Contents

How to Buy Bitcoin in Singapore (2025)

Your step-by-step guide to buying Bitcoin in Singapore. Understand the key requirements, set up your exchange account, execute your first BTC trade, and protect your investment with proven risk management strategies.

Summary

Buying Bitcoin (BTC) in Singapore is legal. For greater protection, it’s recommended to use a compliant and trusted platform. First, open and verify your account on the exchange of your choice. Once that’s done, fund it with SGD and place your first BTC order. Follow this guide to own Bitcoin in just minutes.

What You Need Before Buying Bitcoin

1. Documents for Identity Verification (KYC)

Exchanges must verify your identity before you trade. Have a valid photo ID ready (passport, NRIC, or driver’s licence) and, if needed, a recent proof of address, like a utility bill or bank statement.

If you’re a Singapore resident, Gemini makes this process especially easy with Singpass MyInfo verification, allowing you to skip document uploads and securely verify in just a few taps.

Unlock the future of money on Gemini

Start your crypto journey in minutes on the trusted crypto-native finance platform

2. Choose a Secure Crypto Wallet

When deciding where to store your BTC, you have several to choose from:

Exchange wallet. Easiest for beginners. are held offline (cold storage), with a small portion maintained in a for trading and transfers. Gemini also carries hot wallet insurance for specific loss events (limits and exclusions apply).

Self-custody. Prefer full ownership? Use a cold wallet in the form of a (e.g., Ledger, Trezor). Make sure to keep the drive somewhere safe – just ask the guy who spent years digging up a landfill to, currently worth £695 million. You can also use a non-custodial Bitcoin wallet like BlueWallet or Trust.

For larger, longer-term holdings, Gemini offers a dedicated Custody service with institutional-grade cold storage and reporting features.

Tip: With a , you will have sole control over your private keys, which gives you ownership of your Bitcoin and proves that the funds belong to you.

How to Buy Bitcoin in Singapore (Step-by-Step)

To buy Bitcoin in Singapore, you’ll need to open an account with an exchange. Follow these six steps to get started on Gemini:

Note: Gemini Singapore (Gemini Digital Payments Singapore, Pte. Ltd.) holds an IPA from the MAS for a Major Payments Institution licence.

Step 1 – Create an Exchange Account

on our website (or download the app) and click “Get Started.” Choose an account type (individual, joint, etc.) and select Singapore as your country as residence to access local features.

Step 2 – Verify Your Account

Complete the Know-Your-Customer (KYC) process to enable full trading and transfer capabilities. Make sure you have all the necessary documents ready. Once you have them, head over to the "My Account" tab and follow the instructions in the “Verify your identity” section.

You’ll receive an email when your account is verified. The approval process can take anywhere from a few minutes to a day.

Step 3 – Fund Your Account with SGD

Once verified, you can now deposit funds into your account. Gemini supports both SGD and USD deposits for Singapore customers.

FAST bank transfer: are free on Gemini and processed through DBS bank. In your Gemini dashboard, go to the Transfer button at the top right of your dashboard. Select “Deposit cash” from the dropdown and you will be shown your deposit instructions. The instructions will be emailed to your registered email address.

PayNow: Choose in the Gemini Mobile app to generate a QR code then complete the transfer in your banking app. If this is your first deposit, it may take up to 24 hours for the QR code to be generated. Your funds will appear in your Gemini SGD balance.

Singapore-issued debit card: Purchase BTC instantly with a debit card. Just keep in mind that after you make a purchase with your debit card, there might be a brief waiting period for withdrawals as the funds are processed.

Only deposit from a bank account in your name. Also, note that credit and prepaid cards aren’t accepted in Singapore for crypto transactions.

Step 4 – Buy Bitcoin and Select a Buy Order Type

Go to the “Buy/Sell” section and search for BTC from the list of assets. After tapping buy, you’ll have the option to choose whether you want to place a one-time purchase or a recurring buy.

Enter the amount of Bitcoin you want to purchase, or the amount of SGD you wish to spend. Check the current , review your trade details, and swipe to confirm your order.

Tip: With (DCA), you can buy Bitcoin in smaller equal installments over a set period—whether that’s daily, weekly, twice monthly, or monthly. Once set up, your purchases occur automatically, regardless of what the market is doing. This helps take the guesswork out of timing your investments.

