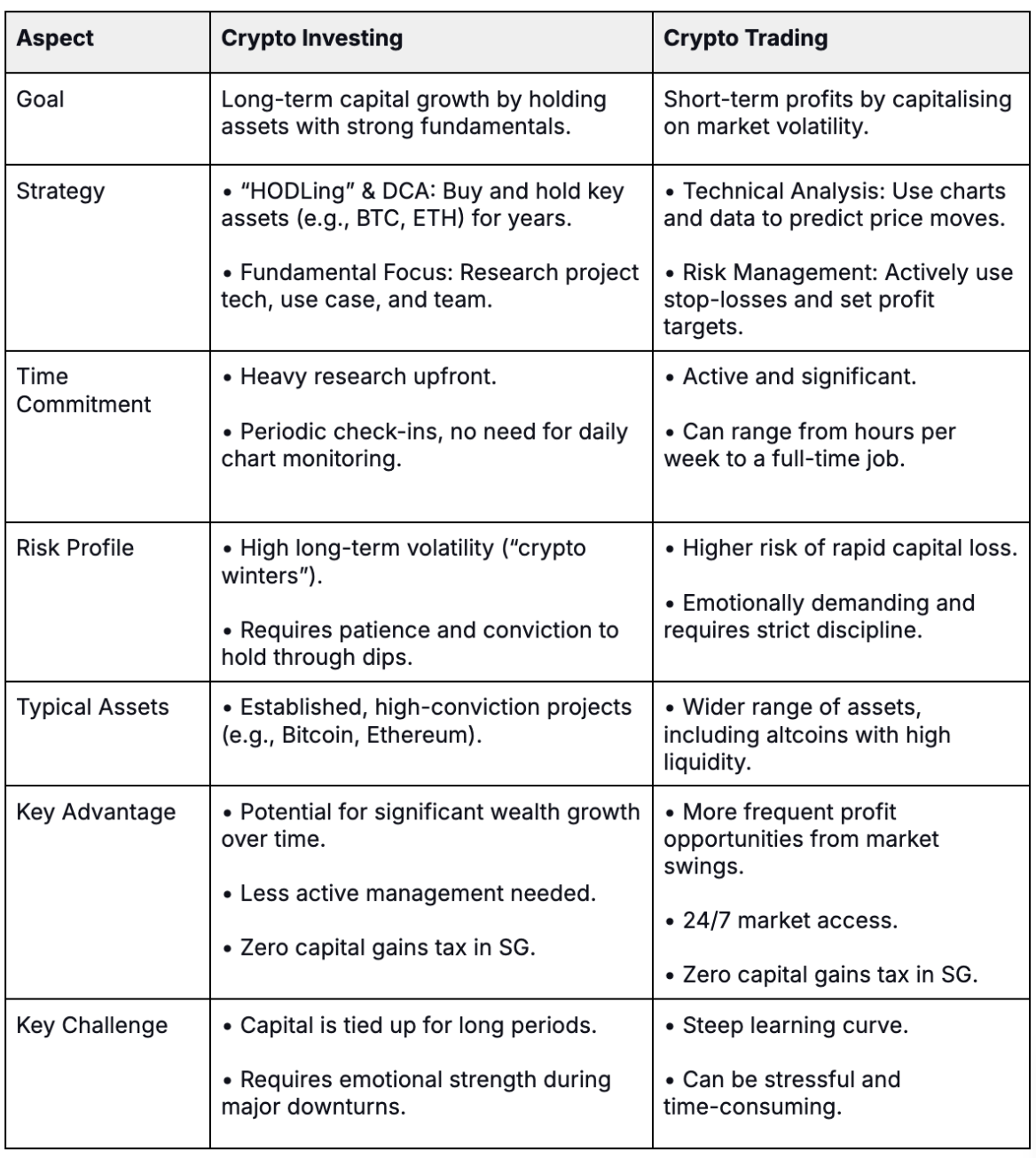

Deciding whether to invest or trade in crypto depends on your goals, strategy, and the time you can realistically commit.

Here’s a more in-depth breakdown:

It’s also important to note that crypto investing and trading are not mutually exclusive. Many people adopt a hybrid approach, maintaining a core long-term investment portfolio while using a smaller, separate pool of capital for short-term trading.

Trading vs. Investing in Singapore: What to Know

For many Singaporeans, traditional wealth-building through CPF and property is a cornerstone of financial planning. Think of crypto as a modern tool for potential wealth acceleration—a way to allocate a portion of your capital to a high-growth technology sector.

For crypto investors, you’re signing up to be an early-stage tech investor. Your life will involve reading whitepapers, researching the teams behind a project, and understanding its real-world use case. You’ll buy assets you believe in and hold them through extreme volatility, viewing major market dips (“crypto winters”) as a potential buying opportunity.

For crypto traders, you’re signing up for a more active, hands-on role. This involves analysing charts, identifying trends, and managing your emotions, often using an to execute strategies quickly. It can be intense and requires strict risk management, but the 24/7 nature of crypto markets means opportunities are always present.

Fortunately, Singapore provides one of the most transparent and secure environments in the world to begin this journey. Here’s what you need to know:

A Clear Regulatory Framework: Singapore does not treat crypto as the “wild west.” The Monetary Authority of Singapore (MAS) provides oversight, and platforms dealing with digital assets are regulated under the Payment Services Act 2019. This means you should only use licensed, MAS-regulated platforms for your investment trading to ensure your funds are secure.

The Zero Capital Gains Tax Advantage: This is the single biggest financial incentive for crypto in Singapore and a massive advantage compared to most other developed countries. For most personal investors, profits from buying and selling crypto are not taxed, meaning they are 100% yours to keep. This rule, however, primarily applies to simple capital appreciation. The tax treatment can differ for income generated from other crypto activities, such as staking rewards or airdrops. A full understanding of requires looking at how different types of earnings are classified by the IRAS.

The smart approach for many is one of balance: building a stable foundation with traditional investments while allocating a smaller, defined portion of their portfolio to crypto. Whatever your strategy, the key is to start with a secure and trusted platform.

Ready to get started? As a platform with an in-principle approval for the Major Payment Institution license from the Monetary Authority of Singapore (MAS), Gemini provides a secure and compliant environment for both crypto investing and trading. You can start your journey in minutes and access all the tools you need to build your portfolio.

Author

Is this article helpful?