Step 5 – Track and Manage Your Portfolio

After buying Bitcoin, you can track and manage your investment via the Gemini Mobile app or web dashboard. You’ll see your Bitcoin balance, purchase price (for cost basis), and transaction history. You can also monitor price charts and market data to decide if you want to place additional buy or sell orders.

Tip: If you hold other cryptocurrencies or some cash balance, check the account overview section. This will show how your overall portfolio is allocated (e.g., what percentage is in Bitcoin vs. other assets vs. cash). It’s a good practice to be aware of your diversification and risk exposure.

Comparing Different Ways to Buy Bitcoin in Singapore

In Singapore, you can buy Bitcoin through and peer-to-peer (P2P) marketplaces. Let’s break down these options, the trade-offs that come with each, and who it’s best for.

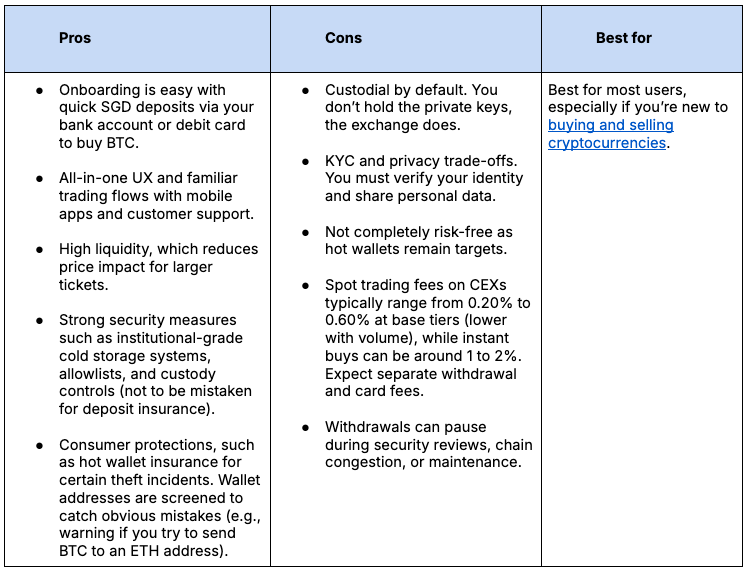

Centralized Exchanges (CEXs)

A offers the easiest starting point thanks to its security, speed, and user-friendly interfaces. They’re safer than going it alone at the start, but you may also trade privacy and control for convenience.

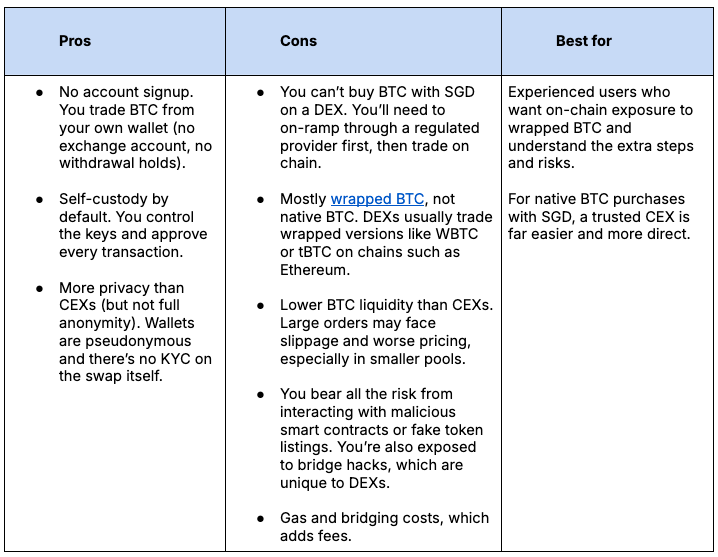

Peer-to-Peer (P2P) Marketplaces

connect buyers and sellers directly on chain. A smart contract on the blockchain automatically pairs two compatible offers and, when conditions are met, moves the crypto between wallets exactly as programmed. Every step leaves a public, time-stamped receipt on the chain.

Some blockchains include these markets at the protocol layer while others run them as (dApps). You’ll find more competitive prices or lower fees compared to CEXs, but they also come with unique risks and can be more complex to navigate.

How to Stay Safe When Buying Bitcoin

You can secure your cryptocurrency investments in Singapore by choosing MAS-compliant exchanges and following best practices for withdrawals and password security. Here’s how to put those safeguards into action.

1. Use Reputable and Trusted Platforms

You can choose to stick with MAS-approved crypto exchanges. These platforms must adhere to strict requirements (such as capital reserves and regular audits), which significantly reduce the risk of fraud. Unlicensed exchanges do not offer the same level of protection; you could have little legal recourse if something goes wrong.

2. Enable Two-Factor Authentication (2FA)

As a Gemini user you'll be required to set up (2FA) on your account. This means that in addition to your password, you’ll need a second code (often from an app on your phone) to log in. Use an authenticator app (such as Google Authenticator, Authy, or Microsoft Authenticator) rather than SMS text messages when possible, since apps are generally more secure against .

3. Withdraw to Trusted Wallets

If you’re moving your Bitcoin off the exchange, be careful about where you send it. An exchange is best used for active trading or short-term storage. For large holdings that you plan to keep for the long term, consider transferring them to a private wallet that you control (like your personal wallet app or hardware wallet).

Only withdraw crypto to a wallet address that you control (like your personal wallet app or hardware wallet) or to a trusted recipient. Before confirming any withdrawal, double-check the destination address. You can even send a small test amount first for peace of mind.

4. Maintain Good Security Hygiene

Use a strong, unique password that you don’t use anywhere else, and consider a reputable password manager to keep track of it. Keep your device (computer or smartphone) secure by updating your operating system and antivirus software.

Always access Gemini via the official URL or mobile app. Be cautious of phishing attempts and never click suspicious links. No legitimate exchange or support staff will ever ask for your password or your wallet’s private keys or seed phrase.

Common Mistakes to Avoid

Most mistakes when buying Bitcoin in Singapore are preventable. However, even seasoned traders have stories they’d rather forget, from sending BTC into the void to falling for or .

Here are the common pitfalls to watch for:

Skipping research: Don’t rush into using the first crypto exchange or service you come across. Take some time to research the platform. Read user reviews or ask for opinions from other Singaporean crypto users.

Ignoring fees: Pay attention to all the fees involved in your transactions. Different exchanges have different fee structures. For example, an exchange might offer zero trading fees but charge a high fee when you withdraw your Bitcoin to an external wallet.

Falling for scams: If someone contacts you out of the blue with an amazing Bitcoin investment scheme that guarantees profits or high returns, it’s almost certainly a scam. Similarly, watch out for phishing emails or WhatsApp messages that impersonate exchanges or banks (which usually leads to a fake site that steals your credentials). Refer to the latest on fraudulent mobile apps and investment/impersonation scams.

Sending to the wrong network/address: Native BTC only exists on the Bitcoin network. Transactions are irreversible, so if you accidentally send BTC to the wrong address, there’s usually no getting it back (unless the owner returns it). Bitcoin addresses start with 1, 3, or bc1. If you somehow tried to send BTC to an Ethereum address (which starts with 0x), for example, the funds could be lost.

Tip: If sent to an exchange or custodian, support can sometimes recover it. To open a support ticket for wrong transfers, go to Gemini Support and select the option to submit a new request.

Is It Legal to Buy Bitcoin in Singapore?

Buying, selling, and holding Bitcoin is legal in Singapore.

If you’re new to cryptocurrency investment in Singapore, going with a trusted exchange like Gemini adds peace of mind while you make your first purchase.

Explore our beginner’s guide on to help you understand its history and function.

MAS Crypto Rules

MAS treats most cryptocurrencies, like Bitcoin, as DPTs. Some tokens, however, can fall under the Securities and Futures Act (SFA) if they have features characteristic of shares, bonds, or units in a fund.

If you’re in Singapore, any crypto provider that you use must be licensed or exempt under the Payment Services Act 2019 (PSA). They also have to follow anti-money laundering (AML) and counter-terrorism financing (CFT) rules, plus meet strict disclosure standards. You can check a provider’s status anytime in MAS’s .

Over the years, MAS has rolled out tighter consumer protection rules, starting with its and the . Using a licensed provider today means you can expect clearer disclosures and stronger safeguards, including:

Better asset protection. Customer tokens must be kept separate from company funds and held on trust, with reconciliation and custody controls in place.

Stricter onboarding. Mandatory risk warning and risk awareness checks before trading.

No leverage. Retail customers can’t use margin, credit, or other leverage from DPT providers. You buy with your own funds only.

No locally issued credit cards. Providers can’t accept Singapore-issued credit cards for retail crypto purchases.

No promotional incentives or activities to the public. Sign-up bonuses, trading rewards, referral perks, and physical crypto ATMs are prohibited.

Additionally, MAS has a dedicated framework for single currency stablecoins issued in Singapore and pegged to SGD or major G10 currencies. Finalized in August 2023, it sets rules for reserve management, redemption timelines, and public disclosures. Only tokens that meet these requirements can be marketed as MAS-regulated stablecoins.

Taxes and Reporting Obligations

In Singapore, individuals aren’t required to pay capital gains tax. If you buy and sell crypto occasionally as a personal investment, those gains are generally not taxable.

However, if you’re actively trading, or you receive crypto as payment for goods or services, profits are treated as income and taxed under normal rules. Value any crypto that you’ve earned at its fair market price when you receive it, then include it in your Inland Revenue Authority of Singapore (IRAS) return. Companies are taxed on crypto-related income the same way they’re taxed on any other revenue.

When it comes to GST, crypto trades (such as swapping BTC for SGD or exchanging BTC for ETH) are exempt. If you use a DPT to pay for something, any GST applies to the good or service you’re buying, not to the token transfer itself.

Looking ahead, Singapore has signed on to the OECD’s (CARF). Starting from 2027 (with some jurisdictions by 2028), tax authorities will begin automatically exchanging crypto account information across borders. Expect more third-party reporting and fewer gray areas, so keep your records clean and consistent.

For a deeper breakdown on how Singapore treats crypto gains, income, and GST, see our .

Your Bitcoin Starter Checklist

Use a MAS-compliant crypto platform. Verify a provider in the MAS Financial Institutions Directory.

Prepare your documents in advance. Have your passport/NRIC and a recent proof of address ready for KYC.

Secure your account. Activate 2FA, set a strong unique password, and beware of phishing messages.

Fund in SGD. Deposit via FAST or PayNow. Credit cards aren’t accepted.

Place your order. Choose BTC/SGD, pick market or limit, review fees, and confirm. Consider a small recurring buy if you want DCA.

Choose storage. Keep trading funds on your exchange wallet and move long-term holdings to self-custody or institutional cold storage. Add and verify withdrawal addresses, enable allowlisting, and do a small test send first.

Keep clean records. Save trade histories, fees, and SGD values. If you trade frequently or accept crypto as income, tax rules can apply.

Buy Bitcoin Today on Gemini

Buying Bitcoin is often the first step in exploring crypto, and for many, it’s the foundation of their portfolio. Some hold BTC as a long-term hedge against monetary debasement while others use it as a neutral, borderless settlement network.

Gemini simplifies and secures the process for cryptocurrency investment in Singapore. From an intuitive trading interface and convenient SGD funding options like FAST bank transfer, PayNow, and debit cards, every feature is designed with your needs in mind.

Join the millions who trust Gemini for buying and storing crypto. Whether you’re starting small or building a long-term position, Gemini gives you the tools, security, and support to trade with confidence. to buy Bitcoin in Singapore and take control of your financial future.

FAQs

Is Bitcoin legal in Singapore?

Yes, it’s legal to buy Bitcoin in Singapore.

Can I buy Bitcoin anonymously?

No. MAS-licensed platforms must perform KYC, through Singpass MyInfo or proof of address. Licensed P2P marketplaces verify users as well, and unregulated or cash trades carry high risk and may be illegal. DEXs are pseudonymous, but fiat on/off-ramps and the Travel Rule still tie transactions to your identity.

What’s the minimum amount I can buy?

On Gemini, you can buy as little as 0.00001 BTC, that’s one hundred-thousandth of a Bitcoin. At current prices, it’s only a few cents, so you can start with a few Singapore dollars to place an order. Gemini supports fractional purchases, so you can buy exactly the amount of BTC you want.

Do I need a wallet before buying?

You don’t need a separate wallet to make the purchase itself; you can buy and hold Bitcoin directly in your Gemini account (“exchange wallet”). For additional security, you may also want to get a personal hardware wallet.

What’s the best app to buy Bitcoin in Singapore?

Gemini is highly rated in Singapore for ease of use, security, and support of SGD payments. Gemini recently received In-Principle Approval (IPA) for the Major Payment Institution license from the MAS, signaling ongoing compliance with the MAS licensing rules. Users can make direct FAST transfers and PayNow deposits for convenient SGD funding.

Can I buy Bitcoin in Singapore with cash?

Yes, but not directly with physical cash. You need to deposit cash into your bank account and then transfer it to an exchange via FAST/PayNow.

Author

Is this article helpful?